Author | Qin Xiaofeng

Author | Qin Xiaofeng

Produced | Odaily

1. Overall overview

1. Overall overview

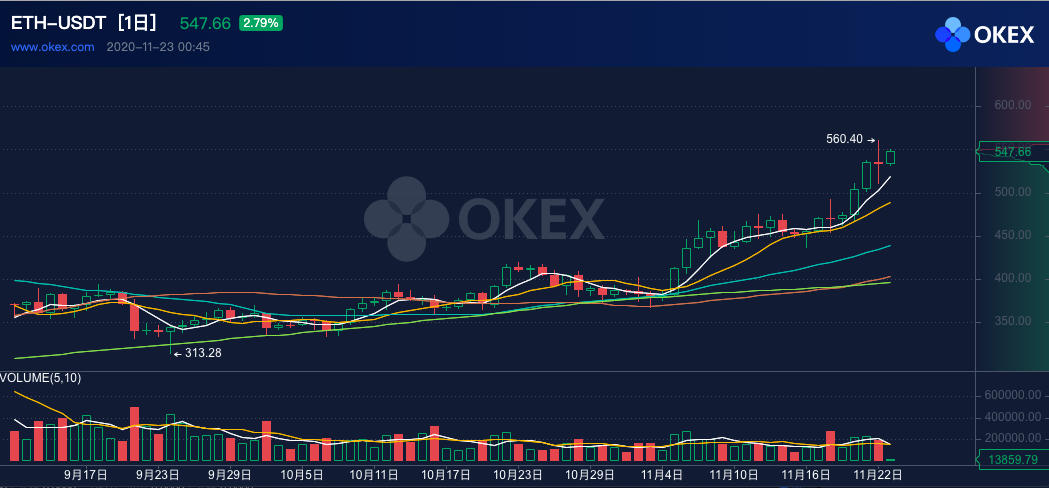

In terms of the secondary market, the current ETH price may fluctuate or slightly pull back in a short period of time, with support at $520 and $490; resistance at $600.

2. Ecology and technology

2. Ecology and technology

1. Technological progress

(1) The balance of the Ethereum 2.0 deposit contract address exceeded 240,000 ETH

(2) The person in charge of the Ethereum 2.0 project: If necessary, the threshold for starting the ETH 2.0 genesis block can be lowered

On November 18, at the AMA event of the Ethereum Foundation, Danny Ryan, the head of the Ethereum 2.0 project, said that if necessary, the minimum deposit threshold of the ETH 2.0 deposit contract can be adjusted to ensure the start of the ETH 2.0 genesis block. He said that I personally think that more than 100,000 ETH in the deposit contract is enough, and it makes sense to lower the threshold to prevent ETH from being trapped for too long. For these early adopters, rewards will be high, and ETH validator nodes will likely continue to grow over time.

Regarding the adjustment time, Danny Ryan said that the plan to adjust immediately on November 24 or December 1 is a bit radical in my opinion. We don't know what's going to happen in the next few weeks, so we should wait and see. The client engineering team seems to want to wait until December and adjust the constant in early January if needed. This seems reasonable.

(3) The second phase of Eth 2.0 may be put on hold for nowin the recentEthereum 2.0 Core Developer Conference Call

After discussion, the core developers believe that Ethereum 2.0 may temporarily shelve its second phase plan until the feasibility of the data sharding layer Rollup solution is proved.

In this regard, V God responded that because we have rollup, Ethereum already has scalability after phase 1 (data sharding), and can handle 100,000 transactions per second, so adding built-in computing allocation is useless. The best understanding is that rollup is a kind of computing sharding. Phase 1 does not need to wait for a long time, we already have a developer working on the test client.

(4) Ethereum 2.0 test network Pyrmont has been launched

On the evening of November 18, Bitfly, the parent company of the Ethermine mining pool, officially tweeted that the Ethereum 2.0 testnet Pyrmont was officially launched. This testnet launch means a stable network, testing validator setup, and the Beaconcha browser is up and running.

(5) V God: In the next 1-2 years, the planned circulation of ETH is about 4.7 million pieces per year

(6) Ethereum’s new roadmap: ETH’s incorporation into the new PoS chain does not necessarily have to wait for Phase 1

However, this merger should not be expected to be completed anytime soon. Developer Justin Drake explained: "The Eth1-Eth2 merger is difficult because it involves coordination between Eth1 and Eth2 and needs to fight against the rigidity of Eth1. I don't think the Eth1-Eth2 merger will happen in 2021." ( Trustnodes)

2. Voice of the Community

In response to Mike Novogratz, the founder of Galaxy Digital, who revealed that he purchased 500,000 Ethereum from V God, V God said on Twitter that this was purchased from the Ethereum Foundation, not me personally. I thank Novogratz and other early buyers of ETH. Without them, perhaps the Ethereum Foundation would not have survived economically, and it would have been much harder for Ethereum to grow to where it is today.

3. Project trends

(1) Synthetix, a synthetic asset issuance platform, announced that Pillar has joined the Volume Program

On November 17, Synthetix, a synthetic asset issuance platform, stated that Pillar joined the Volume Program. According to reports, the Volume Program rewards projects that use the Synth-to-Synth exchange by providing part of the protocol transaction fees.

Send Synths to Pillar using your Ethereum or ENS address from PillarWallet. After adding funds, you can exchange Synth to Synth currency pairs within the wallet with zero slippage regardless of the trading volume.

(2) The burning volume of ALPA in Alpaca City has exceeded 100,000 pieces

(3) KP3R and BOND have been listed on the CREAM Ethereum platform

(4) Asset cross-chain protocol Ren has added multi-chain support function for its RenVM

(5) ConsenSys acquired the Ethereum smart contract development tool Truffle Suite

According to previous news, Truffle Suite was spun off from ConsenSys in April 2019, attracting about $3 million in external funding at that time. In a statement, ConsenSys positioned the acquisition as part of a broader corporate restructuring that began last year. ConsenSys has also cut its overall headcount, a process that began in late 2018. (The Block)

4. Borrowing

Defipulse4. Borrowing

The data shows that last week, the value of locked-up collateral on the chain rose from US$13.621 billion to US$14.119 billion, a week-on-week increase of 3.65%; the previous week (11.9-11.15) had a net increase of US$1.615 billion, and a net increase of US$498 million last week, a month-on-month decrease of 69.16% %.

image description

5. Mining

(data from etherchain.org)

etherchain.org3. Secondary market

3. Secondary market

1. Spot market

image description

(ETH daily chart, picture from OKEx)

(ETH daily chart, picture from OKEx)

image description

(data from BiNuNiu)

(data from BiNuNiu)

(data from Tokenview)

3. Large transaction

(data from Tokenview)

Tokenview dataIt shows that the number of transfers on the chain increased sharply last week, and the number of large-value transfers of "above 5,000 ETH", "above 10,000 ETH" and "above 50,000 ETH" increased by 58%, 47%, and 200% month-on-month. Active frequency. Especially on November 21 (Saturday), there were 16 large-value transfers of "more than 50,000 ETH" in just one day.

OKlink dataIt shows that the current top 300 ETH holdings hold a total of 50.59% of ETH, a month-on-month decrease of 0.72%. 0.66%; 101st to 300th, accounting for 15.85%, down 0.06% from the previous month; 301st to 500th, accounting for 6.56%, up 0.32% from the previous month; 501st to 1000th, accounting for 7.28%, up 0.2% from the previous month; After the 1001st place, accounting for 35.6%, a month-on-month increase of 0.21%.

4. News

(1) DeFi platform Cheese Bank was attacked by flash loan and lost $3.3 million

(2) Dubai IBC Group will invest USD 10 million in ETH 2.0

(3) BNP Paribas and other three giants use Ethereum and Tezos technology to explore digital asset settlement business

(4) Bitcoin Suisse customers deposit more than 70,000 ETH in their ETH2 settlement account

Swiss encrypted asset broker Bitcoin Suisse issued a document stating that as of 17:00 local time on November 20, 2020, Bitcoin Suisse customers have deposited more than 71,891 ETHs in their ETH2 settlement accounts, which is about 33 million US dollars. As of press time that day, the total ETH locked in the deposit contract was 131,328 ETH. Users who want to make crypto history and become part of the ETH2 genesis block still have time to submit their stake in Bitcoin Suisse by November 22 at 23:59 CET. Bitcoin Suisse continuously deposits committed ETH into the ETH2 contract. In order for ETH2 to go live on December 1st, the deposit contract needs to pledge at least 524,288 ETH before November 24th.

(5) Analysis: Nearly 3,800 Ethereum smart contracts have serious vulnerabilities