Note: The original text is from bankless, written by William M. Peaster.

Note: The original text is from bankless, written by William M. Peaster.

Someone once told me that the biggest problem with non-fungible tokens (NFTs) is lack of liquidity, and my answer was "DeFi will solve this problem".

Indeed, and today we’re going to explore how fragmentation tools can be used to split an NFT into a bunch of pieces (usually in the form of ERC20 tokens) and then use them in DeFi.

Trading NFT fragments on Uniswap? Of course no problem.

Put them on Aave's money market? Also possible (hasn't happened yet, but it's coming).

Fragmentation means we can create liquidity on NFT through effective pricing.

One of the new protocols addressing this niche is a protocol called Fractional, whose team just raised a $7.9 million seed round led by Paradigm.

Tip: This project is more likely to carry out retrospective airdrops in the future👀

The following content will show you how to create NFT tokenized fragment ownership through Fractional, as well as some gameplay around this upstart protocol.

Skills: Intermediate

Skills: Intermediate

Work hard: spend at least 30 minutes learning the basics of Fractional

ROI: Understanding New NFT Verticals

✋ Nothing here constitutes financial advice. Fragmenting NFTs can involve legal issues depending on your jurisdiction, including the US. Please consult an attorney and use at your own risk!

1 Unlock the liquidity of NFT through Fractional

As the intersection between DeFi and NFTs continues to flourish, NFT fragmentation protocols are on the rise. They facilitate NFT liquidity and improve price discovery, and democratize NFT access through collective ownership.

it thought? Holders can use a fragmentation protocol to split and mint an ideal but illiquid NFT into many ERC20 tokens. These ERC20 tokens are fungible (and thus easily traded) and divisible, meaning they collectively represent an underlying asset and can be distributed among multiple owners.

So far, we have seen the rise of some NFT fragmentation protocols, such as NIFTEX and Unicly.

Fractional is the latest NFT fragmentation protocol to appear on the Ethereum mainnet. It was launched in July 2021 and has become a popular protocol for unlocking NFT liquidity in a short period of time.

2 A Brief Guide to Fractional

At the core of the Fractional protocol there are two main types of stakeholders:

🛒 Buyers: Users who purchase fragmented NFTs to access these cultural assets;

👩🎨️ Curator: Users who mint NFT into fragmented ERC20 tokens through the agreement and earn curator fees;

To facilitate these processes, Fractional revolves around three main smart contracts: one for a vault for a single fragmented NFT, another for a vault of multiple fragmented NFTs, and a final one to facilitate the vault governance parameters.

Also, keep in mind that since these smart contracts are open and permissionless, anyone can build their own Fractional frontend or interact directly with the protocol using a Web3 wallet, i.e. users don't need to visit the fractional.art website to use this agreement.

In fact, if this main site becomes inaccessible for any reason, you can follow this helpful guide to interact directly with the project's smart contracts.

This is the beauty of Ethereum.

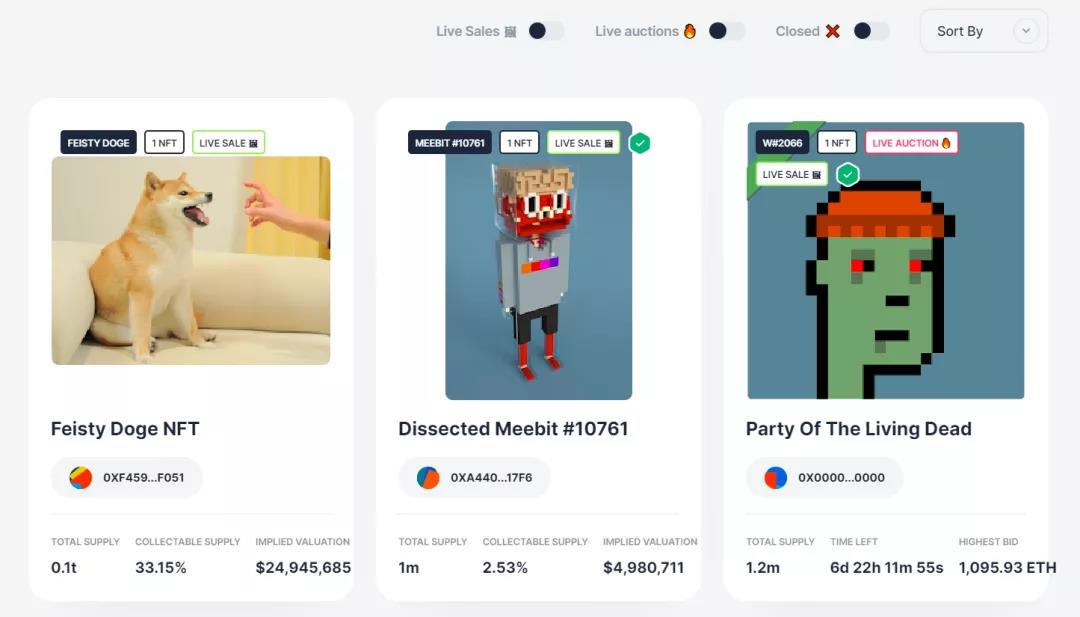

image description

Figure: Fractional interface of Fractional

If you are interested in splitting an NFT via Fractional, your first step is to determine which NFT to use.

Once you've identified your goals, the whole process goes something like this:

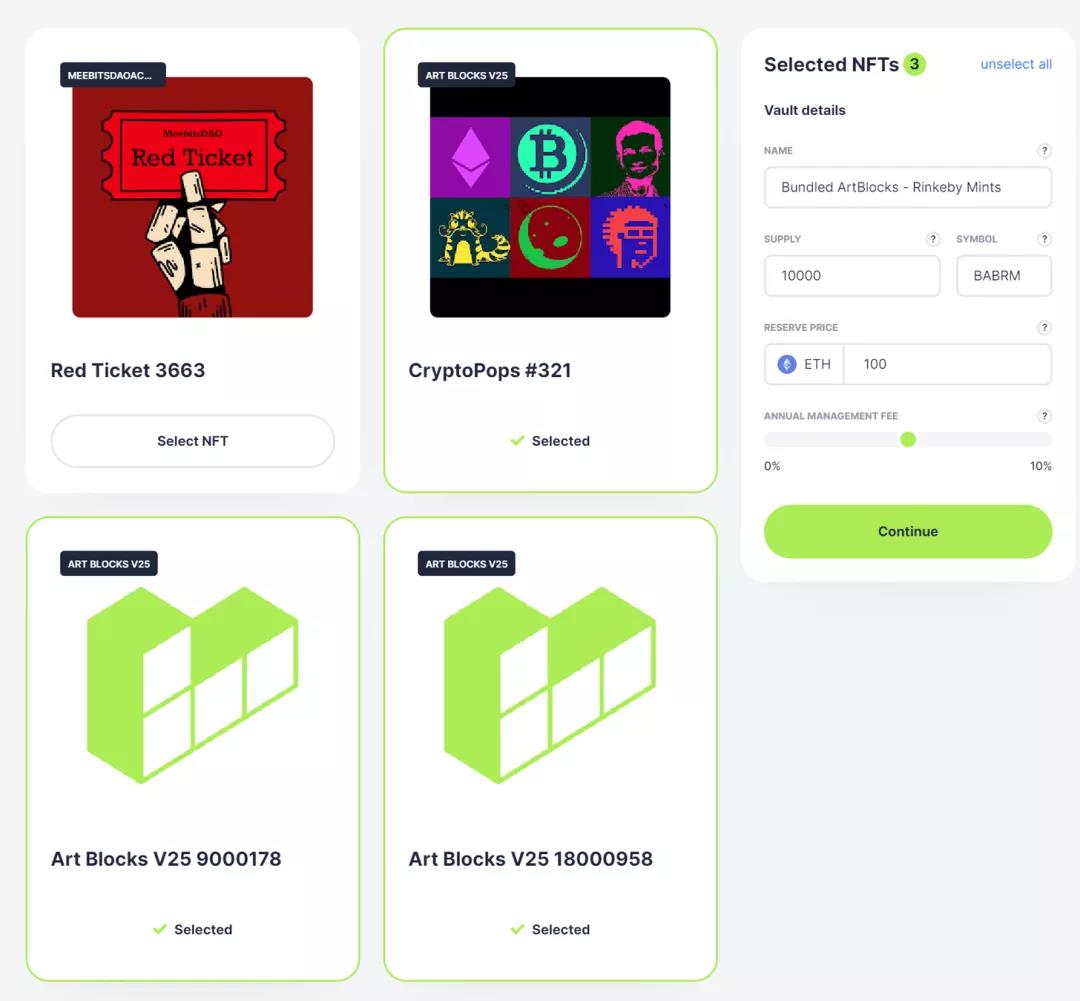

Go to fractional.art, connect your Web3 wallet, and click the "Fractionalize" button at the top of the site.

You'll be taken to an interface where you can select the NFT you want to split, then enter your vault name, token supply, token symbol, reserve price, and management fee.

Press "Continue" to continue, at which point you will be prompted to approve the Fractional transfer related NFT. Confirm approval in the wallet, then make transfers as desired. Finally, press the "Fractionalize" button and confirm the final casting step. (Keep in mind that each NFT needs to go through a process of approval + separate transfer before being able to mint ERC20 tokens)

Once your vault is live, you can use the Settings & Actions dashboard to edit its description, update its auction parameters, and more.

4 Set the reserve price for the vault

In the face of potential future purchases, Fractional's vault relies on a price system in which NFT fragment holders continuously vote on a floor price, and the weighted average of this vote determines the price required to initiate an acquisition.

This might sound confusing, and in a recent blog post, the Fractional team provided two very simple examples to illustrate this rule.

Examples are as follows:

“If you own 100% of the tokens and you set the reserve price at 100 ETH, then the reserve price is 100 ETH. But if you own 75% of the tokens, and someone with the other 25% of the voting rights made a reserve price of 50 ETH vote, the final reserve price result will be 81.25 ETH.

If you only own 49% of the token supply and vote on the reserve price, but others who own the remaining 51% of the tokens did not vote on the reserve price, no reserve price will be set for the vault.

”

That is, a Fractional takeover is initiated when an individual or group deposits enough ETH to meet or exceed the floor price determined by the vault. The auction process then begins, and if the acquisition is successful, the vault's NFT shard holders can exchange their ERC20 tokens for ETH.

5 Use with PartyBid

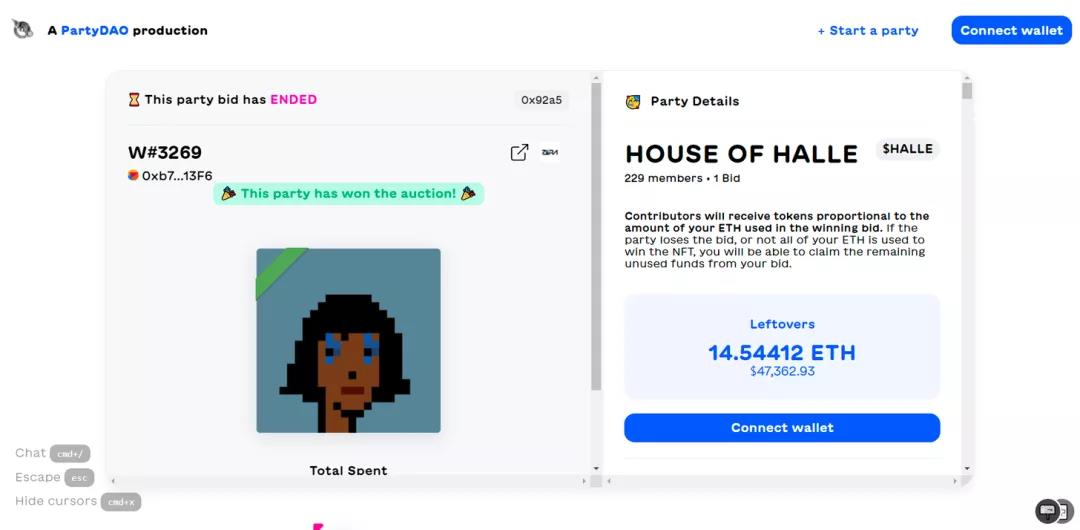

We believe that Fractional is a new cultural Lego building block at the crossroads of DeFi and NFT. This dynamic opens up all kinds of novel Web3 possibilities, such as PartyDAO's recently released PartyBid tool.

PartyBid is a decentralized application that facilitates collective bidding on NFTs. This app allows a group of friends and/or strangers to collectively conduct raids ("raids" in the gaming sense) on selected NFTs, giving ordinary investors an edge for the first time in the NFT ecosystem.

Long story short, PartyBid helps groups acquire NFTs through Foundation or Zora auctions, then conduct trustless splits of the auction items through Fractional, and then distribute the subsequent ERC20 tokens proportionally to party participants.

This Dapp has been used by investors to acquire CryptoPunks, Nouns, and other major NFTs, all thanks to Fractional's open infrastructure.

6 reminders

Fractional is paving the way for new NFT liquidity and token utility possibilities, and the PartyBid example above is just a taste of the innovations that may emerge around the Fractional protocol in the future.

At the same time, as a fan of DeFi+NFT, I personally say with great pain that Fractional is not an agreement that everyone should try now. This is because some jurisdictions, such as the United States, treat fragmented artworks as securities.

In other words, fragmented NFTs appear to be securities in these jurisdictions. Before issuing fragmented NFTs, make sure you understand the relevant laws in your jurisdiction.

This article is from The Way of DeFi, reproduced with authorization.

This article is from The Way of DeFi, reproduced with authorization.