The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

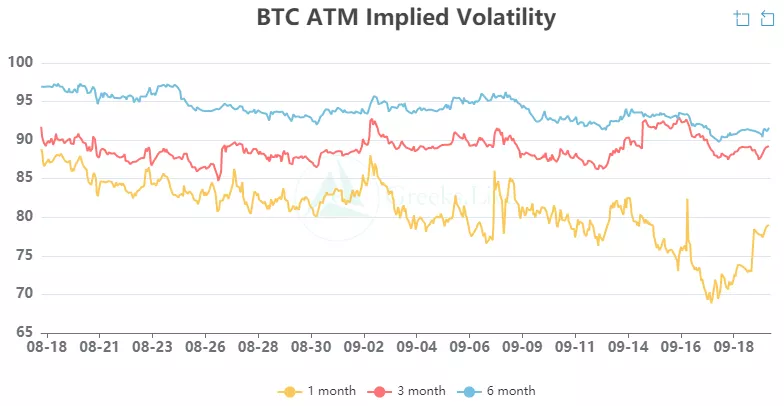

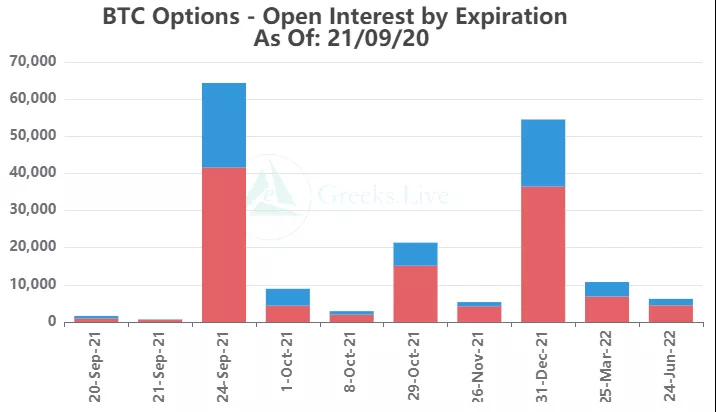

The market rebounded by 10% last week and entered a sideways market. It seems that the market is not enthusiastic enough, and all indicators are calm as usual. Today is a day of correction. After the delivery, the IV has risen significantly, and the transaction is concentrated in the ultra-short term, especially the quarterly options that are about to be delivered.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

The open interest of options is 177,000, worth 8.4 billion US dollars, and the trading volume of options is 6,000.

【Historical Volatility】

10d 47%

30d 64%

90d 70%

1Y 79%

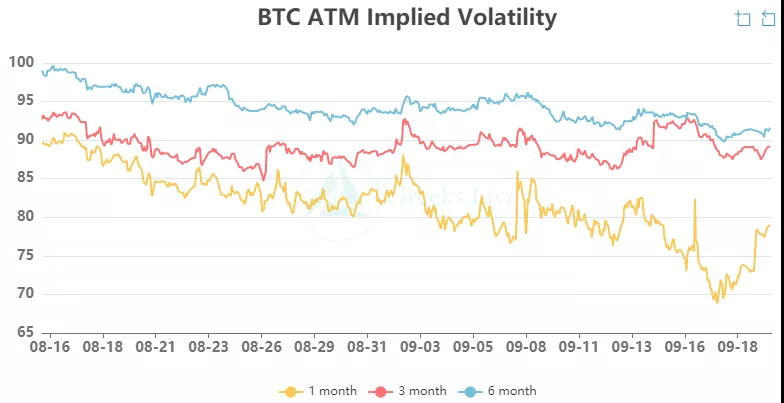

【IV】

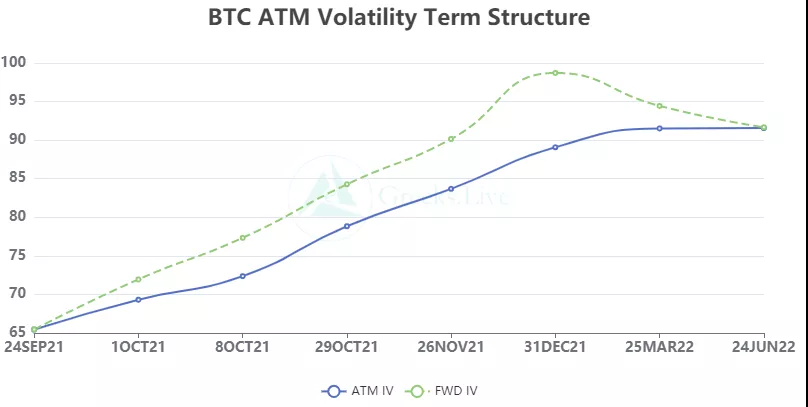

Implied volatility for each normalized term:

【Historical Volatility】

9/19:1m 77%, 3m 88%, 6m 91%,DVol 85%

Today: 1m 77%, 3m 88%, 6m 91%, DVol 85%

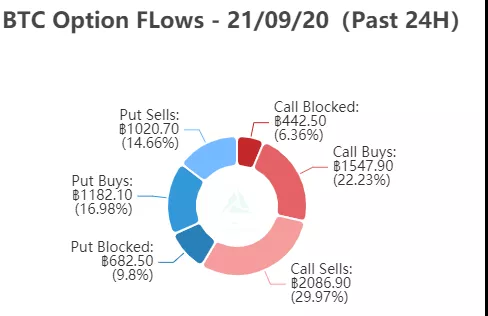

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

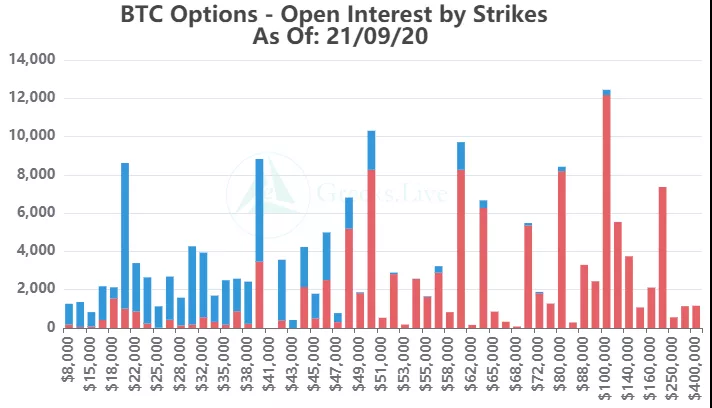

【Option position distribution】

【Option position distribution】

【ETH Options】

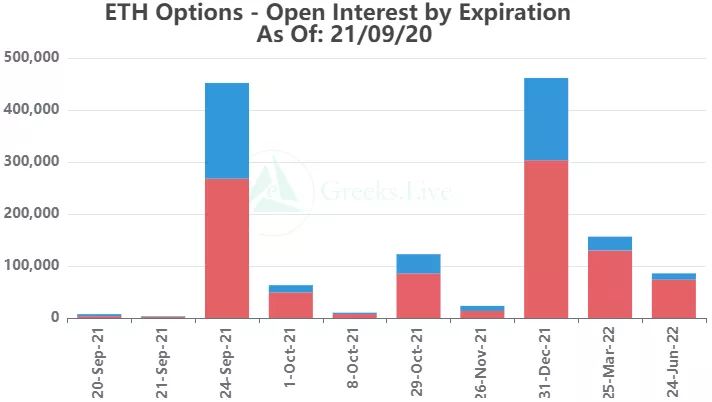

The open interest of Ethereum options is 1.39 million, worth 4.6 billion US dollars, and the trading volume is 35,000.

【Historical Volatility】

10d 77%

30d 87%

90d 92%

1Y 108%

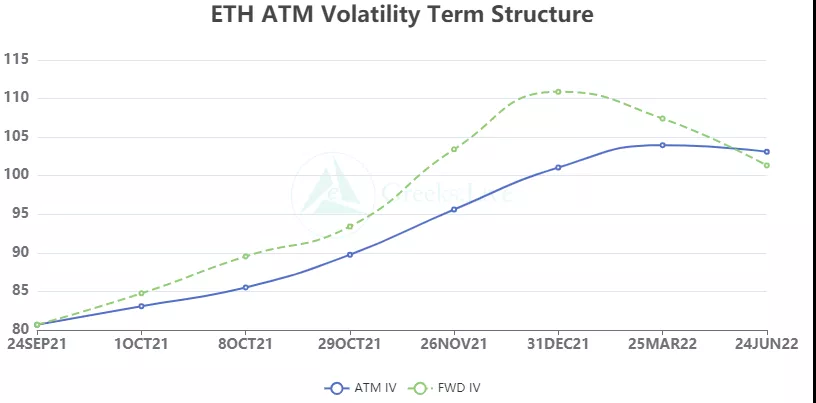

【IV】

Each standardized period IV:

【Historical Volatility】

9/19:1m 89%,3m 101%,6m 104%,DVol 97%

Today: 1m 89%, 3m 101%, 6m 104%, DVol 96%

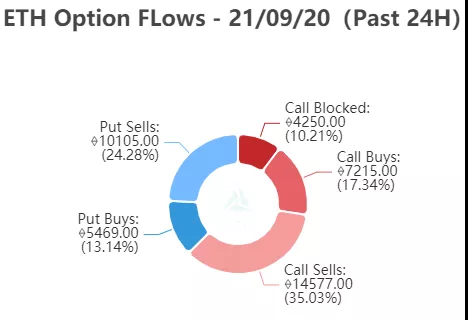

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

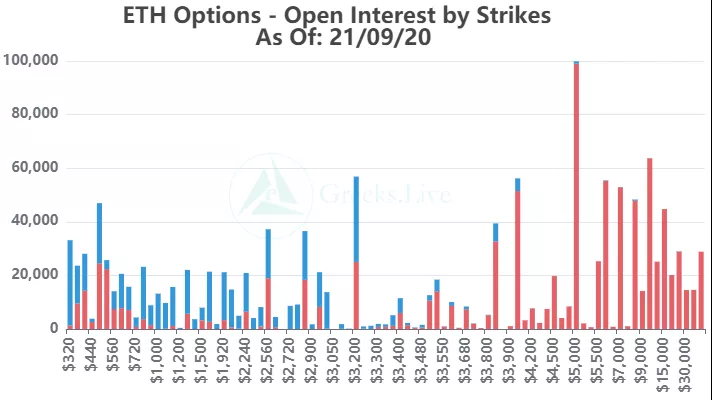

【Option position distribution】

From the perspective of Option Flows, the trading volume of Ethereum options was the same as yesterday, and the trading volume of short call options rose slightly, and the overall trading distribution was close to yesterday. Transactions are still concentrated on the quarterly options that are about to expire, and the transaction of next-week options has become active.