A review of the 2022 Satoshi Roundtable VIII

Original translation: Block unicorn

Original translation: Block unicorn

Review selected topics covered at the 2022 non-conference including Bitcoin Development, Crypto Family Offices, Dubai, El Salvador, Liberal Private Cities, DAO, GameFi, Web3 and more.

As usual, in order to maximize my learning opportunities, I chose to attend primarily sessions on topics on which I am not an expert. Here are the insights I gained from the discussions I participated in.

Bitcoin Development Funding

It is estimated that approximately $20 million per year is used to fund the development of free and open-source Bitcoin software. In general, FOSS funding has a complex set of problems, a "tragedy of the commons" problem.

Open source has a funding problem

Some people ask if it makes sense to issue bonds, but bonds are investment vehicles with the expectation of a return on investment from future income. Therefore, there is consensus that funding Bitcoin development should be a donation/charity model.

Another option might be an endowment that makes its own money and uses the profits to sustainably fund grants? Or businesses taking advantage of Canada's SR&ED tax incentive program - essentially using government grants to fund development.

There will always be some debate about who funds the developers, for fear of exerting pressure to steer development in favor of the funders at the expense of others in the ecosystem.

To reduce the threat of centralization, many profitable companies in the space hire the best FOSS (Open Source Software) developers and sign "no strings attached" contracts on their choice of work. Although from a company's perspective, it's always difficult to justify the cost of hiring a FOSS developer when the benefit is indirect and unquantifiable.

A project worth emulating might be FreeBSD (an open source OS), which has a similar ethos of "slowest and doesn't break things", which has a dedicated foundation funding 3 maintainers.

Does it make sense to post bounties for implementing BIP and other features?

Unfortunately, bounties tend to attract low-quality programmers.

The real bottleneck is quality code review, not code writing.

Bitcoin ACKs is a project that lets you pledge bounties on Bitcoin Core pull requests, although I'm not sure how bounties are paid out; I think it's more of a signaling mechanism.

At the time of writing, it appears that most FOSS Bitcoin developers are funded by charitable organizations or exchanges (which tend to be the most profitable businesses in the industry). Maybe we can try to get some big bitcoin miners to follow suit?

Furthermore, it is widely believed that the bottleneck is not money but the available developer talent. From a talent standpoint, Bitcoin is now competing with almost every industry since software continues to eat the world.

One of the worrying things we're seeing is that there's more and more push for protocol ossification. There is a huge debate about the benefits of sticking to protocols we already know versus risking adding new features that might add value but also introduce vulnerabilities. A tradeoff here is to place more emphasis on the development of the second layer technology, since it often does not require consensus changes.

There are also some inherent issues surrounding development culture, newcomers may be afraid to suggest to the development list, because ideas are often hostile and tend to be singled out. Being a solo developer can also be overwhelming; perhaps more team development should be encouraged. Bitcoiners, on the other hand, tend to have a knee-jerk reaction to whoever makes up the team.

There is also a longevity issue with developer burnout, we don't want talented developers spending years supporting their work, only to give up contributing if their proposal isn't accepted.

Building a Crypto First Family Office

The main purpose of opening a family office is to outsource the management of certain parts of your life in order to expand your lifestyle.

Operating costs for a single family office are high, ranging from $300,000 to $1 million per year. On the other hand, multiple family offices can share resources. What should family offices focus on?

wealth management

Legal advice

concierge service

Safety

concierge service

Managing capital is stressful and can lead to analysis paralysis; high net worth individuals can enjoy peace of mind by outsourcing their finances to professionals...if they can be trusted.

Tips for setting up a crypto family office:

Have a vision of what your office wants to achieve

Hire people who share your vision and values

Bank setup can be a pain

People have a better experience with First Republic Bank than Silvergate and Signature Bank

Some private banking services have a minimum AUM of up to $100 million, which of course means traditional assets

Unfortunately, there is no one-size-fits-all template for all of these

Note that crypto clients are subject to more scrutiny than traditional wealthy clients. Yet bankers’ appetite for servicing crypto clients is growing — and they’ll go wherever the money is.

Sources say Digital Currency Group (Grayscale’s parent company) is currently building a wealth management firm for cryptocurrency clients called HQ, but the timeline for its opening is unclear.

Dubai — Bitcoin Castle?

Dubai is a strange beast when it comes to the regulatory status of crypto assets. For one thing, there is no capital gains tax and no requirement to declare what assets you own. On the other hand, it is illegal to accept any cryptocurrency for payment.

The word on the street is that gambling may soon be legalized, and we hear that hotels have entire floors of empty casinos waiting to open.

If your crypto business has the proper financial licenses, you should be safe. However, these regulations are not always enforced uniformly.

Dubai has a partnership with Crypto Valley in Switzerland, and as a cryptocurrency business, you cannot open a bank account in Dubai, but you can open a Swiss account for use in Dubai.

Internet surveillance in Dubai is comparable to China, and it can cause problems with VPNs and secure messaging apps. There is no sense of free speech in the UAE - criticizing the government is a very bad idea. You should assume that all your data is being monitored, although from a practical point of view, this monitoring is mainly used to target local dissidents rather than loud foreigners.

El Salvador

El Salvador

Locals report that lower-level bureaucrats are keen to increase bitcoin adoption, but higher-ups in the government often block requests on a whim.

President Bukele has a team of advisors from Venezuela and it is unclear who they are/what they do/why they are there.

If you can manage to get past all the layers of bureaucracy and intelligence that protects the president, there's still a good chance he'll change his mind without any notice.

Poorer citizens of El Salvador tend to be more excited about Bitcoin, while wealthier ones are more skeptical because they remember being burned by a previous corrupt government.

Most Salvadorans don't know the difference between custodial and non-custodial wallets. In fact, very few Salvadorans know much about Bitcoin because of how it was launched without any educational program. Now, other private organizations are developing their own plans.

Chivo (El Salvador's official Bitcoin wallet) hovers around 500,000 daily active users — about 10% of the population, many of whom are arbitrageurs.

There are rumors that a delegation from El Salvador is visiting other Latin American countries to offer guidance on how to replicate their efforts. The main contenders for Bitcoin adoption are Ecuador and Panama, since they operate on a dollar similar to El Salvador and are thus at the mercy of the Federal Reserve’s monetary policy. Also, countries known for selling passports are just as sophisticated.

Government involvement in wallets/exchanges

El Salvador has been known to dive headfirst into their bitcoins. They initially launched on the Athena (Bitcoin ATM) wallet, but after running into a ton of issues, they switched to Alphapoint, who rewrote the entire Chivo system from the ground up.

Apparently the government of El Salvador is trying to run their tech projects as fast-growing startups, but they're not really techies and don't understand the software development life cycle. That's why they keep setting unrealistic goals. On a related note, the reason Lightning Network is not Chivo's default option is also due to some bureaucratic decision rather than any technical considerations.

While Chivo users have had many complaints about late payments, these are often not due to technical issues, but rather to long backlogs in the AML review process.

As mentioned earlier, the government devotes almost no resources to actual Bitcoin education. Instead, they choose to provide technical support on an as-needed basis and hope that users will be motivated to educate themselves. Individuals are incentivized by the $30 airdrop, while merchants are incentivized by being able to accept payments with 0 fees.

Bermuda, on the other hand, has taken a slightly different approach. They have no intention of making Bitcoin a legal tender, but instead fight for voluntary adoption of cryptocurrencies and stablecoins by educating citizens about their benefits. Bermuda is a low-tax jurisdiction, and Bermuda has no specific taxes on income, capital gains, or other digital assets. The government itself was an early adopter, having accepted USDC for taxes and services since 2019.

Regarding Bermuda Now Accepts USDC Crypto for Taxes and Government Services, please search for "Bermuda Now Accepts USDC Crypto for Taxes and Government Services" on Coindesk.

It will be interesting to compare the adoption across these countries in the coming years.

free private city

What is Free Private City? This is a city integrated into a country with the understanding that the city will abide by the country's constitution, but nothing more. Such a city would:

Citizens are required to sign a contract with the city

have their own tax plan

Run your own public service

control your boundaries

The goal is to change the relationship between the citizen and the state so that it becomes one of service providers rather than a hegemon. Such a city can even make citizens a shareholder.

What services will the city provide? Probably just basic security - expect most other services to be privatized.

The concept is modeled after Singapore and Monaco. Some examples of free private cities are Prospera in Honduras and Mount Athos in Greece. Economically weak countries may prefer to host free private cities.

Cross-chain self-custodial wallet

As always, there is a tradeoff between security and convenience. What we often see in multi-asset wallets is that they create a single point of failure by using the same key across all assets.

You can also run into user experience nightmares with different networks that support the same address format, such as LTC and BTC P2SH addresses. Since different networks use different derivation paths to generate keys, it can be difficult for users to figure out what went wrong and then expend a lot of effort to recover their funds.

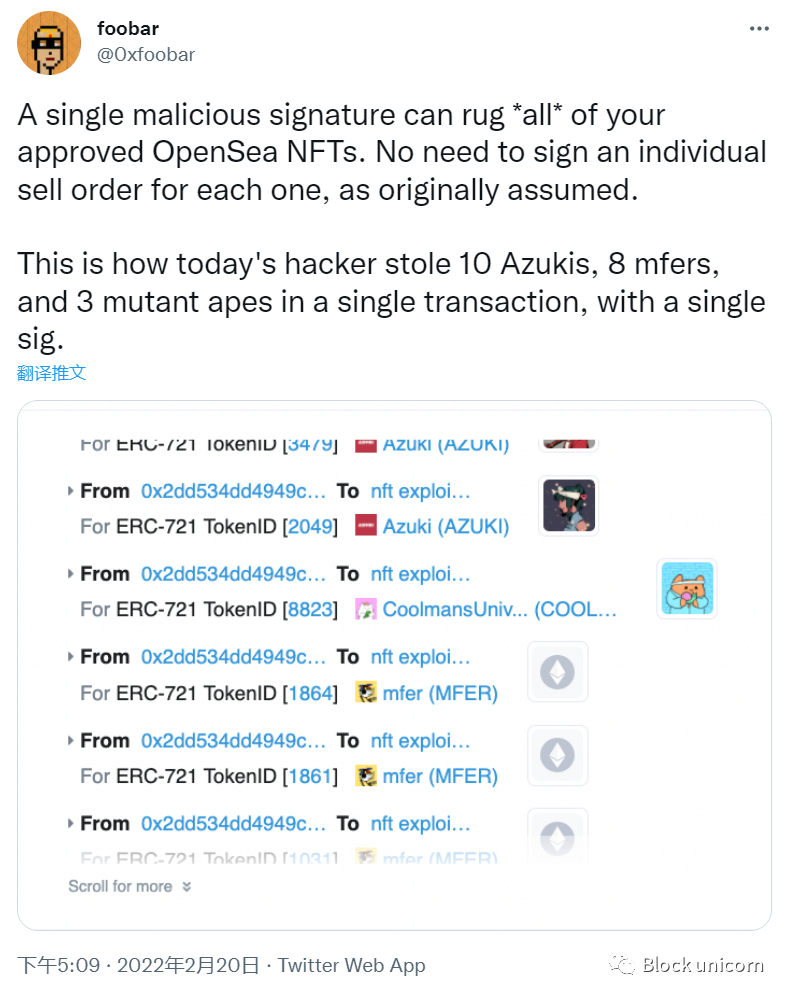

image description

Explanation on the Opensea security incident process: https://twitter.com/0xfoobar/status/1495324659604144131

Decentralized Autonomous Organization

Decentralized Autonomous Organization

DAOs continue to gain adoption as more and more group collaboration experiments are conducted through DAO mechanisms.

Perhaps one of the most underrated aspects of DAOs is DAO-to-DAO collaboration. This situation is far less frictional than a typical B2B partnership, as it tends to forego all legal contract negotiations.

Additionally, DAOs can incentivize each other by participating in token swaps.

DAOs don't need to operate through a purely democratic "token voting" system - they can elect committees to delegate certain powers in order to be more flexible than having all decisions go through a global governance process. And, in fact, we see a wide range of governance mechanisms implemented in DAOs, ranging from fully democratic to quite authoritarian.

While this is rare, we've seen some businesses form partnerships with DAOs and forego legal contracts by incorporating risk into their decisions.

Since DAOs are not legal entities, they do not pay taxes. They also don't have a human resources department. On the other hand, you don't get any traditional benefits when working for a DAO. You also can't get a work visa to live in a different country, because no country will recognize DAO as an employer.

It is generally agreed that the biggest challenge facing DAOs in the long run is apathy. The average person doesn't want to spend time doing research to determine the future of a DAO. Additionally, if someone in a position of power in a DAO becomes apathetic, it could create a huge challenge to facilitate a smooth transition and let them go. As such, there are many unanswered questions surrounding the sustainability and longevity of DAOs.

GameFi - Game Tokenization

When gaming meets finance, beware of gaming behemoths!

Many of the current popular game makers are targeting emerging markets - these are "play to earn/earn while playing" games, or P2E for short.

A unique perspective you can take is that children cannot open accounts on cryptocurrency exchanges, but they can participate in the game economy - so this could become a major entry point for teens into cryptocurrency.

We've seen a backlash from some traditional gamers who feel that incentives are destroying gaming culture, or that game companies are prioritizing profit over playability. GameFi does seem to suffer from the "putting the cart before the horse" problem, and often focuses more on token economics than the actual quality of the game. You can't just stick tokens on the game - it needs to be an integral part of the experience/challenge/reward.

Tokenization is well-positioned to disrupt the esports industry because there are so many middlemen taking money from players.

Unfortunately, many game coins are difficult, if not impossible to trade. From a regulatory standpoint, gaming companies cannot allow "cash-out gaming" as it is considered a form of gambling. It is also difficult for games to implement token economics in a way that is not considered gambling. You have to be 100% sure that gamers aren't getting any rewards by chance. Think about it - the game uses randomness everywhere to make sure your experience isn't as dull as it should be. Therefore, it may be safer to implement incentives for competitive human-to-human games or "play and earn money" platforms.

image description

Tell about children who earn money by playing games every day

Why not integrate Bitcoin into the game like we saw with Zebedee (Bitcoin game wallet)? This is a matter of control - game companies prefer to have maximum flexibility in the token economics of the ecosystem they are building.In short, GameFi is about more than monetizing games.

Metaverse and Web3

Web 2.0: Use username and password to log in to the service Web 3.0: Use wallet to log in to the service.

The pandemic sparked a boom in virtual reality, as many who found themselves physically restricted by the lockdown used it to escape to new worlds. Myself, a VR user since 2018, I was delighted when we started weekly Bitcoin VR meetups on weekends in 2020, and I even ended up speaking at several VR conferences!

Think of the Metaverse as a way to provide a whole new level of interactivity for next-gen websites. With a traditional website, you only need to interact with the company that operates the website. Through virtual worlds, you may also interact with other users of the Site. Although it's a bit out of touch with the current state of adopting the Metaverse, as those worlds tend to be walled gardens. As such, interoperability and standards will be key to mainstream adoption, as brands don't want to have to build the same user experience for a dozen different platforms.

Web 2.0: Websites monetize users through advertising/data mining/monitoring.

Web 3.0: Users capture value and are rewarded for their patronage.

There are a lot of scalability challenges on both the metaverse side and the web3 side. Building virtual worlds that can handle thousands of users simultaneously is difficult because the complexity of handling all interactions grows exponentially. Similarly, web3 scaling may require a second-layer protocol, since it doesn't make sense to permanently store every user interaction on a global ledger.

in conclusion

in conclusion

As the ecosystem around cryptocurrencies continues to grow, so does the diversity of this non-conference and attendees. Trying to keep up with all the developments in this field is overwhelming, so I'm very grateful to be able to take so many crash courses in a few days.