Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Ethereum developer Tim Beiko posted an overview of the Ethereum London upgrade. While upgrade blocks for each network have not yet been determined, all EIPs included have been finalized. According to the upgrade specification, they are: EIP-1559, EIP-3198, EIP-3529, EIP-3541, EIP-3554 (difficulty bomb delayed until December 1, 2021).

Second, the secondary market

1. Spot market

Second, the secondary market

(ETH daily chart, picture from OKEx)

According to OKEx market data, the price of ETH continued to fluctuate last week, closing at $2,577 during the week, a month-on-month decrease of 5.2%.

2. Fund flow

The daily chart shows that the price is currently moving along the middle track of the Bollinger Band, and is expected to hit the upper track ($2,880) in the short term; if the breakthrough fails, it will further fall to the lower track, temporarily reported at $2,263.

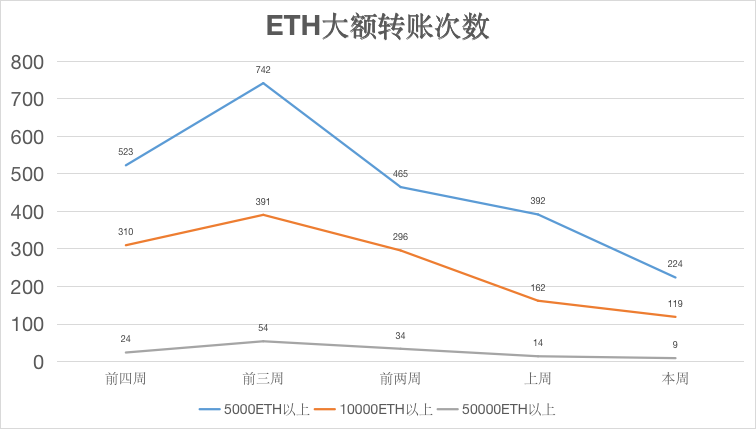

3. Large transaction

2. Fund flow

OKlink dataIt shows that the number of transfers on the chain dropped sharply last week, and the number of large-value transfers of "above 5,000 ETH", "above 10,000 ETH" and "above 50,000 ETH" decreased by 42.8%, 26.5%, and 35.7% month-on-month, respectively. Giant whales are active degree decreased significantly.

3. Ecology and technology

1. Technological progress

OKlink data

It shows that the current top 300 ETH holdings hold a total of 52.77% of ETH, an increase of 0.01% month-on-month; in addition, the entire position distribution presents an oval structure, and the proportions of each part are: 1st to 100th, accounting for 38.23%, 101st to 300th, accounting for 14.54%, down 0.03% from the previous month; 301st to 500th, accounting for 6.68%, up 0.01% from the previous month; 501st to 1000th, accounting for 7.66%, down 0.05 from the previous month %; after the 1001st place, accounting for 32.92%, a month-on-month increase of 0.04%.

EIP-1559: Changing the fee market for the ETH 1.0 chain;

EIP-3198: BASEFEE opcode;

EIP-3529: Reduce refunds;

EIP-3541: Reject new contracts starting with 0xEF bytes;

EIP-3554: Difficulty bomb delayed until December 1, 2021.

EIP-3198: BASEFEE opcode;

EIP-3529: Reduce refunds;

EIP-3554: Difficulty bomb delayed until December 1, 2021.

2. Voice of the Community

On June 10th, official news, Ethereum 2.0 client Lighthouse released v1.4.0 version, this is a low-priority update, mainly includes some optimizations, these optimizations can reduce the cost of RAM, CPU, disk I/O for beacon chain nodes. The impact of O and Eth1 nodes. Notable features in this release include: reduced memory footprint, on mainnet this reduced memory usage from ~6 GB to ~1.5 GB; improvements to avoid disk and memory intensive operations; 80% reduction in Eth1 queries; Beta Windows supported and currently not recommended for production use.

3. Project trends

Ethereum Developer Tim Beiko Explains Why the Berlin Upgrade Didn't Incorporate EIP-2537

Ethereum developer Tim Beiko explained why the Berlin upgrade was not included in EIP-2537, saying that its Berlin upgrade needs more testing, and the team generally agrees, but when we were discussing including it in the London upgrade, someone suggested that we should use A new library, and possibly modifying the gas cost, which requires more testing as it doesn't cut the gas. Also, it went from a very good to have (pre-deposit contract kicks in to verify deposits) to "we need this before sharding", so the urgency is greatly reduced. Earlier news, Ethereum developers updated the Berlin hard fork draft: including five EIPs, removing EIP-2537. EIP-2537 would have introduced a new type of operation (BLS curve).

3. Project trends

In response to the Akita Inu (AKITA) donated to Gitcoin by Vitalik Buterin, the founder of Ethereum, the Gitcoin community voted through a proposal to sell all AKITA and convert it into ETH. This proposal has not yet been implemented. It was previously reported that in mid-May, Vitalik Buterin sold a large number of meme tokens and donated the obtained ETH and some meme tokens, including donating 49 trillion AKITA to Gitcoin’s community multi-signature wallet.

(2) Polygon cooperates with game maker Xaya to launch games on the Ethereum side chain

Autonomous Worlds, the company behind DLT-enabled game maker Xaya, has struck a partnership deal with Polygon to launch games on its ethereum sidechain. The Xaya blockchain will be integrated into the Polygon sidechain compatible with Ethereum.

Hermez, the Ethereum Layer 2 expansion solution, is about to launch a community reward program. The first round of activities will distribute 200,000 HEZ tokens to early adopters of the Hermez network, and the number of airdrops is proportional to the amount of user deposits. The first round will start at 10:00 UTC on June 21 (18:00 Beijing time) and end at 9:00 UTC on June 28 (17:00 Beijing time).

(4) Ethereum privacy technology solution Aztec announced that it will open source

(5) Hermez, the Ethereum Layer 2 expansion plan, will launch a community reward program on June 21

(6) SKALE Network integrated development kit Truffle Box for Ethereum expansion solution to simplify application development

4. Borrowing

DefipulseAccording to the official news, the SKALE Network integrated development kit Truffle Box, the Ethereum expansion solution, allows developers to build applications on the SKALE network through the Truffle Box. SKALE is compatible with the EVM (Ethereum Virtual Machine), and all existing tools built for Ethereum can also run directly on the SKALE network. Alternatively, developers can use Truffle to compile and migrate existing smart contracts to the SKALE network.

The data shows that last week, the value of locked-up collateral on the chain dropped from US$65.74 billion to US$62.102 billion, a decrease of 5.5% a week; 155.4%. Specifically, the amount of ETH mortgages dropped from 9.724 million to 8.883 million last week, a drop of 8.6%; the amount of BTC mortgages dropped from 179,995 to 175,073, a drop of 2.7%.

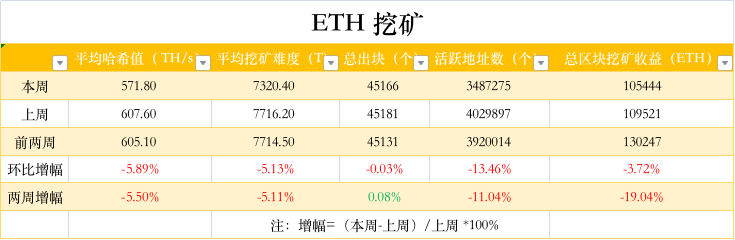

5. Mining

(data from etherchain.org)

etherchain.org5. Mining

4. News

(data from etherchain.org)

4. News

Last week, the RTX 3080 Ti went on sale for the first time. The RTX 3080 Ti restricts mining from the GPU level, and NVIDIA previously stated that it was targeting Ethereum. After testing by an organization, it was found that the RTX 3080 Ti Ethereum computing power is about 57MH/s, which is less than half of the RTX 3090 (120MH/s), and it is also not as good as the lower RTX 3080 (85MH/s). Further testing found that not only Ethereum, but also some relatively unpopular small currencies are also "unsuitable" with RTX 3080 Ti, such as Ethereum Classic, Ergo, RavenCoin, etc. The only one known to be unaffected seems to be ConFlux. (fast technology)

(2) Data: The Ethereum NVT ratio has been on the rise in the past few days

Data shows that Ethereum’s NVT ratio is currently trending upwards over the past few days, but its average value remains low. A low NVT ratio indicates that ETH's network is currently undervalued, meaning that market capitalization is more likely to appreciate than decline. Additionally, Ethereum’s exchange inflows hit a new low since October 2020. It can be inferred that after the inflow hit a new high of 780,000 on May 19, the selling pressure finally reached a breaking point. (AMBCrypto)