Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

On the evening of the 16th Beijing time, the decentralized organization BitDAO issued a total of 200 million BIT tokens on the MISO platform of SushiSwap.

The official originally planned auction period was half a month, lasting until the end of August. However, just a few hours after it was launched last night, the ETH crowdfunding pool was full, and all 180 million BIT tokens were sold out. A total of 9,269 addresses participated, raising 112,670 ETH ($360 million); 58.5% (approximately 11.7 million) of the tokens have not yet completed the auction.

BIT tokens are also listed on Matcha, SushiSwap, and Uniswap today, tentatively reported at $1.6. According to Odaily's calculations, BIT's circulating market value was as high as 6 billion US dollars at the beginning of its launch, ranking 25th in the market value list; its current circulating market value is about 4.8 billion US dollars, which is basically the same as XMR, FTT, etc.

According to previous reports, BitDAO completed a financing of US$230 million in June this year, led by Peter Thiel, Founders Fund, Pantera Capital and Dragonfly Capital.

At present, NFT is hot, DeFi is not hot, and the overall performance of the DAO sector is not good. Why does BitDAO get such a high valuation? Why do institutional users and retail investors have a soft spot for a non-star new project in a non-popular sector? Odaily will answer them one by one.

It will be "broken" when it goes online, and the market value of circulation exceeds FTTAccording to data from Coingecko, BIT once rose to $2.03 after its launch, and fell as low as $1.44, and is currently at $1.6. Due to the Dutch auction, the average auction price of each BIT token is about 0.000625 ETH (1.97 USD) based on the estimated amount of ETH raised by the ETH crowdfunding pool. In other words, many users who participated in the auction last night should not sell for the time being.

But not all users are in a state of floating losses. Because the government set up an incentive measure,

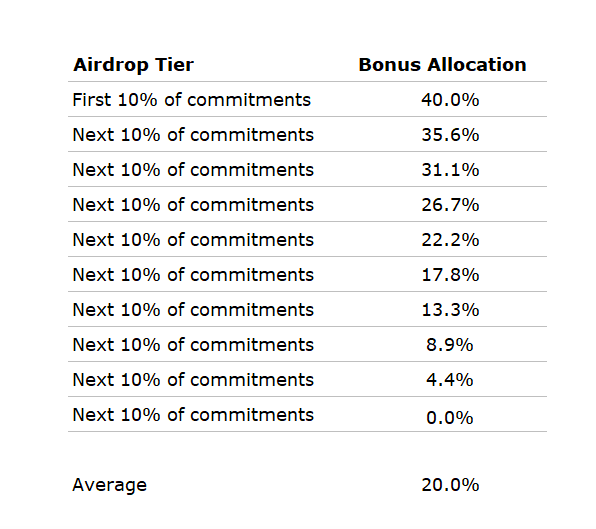

Early quotation users will receive airdrop rewards: the first 10% quotation users will receive 40% airdrop rewards, the next 10% quotations will receive 35.6% rewards, and so on. The specific rewards are as follows:

image description

Airdrop Reward Rules

It is worth noting that these airdrop rewards will be issued in the form of BIT-ETH SLP based on the final price and locked for 90 days. Within 90 days, BIT-ETH SLP tokens may be affected by impermanent loss, etc.Of course, for investors who participated in the Dutch auction last night, what is more concerned about is whether the price of BIT will continue to decline in the future? No one can give a definite answer to this question, but we have calculated the investment cost of institutional investors for your reference:According to the official announcement, BitDAO completed the private placement of initial partners led by billionaire Peter Thiel, Founders Fund, Pantera Capital and Dragonfly Capital in June this year, with a total financing of 230 million US dollars. Other investors include Alan Howard, Jump Capital, Spartan Group, Fenbushi, Kain Warwick (Synthetix), etc.

BIT tokens represent the ownership and voting rights of BitDAO, while in

BitDAO official website

If the financing amount data is accurate, the holding cost of private equity investors is approximately: US$230 million/500 million = US$0.46/unit, which is lower than the current market price of US$1.6.

(Odaily Note: The above calculation is based on the assumption that the 500 million tokens planned to be distributed to private investors are all delivered. Since this 5% may not be fully sold, the calculation results are for reference only.)

Another interesting situation is that with the listing of BIT tokens, its circulation market value once surpassed OKB and FTT. According to the BIT token unlocking rules, 30% (3 billion) of the tokens are in circulation after the token goes online, including: 10% of the "BitDAO Treasury", 5% of the "Initial Partner Reward" and 15% of Bybit non- Locked funds. As follows:

image description

(Token Distribution Rules)

Calculated based on the highest listing price of US$2.03, the circulation market value of BIT at the beginning of its launch was as high as US$6 billion, surpassing OKB and ranking 25th in the market value rankings; calculated at the current price of US$1.6, its current circulation market value is about US$4.8 billion, which is comparable to that of XMR , FTT are basically the same, more than Pancake.

The backside of BitDAO - Bybit

On the official website, BitDAO positions itself as one of the largest DAOs in the world, and its vision is open finance and a decentralized tokenized economy.

To put it simply, DAO initiates proposals through blockchain and smart contracts to coordinate member actions and resources. Members can vote on proposals by voting. The more tokens they hold, the greater their voting rights. Today, DAO (Decentralized Autonomous Organization) has also become an important direction for many DeFi projects (such as Maker).

“BitDAO is a DAO controlled by BIT token holders. It is not a company and has no management team or employees. Any individual, development team or R&D lab can propose upgrades, token transactions and partnerships for BitDAO .BIT token holders will vote to decide whether to approve or reject these proposals." BitDAO official said, and hoped to support the development of the DeFi industry through the form of DAO, specifically working in three directions:

fluidity. BitDAO will control one of the largest pools of assets that can be used to provide liquidity to partner agreements. BitDAO can bootstrap new protocols such as DEX, Lending, Synthetic.

funds. BitDAO will support blockchain technology through grants (e.g. through Gitcoin) and support DeFi projects through token transactions.

In the blockchain world, the most indispensable thing is an ambitious grand blueprint. The above plan about DAO is not enough to impress many institutional investors in the context of the overall downward trend of the DAO sector.

image description

The reason why BitDAO can become popular is inseparable from the contribution of Bybit, the derivatives exchange behind it.Twitter。

Odaily query found that,According to the announcement, Bybit promised to contribute 0.025% of its futures contract trading volume as income to the BitDAO treasury, making regular donations. The official estimate given by BitDAO is that the annual revenue will exceed US$1 billion.Odaily query found that,

Bybit did make regular donations to BitDAO every day as promised, with an average daily donation of close to 4 million U.S. dollars

,As follows:

image description

(Bybit daily contribution)

Compared with most DAO organizations currently in a state of "cooking without rice", BitDAO, which is backed by Bybit, has a stable source of income (funding), seems to be more capable of telling stories, and is more able to stimulate the imagination of the market.

Contributing an average of $4 million per day, roughly equivalent to half of revenue, Bybit obviously has its own considerations in funding BitDAO.

Previously, both the UK Financial Regulatory Authority and the Ontario Securities Commission in Canada banned Bybit from providing services to their citizens, and Bybit subsequently stopped services in the region. With the tightening of global regulation, encrypted derivatives trading platforms are facing transformation: one is to follow the path of compliance and cater to the regulation; the second is to take the path of decentralization through DAO, Binance chose the former, and Bybit chose the latter .According to Decrypt reports, Bybit CEO has expressed his favor for decentralized exchanges and DAO. "There's really not much we can do about regulation, but that speaks to the importance of decentralized exchanges. If we want to take our business from billions to trillions, we can't exist as a company, but as a 'society'. Phenomenal forms 'exist."

It is against this background that BitDAO came into being, and may inherit Bybit's trading business in the future, shifting from centralization to decentralization.

From this perspective, BIT can also be regarded as Bybit's "platform currency".

Based on this, comparing the trading volume of Bybit and FTX, it is not difficult to understand that the market capitalization of BIT is equal to that of FTT.

Where is BitDAO headed in the future?

Previously, many DeFi protocols had two major problems in the implementation of DAO governance:

Voting rights are too concentrated, some retail investors are not interested in voting, and insufficient participation leads to unfair voting results.hereLooking at BitDAO’s token distribution, Bybit has a relatively large proportion, a total of 60% of the tokens will be allocated to Bybit: 15% of the tokens will be unlocked after listing, and the other 45% will be locked for 1 year and after the lock-up period ends. Release gradually over 2 years.

“Bybit has committed to making a significant contribution to the BitDAO vault, which can be

here

check the detail information. Therefore, Bybit will hold a large percentage of BIT tokens at launch. Since these tokens are privately held by Bybit, they can be used for any purpose, including: establishing R&D centers to support BitDAO, supporting Bybit business growth, rewarding employees and stakeholders of Bybit or BitDAO-affiliated R&D centers. ” BitDAO explained some of the uses of Bybit holding tokens.