Recently, Sequoia Capital, the "strongest venture capital on the surface" with the longest history and largest fund size, has frequently sent out high-profile All in Crypto and Web 3.0 signals.

On the one hand, Sequoia Capital and Sequoia India changed their Twitter profiles in the past two days, focusing on encrypted keywords such as "DAO", "Metaverse", and "Mainnet Faucet", and auctioned NFT to catch up with the wave, and continued to speak out on social media .

On the other hand, Sequoia Capital, Sequoia India, and Sequoia China have successively increased their investment in crypto companies. Sequoia Capital announced the establishment of a new large-scale open-end fund last month, and more than 30 financings have been announced this year. , Shen Nanpeng, head of Sequoia China, also said in "All in Crypto".

secondary title

1. Web2.0 Promoters Actively Embrace Web3.0

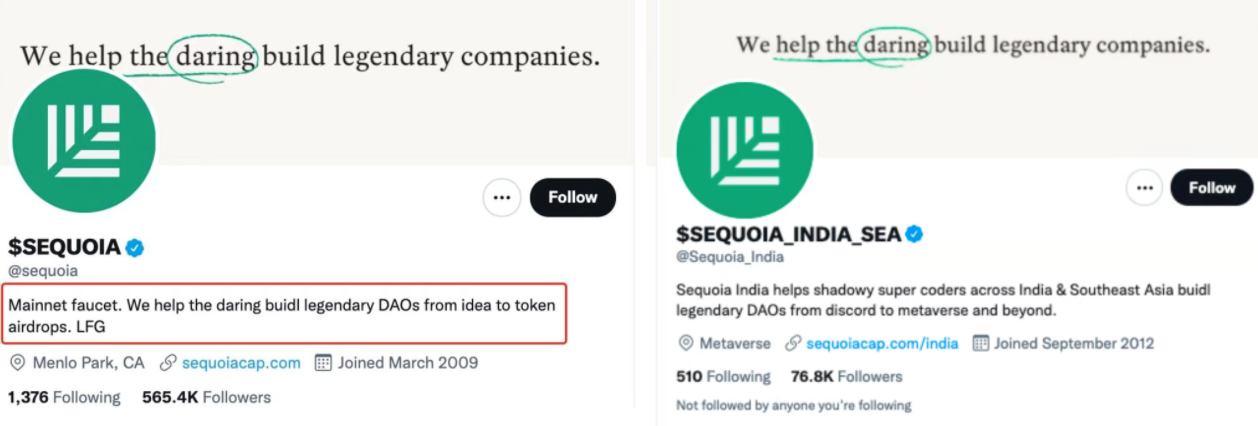

On December 8 (Wednesday), Sequoia Capital changed its Twitter profile to "Mainnet faucet. We help the daring buidl legendary DAOs from idea to token airdrops. LFG", "We help people with courage to create legendary DAOs. to token airdrops”.

In just one brief introduction, the content of encrypted "black words" exploded. "Mainnet" refers to the main network of the blockchain, "faucet" refers to the faucet, which refers to the small airdrops distributed in the early stage of the project, "DAO" refers to decentralized self-organization, and the spelling of "buidl" is also exclusive to encrypted users.

The day before, Sequoia India’s Twitter account also revised the introduction of the same paragraph “Sequoia India helped super programmers in India and Southeast Asia create a legendary DAO, from discord to metaverse”, and changed the account positioning to: Metaverse (metaverse ).

In the early hours of this morning, Beijing time, Sequoia Capital’s Twitter once again posted a tweet of “GM” (good morning), which is commonly used by users in the encryption community to greet each other, and received more than 3,000 likes.

Frequent Crypto Native speeches made people in the encryption community ridicule "it feels like watching Cai Ming speak Internet buzzwords on the Spring Festival Evening", "it seems that your grandfather told you that today is really YYDS when you wake up in the morning".

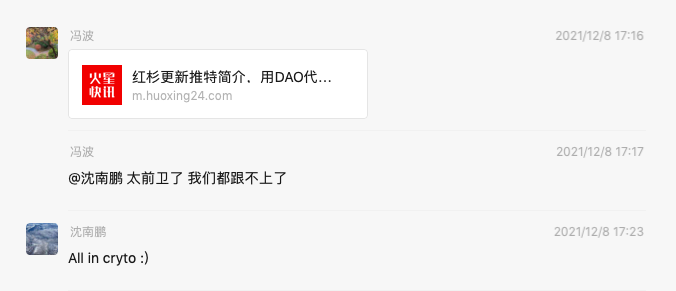

Later, in the chat records between Shen Nanpeng, the global executive partner of Sequoia Capital, and Feng Bo, the founder partner of Dragonfly Capital, Shen Nanpeng also said that he was "All in cryto". Perhaps a little excited, Shen Nanpeng also misspelled "Crypto".

However, after a day of heated discussions on the Internet, they were rushing to spread the news of Sequoia All in Crypto, but they have silently changed their Twitter profile from Web 3.0 to Web 2.0, back to "Helping Legendary Enterprise IPO". It caused people who eat melons to laugh and say, "Sequoia's one-day All in is over."

Of course, ridicule is ridicule. It is understandable that the old-fashioned capital wants to keep a low profile because the PR effect is too strong. In any case, the effect has been achieved, and in the past period of time, Sequoia’s sincere investment in silver and a series of actions to actively embrace Web3.0 are enough to show that they Determination.

For example, earlier this month, Sequoia Capital tested the waters to catch up with a wave of NFT trends. On December 3, Sequoia Capital tweeted that the 2005 YouTube Investment Memorandum will be auctioned as an NFT, and anyone can bid, and the proceeds will be used for the public ecosystem fund of 0xPARC (Cryptography Applied Research Program on Ethereum), The winner will have 100% ownership.

The news fermented quickly, and a large number of encrypted people participated in the auction. In the end, NFT collector Panksy.eth won the collection with 200 ETH.

secondary title

2. Set up an open fund and take heavy positions in encryption companies

Of course, the publicity stunt is only one aspect. It is not important how to say it, but how it is done. Judging from the data, Sequoia Capital is "increasing positions" this year to bet on projects in various fields of the encryption track.

At the same time, Sequoia Capital also announced last month that it plans to become a registered investment advisor (RIA) with the US SEC in order to invest more in alternative assets such as cryptocurrencies. In addition, according to the statement issued by Sequoia partner Roelof Botha, they are forming a new open fund, which will not have an "artificial time frame". This kind of permanently open fund is the choice of many institutions in the encryption circle.

In fact, Sequoia started investing in the encryption field as early as 2014. In 2017 and 2018, he also participated in the investment of many encryption projects. However, as the bubble burst in 2018, the traditional VC collectively ebbed. In the next two years, Sequoia’s investment in the encryption field also slowed down relatively. Some projects have been invested, but most of them are in the large infrastructure category.

2021 is different. Since Coinbase was successfully listed on Nasdaq in April, VCs who have doubts about the compliance of the encryption industry have rekindled their enthusiasm for investing in encryption projects. Many funds have shown this tendency. The legendary VC In the middle of a16z, the largest encryption fund of US$2.2 billion in history was established, which also made it impossible for global capital to ignore it.

So in 2021, which is about to pass, Sequoia Capital will start the "buy, buy, buy" model around the world, and continue to deploy public chains, exchanges, Layer2, NFT and other tracks. According to public information, three investment institutions including Sequoia Capital (USA), Sequoia China, and Sequoia India have announced more than 30 investment projects this year (including follow-up investment), including:

Crypto Derivatives PlatformFTX

Digital asset custody platform Fireblocks

Ethereum Layer 2 Solutions StarkWare

Ethereum Layer 2 SolutionsPolygon

Cryptocurrency Index Protocol Index Coop

Crypto StartupsIron Fish

Blockchain Security CompanyCertiK

Polkadot DeFi ProtocolParallel Finance

Metaverse Interactive PlatformGather

game start-up studioFaraway

Cricket NFT Platform Faze Technologies

Decentralized Fixed Income Trading PlatformStrips Finance

Social Blockchain PlatformDeSo

African mobile payment platformOPay

Asia's largest encrypted financial institutionPayPal Finance

Public resource trading platform logoXinzhi Chain

digital payment companyStripe

Stock and Cryptocurrency Trading PlatformRobinhood

Cosmos Ecological Liquidity Staking ProtocolpSTAKE

DeFi platformBeta Finance

Encrypted asset management platformCoinshift

Cryptocurrency Trading PlatformTonik Financial

Cryptocurrency Trading PlatformCoinSwitch Kuber。

(Note: The above project links can be clicked to view details)

Judging from the data, Sequoia Capital has placed a heavy bet on the infrastructure platforms of the encrypted financial field and the blockchain ecosystem in the world, from encrypted exchanges, asset management platforms, payment tools, to underlying public chains, technology middleware, and security companies. At the same time, they also tried a small amount of exploration in new fields, such as the DeFi protocol of the Polkadot ecosystem and NFT projects.

In general, based on the scale of funds, Sequoia Capital prefers mature targets with high certainty. For example, Sequoia China participated in the investment in October this yearAnimoca Brandssecondary title

3. The Paradigm Shift of Venture Capital

Venture capital appeared in Silicon Valley in the United States in the 1960s. In the past few decades, venture capital institutions have been pioneers in leading technological progress and business innovation. They accompany innovators and entrepreneurs with funds and resources, and advocate adventure, Be free and open, and let your eureka ideas shine into reality. Helping a portfolio continue to grow and head towards an IPO (initial public offering of stock) is the ideal exit.

However, with the passage of time and changes in the market, today's venture capital is no longer the representative of risk-takers. Their financial resources are constantly approaching their heads, and their strategies tend to be conservative. They even avoid innovation risks and only place heavy bets on certainty. Sexual opportunities, from early investment to late investment, from innovator to "Old Money".

The mode of operation of most VCs is no longer the former "research and data-driven bold innovation". Apart from funds, the value they can provide to entrepreneurs has become very limited.

However, with people's discussion on the open Internet of Web 3.0, the discussion on the decentralized business form of DAO, the fundraising method of the project, the exit method of investors, and the relationship between investors and entrepreneurs have also taken the lead in the encryption field. .

There are many problems in the attempt of ICO, but it does show entrepreneurs and investors around the world a new form of fundraising for start-up projects. After several years of development, today's token lock-up period, economic model, and requirements for investor contributions have a new system.

In the encrypted world, we praise technological innovation and paradigm innovation, make risky investment decisions, and even become a member of the project to contribute and participate in governance, spread consensus, and continue to share and exchange, all of which highlight the beginning of a new cycle.

So we think: venture capital will not disappear, but its paradigm must change in the Web 3.0 era.

If you don’t subvert yourself, you will be subverted by others. Sequoia Capital actively embraces new trends, and its status as the king in the old world is the reason why they still hesitate.

Finally, I want to ask an interesting question: do you want to make an impact on the world, or do you want to play a financial game?

Perhaps many people today take it for granted and disdain that the attribute of the encrypted world is the latter, but a few smart people know that moving towards Web 3.0 through the tools and facilities of the encrypted world is as exciting as the birth of computers and the emergence of the Internet. excited.