The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

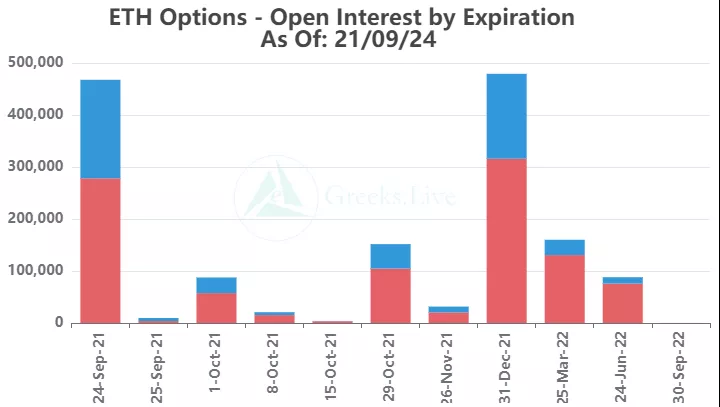

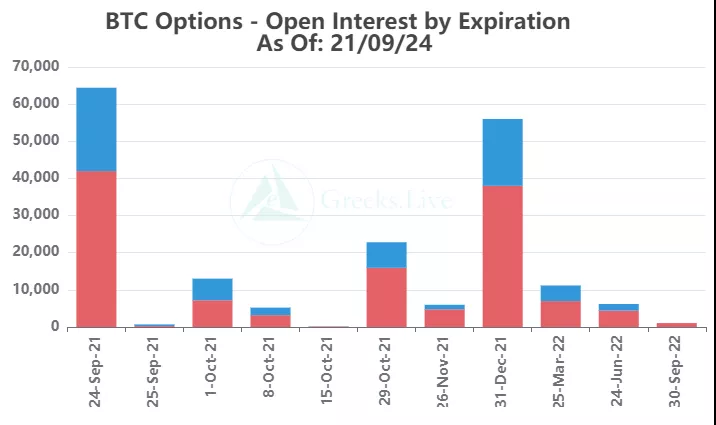

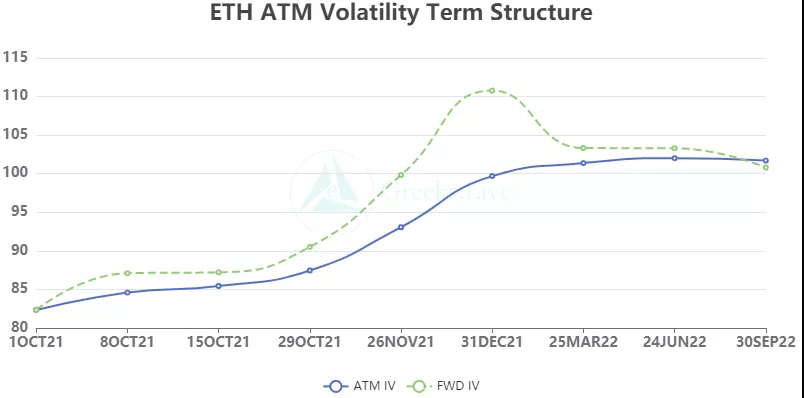

Today is the quarterly delivery day, with 64,400 Bitcoin open positions pending delivery, with a nominal value of 2.87 billion US dollars, and the most painful point is 44,000 US dollars. Ethereum has 467,000 open positions to be delivered, with a nominal value of 1.45 billion US dollars, and the most painful point is 2880 US dollars. With the arrival of the quarterly delivery, IV has shown a significant decline, and the medium and long-term transaction volume has increased significantly.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

The option open interest was 187,000 contracts, worth $8.3 billion, and the option volume was 11,000 contracts.

【Historical Volatility】

10d 89%

30d 77%

90d 70%

1Y 79%

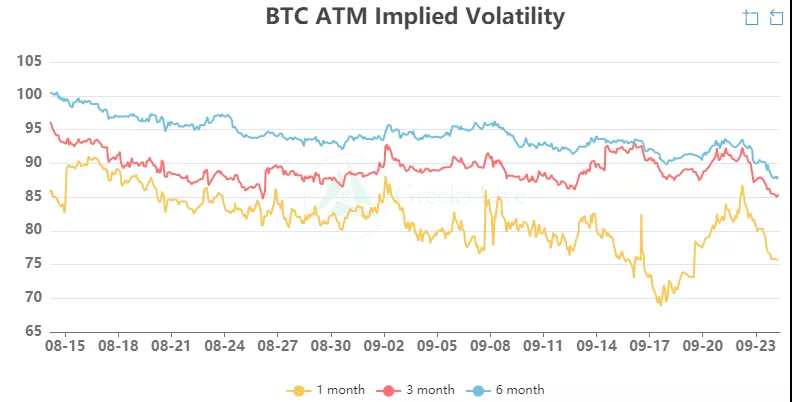

【IV】

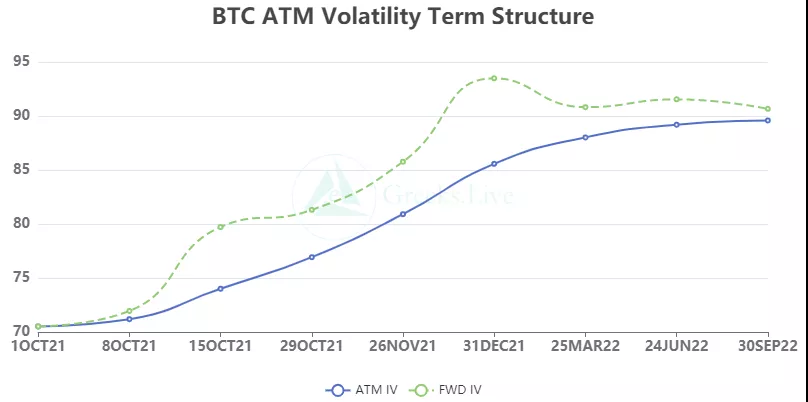

Implied volatility for each normalized term:

【Historical Volatility】

9/23:1m 81%, 3m 87%, 6m 90%,DVol 89%

Today: 1m 76%, 3m 85%, 6m 88%, DVol 85%

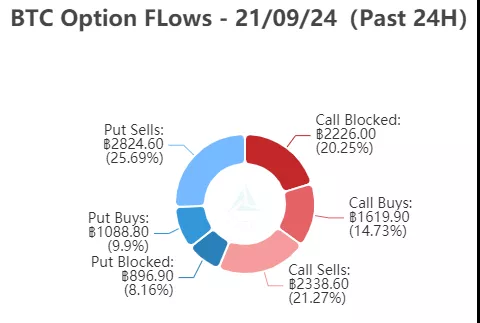

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

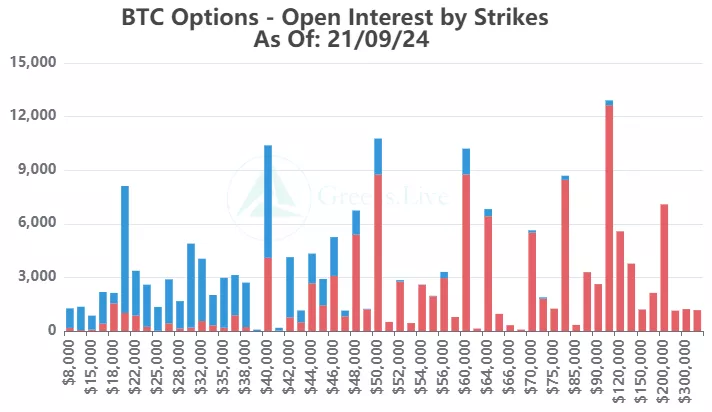

【Option position distribution】

【Option position distribution】

【ETH Options】

【Historical Volatility】

【Historical Volatility】

10d 122%

30d 105%

90d 92%

1Y 108%

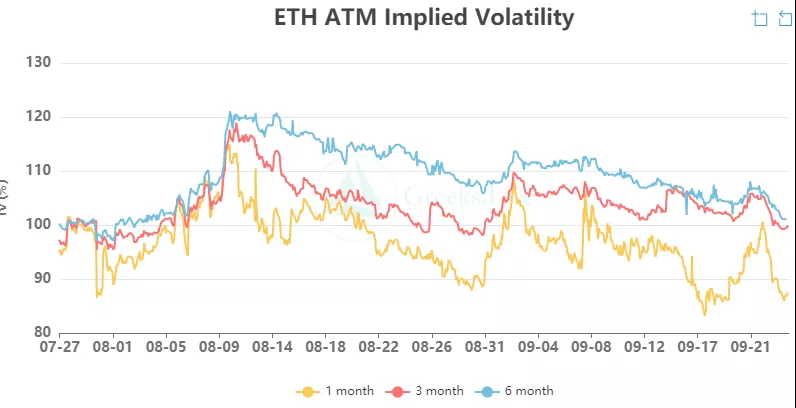

【IV】

Each standardized period IV:

Today: 1m 92%, 3m 100%, 6m 103%, DVol 100%

9/22:1m 89%,3m 99%,6m 102%,DVol 99%

Today: 1m 92%, 3m 100%, 6m 103%, DVol 100%

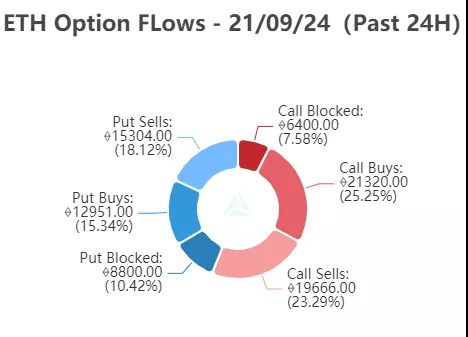

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

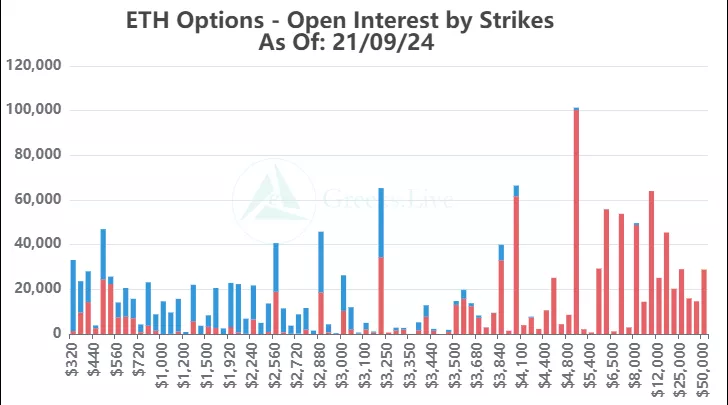

【Option position distribution】

From the perspective of Option Flows, the transaction distribution of Ethereum options remains basically unchanged, and the trading volume from the bullish direction shifts slightly to the bearish direction. However, during the period of position adjustment at the end of the month, such small changes are relatively normal. The transaction volume at the end of the year is higher than that at the end of the month. As the quarter expires, the transaction volume in the medium and long-term has increased.