The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

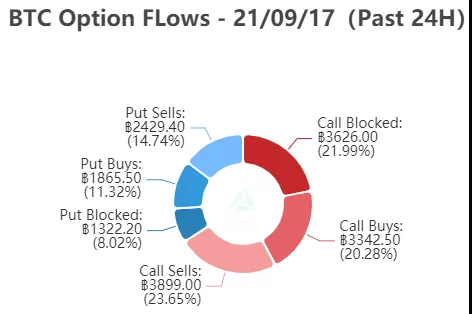

Bitcoin is oscillating around $48,000, and the market is cautious about rising. The transaction volume of Bitcoin’s bulk call options doubled, and the sales of call options on the market also contributed a lot. The main reason was that 50,000 Calls were sold in the current month, and more than 2,700 contracts were traded. A large number of fair-value sales directly lowered the short-term IV.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

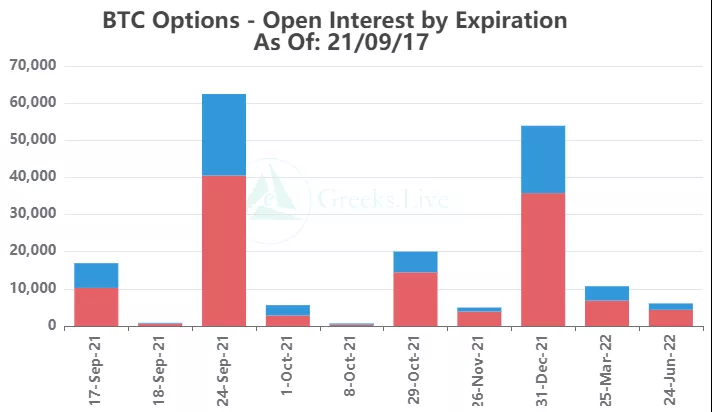

【BTC Options】

The option open interest was 182,000 contracts, worth $8.7 billion, and the option volume was 16,000 contracts.

【Historical Volatility】

10d 84%

30d 66%

90d 70%

1Y 79%

【IV】

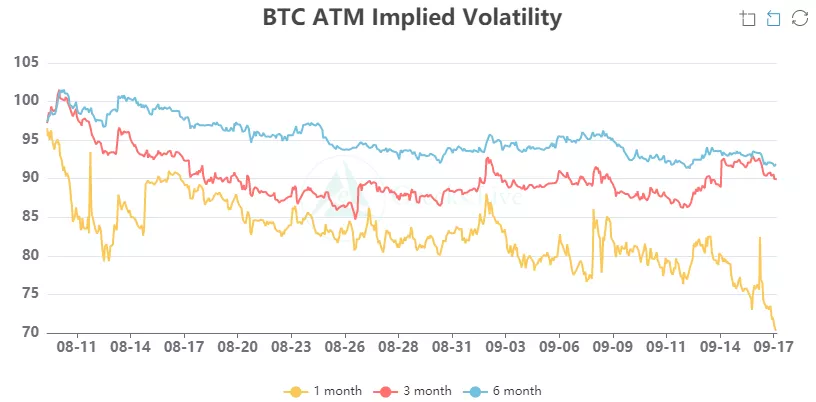

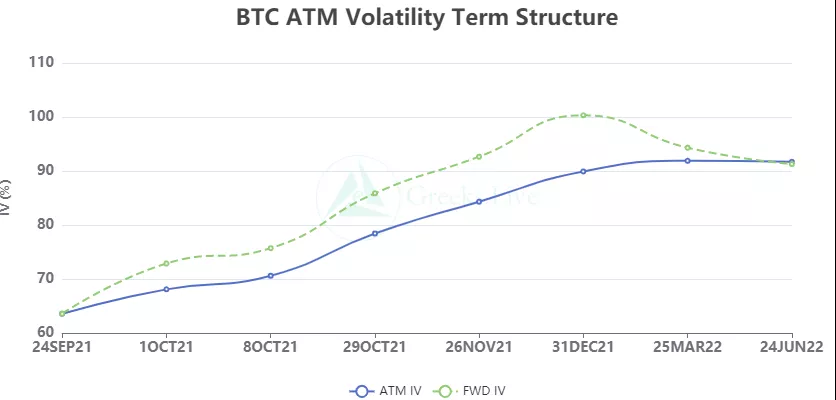

Implied volatility for each normalized term:

【Historical Volatility】

9/16:1m 81%, 3m 91%, 6m 93%,DVol 91%

Today: 1m 75%, 3m 89%, 6m 92%, DVol 83%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

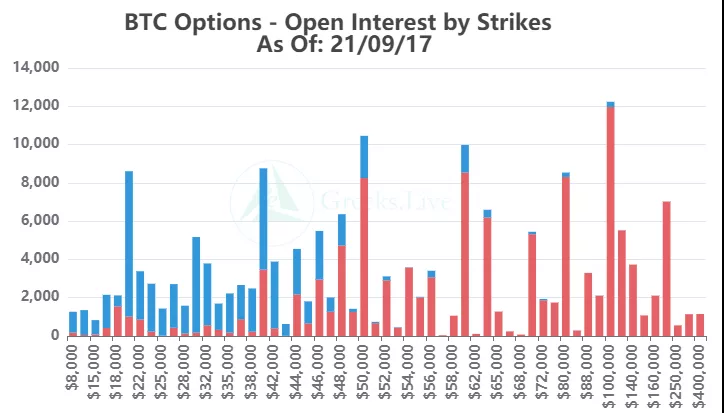

【Option position distribution】

【Option position distribution】

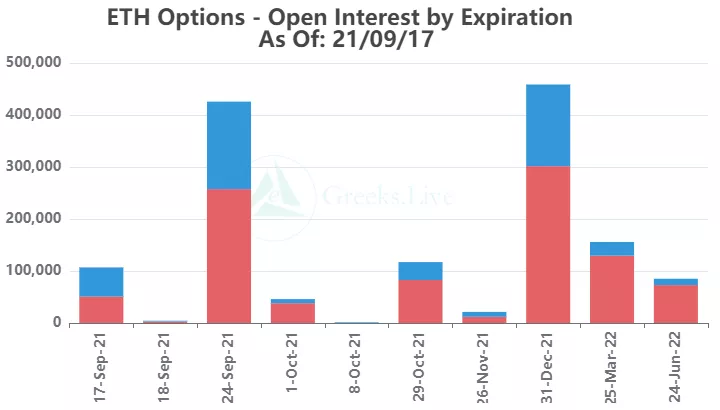

【ETH Options】

【Historical Volatility】

【Historical Volatility】

10d 107%

30d 88%

90d 93%

1Y 108%

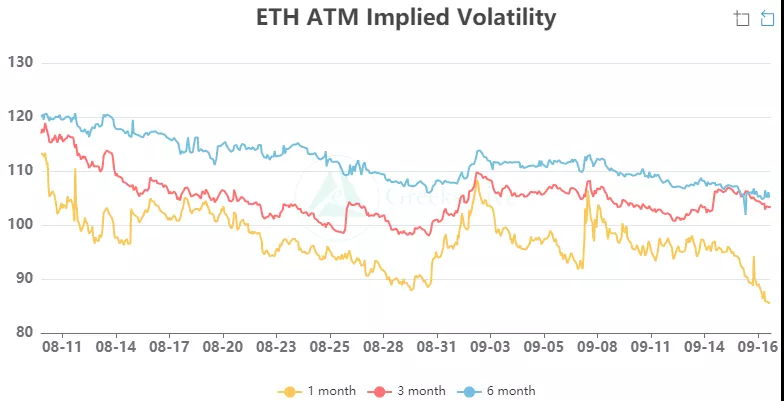

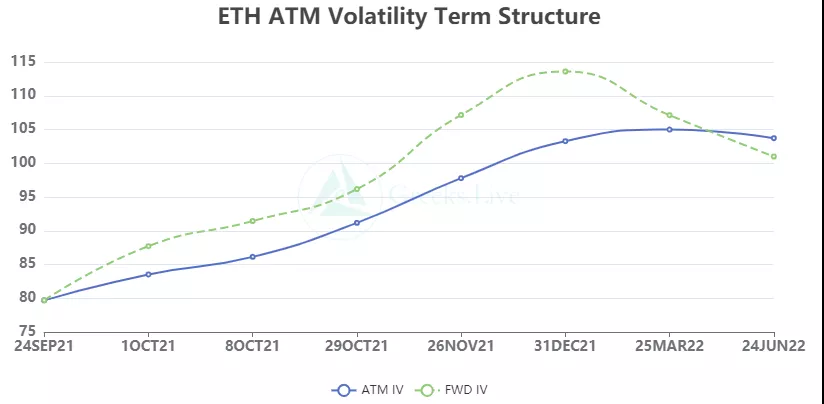

【IV】

Each standardized period IV:

Today: 1m 90%, 3m 102%, 6m 105%, DVol 98%

9/16:1m 95%,3m 104%,6m 107%,DVol 103%

Today: 1m 90%, 3m 102%, 6m 105%, DVol 98%

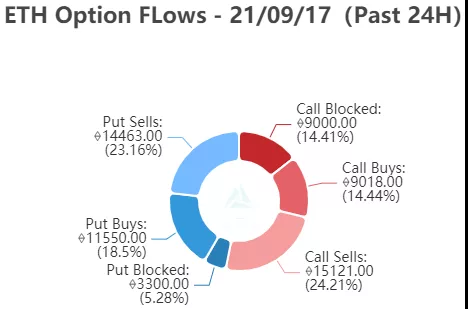

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

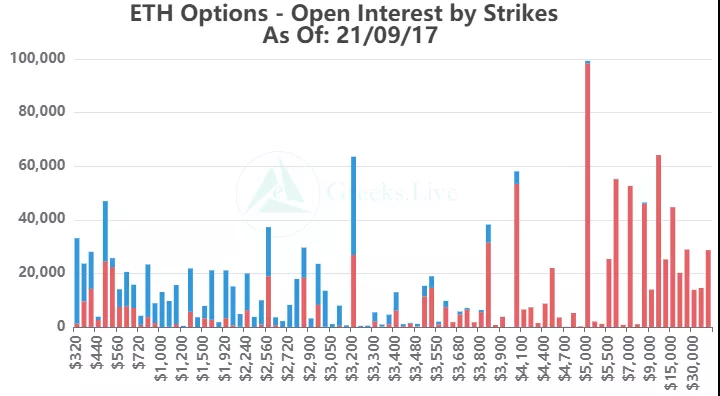

【Option position distribution】

From the perspective of Option Flows, the trading volume of call options has dropped significantly, especially for bulk and buying. The main transaction is concentrated in the options of the current month. Buying the puts of the month has become the highest type of contract on the day. The pressure on Ethereum is less than that of Bitcoin, and there are not as many calls to sell as Bitcoin.