The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

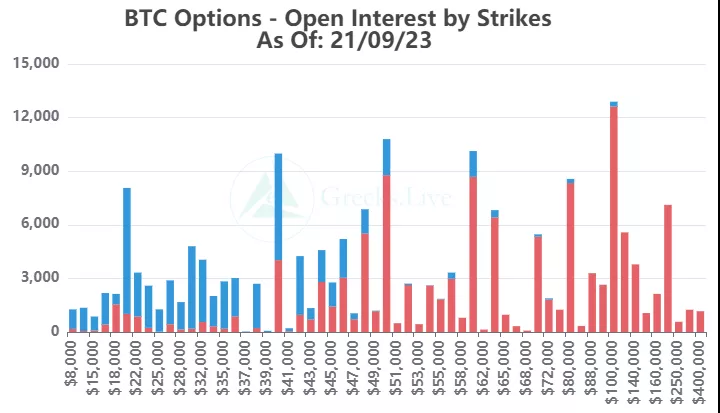

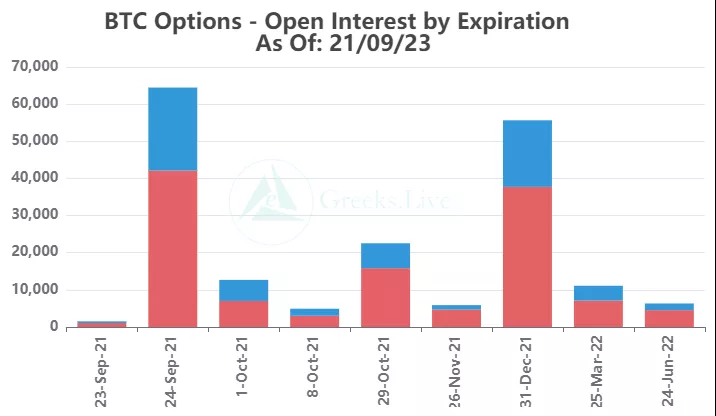

Affected by the easing of external market pressure, mainstream currencies have rebounded. Digital currencies are currently greatly affected by external factors, and the future market needs to observe more information from other markets. There are many large put options on Bitcoin, among which 20,000P is the most concentrated, which is a halved price for the current Bitcoin price. The options that expire in October and December are each traded 600 contracts, which is likely to be a calendar spread.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

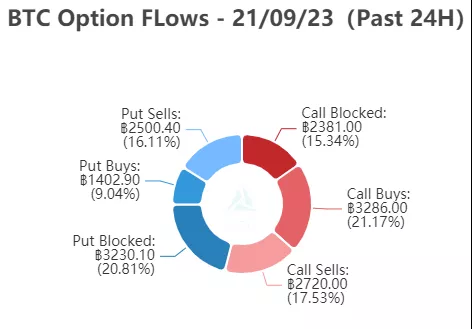

The option open interest was 185,000 contracts, worth $8 billion, and the option volume was 17,000 contracts.

【Historical Volatility】

10d 88%

30d 76%

90d 70%

1Y 79%

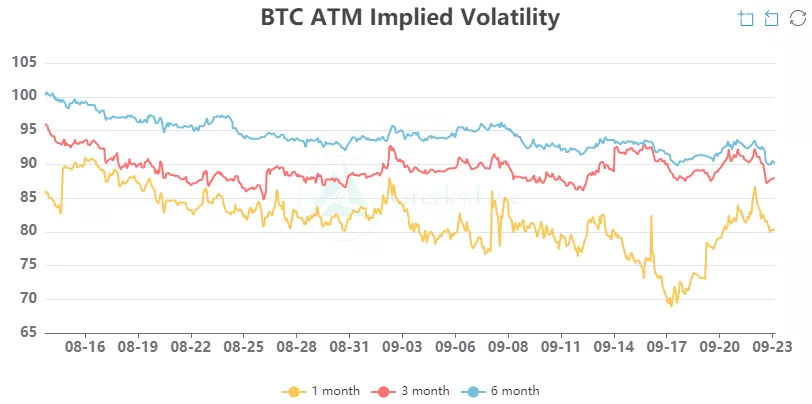

【IV】

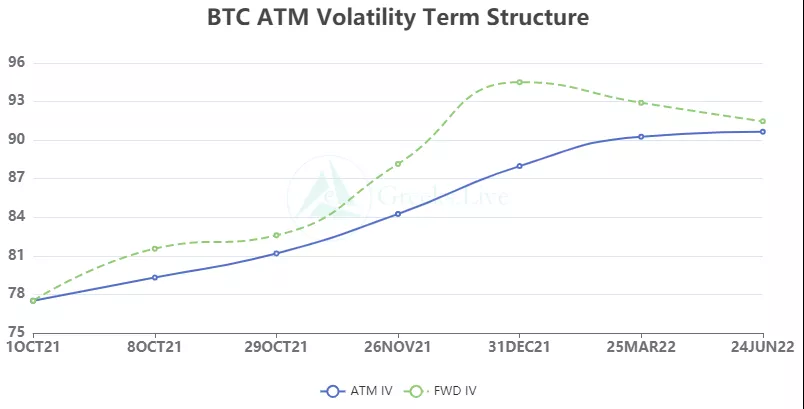

Implied volatility for each normalized term:

【Historical Volatility】

9/22:1m 85%, 3m 91%, 6m 93%,DVol 94%

Today: 1m 81%, 3m 87%, 6m 90%, DVol 89%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

【Option position distribution】

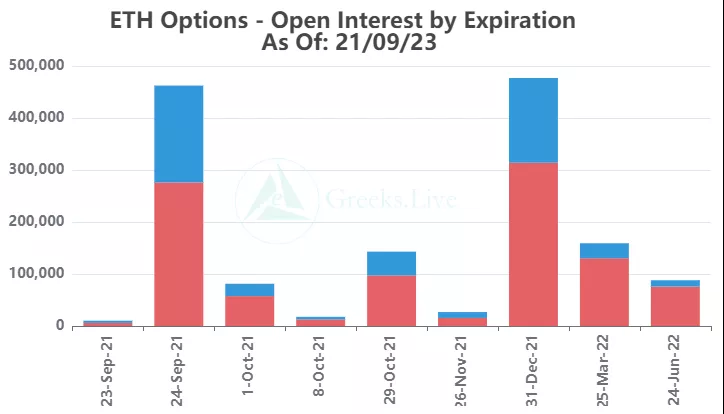

【ETH Options】

【Historical Volatility】

【Historical Volatility】

10d 105%

30d 98%

90d 90%

1Y 108%

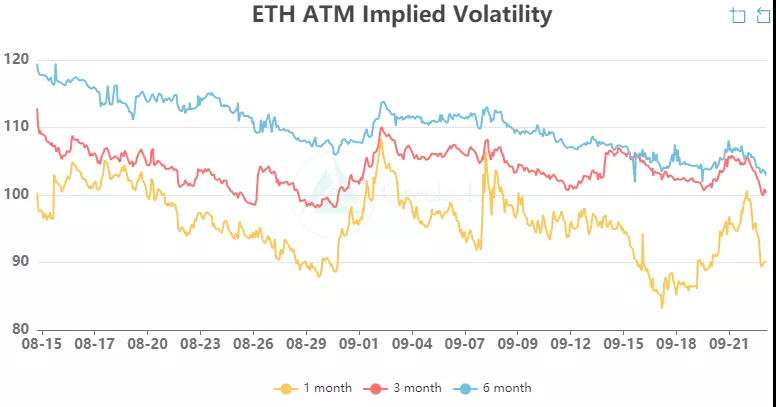

【IV】

Each standardized period IV:

Today: 1m 92%, 3m 100%, 6m 103%, DVol 100%

9/22:1m 102%,3m 105%,6m 106%,DVol 110%

Today: 1m 92%, 3m 100%, 6m 103%, DVol 100%

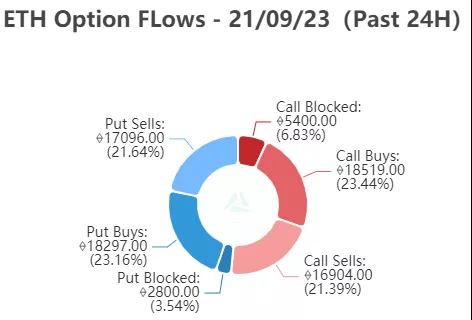

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

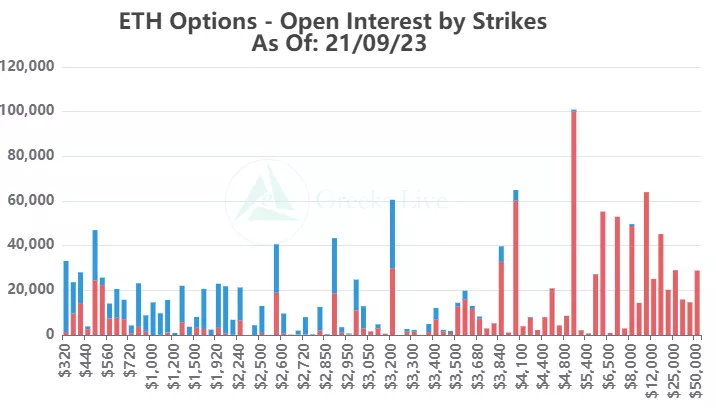

【Option position distribution】

From the perspective of Option Flows, the transaction distribution of Ethereum options remained basically unchanged, and the transaction volume decreased slightly. At the end of the month, the transaction of put options with an exercise price of US$3,040 reached as high as 12,000, while other contracts were less than 3,500. Although there were no transactions of 20,000 in the previous two days, it can also be seen that the option competition at the end of the quarter is still fierce. intense.