The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

In the past two days, the hot spot is the new public chain, most of the emerging public chains are taking turns to promote, and the popularity of mainstream coins is not high. Ethereum is facing a great impact from the new public chain. Although Ethereum’s dominance is still there, everyone sees the problem of expensive Gas. The rise in the price of Ethereum will undoubtedly limit its own development.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

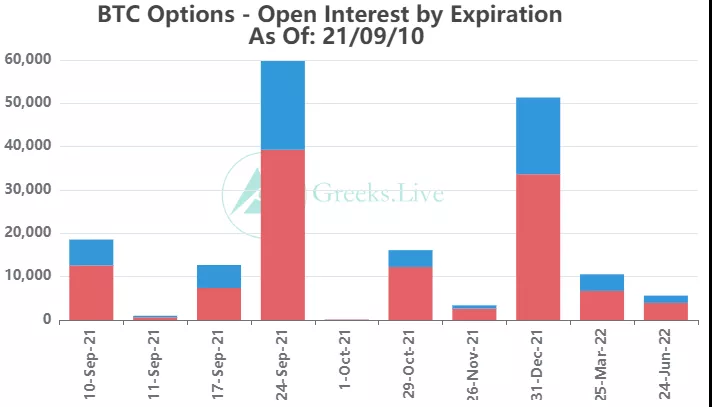

【BTC Options】

The option open interest was 179,000 contracts, worth $8.4 billion, and the option volume was 11,000 contracts.

【Historical Volatility】

10d 83%

30d 68%

90d 73%

1Y 79%

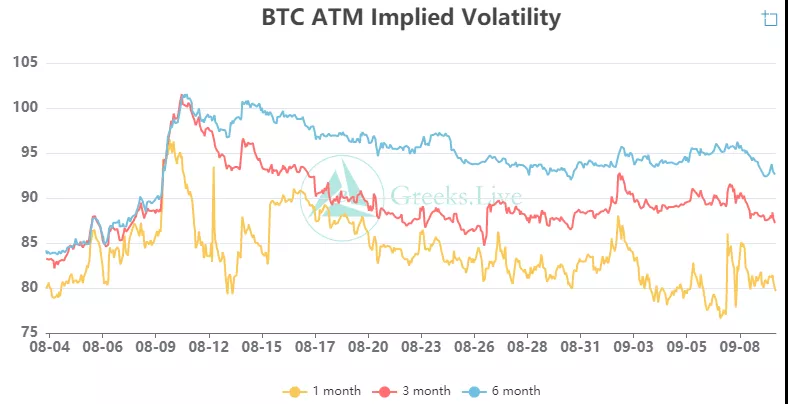

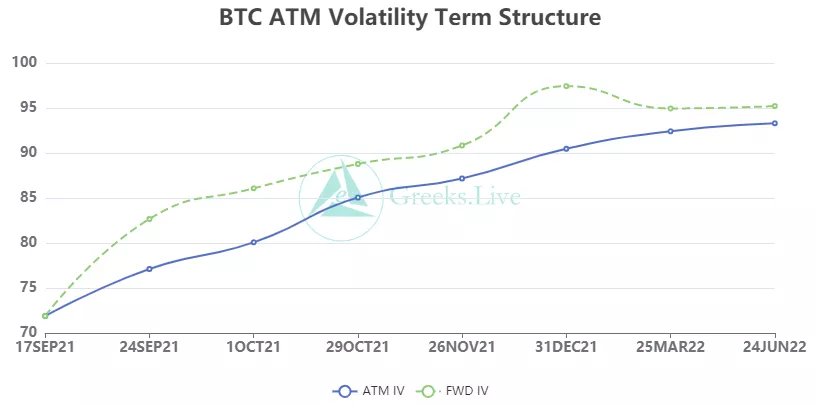

【IV】

Implied volatility for each normalized term:

【Historical Volatility】

9/9 :1m 84%, 3m 90%, 6m 94%,DVol 93%

Today: 1m 83%, 3m 89%, 6m 92%, DVol 92%

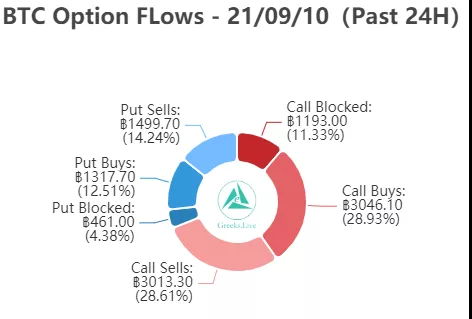

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

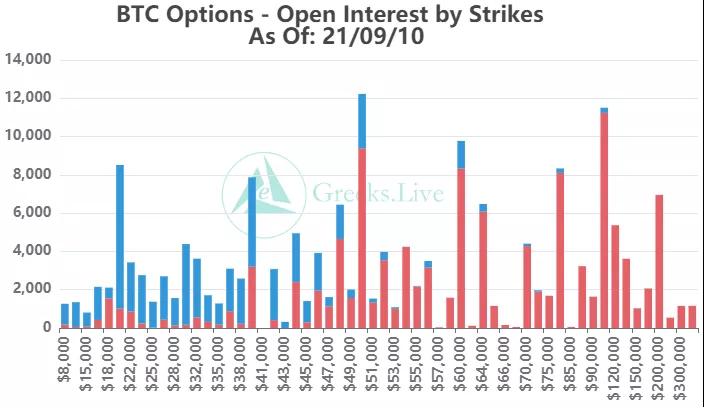

【Option position distribution】

【Option position distribution】

【ETH Options】

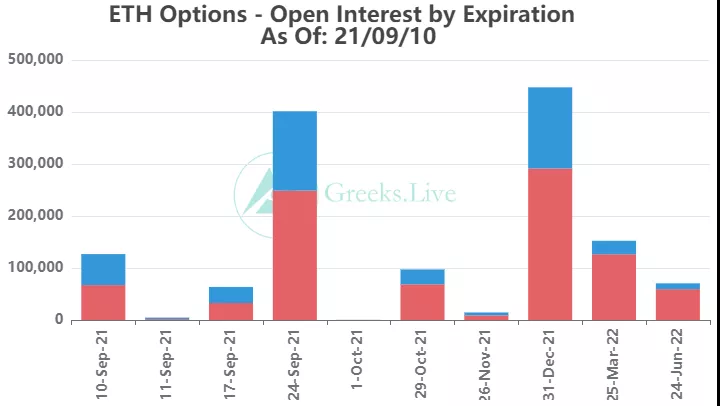

The open interest of Ethereum options is 1.38 million, worth 4.8 billion US dollars, and the trading volume is 90,000.

【Historical Volatility】

10d 116%

30d 90%

90d 93%

1Y 108%

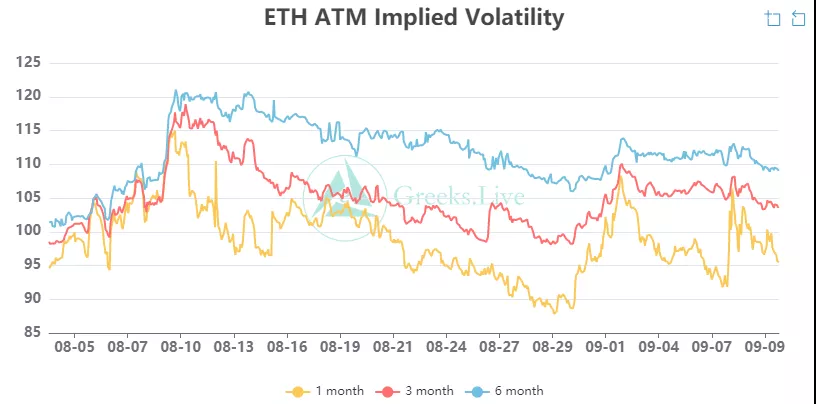

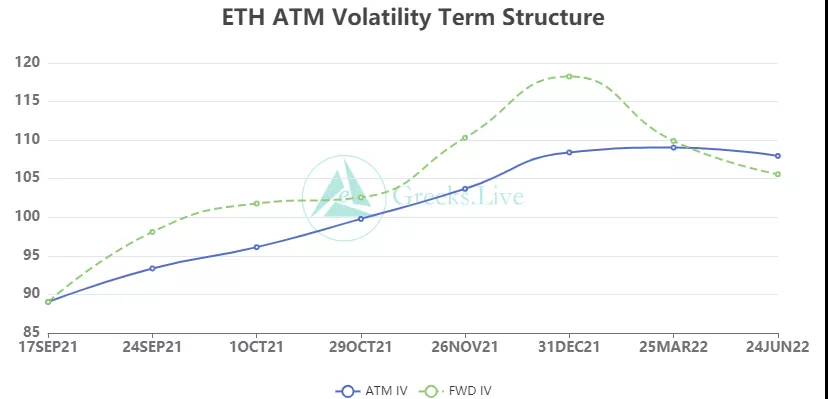

【IV】

Each standardized period IV:

【Historical Volatility】

9/9 :1m 101%,3m 107%,6m 110%,DVol 107%

Today: 1m 98%, 3m 106%, 6m 109%, DVol 105%

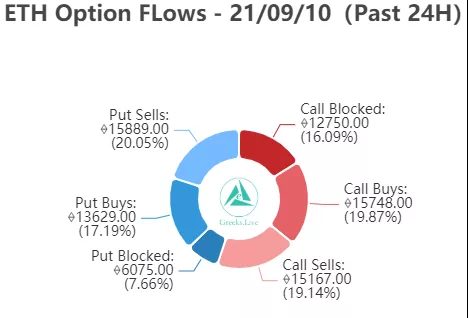

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

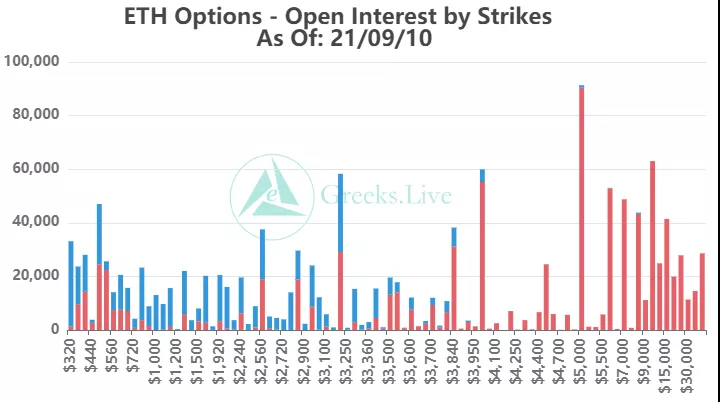

【Option position distribution】

From the perspective of Option Flows, the volume of bullish transactions has increased significantly, and the trading volume of call options and put options is evenly matched. There are more ultra-short-term fair-value transactions, and the out-of-the-money put options due in the next week and the call options of the current month are more popular. This is a significant change from yesterday's market, and the market is waiting for delivery.