People Participating in DeFi Saga Without Knowing the Potential Risks!

Decentralized finance, commonly known as "DeFi", aims to disrupt traditional financial institutions such as banks and cryptocurrency exchanges, most of which run on the Ethereum blockchain.

The recent DeFi boom also brings with it various associated risks. Each DeFi project involves different levels of risk, the main types of risks involved are: technical risk, asset risk and product risk.

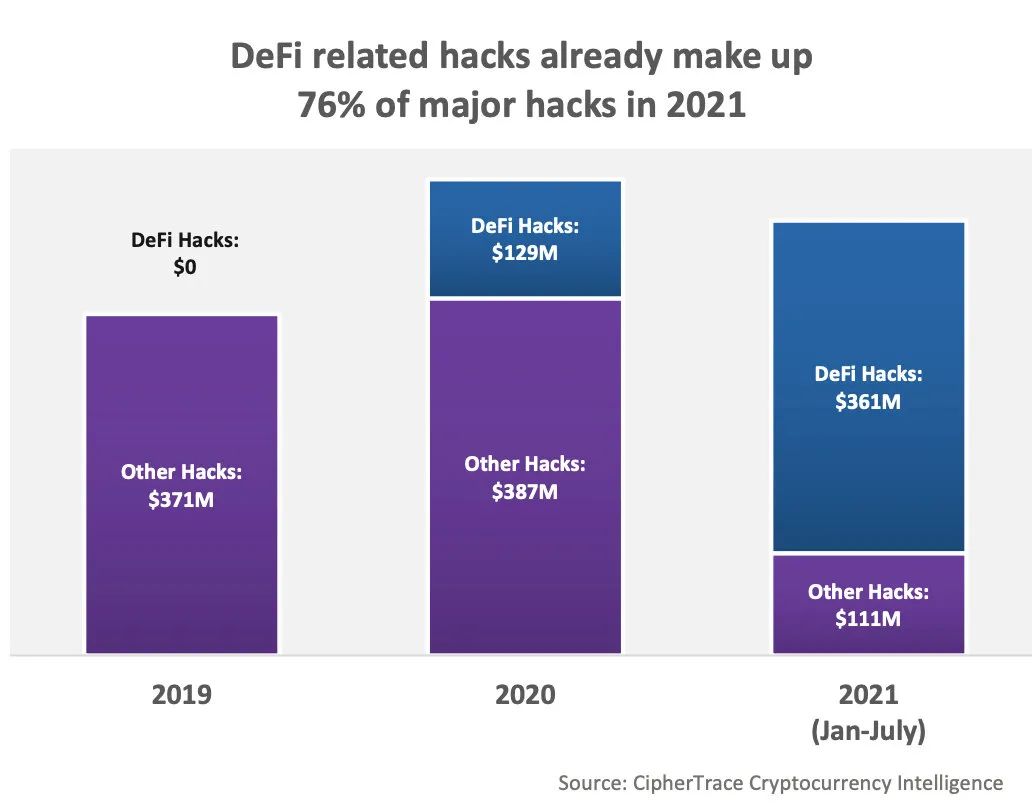

Anyone who is a beginner should be aware of the "red flags" that any platform raises. Since the explosion of DeFi in the past decade, we have seen hundreds of millions of dollars in funds lost to various hacks, thefts, frauds, and system failures.

Back to today: Notable DeFi hacks only in 8/21:

PolyNetwork - $613 million (notoriously the largest crypto theft ever!)

Japan’s Liquid Global Exchange — $94 million

Popsicle Finance - $25 million

Punk Protocol — $8.9 million

Flash Loan Attack on XSURGE DeFi - $5M

These are just a few numbers on the list of major hacks that occurred in the first half of 2021.

first level title

How is DeFi in 2021?

The last decade has witnessed the dramatic growth of the DeFi economy. At the time of writing, the total amount locked (TVL) stood at $82.95 billion, according to DeFi Pulse. Although DeFi is developing rapidly, there is still enough room for innovation in projects in the DeFi space.

secondary title

NFT

Social network

Social network

Fashion

game

Fashion

Liquidity mining

Liquidity mining

Liquidity mining uses cryptocurrencies to provide liquidity to decentralized exchanges.

first level title

Stablecoins - "Hot in 2021"

Stablecoins are digital currencies pegged to any underlying asset, such as a national currency or a precious metal such as gold. This gives stablecoins freedom in terms of security, transparency and privacy.

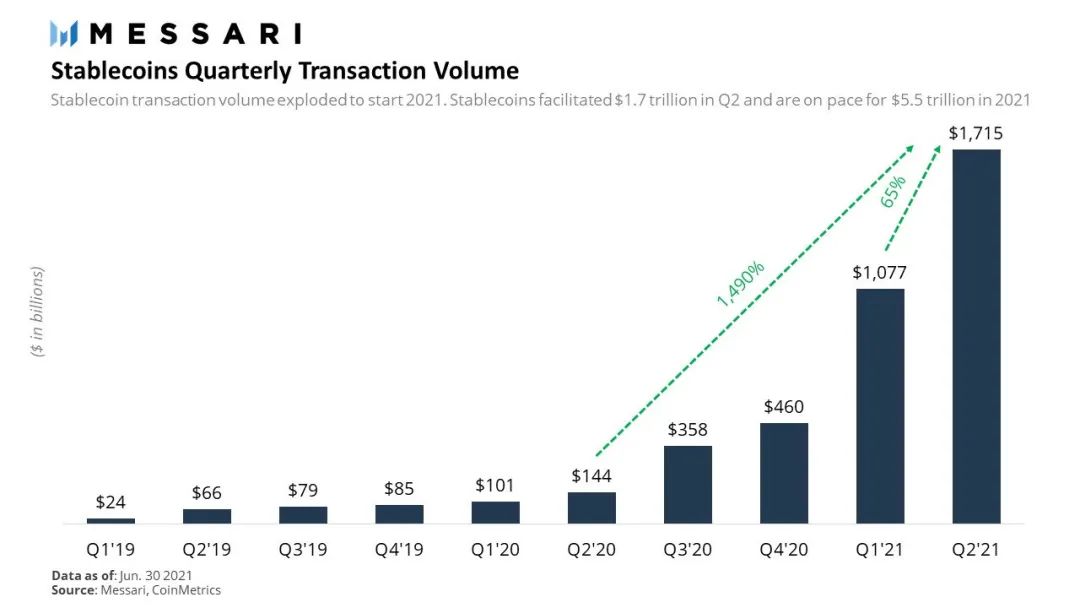

Since its launch in 2019, the transaction volume of the stablecoin has been growing. By April 2021, that number had risen from billions of dollars a day to a median of $100 billion, hitting a record of $250 billion in mid-April.

Not too long ago, we witnessed a “stablecoin invasion”.

Globally, around 200 stablecoins have been launched or are in development. However, one reason for their sudden growth is their reliable peer-to-peer (P2P) trading environment. It removes the need to transact with volatile cryptocurrencies like Bitcoin.

In a recent report, Messari revealed that stablecoin activity spiked significantly in the second quarter of 2021.

first level title

Attacks Sweeping the DeFi World

Beginning in early 2021, we began to witness hacks and exploits resulting in millions of dollars lost to various stakeholders. Obviously, a platform audited by a trusted audit firm is less likely to be hacked. The total value locked (TVL) in DeFi is at an all-time high, as are DeFi-related attacks.

secondary title

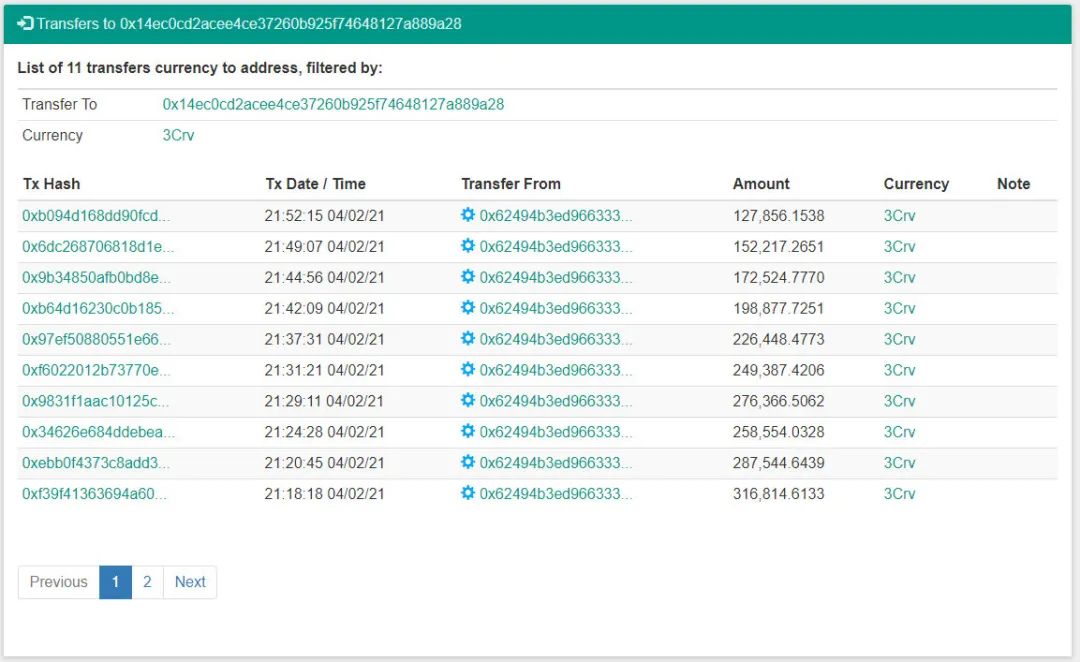

Yearn Finance Exploit - 2/4/21

How to use: flash loan

Lost funds: $11 million

Yearn.Finance fell victim to a massive flash loan attack with total losses exceeding $10 million. The attacker obtained 1.7M USDT, 513K DAI and 506K 3CRV. The screenshot below depicts the profit made by the 3CRV attackers on each transaction.

picture

secondary title

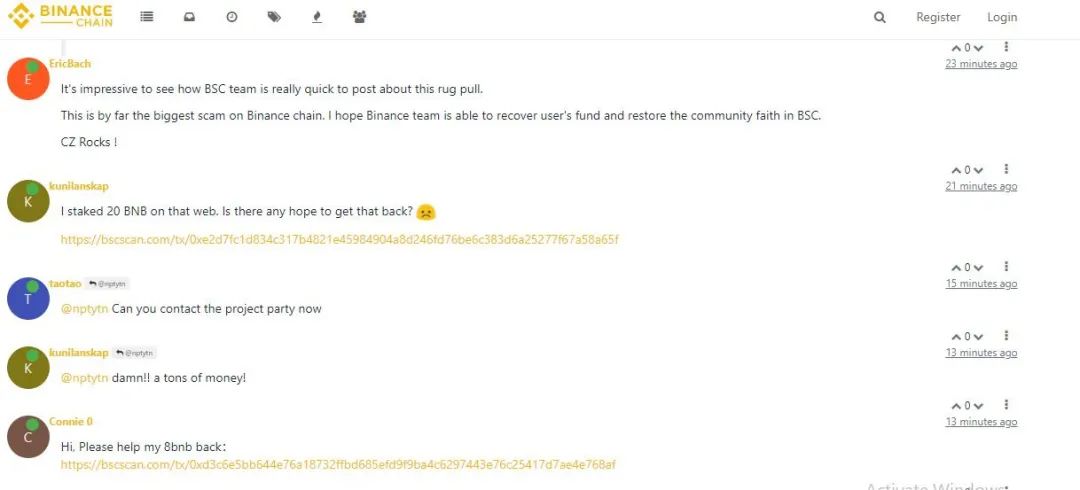

Meerkat Finance Exploit - 3/4/21

How to use: pull the carpet

Lost funds: $31 million

DeFi project Meerkat Finance was siphoned off $31 million in crypto assets. This is a liquidity mining protocol running on Binance Smart Chain. The attack was carried out a day after the BSC went live.

The siphoned funds were transferred to multiple new blockchain addresses. The project was subsequently slashed to 13 million BUSD and roughly 73,000 BNB, equivalent to the current $31 million.

Shortly after the report was made public on the BSC community page, many users highlighted the risks they faced and demanded solutions from crypto exchanges.

secondary title

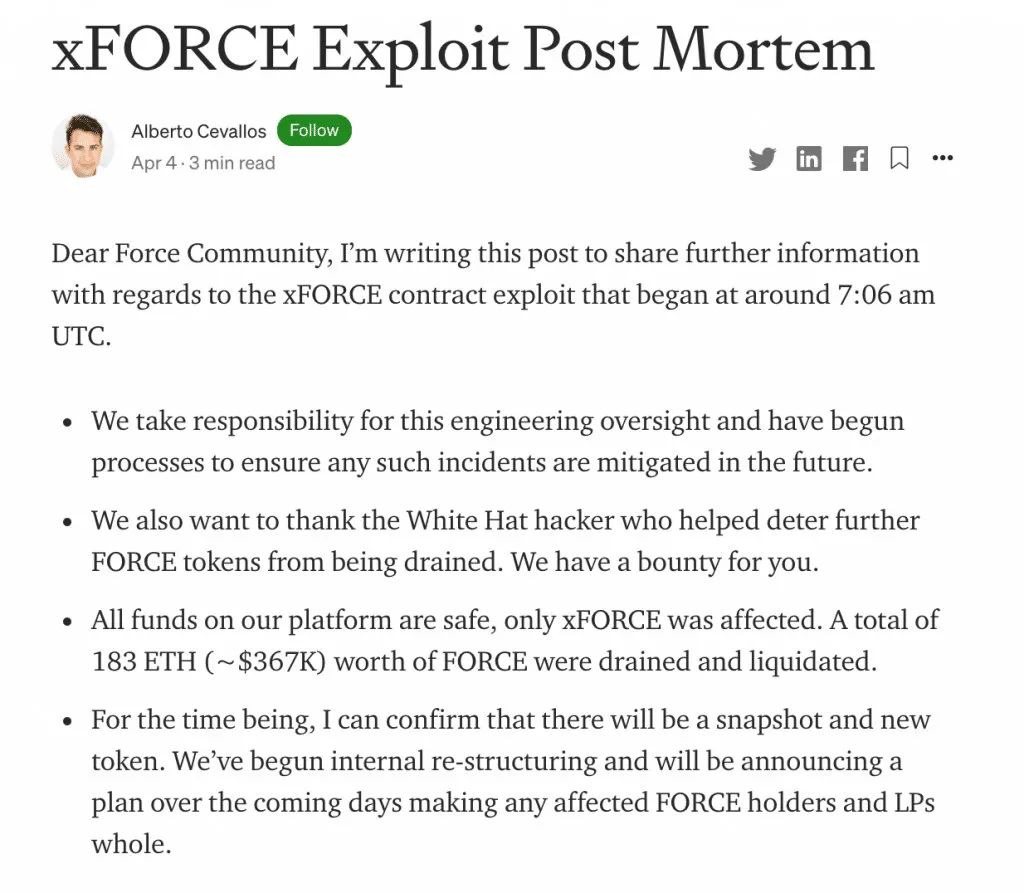

ForceDAO Attack - 4/4/21

How to use: engineering supervision

Funds lost: $367,000

Force is defined as a quantitative hedge fund, an agreement, and a decentralized autonomous organization. It aims to provide higher yielding DeFi opportunities to its community.

This hack was made possible due to a mismatch between two components in the ForceDAO environment.

During the attack, Force, xForce and Force/ETH LP on UniSwap and SushiSwap were at risk. Vulnerabilities in the ForceDAO ecosystem are easily identified and can be fixed through deep smart contract audits.

first level title

Can Audit Firms Save Them?

2020 was a resounding year for DeFi, but DeFi in 2021 is on the rise, and as TVL rises, it is also attracting the attention of attackers. It is expected to be even worse in the coming year.

Gaining the trust of users of different platforms has become increasingly difficult amid uncertainty and insecurity.

Summarize

Summarize

It's been a big year for DeFi, with various DeFi protocols showing tremendous innovation and scalability. There is no doubt that DeFi has the potential to impact financial services in the global economy.

This article comes from the decentralized financial community and is reproduced with authorization.

Source:https://medium.com/coinmonks/defi-trends-hacks-of-2021-a2142cab3669

This article comes from the decentralized financial community and is reproduced with authorization.