Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Topic | Messari 2022 In-Depth Research Report on Encryption Industry

Chapter 3 - 10 Thoughts on Bitcoin

Chapter 3 10 Thoughts on BitcoinSu Zhu

1. See Peter Schiff's point of viewPeter Schiff。

"Gold will be brutally demonetized and your grandkids will think a gold digger is someone who picks up scraps of metal in a dumpster and sells them for money". ——Woonomics)

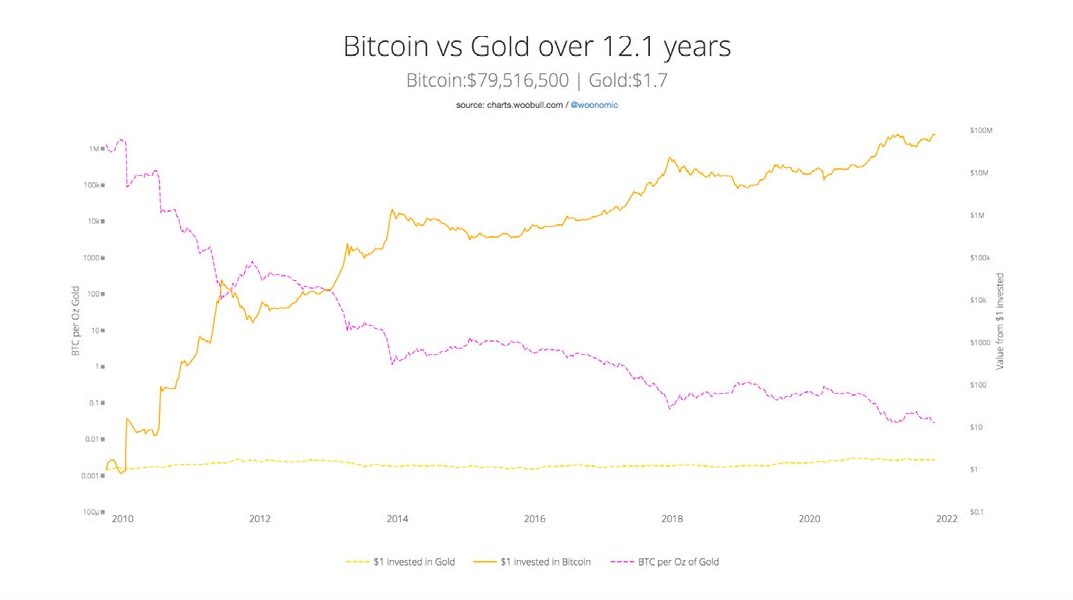

Bitcoin has had its golden decade lunch. These were supposed to be boom times for gold lovers — high inflation, low trust in government, a commodity boom — but gold was outflanked by the faster, younger, wilder Bitcoin. Investing $100 in gold 10 years ago would return $102 today, underperforming inflation. Meanwhile, investing $100 in BTC would have yielded $1.7 million during that time period. Ouch,Paul Tudor Jones, Tesla, El Salvador, Miami,image description

Marty Bent(source:Bitcoin also shows no signs of slowing down. Given its macro winds and multi-cycle resilience, it's hard to envision a scenario where Bitcoin falls out of favor anytime soon while other cryptocurrencies bounce back. From a regulatory standpoint, investors are more comfortable than ever with digital gold. There are now multiple institutional vehicles to access Bitcoin, and other early adopters have paved the way (etc.), "the institution is coming" has been flipped to "the institution is here."The strongest tailwind behind us was best summed up when he pointed out: "There is simply too much money owed to pensioners, generating too little return, and when it does, it is denominated in a currency with diminishing purchasing power. With stocks at low prices, bonds have negative real returns, and inflation willcontinue to exist

, Bitcoin is stillinstitutional turnIf QE does devalue the currency (duh), then as

(source:Raoul Pal, Bloomberg)

Raoul Pal points out

(source:

Coin printers go...buy everything. Especially the orange coins.2 - King or King: No Big Flip2. King or King: No Big Flip

I think the probability of "flippening" happening next year is maybe 20%, not because ETH is money, regardlesswhat sotheby's said. If ETH does surpass BTC, it won't be because it's a premium "currency", but because the market values the world's most unique user-owned computing platform and its potential for earnings and growth more than digital gold . In other words, we will look at BTC and ETH like we look at M0 and Google.

This is not an original idea. Arthur Hayes, founder of BitMEX

Breaking down the analogy in an article on the flippening debate

,He said:

ETH cannot be the best virtual computer in the world and the best currency in the world at the same time (I agree).

A cryptocurrency's largest money network will probably be bigger than its largest distributed technology "company" (and I agree).

That said, it is also possible to hold the view that "cryptocurrency" as a whole will outperform "Bitcoin" (i.e. BTC's dominance will decline) while Bitcoin maintains its position on the global leaderboard position on the For a competitive layer-one computing platform, Ethereum is an easier target than Bitcoin. Ethereum's scarce resource is the limited capacity of its global settlement ledger, which this year proved that when ethereum's ledger becomes too expensive, other first layers can quickly drain the need for cryptocurrency transaction settlement. (More on this subject in Chapter 8).Bitcoin's scarce resource, on the other hand, is its simple memo of money. Its pure "currency" competitors are less intimidating: Dogecoin, Shiba Inu, Bitcoin Cash, Craig Cash and their forks are nothing to write home about. Maybe you like Doge! There are many smart investors who do, such as Su Zhu, who "fundamentally" likes Doge because of its virality, community, humor, and non-serious user base. Pushed memestocks to the moon.I understand the argument, but it falls short in one key way: jokes can get old too, and even early holders will eventually realize they're sitting on real gains and find a cheaper joke. Reflexivity is not fun on the way down, and no institution will buy a wall for the lovely Shiba Inus when the trend reverses. A non-serious user base could also cause a large number of users to panic sell in the first quarter once they get their tax bills and realize how big their obligations are. Bitcoin investors are not new to capital gains taxes. Many Dogecoin gamblers probably are.

, I'd rather make money than be right. ZEC is still in the 1% of my portfolio, I still like Zooko, but it's not in my top 5 anymore. (Others have surpassed ZEC. It's not my fault!)

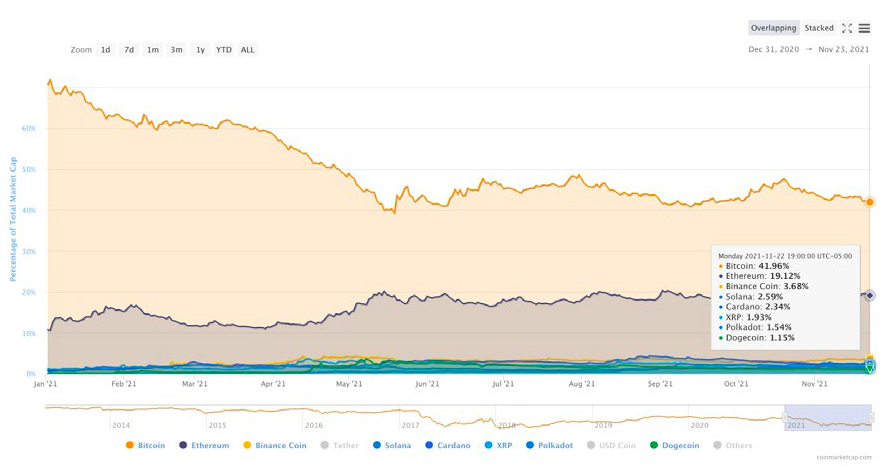

(source:CoinMarketCap)

Bitcoin really doesn't have a credible hype competitor other than Ethereum, but ETH also needs to watch its own backside. Bitcoin dominance has slipped from 71% to 42% this year. This is very bad. But ETH’s smart contract platform dominance has also slipped from 80% to 60%, and could deliver additional value to its new second-tier rollup “allies” that list in early 2022.image descriptionThere may be higher upside in cryptocurrencies, but

Not wrong. There's nothing wrong with owning GE in the heat. GE stock went from $100 in mid-1999, to $450 in mid-2000, and back to $185 in mid-2003. In four years, it "collapsed" to 85% above the level it found in the market rally. If Web3 reaches the madness of Web1, this is likely to be the trajectory of Bitcoin. Would you be disgusted if BTC fell from $275,000 to $125,000 next year?

secondary title3. Multi-chain reservetextWe'll talk about interoperability in Chapter 8, but for now, I'd like to say that I thinkUdi is right

: If the future is hundreds or thousands of interoperable blockchains, then end users don't necessarily know or care which blockchain a currency application is running on. Bitcoin holders will hold and use Bitcoin as an alternative to digital gold without having to worry about the technical details of which chain or pegged Bitcoin derivative they use in the process. As long as the underlying Bitcoin blockchain is humming, producing a block every 10 minutes as the settlement layer. More than 1.5% of Bitcoin Supply Already Passed

Wrapped on Ethereum via BitGo

, double the amount locked at the end of last year. But this may just be the tip of the iceberg, as millions of bitcoins are starting to make their way to other blockchains as well.

Several demand factors drive Bitcoin:

BTC will be the reserve for other L1s and ETH will be their competitorCross-blockchain bridging protocols like Rune will unlock more peer-to-peer swaps.Ethereum folks might protest that this is exactly what makes ETH a good currency and capital asset: it's compatible with other EVM chains and L2 rollups, and it already collateralizes stablecoins like Maker's Dai. But this is looking backwards. BTC's market capitalization lead is 2.5x, the collateral ratio as working capital is much lower today, which means it is undervalued, and the new BTC as DeFi collateral has a much higher ceiling than ETH. I think wrapped/synthetic bitcoins tradable on other blockchains will double again in 2022 (75% believe we will see at least 3% wrapped) as more long term bitcoin holders Realizing that they can borrow cheaper with their holdings in DeFi than in centralized services. (You can read more about the

DeFi Assets That Facilitate Bitcoin Interoperability

Content).

secondary title

Despite the toxicity of bitcoin futures ETFs, it was a fortunate historical accident that the SEC protected the retail industry (and Wall Street) from it by undermining the approval process for a long time. Grayscale trading” (Chapter 5) and its one-way inflows likely drove institutional demand from investors looking to take advantage of GBTC’s public market premium, as well as specific forms of retail demand from those holding Bitcoin in tax-exempt retirement accounts .But even so, the eight-year SEC drag has capped Bitcoin’s 5% float in ETF-like instruments. Earlier approvals could pose a centralization risk for Bitcoin’s money supply — the kind The risk is minimal today, reducing the chances of Wall Street manipulating the Bitcoin market.

Crypto Migration,View this NFT on OpenSea

I'll save more of my ETF predictions for other sections, but I'd wager that the total amount of BTC locked in ETF-like vehicles will remain below 10% of the circulating Bitcoin supply over the next five years. As other large institutions build positions, smart people will reach out directly and lower fees. If we see more than 10% of Bitcoin supply locked in ETF structures, it could be due to their inclusion in "other" ETF offerings. For example, Ark Invest holds USD 400 million in GBTC in ARKW.

secondary titlewarn usSenator Warrenwarnwarn us, we need to “crack down on environmentally wasteful cryptocurrency mining” to protect the planet. EU's top market regulatorwarn

The environmental costs of investing in digital currencies have "surgered," he said. Even we are warned that in ESG portfolios, the “Exposure rate"It's going up — it's like bitcoin is a real poison.

I acknowledge that among world leaders, the media and

Corporate Responsibility Greening Staff

At a time when emissions are obsessed, the global Bitcoin network consumes a lot of energy, which is optically bad. However, Bitcoin’s energy consumption is only “a problem” because most politicians and mainstream media pundits are either stupid, lazy, or dishonest. Typically, it's all three.

Let's talk about what Bitcoin actually does in our future of clean energy. The tldr:

It is politically impossible to curb global emissions within a reasonable time frame.

Still, we should try to "bend the curve" by curbing the biggest emitters.

Bitcoin can help reduce emissions by recycling energy that would otherwise be wasted/stranded.

Mining infrastructure can actually help subsidize new clean energy capacity.

At the same time, Bitcoin also provides S and G solutions in terms of ESG.Let's go one by one.**1. Curbing emissions is politically impossible. **Can someone please, say, be honest, just for a second? Carbon capture and clean cryptocurrencies. Or climate and political chaos. These are options.

in a recent article

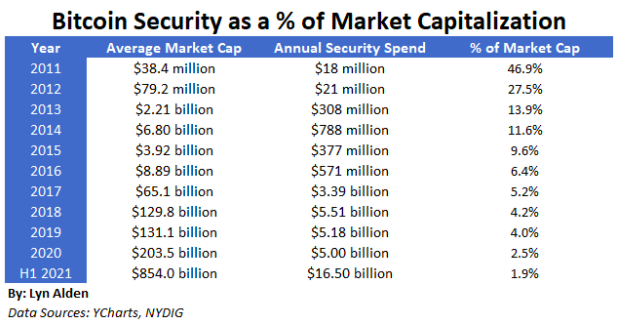

This is analyzed in , but Bitcoin's environmental impact should be sub-linear to its economic impact. The "problem" is that Proof-of-Work mining will either disappear in the short term (in the event of a failure), or if it grows to a $20 trillion global settlement layer and systemically important Fedwire complements (or replaces), it will Consume 1% of the world's energy. That’s a big number, but not if cryptocurrencies otherwise automate large swaths of financial services.Lyn Alden

A decrease in Bitcoin’s inflation rate means a decrease in the proportion of security spending, which means a decrease in hash rate strength.

image description

*Source: *If anything, most of us Bitcoin holders are aware that the bigger concern is around Bitcoin's current inflationary supply plan. The decreasing proportion of block rewards to total market capitalization carries the risk that, if anything, fee-driven block rewards will not attract enough energy to keep the network secure.(In most economic circles, you'll get in trouble for using the term "hyperinflation" because many fear the phenomenon will become a self-fulfilling prophecy. In Bitcoin, for anyone who points out that inflation is too low risk The same is true for people. Ask the question, and prepare to hide from the truth about "21 million.")**3. BITCOIN RECOVERS ENERGY:** It turns out that some of the cheapest clean energy in the world is sitting "off the grid" waiting to be tapped. It would be nice to have some mobile, non-geo-restricted consumers! Proof-of-work miners - as we can see from the graph in Sichuan - are these consumers, greedily sucking up the kWh available at the lowest marginal cost, likeWater on a 3D topographic map

. (Really, Bitcoin miners are just

Merciful Daniel Plainviews). That's what led Nick Grossman, Square and Ark Invest and others to refer to Bitcoin as a "money battery."At first I was hesitant to use this framework. Sounds so convenient, right? But I've figured it out.

Natural gas emissions (methane leaks) and flaring (burning methane into carbon dioxide) are perfect examples of money batteries in action. In the U.S., we burn more natural gas (150 TWh equivalent) per day than Bitcoin’s peak annualized global energy use.

I wrote about some companies doing this work in my paper two years ago (

Policymakers: For God's sake, your question revolves around the energy habits of American consumers and our energy industry, not Bitcoin energy recovery factories. I know this sounds like a fanciful, self righteous narrative, but Bitcoin mining could really be of such great benefit to America! Not a fringe polar bear has to die because of it. (Bitcoin bears are another story, and every bear has to die.) With some subsidies, bitcoin mining in the US could be net negative in a few years.

even

Ted Cruz got it all“50% of the natural gas in this country is being flared, it’s being flared right now in the Permian in West Texas. I think that’s a huge opportunity for Bitcoin because that energy is being wasted. It’s wasted It’s because there’s no transmission equipment to get the gas to where it can be used; it’s just being burned.”So much potential here. We simply cannot afford to waste this gift from China.

**4. Bitcoin is a green energy stimulant:**Let’s hammer this home and consider Bitcoin mining not only a potential net-zero emitter, but a sausage maker for big energy companies: Processors turn the remaining waste into something edible. Coastal elites will scoff at the notion — they don’t need Bitcoinpink slime— because they're not hungry for financial products (or prime beef). But what about communities where mining investments can help fill clean capex budgets? Or emerging markets with vast amounts of renewable resources, but currently little consumer demand for all this clean energy?

Bitcoin miners are unique business partners because they optimize for a single variable (lowest kWh) and act as mobile "energy buyers of last resort" for energy that is not easily transportable. You can see nomadic miners being factored into the new clean energy capex that these towns need to offset earlier sluggish demand. Then drive them to the next town. The reverse is also true: for low-income countries with cheap energy, miners may help fund or help them develop clean energy. In low-income countries with energy, miners can help fund or subsidize capital expenditures in exchange for cheap energy rights. (Ark Invest (Ark Investment)announced the modelworks, so you can check these assumptions yourself).Bitcoin mining is already anecdotal — and with increasing frequency — fueling clean energy investments. In addition to burning, there areMining Facility at Niagara Falls

, which took over a former coal power plant and now uses hydropower to generate electricity. Its owners previously operated coal plants in China. There is also North Vancouver, which uses technology developed by Mintgreen to integrate data from bitcoin miners.96% of recovered energy is used for heating. Other novel innovations will inevitably emerge as well.

If you were skeptical, I don't blame you. I used to think it was more marketing bells and whistles than substance. But China changed all the variables. Ben Thompson

In a recent articlepointed this out:"One of the biggest mistakes we make as a society is assuming that energy is inherently scarce...arguments that Bitcoin actually provides an incentive to invest in energy abundance are pretentious, but that doesn't mean they are WRONG! Bitcoin actually serves itself by providing an incentive to invest in energy abundance, but that doesn’t mean they’re wrong!”

Nic Carter also this year

experienced a similar

The transition from skeptic to evangelist:"Bitcoin mining is converging with the energy industry at breakneck speed, producing an explosive innovation that will both decarbonise bitcoin in the medium term and greatly benefit an increasingly renewable grid .More importantly, it appears that only Bitcoin — and not other sources of industrial load — can actually achieve some of these goals.”He attributes this to the advent of lifecycle mining (newer chips for grids with high uptime, older chips for places where marginal kWh is cheap), slowing ASIC development cycles (30% Mining happens on chips that are more than five years old), as well as grid-based hybrid mining systems and off-the-meter mining systems (variable consumption by miners in a demand response system).

Square is at

In a White Paper About Bitcoin's Clean Energy PotentialLyn Alden*, Nic Carter, Square, Nick Grossman, and *The B Word)

“As society begins to deploy more solar and wind power, [we] have the potential to unlock profitable new use cases for this electricity, such as desalinating water, removing carbon dioxide from the atmosphere, or producing green hydrogen,” notes the paper.This really might just be the beginning of a beautiful friendship.(further reading:**5. Cost in USD:** You could say that the financial industry (25 times stronger than carbon

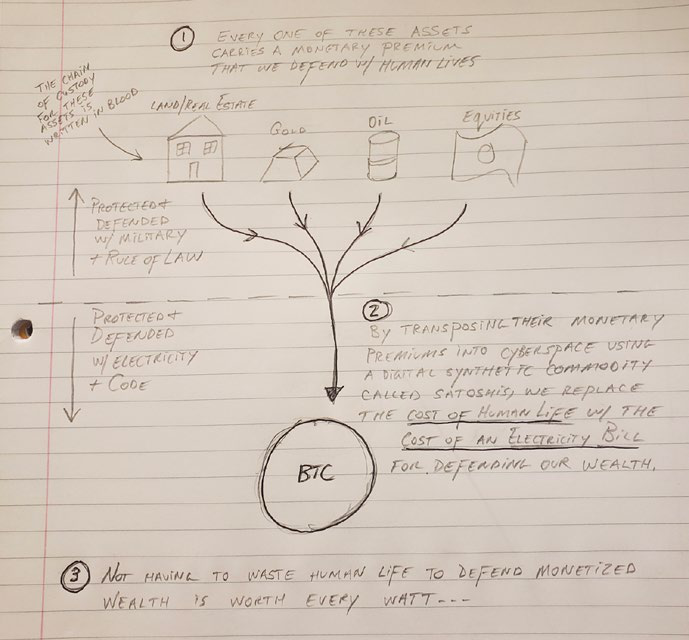

) and the military-industrial complex (50 times stronger than carbonIt's best summarized in an incredible article by . That said, even if policymakers think Bitcoin is hopelessly dirty and wasteful, and ruining the future of the planet, they shouldn't be discriminating in their energy usage preferences when petrodollars prop up authoritarian regimes. , would lead to militarized aggression and, in the process, fuel even more fossil fuel consumption. Enough people believe in Bitcoin's value as an investment in new social and governance experiments that its S and G arguably offset even the worst E-case of its critics. Bitcoin is inherently political.

(source:Jason Lowery)

image description(source:textOf course, there is one more "E" that may prove persuasive to policymakers: economic impact. Mining in the U.S. is big business, and miners listed in the U.S., at current prices, are now sitting onBTC, and due to the outflow of China's mining capacity, there are hundreds of millions of income every year, and the profit margin is also greatly improved. Here’s What Senator Cruz Was Speaking at a Bitcoin Conference in Austin This Fall

published on this issuementioned in his thoughtful speech.text

Mining infrastructure can even lead to some unusual alliances like those between Ted Cruz on the right and AOC on the left. If you want the economic growth that cryptocurrencies bring and you want to subsidize and stimulate green energy investment, subsidizeclean miningBar! It’s a single, zero-sum global market, which means clean energy subsidies drive out more expensive “dirty” mining. The net result would be a low-carbon-intensity Bitcoin network dominated by the West.

also pointed out

, ESG investors can invest in publicly traded miners that only have renewable energy, such as Iris Energy, and have the same effect as government subsidies by reducing the cost of capital for green mining.

secondary titleMeltem

6. Proof of work works because proof of work works

“PoW and PoS are not substitutes, they are not even complements, and are two fundamentally different things that should not be compared or contrasted.” —

Microsoft Yahei, STHeiti,

Much like the “BTC is money, no ETH is money” argument, this is one of the areas where the two sides argue with each other. Proof-of-work burns energy to prove that the network provides fair settlement guarantees globally without relying on the network’s owners, which are prone to centralization over time. The separation of transaction processing incentives and ownership responsibilities is important for a network that aims to be a non-sovereign alternative to money.

In contrast, it is appropriate to think of proof-of-stake networks (which employ token holders as collective governance bodies) as commercial analogues. Every single proof-of-stake network carries risks of centralization, censorship, and duress, but it's OK.

True PoS decentralization comes from thousands of interoperable PoS blockchains that will provide their own unique token incentives, emission schedules, governance rules, target applications, etc. in the long run.You don't want a monetary system where Elon Musk owns a large percentage of the money supply and a large voting power, economic activity on that underlying network is efficient and generates The fees and taxes have great requirements. Too much power over half of all transactions. On the other hand, if he amassed a similarly large percentage in a decentralized self-driving taxi service, you probably wouldn't have much of a problem since it's just a single web3 application.,(Read more about PoW and PoS security:)。

only the strong survive

rationality is self-destructivesecondary title7. Proof of Work Protects Minority Rights

My former CoinDesk colleague Pete Rizzo

wrote a thought-provoking article

, argues that Bitcoin's social contract, proof-of-work mining scheme, and preference for user-activated "soft forks" make it the "tyranny of the majority" that hard forks offer The only encryption protocol that protects the rights of minorities.

If you read the debate on twitter, this might seem academic or semantic, but it's probably one of the most important things a new institutional person entering cryptocurrency should seek to understand. We've been five years since the only contentious hard fork in Ethereum's history, and four years since Bitcoin's "user-activated soft fork," which ended exchanges, miners, users, and core Years of size wars between developers. If you haven't been there, it's hard to describe how risky these political rifts are, and how problematic deal politics could be in future gridlock.

(For example, do you think the most likely avenue for censorship is in a validator-activated soft fork code whose incentives are tied to ongoing transaction processing? Or a hard fork of code activated by a majority of owners with incentives tied to their accumulated capital?、Bitcoin’s bias towards soft fork escalation is to prioritize “user coercion over separation” — keeping families together, sort of like “drag along” shareholder provisions. Once enough users express support for the fork, you will eventually be automatically pulled onto the new version of the protocol. For Ethereum, on the other hand, it's more of an iOS upgrade. Yes, new hard forks are "opt-in" for users, but only in the sense that they either submit to the upgrade or lose access to the main network. In an internet of blockchains not dominated by Ethereum, this tyranny of the market would diminish over time. Exit = Select.、I don't hold strong opinions here as I have investments in both Bitcoin and Ethereum and believe both will be successful. If you're new to this, it's worth looking into further. This is also a dense section. I'm sorry for level 301. Episode, but I don't have time to simplify it after 800 hours of writing.Vitalik's thoughtsHasu's debate)。

, if you are new here, there is

A Book About Zoom Legends

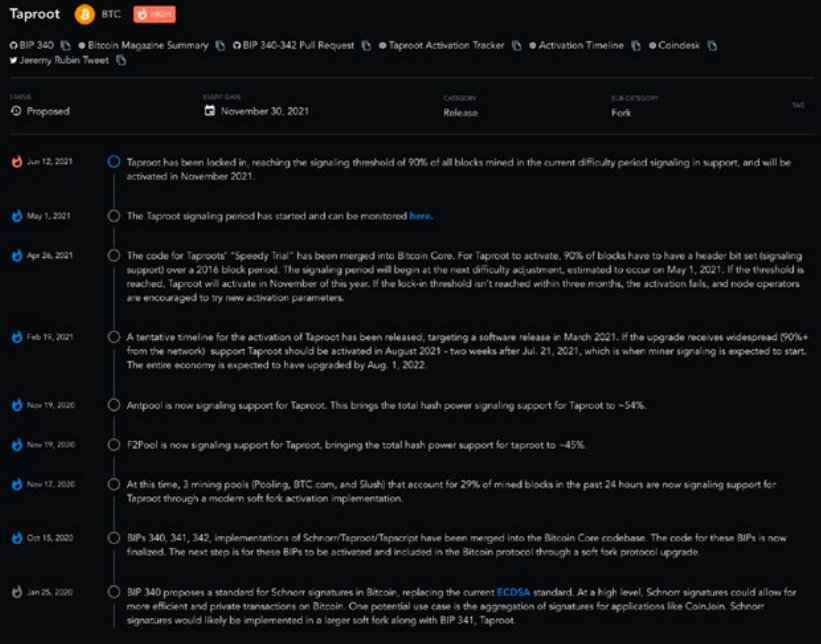

forlaymanIn general, Taproot makes Bitcoin transactions cheaper, and its use of "Schnorr signatures" will enhance Bitcoin's privacy defaults and replaceability. And it could start the next phase of development for the Bitcoin Lightning Network. The next phase of development for Bitcoin's Lightning Network, after years of writing about it, finally, it may explode next year.To be honest, Taproot is really a big problem for privacy and Lightning, but for Bitcoin'sThe Future of Smart ContractsSapioThat's not the case (we've been talking about "sidechains" since 2014, and they lost). As discussed earlier, Bitcoin can be wrapped as collateral on a large scale on other platforms, but this still does not make Bitcoin technically suitable for new smart contract applications.

external paymentpart. I've invested in several companies that rely on Lightning (such as Kollider* and its real-time settlement derivatives exchange), and I would like to see Jeremy Rubin'ssuccess. So I'm also cautiously optimistic that there will be winners.

However, I've been around here long enough to curb my enthusiasm for Bitcoin applications beyond payments and stored-value settlement use cases. A standalone Fedwire replacement is great enough, thanks. In fact, Bitcoin has 300,000 on-chain Bitcoin settlements every day,

And now there are 800,000 Fedwire billings a day. When you consider that escrow services often batch up hundreds or even thousands of small transactions with a single transaction, Bitcoin already surpasses Fedwire in terms of throughput. Lightning can further increase the speed.Developing on Bitcoin is like building a rocket, while developing on Ethereum has historically been more akin to building a Silicon Valley startup. The stakes are higher with Bitcoin (arguably, we'll discuss this in Chapter 6), and you'd need rocket science-level security to build a solid FedEx encryption alternative to Fedwire. The continued updates and investments in Bitcoin's core code and communications infrastructure show what I'm talking about.

v22.0 (released this fall) connects Bitcoin to a second anonymous communication protocol, the Invisible Internet Project, to complement Tor's integration and build resilience into Bitcoin's secure resilient messaging capabilities, making it harder for users to de-anonymize . Blockstream EffortsLaunch a bitcoin satellite into space, which sounds wacky, but it also guarantees that society (and the Internet) will crash anywhere with network access.

That doesn't mean Bitcoin is a bet on the future of Mad Max. Rather, it is a life raft for current and future refugees. "Social collapse. That's what it's about to have 190+ countries and then add a borderless value transfer layer. "This work is important.)

(further reading from

Bitcoin Magazine: Aaron is the Best Bitcoin Technical Writersecondary title9. Lightning strikes El Salvador

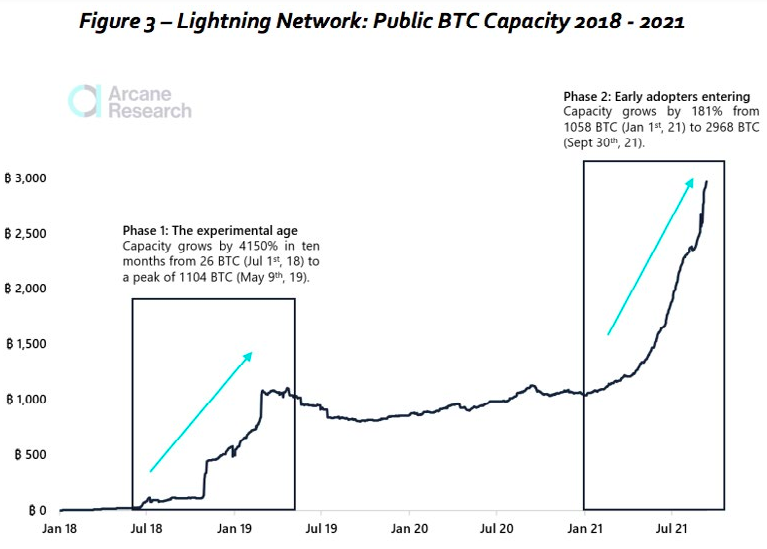

, but its total capacity is only 200 million U.S. dollars, while ERC-20 stablecoins will settle settlements of 5 trillion U.S. dollars this year, with no capacity limit.

(source:Arcane Research)

For all their progress, neither ERC-20 stablecoins nor any other crypto asset has done what Bitcoin has done as a “money” this year. Of course, I am referring to Bitcoin being accepted as legal tender in El Salvador. What surprising things happen to usage when you've done a closed-loop payment system without forcing you to reconnect to fiat reserves.image description(source:

We're still talking small numbers compared to DeFi, but we're still talking six million people in legitimatereal currency, rather than tokenized fiat currencies that ride the cryptocurrency rails and can be shut down in a flash.

I believe I'm going to be wrong about Lightning again. But I can see Lightning reaching a capacity of 30,000 BTC by the end of 2022 (and another 10x next year) thanks to Twitter, Taproot, and President Ukele's aggressive promotional plans. If other countries like Paraguay or Ukraine followBitcoin Game Theory, may be higher.I love "Lightning". It's cool. I love so muchdemonstration of strike(strike demos). I love the news that 2.7 million Salvadorans have downloaded the new Chivo wallet$30 BTC airdroppedmessages and allow users to pay with Lightning on their phones. Lightning pays on their phones. i believe thisit's all just propagandaSnowden. i love twitter

Lightning Tip Service