Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

CME Group has announced plans to launch micro-bitcoin and ethereum options on March 28, with the products currently awaiting regulatory review. It is understood that the size of the new micro option contract will be one-tenth of the respective basic specifications of Bitcoin and Ethereum, aiming to provide more trading options for a wider range of market participants.

Second, the secondary market

1. Spot market

In February, CME Group’s Ethereum futures trading volume fell to $691 billion, a drop of 4.5%; the monthly Ethereum options trading volume fell to $12 billion, a drop of 23.4%.

In terms of the secondary market, the current ETH price may pull back slightly in the short term, with support at $2,500 and resistance at $2,800 and $3,050.

According to OKX market data, the price of ETH once rose to around US$3,050 last week, and closed at US$2,627 during the week, a month-on-month decrease of 6.5%.

2. Large transaction

OKlink dataThe daily chart shows that the price is currently on the lower track of the Bollinger Band, and the price may continue to test the $2,800 mark (the middle track of the Bollinger Band) in the short term; the lower support level is $2,500 and $2,300 (the previous low), and the upper resistance level is $2800 and $3050.

3. Rich list address

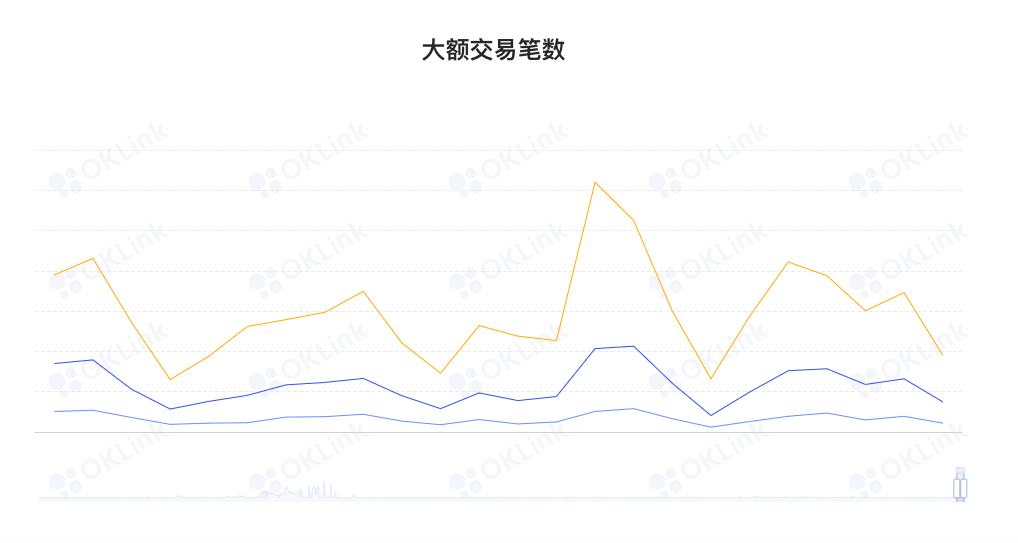

OKlink dataIt shows that the number of on-chain transfers dropped sharply last week, with "above 1,000 ETH", "above 2,000 ETH" and "above 5,000 ETH" decreasing by 10.3%, 8.4%, and 6.5% month-on-month respectively.

3. Ecology and technology

1. Technological progress

OKlink data

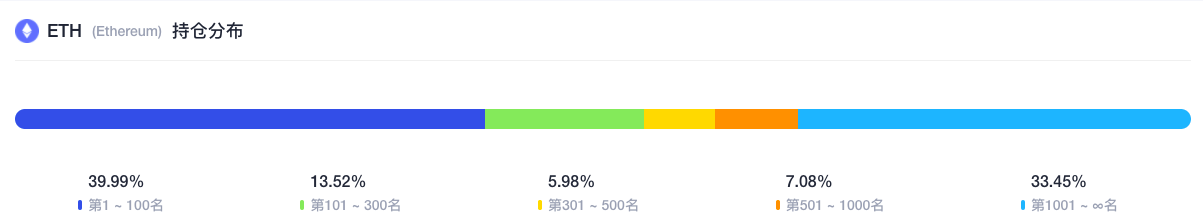

It shows that the current top 300 ETH holdings hold a total of 53.51% of ETH, a month-on-month decrease of 0.1%; in addition, the entire position distribution presents an oval structure, and the proportions of each part are: 1st to 100th, accounting for 39.99%, 101st to 300th, accounting for 13.52%, down 0.12% from the previous month; 301st to 500th, accounting for 5.98%, down 0.12% from the previous month; 501st to 1000th, accounting for 7.08%, up 0.03 from the previous month %; after the 1001st place, accounting for 33.45%, a month-on-month increase of 0.19%.

3. Ecology and technology

(1) Kiln, the Ethereum merged public test network, is expected to launch next week

2. Project trends

In addition, the priorities of the Shanghai upgrade are to push beacon chain withdrawals to the execution stage, reduce rollup fees, and improve EVM.

(2) The number of validators on the Ethereum beacon chain network exceeded 300,000

Beaconcha data shows that the number of verifiers on the Ethereum Beacon Chain (The Beacon Chain) network has exceeded 300,000 and is currently 306,698.

(1) The ETH pledge volume of the Ethereum 2.0 liquidity staking protocol Rocket Pool exceeded 100,000 pieces

According to official news, the ETH pledge volume of the Ethereum 2.0 liquidity staking protocol Rocket Pool has exceeded 100,000.

(2) FloorDAO purchased $5.16 million worth of CryptoPunks series NFT

Nori, a blockchain application dedicated to improving carbon-neutral transparency, recently announced the completion of a US$7 million Series A financing led by M13 and participated by Toyota Ventures.

It is reported that Nori’s upcoming token NORI will solve another problem in the carbon offset industry: establishing a real price for a ton of carbon dioxide. While developing the NORI token, Nori has built a community focused on carbon removal, connecting farmers, large corporations, crypto NFT artists and crypto enthusiasts, NFT marketplace partners like Rarible, and more.

Nori is a blockchain-based carbon removal marketplace founded in 2017 and headquartered in Seattle, Washington. Currently, Nori achieves carbon removal by supporting farmers to adopt regenerative agriculture projects that sequester carbon dioxide from the atmosphere. In the future, Nori will introduce multiple carbon removal methods. Nori provides transparency and prevents double counting by minting NFTs on the Ethereum blockchain. (Business Wire)

(4) Nori, a carbon-neutral blockchain application, completed a $7 million Series A financing led by M13

Nori, a blockchain application dedicated to improving carbon-neutral transparency, recently announced the completion of a US$7 million Series A financing led by M13 and participated by Toyota Ventures.

Nori is a blockchain-based carbon removal marketplace founded in 2017 and headquartered in Seattle, Washington. Currently, Nori achieves carbon removal by supporting farmers to adopt regenerative agriculture projects that sequester carbon dioxide from the atmosphere. In the future, Nori will introduce multiple carbon removal methods. Nori provides transparency and prevents double counting by minting NFTs on the Ethereum blockchain. (Business Wire)

According to official news, Melos Studio will conduct the first public sale of Melos tokens at Tokensoft at 2:00 pm UTC time on March 1, 2022 (10:00 pm Beijing time). Melos tokens run on the Ethereum chain (ERC-20). The public sale price of each Melos token is 0.05 USDT, and the total fundraising amount is 500,000 USDT, accounting for 1% of the total amount of tokens. The Public Sale will be completed when the fundraising amount reaches 99.9%. This Public Sale has 6,600 participants, so the lottery system was adopted, and the final number of winners was only 530.

(5) The DeFi oracle machine Umbrella Network has been launched on the Arbitrum mainnet

According to official news, the DeFi oracle machine Umbrella Network announced that it has launched the Arbitrum mainnet, so that DApps built on Arbitrum can take advantage of Umbrella's advantages, including access to its oracle machines.

As of now, Umbrella Network is currently running on 5 blockchain ecosystems, including Ethereum, BSC, Polygon, Avalanche, and Arbitrum, and plans to support other chains in the coming months.

According to official news, Melos Studio will conduct the first public sale of Melos tokens at Tokensoft at 2:00 pm UTC time on March 1, 2022 (10:00 pm Beijing time). Melos tokens run on the Ethereum chain (ERC-20). The public sale price of each Melos token is 0.05 USDT, and the total fundraising amount is 500,000 USDT, accounting for 1% of the total amount of tokens. The Public Sale will be completed when the fundraising amount reaches 99.9%. This Public Sale has 6,600 participants, so the lottery system was adopted, and the final number of winners was only 530.

Melos is a decentralized metaverse + music web3.0 collaboration platform for musicians and music creators. It is also a precursor to a decentralized creator economy, as Melos allows anyone to create music through its tools.

Defipulsehttps://(9) a16z announced that it has invested $70 million in Lido, a decentralized staking platform

3. Borrowing

4. Mining

(data from etherchain.org)

etherchain.orgThe data shows that the value of locked-up collateral on the chain rose from US$68.91 billion to US$75.52 billion last week, an increase of 9.5% a week; a net decrease of US$1.92 billion in the previous week and a net increase of US$6.61 billion last week, a month-on-month increase of 445%. Specifically, ETH mortgages rose from 7.336 million to 8.137 million last week, an increase of 10.9%; BTC mortgages rose from 199,694 to 205,863, an increase of 3%.

4. Mining

4. News

(data from etherchain.org)

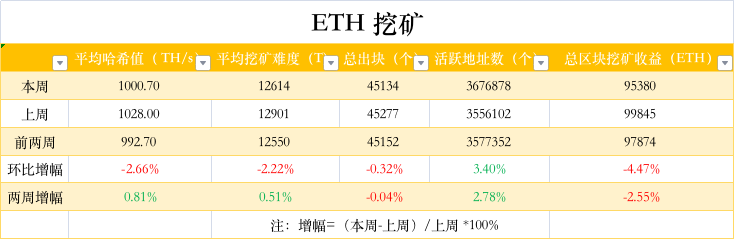

The data shows that the average computing power last week decreased by 2.6% month-on-month, temporarily reporting 1000.7TH/s; the average mining difficulty decreased by 2.2% month-on-month, temporarily reporting 12614T; the activity on the chain increased by 3.5% month-on-month, and the total mining revenue decreased by 4.5% month-on-month .

According to BeInCrypto Research data, the revenue of Ethereum miners in February was US$1.25 billion, a decrease of 14% from the US$1.47 billion in January, and a decrease of 10% from the US$1.39 billion in February 2021; In January, the income of Ethereum miners exceeded Bitcoin by 20%. In addition, in December 2021, Ethereum’s mining revenue exceeded Bitcoin’s by 32%.

(1) Report: Cryptocurrency trading bots are making billions from 'sandwich trading'

“Sandwich trading” is a process in which software developers program bots to spot another trader trying to buy a crypto asset on a blockchain. The bot places an order for the same token and completes the transaction first, pushing the price of the asset up. The bot then “finishes the sandwich” by selling the tokens to the original trader at a higher price.

According to Bloomberg, the method was discovered by developers as a success, but it became increasingly difficult to implement due to the number of other bots trying to "sandwich trade." The end result is the proliferation of “sandwich trading” bots to other blockchains, notably Solana, Polygon, and Avalanche. The bots brought a sudden, exponential increase in traffic to these tokens, causing their networks to become congested. (Cryptoglobe)

(2) The Ethereum Foundation announced the academic research funding plan for Ethereum and blockchain-related fields

The Ethereum Foundation Ecosystem Support Program (EF Ecosystem Support Program) announced a $750,000 academic research funding program, hoping to promote academic research in related fields such as Ethereum, blockchain, cryptography, and zero-knowledge proofs. Research, grant application deadline is April 22, 2022.

(3) CME will launch micro-bitcoin and ethereum options

CME Group has announced plans to launch micro bitcoin and ethereum options on March 28, with the products currently awaiting regulatory review. It is understood that the size of the new micro option contract will be one-tenth of the respective basic specifications of Bitcoin and Ethereum, aiming to provide more trading options for a wider range of market participants. (PR News Wire)

(4) Data: In February, the trading volume of the NFT market on the Ethereum network fell by nearly 30%

According to The Block data, the transaction volume of the NFT market on the Ethereum network dropped to 5.46 billion US dollars, a drop of 29.1%.

In addition, the Ethereum network burned a total of 212,040 ETH in February, or about $608 million. Since the implementation of EIP-1559 in August 2021, Ethereum has destroyed a total of 1.93 million ETH, or about $6.95 billion.