The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

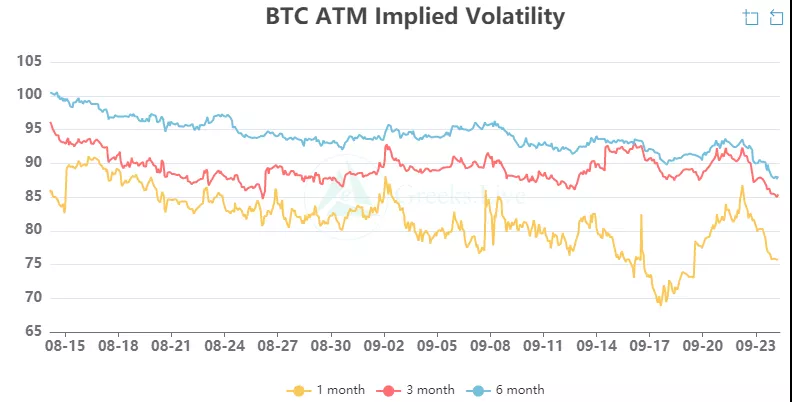

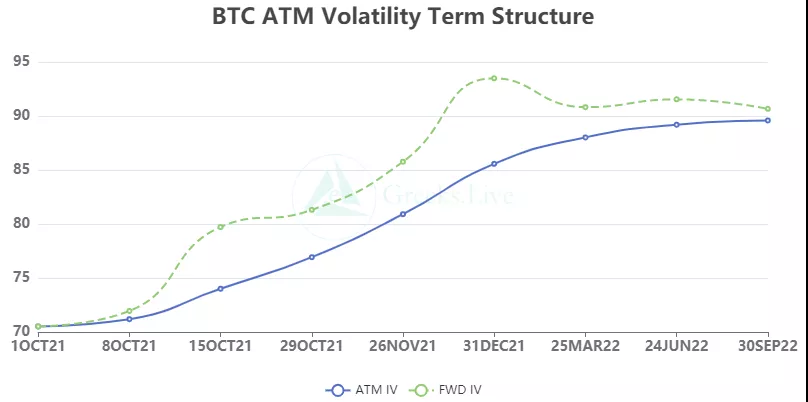

Quarterly delivery is relatively quiet, and yesterday was one of the few big delivery days when the delivery was at the most painful point recently. However, after the delivery, regulatory news brought a sharp drop of nearly $4,000. Bitcoin was already in a fragile rebound market, and the market outlook needs to be more cautious. Each period IV only fell during the plunge, and soon returned to normal, and the options market sentiment was stable.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

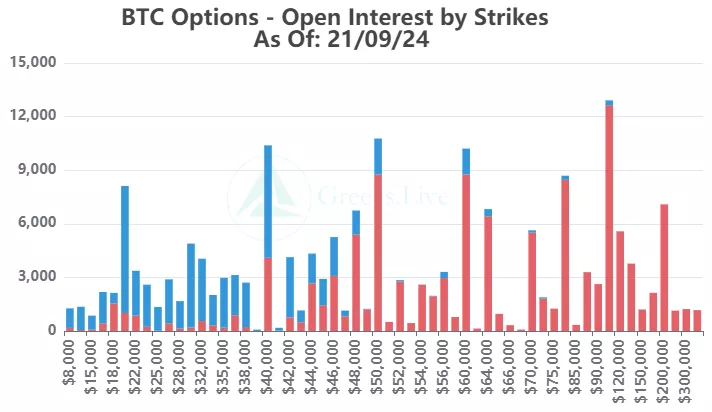

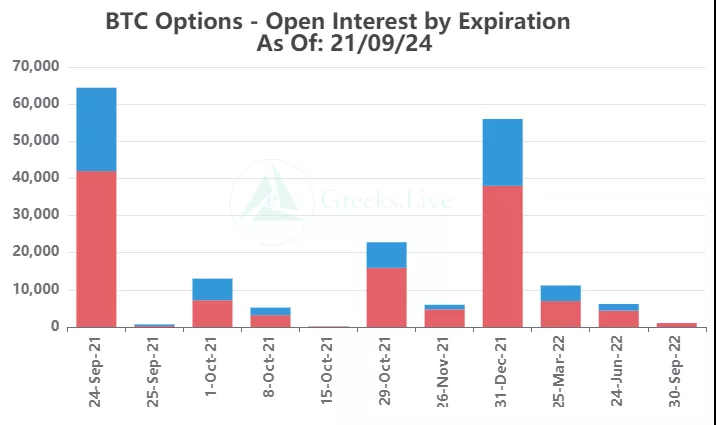

130,000 options open interest, worth 5.6 billion US dollars, 22,000 options trading volume.

【Historical Volatility】

10d 93%

30d 77%

90d 70%

1Y 79%

【IV】

Implied volatility for each normalized term:

【Historical Volatility】

9/24:1m 76%, 3m 85%, 6m 88%,DVol 85%

Today: 1m 79%, 3m 85%, 6m 88%, DVol 87%

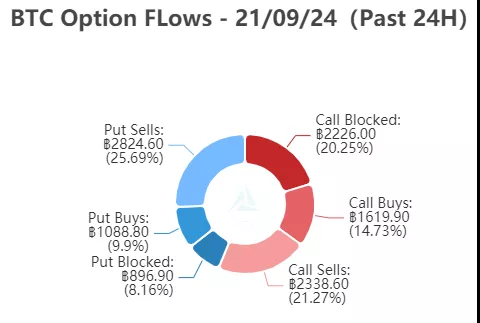

【Option Flows&Bulk Transaction】

【Option position distribution】

【Option position distribution】

There are about 23,000 option positions in October and about 57,000 options in December.

【ETH Options】

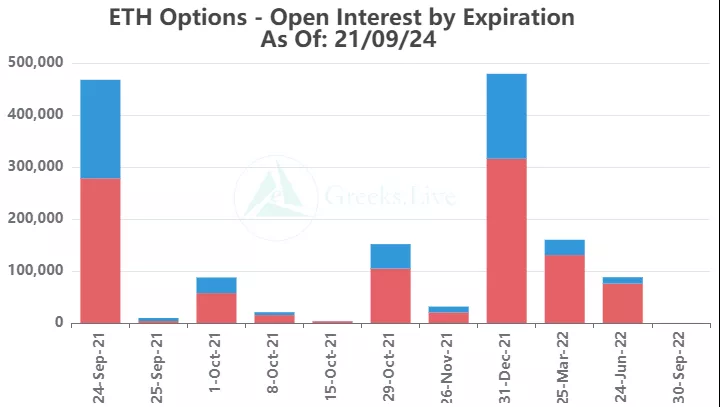

The open interest of Ethereum options is 1.11 million, with a value of 3.2 billion US dollars, and the trading volume is 150,000.

【Historical Volatility】

10d 128%

30d 107%

90d 91%

1Y 108%

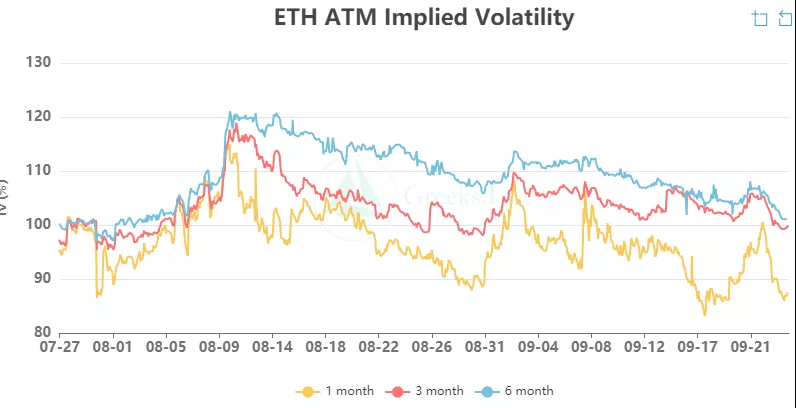

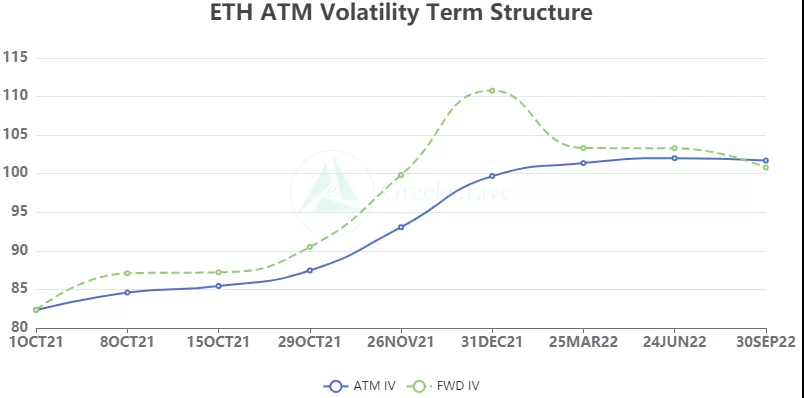

【IV】

Each standardized period IV:

【Historical Volatility】

9/24:1m 93%,3m 100%,6m 103%,DVol 100%

Today: 1m 92%, 3m 100%, 6m 103%, DVol 100%

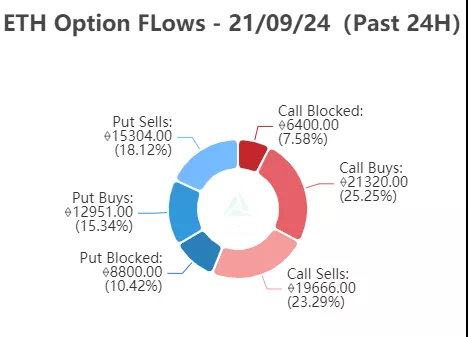

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

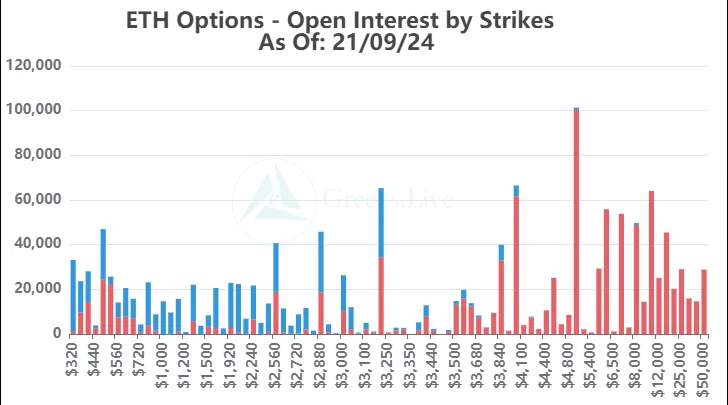

【Option position distribution】

From the perspective of Option Flows, the transaction distribution of Ethereum options is basically unchanged, and the transaction volume in the selling direction has increased more. The market sold a lot during the rising period of IV, which directly smashed the rising trend of IV.