The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

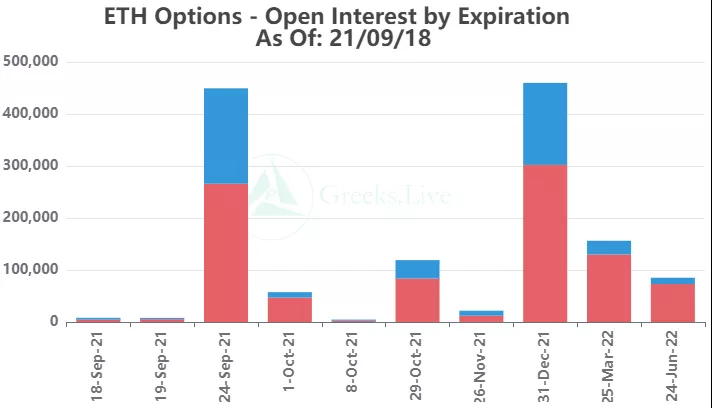

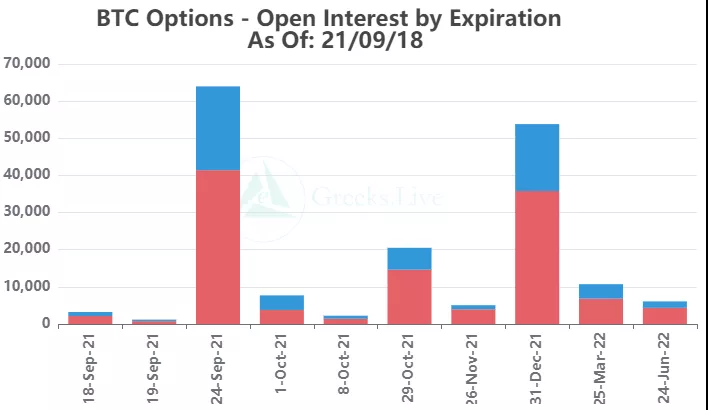

Entering the quarterly delivery week, the overall market is not big, and the volatility is gradually decreasing. However, the quarterly holdings that are about to expire ushered in a significant increase. When Bitcoin had multiple large transactions on the 16th, the quarterly holdings exceeded the annual holdings, which came a little later than other quarters. Today, the quarterly holdings of Ethereum have increased significantly, surpassing the annual holdings, which is relatively rare.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

The option open interest was 174,000 contracts, worth $8.3 billion, and the option volume was 18,000 contracts.

【Historical Volatility】

10d 83%

30d 65%

90d 70%

1Y 79%

【IV】

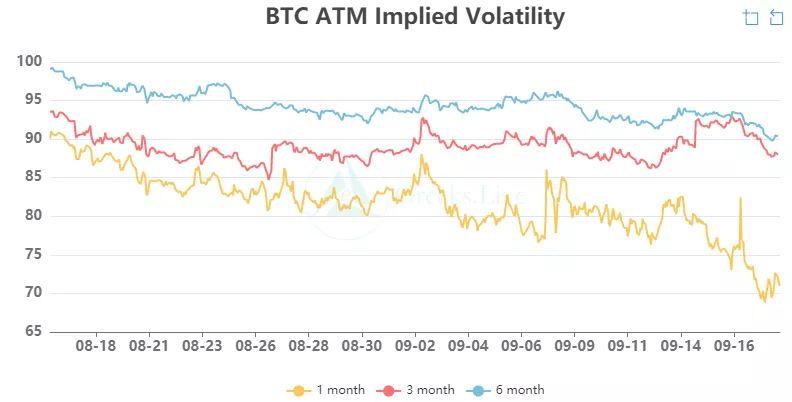

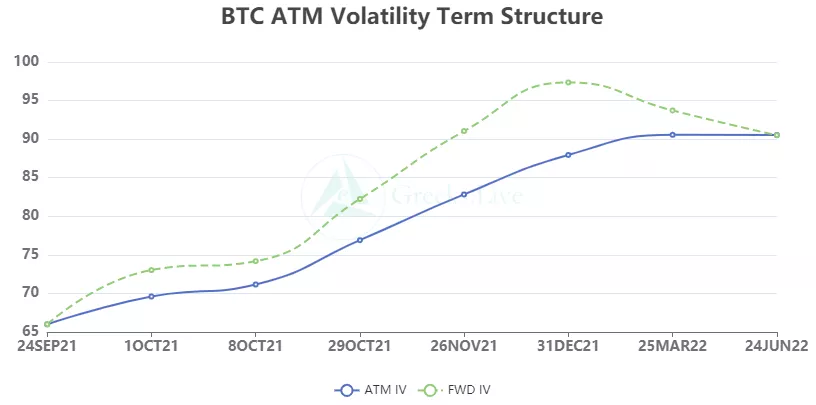

Implied volatility for each normalized term:

【Historical Volatility】

9/17:1m 75%, 3m 89%, 6m 92%,DVol 83%

Today: 1m 74%, 3m 87%, 6m 91%, DVol 81%

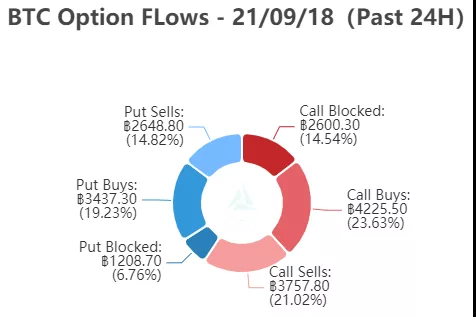

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

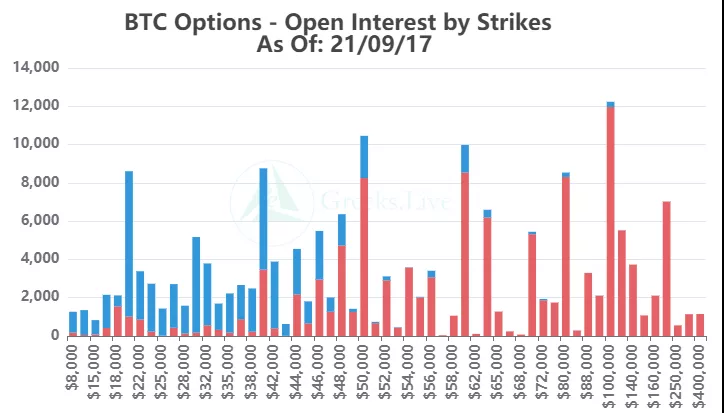

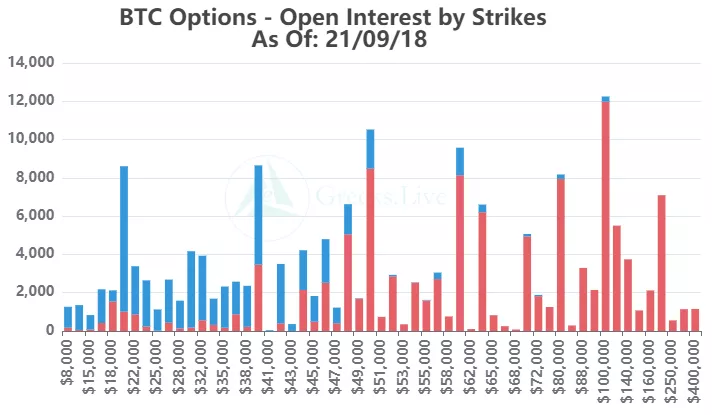

【Option position distribution】

【Option position distribution】

【ETH Options】

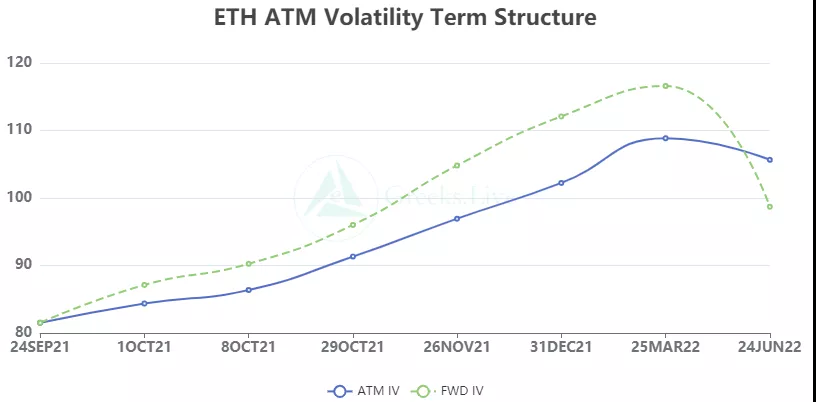

The open interest of Ethereum options is 1.37 million, worth 4.7 billion US dollars, and the trading volume is 100,000.

【Historical Volatility】

10d 105%

30d 88%

90d 93%

1Y 108%

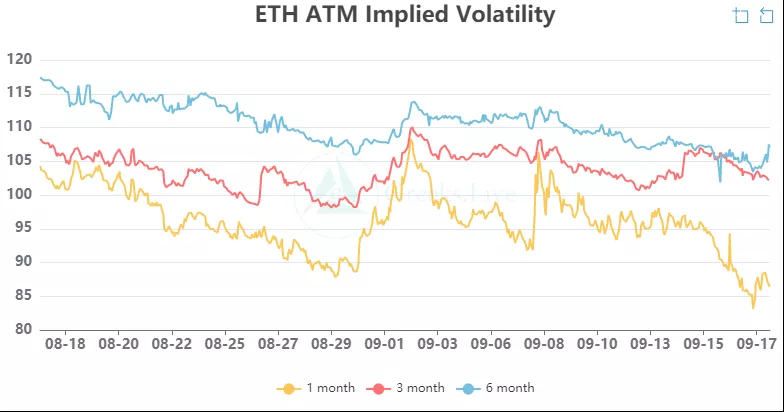

【IV】

Each standardized period IV:

【Historical Volatility】

9/16:1m 87%,3m 102%,6m 107%,DVol 97%

Today: 1m 90%, 3m 102%, 6m 105%, DVol 98%

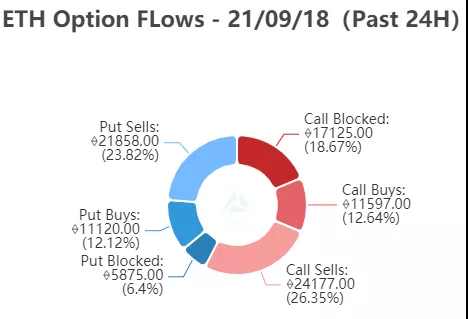

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

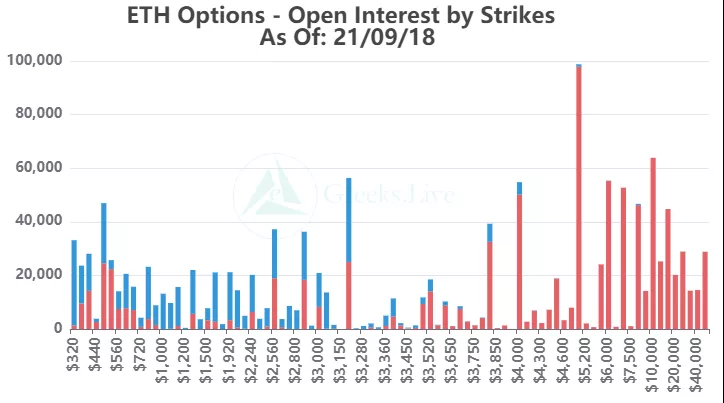

【Option position distribution】

From the perspective of Option Flows, the trading volume of option selling has obviously increased strongly, especially in the bullish direction. The main transactions are concentrated in the options of the current month. The put and call transactions in the month both exceeded 21K, and the call transactions in the next week were also relatively high. The quarterly position of Ethereum has approached the annual position.