In the week of November 16-November 22, the events worthy of attention in the progress of star projects include: the end of Uniswap’s initial liquidity mining plan, and the total lock-up volume has been cut in half; the privacy computing platform Oasis mainnet is officially launched; the DeFi insurance project COVER Protocol is officially launched.

Last week, security incidents occurred frequently. Pickle Finance lost nearly 20 million US dollars due to loopholes. Flash loan attacks continued to rage, and Cheese Bank and Origin Protocol were hacked one after another.

Star Project Progress

The following are specific project progress and financing events:

Star Project Progress

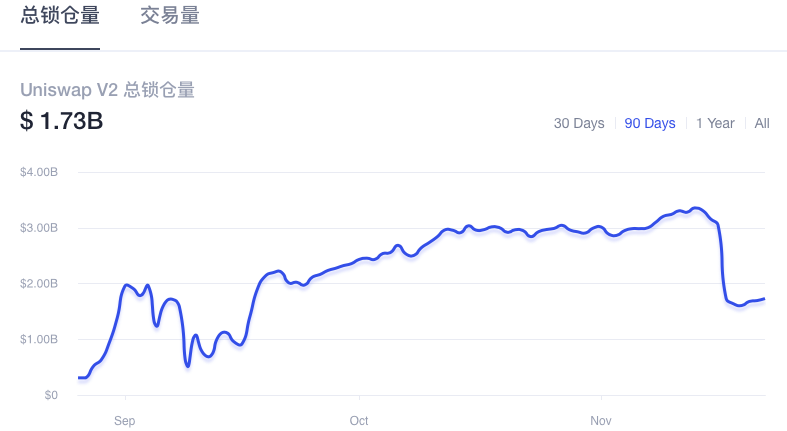

Uniswap's initial liquidity mining plan is over, and the total lock-up volume has been cut in half

At 8:00 on November 17th, Uniswap’s initial liquidity mining plan officially ended, and users who provided liquidity for the four pools of ETH/USDT, ETH/USDC, ETH/DAI and ETH/WBTC will no longer receive any UNI rewards.

After Uniswap stopped liquidity mining, Sushiswap, Bancor, 1inch (Mooniswap) and other projects have launched very purposeful (for the above four pools) mining plans one after another, intending to undertake the liquidity flowing out of Uniswap. Affected by this, the lock-up volume of Uniswap has dropped sharply. OKLink data shows that as of 1:30 on November 23, the lock-up volume of Uniswap has dropped to 1.73 billion US dollars, which is almost halved from the peak value of 3.36 billion US dollars.

Currently, the Uniswap community’s proposal on extending liquidity mining has passed the Temp Check stage and will enter the Consensus Check stage.

Parity engineer Bastian Köcher announced the latest progress of Rococo in the official Element chat room. At present, the code of Cumulus (the parachain used to connect to Substrate) master has been upgraded to version v1.

Privacy computing platform Oasis mainnet officially launched

Oasis Network, a blockchain privacy computing platform, has officially launched its mainnet at around 0:00 on November 19, Beijing time, realized the transfer of ROSE tokens, and launched the network pledge reward plan. It is reported that Oasis will launch the network native token ROSE when its main network is launched. The circulation of ROSE tokens at the start of the main network is about 1.5 billion, and the total limit of tokens is 10 billion.

The decentralized service platform avalanche agreement Avalanche (AVAX) announced that it will launch an important update Apricot (Xingzi). The official said that this is a major upgrade of the platform, introducing functions that are not available on any other chain, and is expected to be released in December this year. Avalanche said that Apricot will debunk a common misconception that as time goes on and data sets grow, blockchains are bound to slow down and consume more resources. Apricot will implement "verifiable pruning", nodes can safely compress past historical transactions, regardless of the size of historical transactions or blockchains, Avalanche nodes can bootstrap and go online quickly and continuously, and light clients can Securely participate in the platform without downloading the entire blockchain.

Celo plans to build a link to facilitate two-way communication between the Cosmos and Celo networks

Celo has awarded a grant to stakeholder service provider Chorus One to build a link that will facilitate interoperability between the Cosmos and Celo networks. The link will allow for "two-way communication" between Celo and Cosmos, allowing Celo's cUSD stablecoin to run on the Cosmos network, while Cosmos-based assets, including ATOM, BAND, and KAVA, can be stored in the Celo Reserve. (Cointelegraph)

Blockstack mainnet Stack 2.0 mainnet is expected to launch on January 14 next year

Blockstack mainnet Stack 2.0 is expected to complete the code before December 15. After discussions with exchanges, launch partners and potential miners, the mainnet launch date is now set for January 14, 2021.

COVER Protocol was officially launched, and governance tokens were released on November 20 and shield mining activities started

The DeFi insurance project COVER Protocol announced its official launch, and released the governance token COVER on November 20, and started Shield Mining and migration activities at the same time. The initial support protocols include ten protocols including Curve, Aave, Balancer, SushiSwap, Yearn.finance, Pickle.finance, BarnBridge, Harvest.finance, REN, and CREAEM.

The DeFi fixed interest rate generation protocol 88mph was officially launched, allowing users to earn fixed interest based on cryptocurrencies while earning MPH tokens in return. Currently supported DeFi platforms include Aave, Compound, and yEarn, and supported tokens include USDC, UNI, yUSD, and ycrvSBTC.

Since then, 88mph has launched a liquidity mining plan, but the attack was shut down urgently due to a contract loophole. Fortunately, the project team responded quickly and transferred the funds safely, and completed the loophole repair in less than 24 hours. Since the team froze the attacker’s $100,000 worth of assets in the MPH bond contract and decided to distribute the extra income to liquidity providers, this attack not only did not cause losses to users, but also caused the first A group of participants received an unexpected bonus.

YFI founder Andre Cronje has withdrawn from DeFi fund M&A

On November 18, Molly Wintermute, the anonymous creator of the on-chain options protocol Hegic, used the M&A account to post a message saying that since Andre Cronje does not want to be involved in any token promotion, M&A is now the only one. According to him, currently M&A still holds 10% of the total supply of zLOT tokens. It is understood that since M&A announced its investment in the zLOT project, the project’s token price has skyrocketed and plummeted.

KIRA will conduct a public liquidity auction on November 25, selling 4 million KEX

security incident

security incident

Pickle Finance Loses Nearly $20 Million Due to Bug

DeFi protocol Pickle Finance lost nearly $20 million in DAI due to a bug on Saturday. It is reported that the vulnerability exploit involves Pickle Finance’s DAI pJar strategy (which uses the Compound protocol to obtain income through DAI deposits), and the funds from the vulnerability have been transferred to the address 0x70178102AA04C5f0E54315aA958601eC9B7a4E08.

Pickle Finance has since announced that it is actively investigating the matter and will provide further updates encouraging all LPs to withdraw funds from Jar until the issue is resolved. (The Block)

Cheese Bank, an Ethereum-based DeFi platform, recently suffered $3.3 million in losses due to a hack. It is reported that hackers use the flash loan vulnerability to instantly borrow, exchange, deposit and borrow a large number of tokens again. Thus, they can artificially manipulate the price of a specific token on a single exchange (e.g. Uniswap, Curve). Value DeFi and Akropolis have recently suffered similar DeFi hacks, blockchain security firm PeckShield said in a blog post on Monday. (Cointelegraph)

Stablecoin OUSD suffers $7 million in flash loan attack

Origin Protocol was attacked by flash loans. Matthew Liu, the founder of the protocol, published the details of the attack, saying that the attack had caused about $7 million in losses, including more than $1 million deposited by Origin, founders and employees.

Since then, Origin Protocol has issued an official document announcing the progress of the attack, stating that it will offer a reward of $1 million to anyone who provides information or evidence to recover the lost funds. At the same time, the official propaganda attacker stated that he hoped that the attacker would return the stolen funds in the form of a white hat, and the funds of the founder and company of Origin Protocol could be removed, with a total of 6.159 million US dollars. If the attacker complies, the tracing of his identity and legal responsibility will be abandoned. (CoinDesk)

On-chain options protocol Hegic was exposed to have a backdoor that can manipulate option prices

Investment and financing overview

Investment and financing overview

Encrypted Security Firm Fireblocks Raises $30 Million in Funding, Lead by Paradigm

Encrypted security company Fireblocks received $30 million in Series B financing, led by venture capital firm Paradigm. Other investors participating in the round include Galaxy Digital, Digital Currency Group, Swisscom, Cyberstarts, Tenaya Capital, and Cedar Hill Capital. Paradigm co-founder Fred Ehrsam joins Fireblocks board. Fireblocks plans to expand its team and infrastructure. (The Block)

Payment startup Chipper Cash raises $30 million in Series B funding led by Ribbit Capital

Chipper Cash, an African cross-border payment start-up company, completed a US$30 million Series B round of financing, led by venture capital firm Ribbit Capital, and Bezos Expeditions, the personal venture capital fund of Amazon CEO Jeff Bezos, participated in the investment. San Francisco-based Chipper Cash, founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, offers free mobile P2P payments. (Bitcoin.com)

OXIO Raises $12M in Series A Funding Led by monashees and Atlantico Capital

New York encryption startup OXIO announced that it has received US$12 million in Series A financing, led by Brazilian venture capital firms monashees and Atlantico Capital, and participated by FinTech Collective and Multicoin Capital. With this round of funding, OXIO will allow big brands to offer telecom-like services by using tokens to turn mobile data into tradable digital assets. (CoinDesk)

DEX Aggregator DEX.AG Raises $3.1M and Rebrands as Slingshot

Decentralized exchange (DEX) aggregator DEX.AG has raised $3.1 million and rebranded to Slingshot. The round was led by Framework Ventures, with participation from Electric Capital, IDEO CoLab, Coinbase Ventures, Winklevoss Capital, Digital Currency Group and Robot Ventures, among others. (CoinDesk)

Encrypted derivatives platform Globe has completed a $3 million seed round to launch Globe Derivative Exchange, an institution-oriented trading platform. It is reported that Globe’s early investors include billionaire Tim Draper, blockchain investment fund Pantera Capital and venture capital firm Y Combinator. (Cointelegraph)

Idle Finance Receives $1.2 Million in Seed Round Funding Led by gumi Cryptos Capital

The team behind the DeFi protocol Idle Finance received US$1.2 million in seed round financing, led by gumi Cryptos Capital, with participation from Quantstamp, BlockRock Capital, and Long Hash. With the new funding, Idle plans to expand its yield optimization protocol with new features. (The Block)

NFT trading market Mintbase raises $1 million, led by Sino Global

Mintbase, an NFT trading market, announced the completion of a $1 million seed round of financing led by Sino Global, with participation from other investors including D1 Ventures, Block Oracle Capital, and Arweave.

The new funding will allow the team to expand its development and design teams, and also prepare for the launch of the NEAR testnet by the end of this year. Additionally, building on NEAR will complement its continued work on Ethereum. Mintbase CEO Nate Geier revealed that the issuance of governance tokens is in the pipeline. (CoinDesk)

NFT Game Axie Infinity Raises $860,000

NFT game Axie Infinity has raised $860,000 through a strategic sale of its governance token, AXS. The round was led by Delphi Digital. (CoinDesk)

Investment company Mercuria Investment and ITOCHU Corporation's joint fund announced an investment in blockchain real estate company Propy. The specific investment amount has not yet been announced.

In October, Propy raised $1.2 million from investors including Tim Draper and Michael Arrington. Propy said in its Sept. 15 SEC filing that it still intends to raise an additional $500,000, bringing the total raised to $1.7 million. (Nikkei News)

Open programmable insurance marketplace Tidal Finance secures investment from LD Capital

Tidal Finance, an open programmable insurance market, received investment from LD Capital. Tidal Finance is an insurance market similar to Balancer built on Polkadot. It has the function of creating a custom insurance pool for one or more assets in multiple chains, and achieves the maximum capital efficiency by giving the pool creator part of the deposit income as a reward change. The open market nature of Tidal Finance will greatly increase capital efficiency by facilitating competition between different pools of funds. Users can create a vault by selecting one or more contracts.