Robo-advisory is a mature product in the traditional financial field, and it has recently been combined with DeFi.

The picture below shows the DeFi smart investment advisory platformRari CapitalThe liquidity mining pool, stable currency pool and Yield pool (that is, the yield pool in the figure) have an annualized rate of return of 15.8%, which is a good performance among many DeFi products. In addition to the returns of robo-advisors, liquidity mining Based on the user's additional governance token RGT, the participating users can also obtain an additional 44% annualized income. But there are only 10 days left before the end of this bonus period, would you consider participating?

secondary title

What kind of imagination does the robo-advisor, which is naturally compatible with the blockchain, bring to DeFi?

Robo-advisorIn recent years, as a new investment method, it has risen rapidly in the financial market.

Robo-advisor, also known as robo-advisor, means that investors can directly hand over their money to professional robots. The robot combines investors' financial status, risk preference, financial goals, etc., and provides investors with relevant financial advice through the built data model and background algorithm.

Robo-advisor is a substitute for manual investment advisor, and has a natural fit with the decentralized operation of the blockchain.

For robo-advisor products, in a decentralized form, anyone can take it and use it at any time to realize automated and intelligent personal asset management. The resulting inclusive finance and user scale growth may be orders of magnitude.

For the decentralized financial market (or DeFi), robo-advisors can solve many problems, including:

Investors' understanding of the DeFi market is immature, and they lack effective guidance and risk warnings, making it easy to operate rashly, resulting in losses;

New DeFi projects and new ways of playing are emerging one after another, and the level of projects is uneven. Investors may not be able to try and participate one by one by themselves;

The interest rate spread in the DeFi market is time-sensitive, and manual operations are inevitably inefficient and emotional.

as

asCortex LabsTo sum up, decentralized robo-advisors can not only improve transaction processing speed, but also comprehensively judge the overall credibility of each product based on the rate of return of different platforms, the size of the total fund pool, activity, third-party word-of-mouth data, etc. , rate of return and risk coefficient, etc., to help ordinary investors make safe, efficient and accurate investment and asset management.

secondary title

Rari Capital: No one cares about it when it’s just launched, it’s better to mine

It is understood that Rari Capital was officially launched in June this year.

After the announcement of the governance token RGT and the liquidity mining method on October 19, the lock-up volume skyrocketed, reaching a peak of 81 million US dollars, and then fell slightly. As of press time, according toDeBankimage description

Changes in Rari Capital’s locked positions, source:DeBank

RGT also experienced a similar trend after its launch. according tocoingecko.comimage description

In addition to lock-up and currency price performance, let’s take a look at Rari Capital’s gameplay.

According to reports, Rari Capital adopts the more common automatic rebalancing strategy (Rebalancer) in robo-advisors to carry out arbitrage between different protocols, including but not limited to market making, arbitrage, decentralized insurance, etc. The products currently connected include AAVE , Opyn, 0x, dYdX, etc.

On the user side, Rari Capital currently supports 3 fund pools (stable pool, Yield pool, ETH pool), that is, users can deposit stable coins, ETH or other coins to obtain corresponding RSPT tokens (synthetic stable coins), RYPT tokens as well as REPT coins, and redeem funds when needed. The three pools will charge a 9.5% fund management fee, and the first two pools will charge an additional 0.5% withdrawal fee.

The total number of governance tokens RGT is 9.47 million, of which 87.5% are allocated to users stored in the fund pool, and will be distributed within 60 days after going online (that is, around December 20), and the remaining 12.5% of the tokens will be reserved for the team (linear release). After mining RGT, users need to pay an additional fee for withdrawing coins within 60 days, and the fee decreases linearly with time (33%-0%), which may be due to its current low circulation (less than 1.24 million pieces, accounting for 15% of the mining release).

RGT features include maintenance governance and fee discounts for the Rari Capital protocol. The biggest advantage is the destruction plan.

Initially, Rari Capital stated that 70% of all revenue generated by the agreement will be used to burn RGT. By November, Rari Capital changed the distribution rules, saying that it will start an automated charity plan, distributing 50% of the income to the "Rari Foundation", and the remaining 50% will be used for token repurchase and destruction.

The Rari Foundation is governed by RGT token holders and decides which charities the funds should be allocated to. Rari Capital also plans to develop donation tax benefits for individual savers in the coming months. Rari Capital expects the move to donate millions of dollars to charities in the coming year.

Recently, Rari Capital has made two important progresses. One is to be included in Aave’s lending list, and the other is to cooperate with the decentralized asset management protocol Melon Protocol to migrate its liquidity to Melon.

secondary title

Other DeFi+ robo-advisory product gameplay renovation

andDADAandCyFiThese two products. Although there is a certain gap in its attention compared with Rari Capital, it seems to have more ways to play and has its own unique route.

According to public information, DADA’s robo-advisory strategy mainly focuses on the pledge mining function it provides, but when the author experienced this function, the pledge page could not be buffered.

DADA also promotes the concept of community autonomy and building a financial advisory system.image description

As of now, the platform has not issued coins. according topublic information, DADA team members come from Zhongan Insurance, Wanxiang Blockchain and other companies, and investors include DFG and so on.

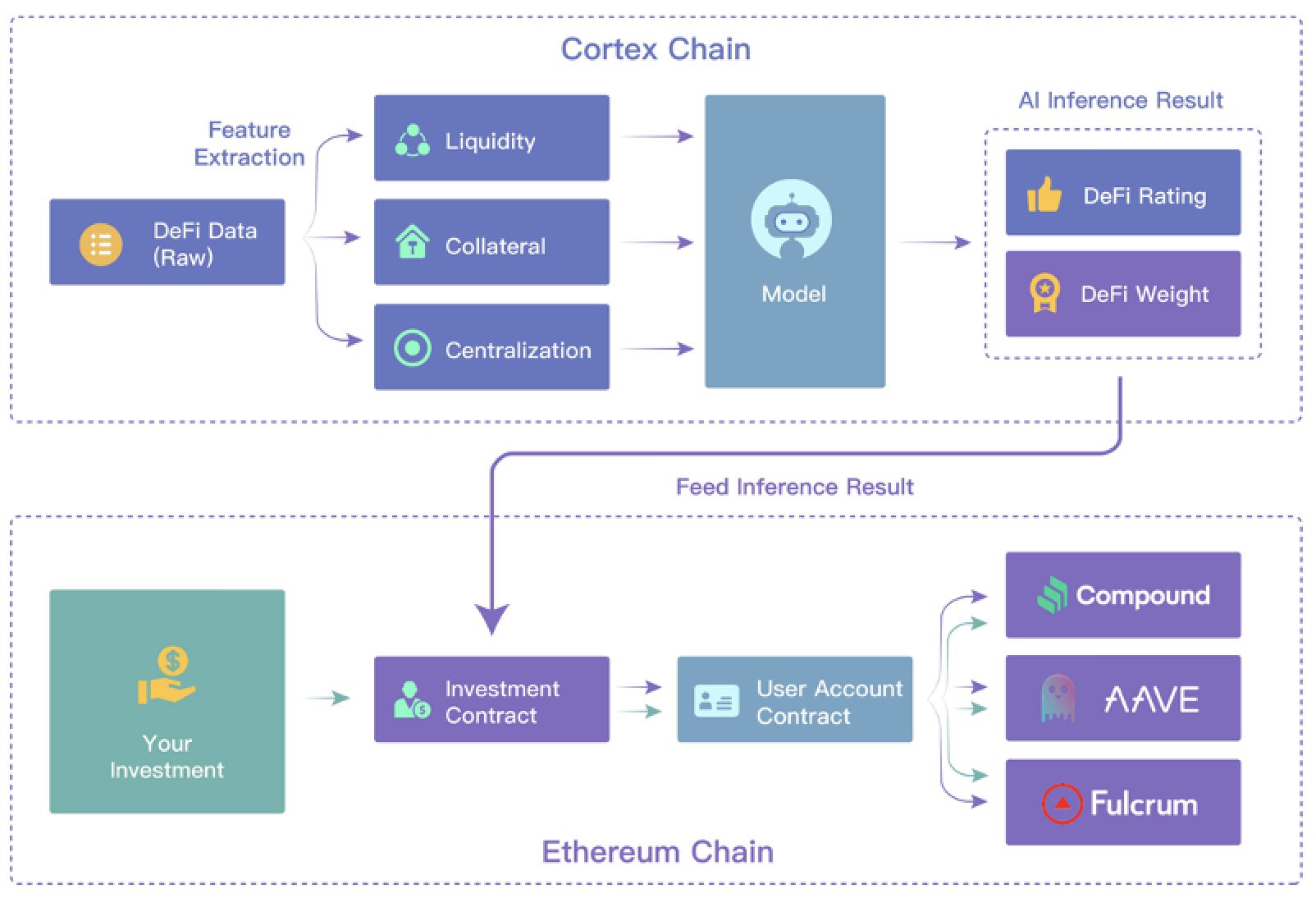

CyFi is developed by the Cortex AI public chain team. Just like its name, CyFi focuses on the application of AI technology (probably the most intelligent of several products), emphasizing the benefits while emphasizing the evaluation of the risks behind DeFi products, so as to comprehensively make decisions on investment strategies and investment portfolios .

image description

CyFi’s cross-chain investment advisory model, source:DADA

At the same time, CyFi's rating of each product and the AI model that deduces the optimal investment portfolio at the current stage are open source.

The platforms currently supported by CyFi include Compound, Aave, and Fulcrum, and the supported assets are currently mainly DAI, with an investment rate of 4.3%. As of now, the platform has not yet issued coins.

Overall, the current robo-advisory products are still in the early stages of development, and they still need to be tested by the market in terms of rate of return and stability. Compared with aggregate financial products on the market, the difference is not very obvious. But from it, we can see the ideas and practices of technology blessing from traditional finance.

Looking forward to their improvement and upgrading, and waiting for a day when farmers will be able to obtain the latest and highest-yielding investment products on the market in time without going out early and returning late.