The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

The market delivery is stable, the center of gravity of mainstream currency prices is moving downward, and various data show that the downward pressure on the market is relatively strong. However, nearly 20,000 large Ethereum call options bucked the trend and were traded, mainly in the form of deep out-of-the-money call options with an ultra-long term, and there were even deals at an exercise price of $30,000 in June next year.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

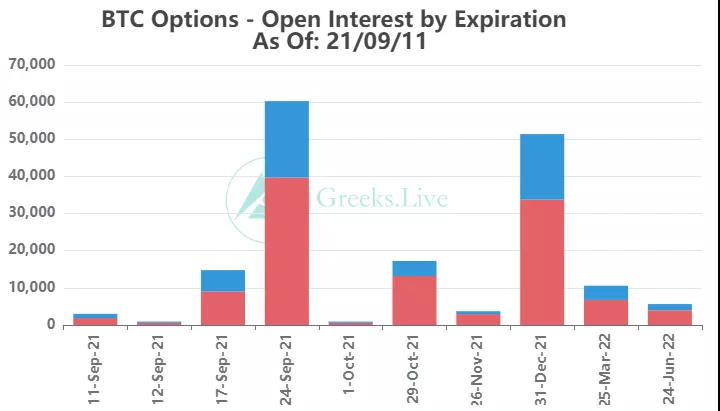

【BTC Options】

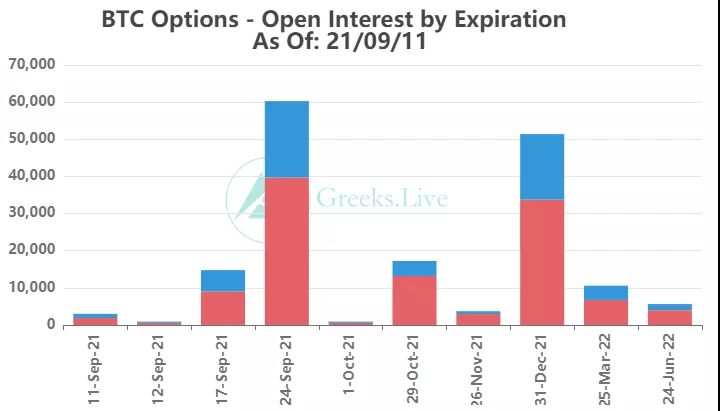

The option open interest was 168,000 contracts, worth $7.7 billion, and the option volume was 17,000 contracts.

【Historical Volatility】

10d 82%

30d 69%

90d 73%

1Y 79%

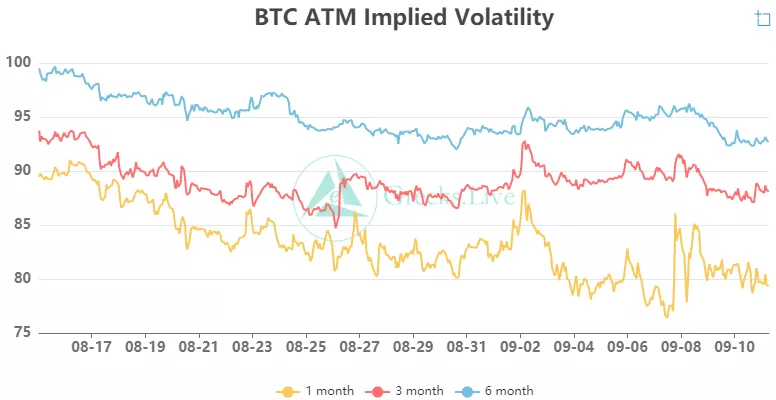

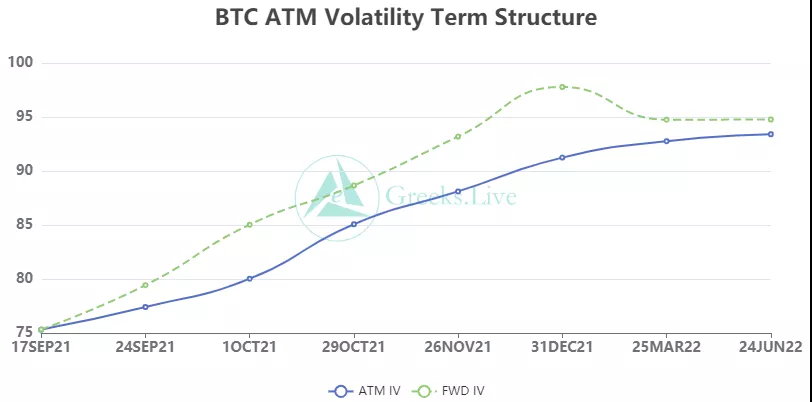

【IV】

Implied volatility for each normalized term:

【Historical Volatility】

9/10:1m 83%, 3m 89%, 6m 92%,DVol 92%

Today: 1m 82%, 3m 90%, 6m 93%, DVol 90%

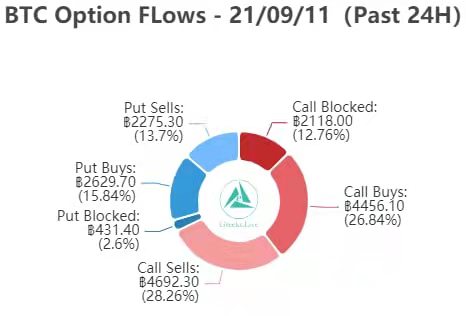

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

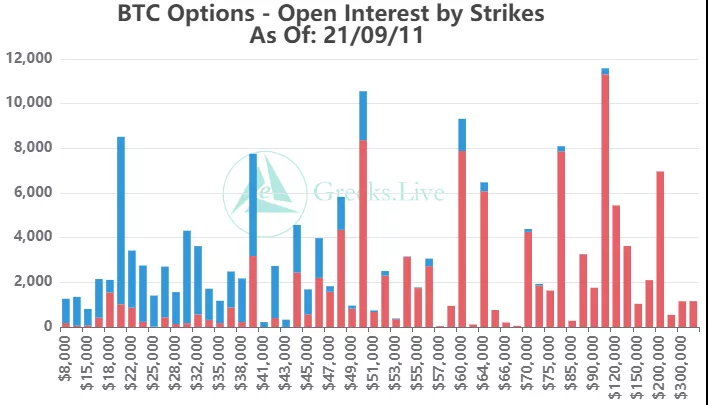

【Option position distribution】

【Option position distribution】

【ETH Options】

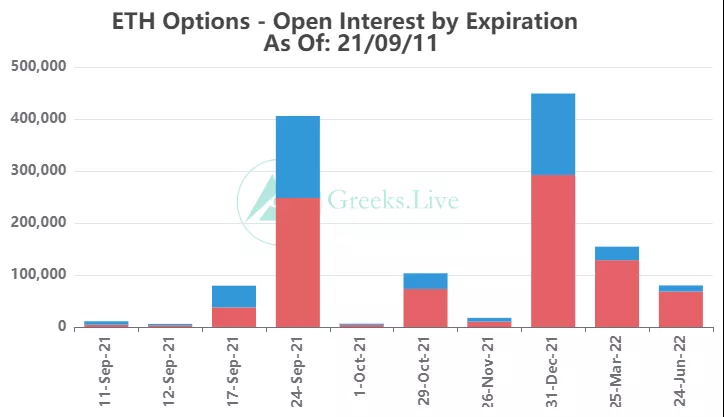

The open interest of Ethereum options is 1.31 million, with a value of 4.3 billion US dollars, and the trading volume is 110,000.

【Historical Volatility】

10d 122%

30d 91%

90d 93%

1Y 108%

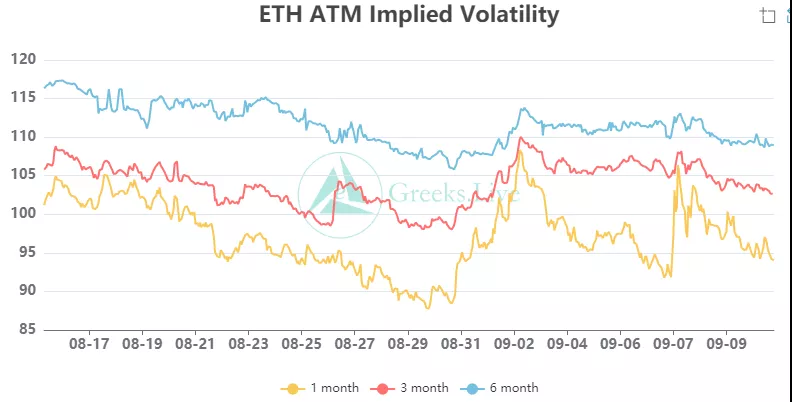

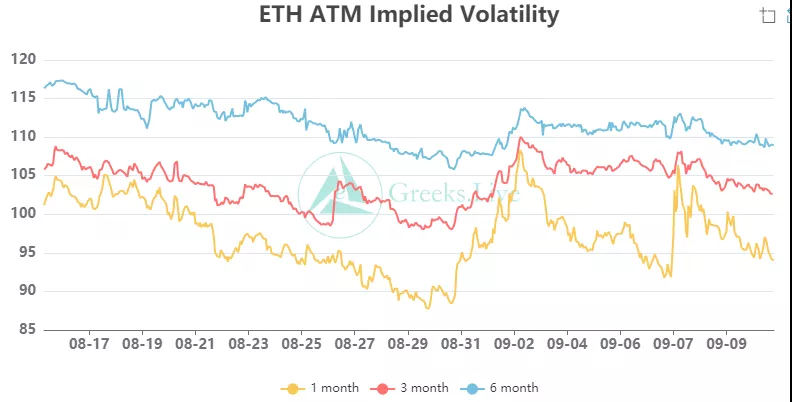

【IV】

Each standardized period IV:

【Historical Volatility】

9/10:1m 98%,3m 106%,6m 109%,DVol 105%

Today: 1m 97%, 3m 106%, 6m 109%, DVol 103%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

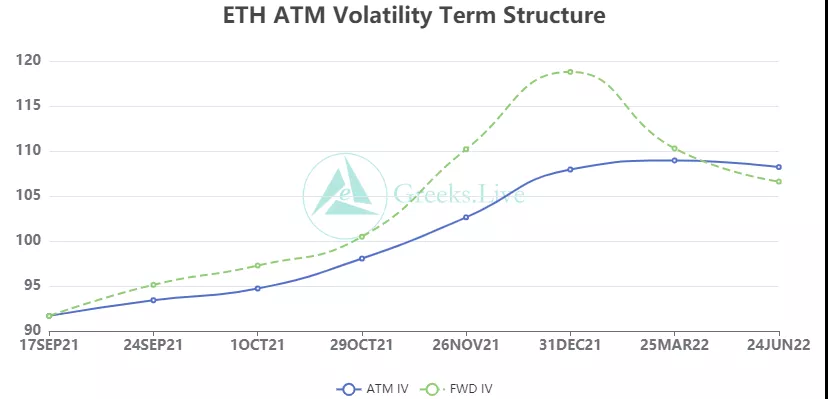

【Option position distribution】

From the perspective of Option Flows, the overall trading volume is stable, with a large number of bullish transactions, 19,625 contracts accounting for 19%, and the total trading volume of call options and put options is similar. There are more out-of-the-money puts in the market this week, and shallow out-of-the-money puts that expire in the current month are also more popular. The bulk of transactions are focused on call options with an ultra-long term, and the deep out-of-the-money calls for next year, with the highest strike price as high as $30,000.