The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

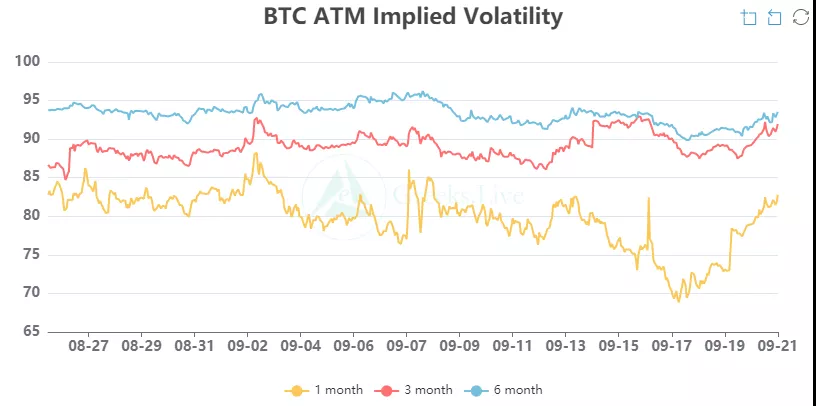

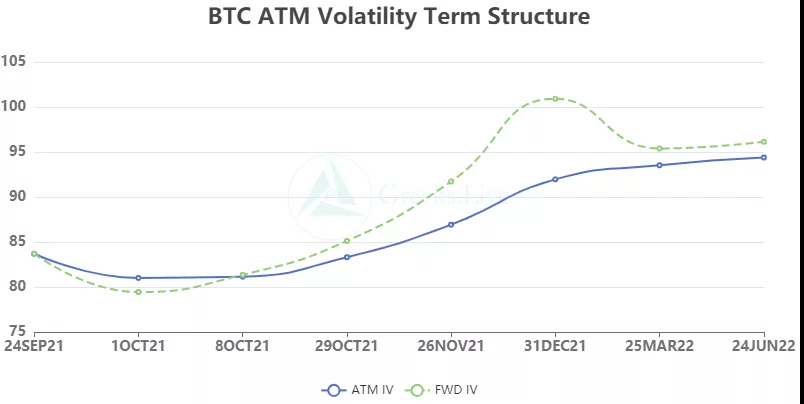

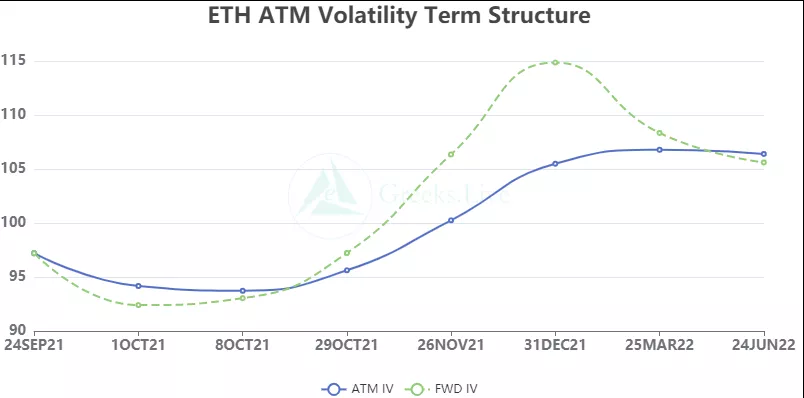

Affected by external factors, mainstream currencies fell across the board, and the current flash crash has fallen below the trend line. The IV of each term has risen in different ranges, and the 10% decline is actually not that big. The increase in IV is mainly due to the change in the average price, and the market reaction is delayed.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

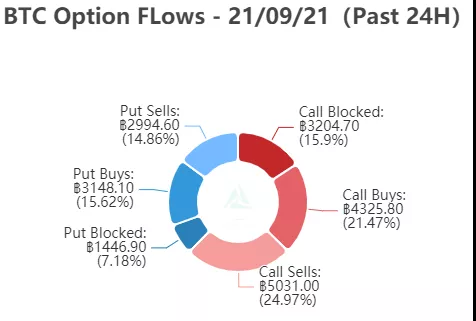

【BTC Options】

The option open interest was 182,000 contracts, worth $7.7 billion, and the option volume was 22,000 contracts.

【Historical Volatility】

10d 74%

30d 70%

90d 70%

1Y 79%

【IV】

Implied volatility for each normalized term:

【Historical Volatility】

9/20:1m 77%, 3m 88%, 6m 91%,DVol 85%

Today: 1m 84%, 3m 91%, 6m 93%, DVol 93%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

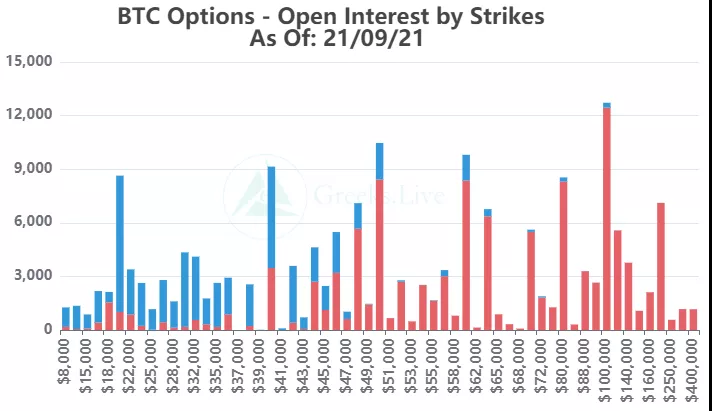

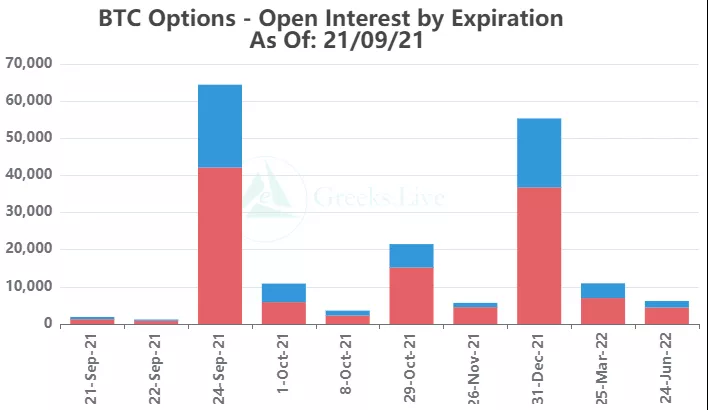

【Option position distribution】

【Option position distribution】

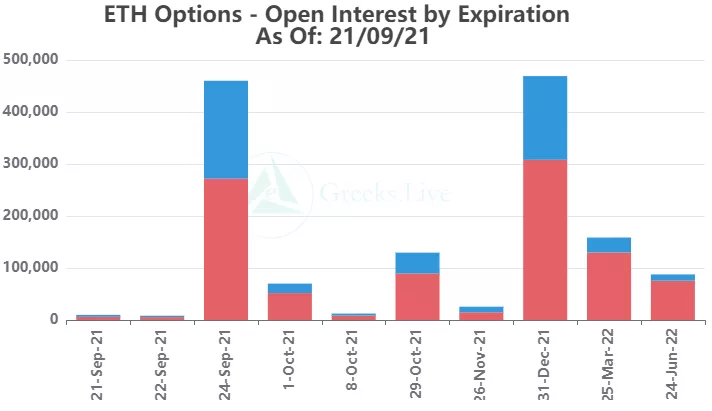

【ETH Options】

The open interest of Ethereum options is 1.43 million, worth 4.3 billion US dollars, and the trading volume is 150,000.

【Historical Volatility】

10d 103%

30d 95%

90d 90%

1Y 108%

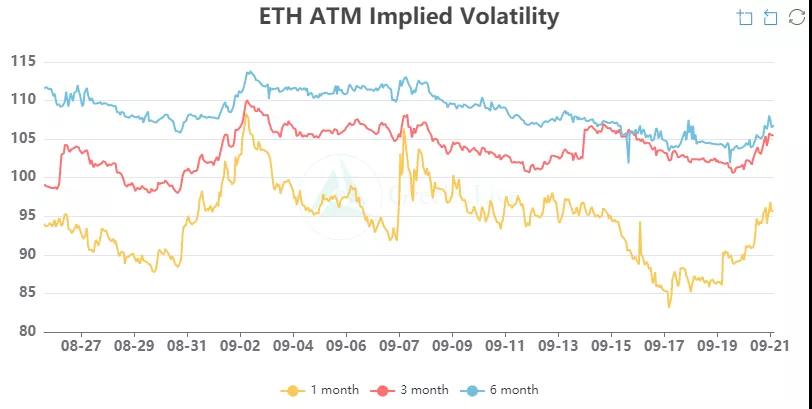

【IV】

Each standardized period IV:

【Historical Volatility】

9/20:1m 89%,3m 101%,6m 104%,DVol 96%

Today: 1m 96%, 3m 105%, 6m 107%, DVol 103%

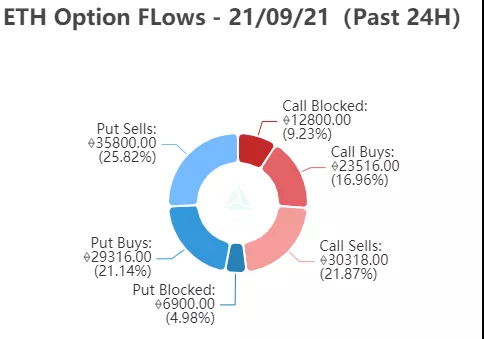

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

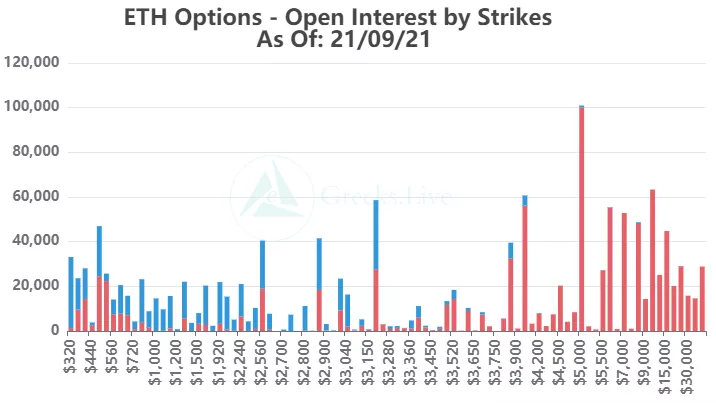

【Option position distribution】

From the perspective of Option Flows, the trading volume of Ethereum options has nearly quadrupled, and the contribution is mainly due to the sharp increase in the trading of put options, especially the buying and selling of 30,000 put options due at the end of the month. Volume was flat. The most traded is 2880 put options on the 24th, with a single contract turnover exceeding 10,000.