Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

1. Overall overview

Second, the secondary market

1. Spot market

In terms of the secondary market, the current ETH price may continue to drop in the short term, with a support level of $3,500 and a resistance level of $4,000.

(ETH daily chart, picture from OKEx)

1. Spot market

2. Fund flow

According to OKEx market data, the price of ETH once rose above $3,900 last week and closed at $3,877.28 during the week, a month-on-month increase of 17.3%.

(ETH daily chart, picture from OKEx)

2. Fund flow

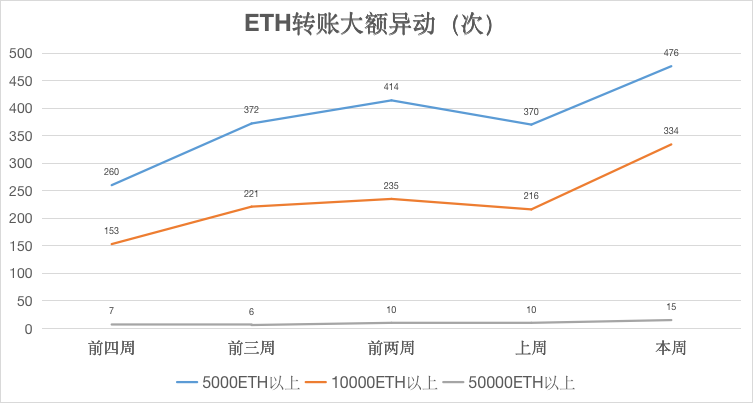

Tokenview data3. Large transaction

OKlink dataTokenview data

3. Ecology and technology

1. Technological progress

OKlink data

It shows that the current top 300 ETH holdings hold a total of 52.39% of ETH, an increase of 0.02% month-on-month; the entire position distribution presents an oval structure, and the proportions of each part are: 1st to 100th, accounting for 37.75%, a month-on-month decrease 0.02%; 101st to 300th, accounting for 14.64%, up 0.04% from the previous month; 301st to 500th, accounting for 6.47%, basically the same; 501st to 1000th, accounting for 7.67%, down 0.4% from the previous month; After 1001, accounting for 33.25%, a decrease of 0.38% from the previous month.

1. Technological progress

At the Ethereum Global Summit, V God said that with the approach of the merger of Ethereum 1.0 and 2.0, many aspects of the roadmap have become more pragmatic, and the long-awaited upgrade "optimistically estimated" will be completed by the end of this year. For the merger, the biggest compromise is that the new Pos chain will not contain the transaction data of the old chain, the old chain will be named the execution chain (execution chain), and the beacon chain that introduced PoS into the Ethereum network will be named the consensus chain (consensus chain), after the merger, the execution chain will exist in the consensus chain. He believes that this design is to make the merger easier and smoother.

2. Voice of the Community

(2) ETH 2.0 developers: Altair upgrade specifications will be frozen around May 21

2. Voice of the Community

3. Project trends

According to official news, the Ethereum community proposal EIP-3554 proposes to delay the difficulty bomb until the first week of December this year, and the proposal is currently in draft status. EIP-3554 aims to delay the difficulty bomb until the Shanghai upgrade and PoS merger. According to previous news, the upgrade of Ethereum Shanghai will be launched as early as October this year.

(2) Billionaire Mark Cuban: ETH is rapidly becoming a deflationary asset

3. Project trends

According to official news, on May 6, the Uniswap V3 version has been officially launched on the Ethereum mainnet. As previously disclosed by Twitter user JuanSnow, the Uniswap team launched a liquidity migration contract and user front-end at the same time to help liquidity providers migrate market-making funds from Uniswap V2 to V3. The liquidity migration contract and user front-end are also applicable to help Liquidity providers migrate market-making funds on SushiSwap. When Uniswap V3 was launched, a new liquidity mining plan for this version has not yet been launched. The Uniswap team stated that the liquidity mining program can be launched through standard governance processes.

4. Borrowing

DefipulseThe team also stated that the biggest change of the V3 version compared with the previous version is that it is expected to greatly improve the capital efficiency of liquidity providers, "it is expected to increase by up to 4000 times compared with the V2 version." The Uniswap V3 version introduces a feature called "centralized liquidity". Liquidity providers can allocate funds within a custom price range, creating a personalized price curve in the process. For example, liquidity providers can choose to only Provide liquidity for a certain price range to participate in market making within the specified price range, thereby obtaining a higher return on capital. According to the previous release plan, the version on Optimism, the second layer network of Ethereum, will be released in mid-May.

(2) Parasset, a parallel asset protocol incubated by NEST LABS, will open its public beta on May 7

4. Borrowing

(data from etherchain.org)

etherchain.orgFrom the perspective of individual projects, the top three lock-up values are: Maker $14.4 billion; Compound $11.11 billion; Aave $11.08 billion.

4. News

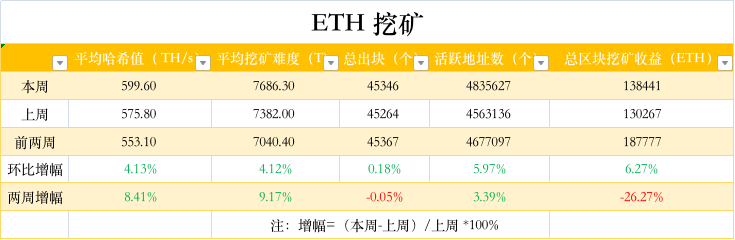

image description

The data shows that the average computing power has increased by 4.1% month-on-month, temporarily reported at 599.6 TH/s; the average mining difficulty has increased by 4.1% month-on-month, reaching 7686 T; the activity on the chain has increased by 6% month-on-month; network congestion has increased slightly, and Ethereum Gas fees The total mining revenue increased by 6.2% month-on-month.

(1) Ethereum's market capitalization ranking rose to 15th, surpassing Johnson & Johnson

Asset Dash data shows that the market value of Ethereum is currently about 445.18 billion U.S. dollars, ranking 15th in global assets, surpassing Johnson & Johnson and approaching JPMorgan Chase.