Today (July 8th), Blockpit, an Austrian crypto asset tax reporting company, announced the completion of a Series A financing of more than US$10 million. This round of financing was led by MGV, with participation from Fabric Ventures and Force over Mass Capital. The financing will be used for the development of encrypted tax products and the layout of the global market.

Cryptocurrencies have been around for more than a decade, but lawmakers have struggled to properly tax them, and exchanges and investors are largely ignorant of the finer points of tax filing, especially in jurisdictions where regulation is unclear. Logically speaking, as long as cryptocurrency-related activities are carried out under the requirements of anti-money laundering laws, encrypted asset taxes must be paid.

In 2014, the IRS first issued a legal statement on cryptocurrencies to help tax advisors and individuals tax crypto assets. In 2019, they published a new and revised guide and provided a FAQ page on their website. Since the publication of the first draft, almost every aspect of the laws and regulations related to the taxation of cryptocurrencies has changed. Cryptocurrency taxation was not specifically mentioned in the EU AML5 and FATF travel rules until early this year. With the emergence of more new encryption technologies and behaviors, such as airdrops, hard forks, lock-up dividends, liquidity mining, etc., it is difficult for even experts in this field to keep up with the ever-changing gameplay and regulations.

(Odaily Note: The "Travel Rule" was first proposed by the US Financial Crimes Enforcement Network in 1996 as part of the "Anti-Money Laundering" standard for all financial institutions in the United States. In March 2013, the rule was expanded to apply to encrypted exchanges.)

Another notable trend in recent years is that leading crypto companies (mainly concentrated in mining companies and exchanges) represented by Canaan Technology and Coinbase have chosen a more traditional path of corporate growth—listing. Against such a background,A team that provides professional legal, financial, and taxation services to the encrypted world has become a rigid need for compliance.

Blockpit and CryptoTax (now merged) were among the first three parties to try to file tax returns for cryptocurrencies, acting as a bridge between exchanges and regional governments.

Blockpit was established in 2017,The main business is Cryptotax, an encrypted asset tax agreement, which is used to automatically calculate data related to encrypted asset transactions and other activities (such as from mortgages, DeFi, lending, mining, and margin transactions), and import and standardize them in real time, and then pass them through specific countries and regions. Tax laws perform calculations and generate reports showing taxable profits and other important data.

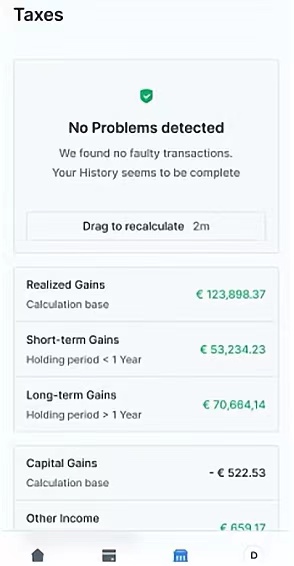

In terms of tax declaration, it provides API and CSV for enterprises to import user transactions (Blockpit also launched an independent application in the app store in June), and uses transaction data to automatically calculate encrypted asset taxes. In addition, it can download verified tax returns in PDF format and get complete tax returns in every currency. Currently supported exchanges are Bitpanda, Kraken, Coinbase, Bitfinex, Binance, Bitstamp, Bittrex, Coinfinity, HitBTC, Kucoin, LiveCoin, Poloniex, Bitcoin.de.

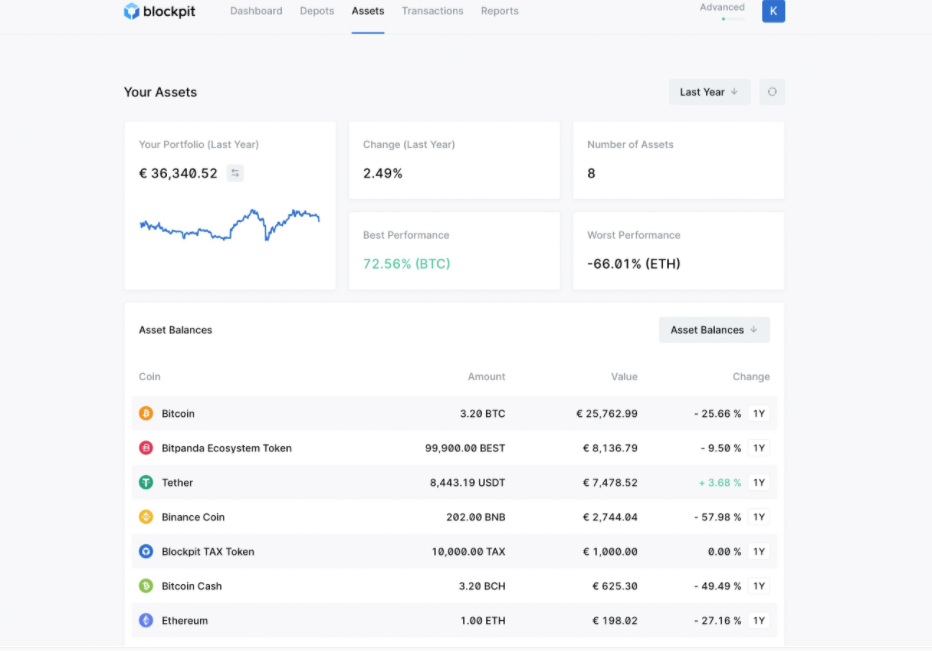

Second, it also has a portfolio management feature that consolidates all transactions and income in a single dashboard to facilitate a total income overview of assets (divided into short-term and long-term income), as well as additional classifications such as investment income and other income. In addition, it enables seamless transfer of operational data between exchanges and wallets, showing current holdings and recent gains and losses for each coin. This is closer to the hosting function of traditional wallets or exchanges.

Some of Blockpit's current customers are the above 13 exchanges, and the other part is composed of various tax consultants, banks and governments. The cooperation between Blockpit and the authorities first covered Germany, Austria, and Switzerland. Up to now, 70% of the encryption tax business in the European market is occupied by Blockpit. Expansion plans in global jurisdictions such as France, Spain, the United States, Canada, Australia and the United Kingdom are currently in the pipeline.

In addition to Cryptotax under Blockpit, similar tax agreements include Tokentax.TokenTax was founded by Alex Miles, who has a traditional legal and investment banking background. The product initially imported data directly from Coinbase and won the Product Hunt Global Hackathon. In 2019, TokenTax acquired Crypto CPA, a cryptocurrency tax accounting firm, and brought CPA Andrew Perlin in-house.

Tokentax’s ability to declare taxes in on-chain transactions is even more outstanding. In addition to traditional centralized exchanges, Tokentax has supported DeFi protocols such as 1inch, Uniswap, and Aave since its inception, and has now helped 18 countries/regions around the world to provide encrypted tax services. .

In fact, on the road to compliance, the development trend of three-party analysis/monitoring companies, including tax reporting companies, has been in the ascendant. According to statistics, in 2020 alone, there will be more than 20 such companies that have long-term and stable purchase services, such as Chainalysis, Cyphertrace, and Elliptic. These companies provide functions such as data monitoring, analysis and calculation, and are committed to bringing the necessary transparency and trust to the blockchain-based financial market; In the process, it also has the function of minimizing expenditure for the enterprise level, and becomes an indispensable "consultant" for the compliance of exchanges and wallet blockchain enterprises.