Chain Hill Capital | การต่อต้านความเปราะบางของ Bitcoin: อะไรที่ไม่ฆ่าฉันทำให้ฉันแข็งแกร่งขึ้น

โดย Ann Hsu | หัวหน้านักวิเคราะห์ดัชนี Chain Hill Capital

บทความนี้เขียนโดย Ann Hsu จาก Chain Hill Capital (Qianfeng Capital) โปรดติดต่อบัญชีอย่างเป็นทางการของ Chain Hill Capital เพื่อพิมพ์ซ้ำ

ชื่อเรื่องรอง

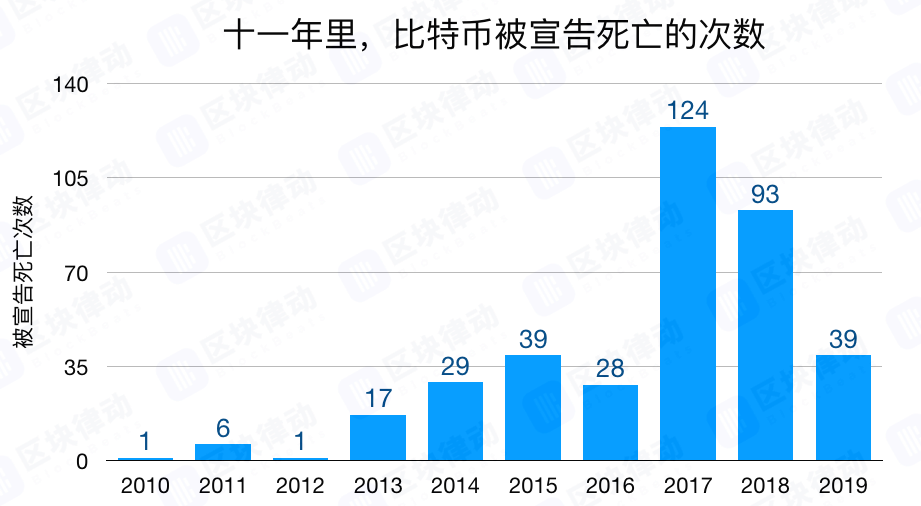

Bitcoin ถูกฆ่ามากกว่า 300 ครั้ง

คำอธิบายภาพ

คำอธิบายภาพ

บางกรณีที่ Bitcoin ถูกประกาศว่าตาย ที่มา: 99bitcoins

ชื่อเรื่องรอง

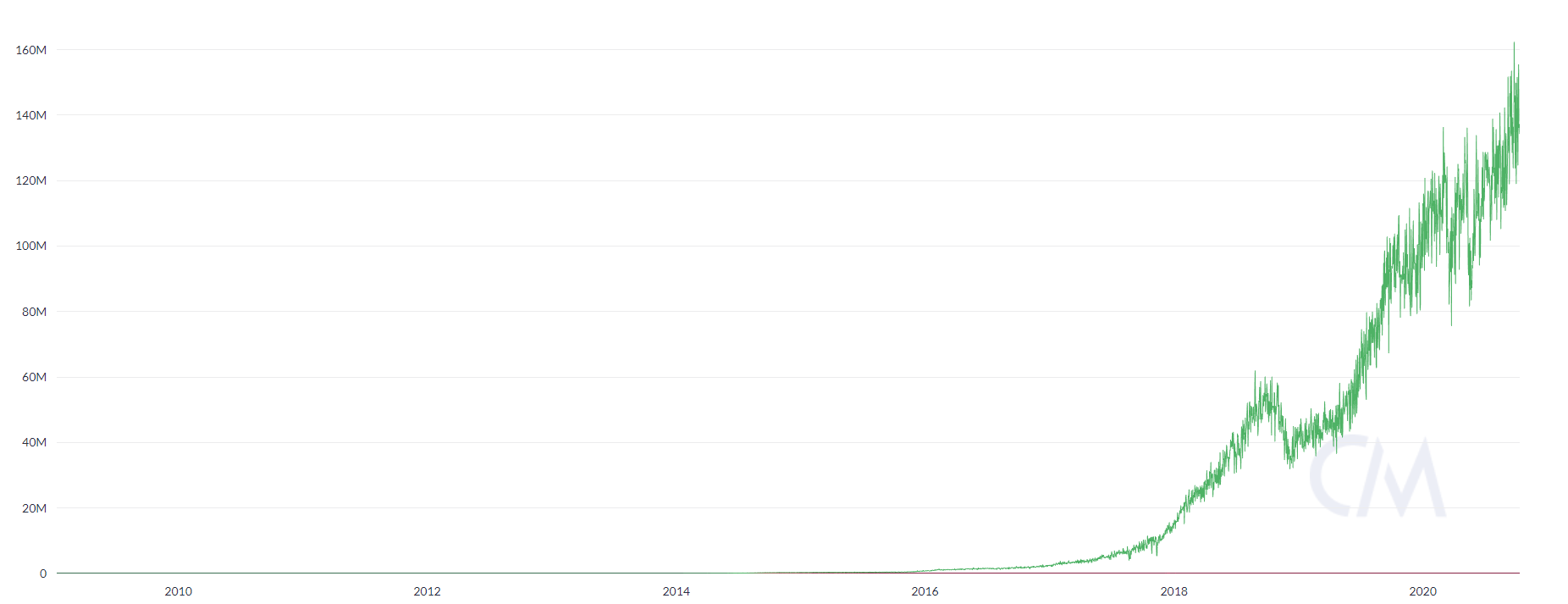

ความแข็งแกร่งของเครือข่ายเติบโตอย่างต่อเนื่อง

คำอธิบายภาพ

แหล่งพลังงานการประมวลผลเครือข่าย Bitcoin: coinmetrics

พลังการประมวลผลของเครือข่าย Bitcoin blockchain ประสบกับการแก้ไขในระยะสั้นหลายครั้ง จากนั้น พลังการประมวลผลก็แตะระดับสูงสุดใหม่ เบื้องหลัง การลงทุนด้านพลังการประมวลผลอย่างต่อเนื่องของนักขุดคือการยืนยันฉันทามติของเครือข่ายและการรับรู้ถึงศักยภาพในการพัฒนาในอนาคต พลังการประมวลผลเป็นแกนหลักของการรักษาความปลอดภัยสกุลเงินดิจิทัลของ POW ยิ่งระดับพลังการประมวลผลสูงเท่าไรนักขุดที่เกี่ยวข้องกับการบำรุงรักษาเครือข่ายบล็อกเชนก็ยิ่งยากขึ้นเท่านั้นที่เครือข่ายจะถูกโจมตีและความแข็งแกร่งของเครือข่ายก็จะยิ่งแข็งแกร่งขึ้น

คำอธิบายภาพ

ชื่อเรื่องรอง

ฐานผู้ใช้ขยายขึ้นเรื่อยๆ

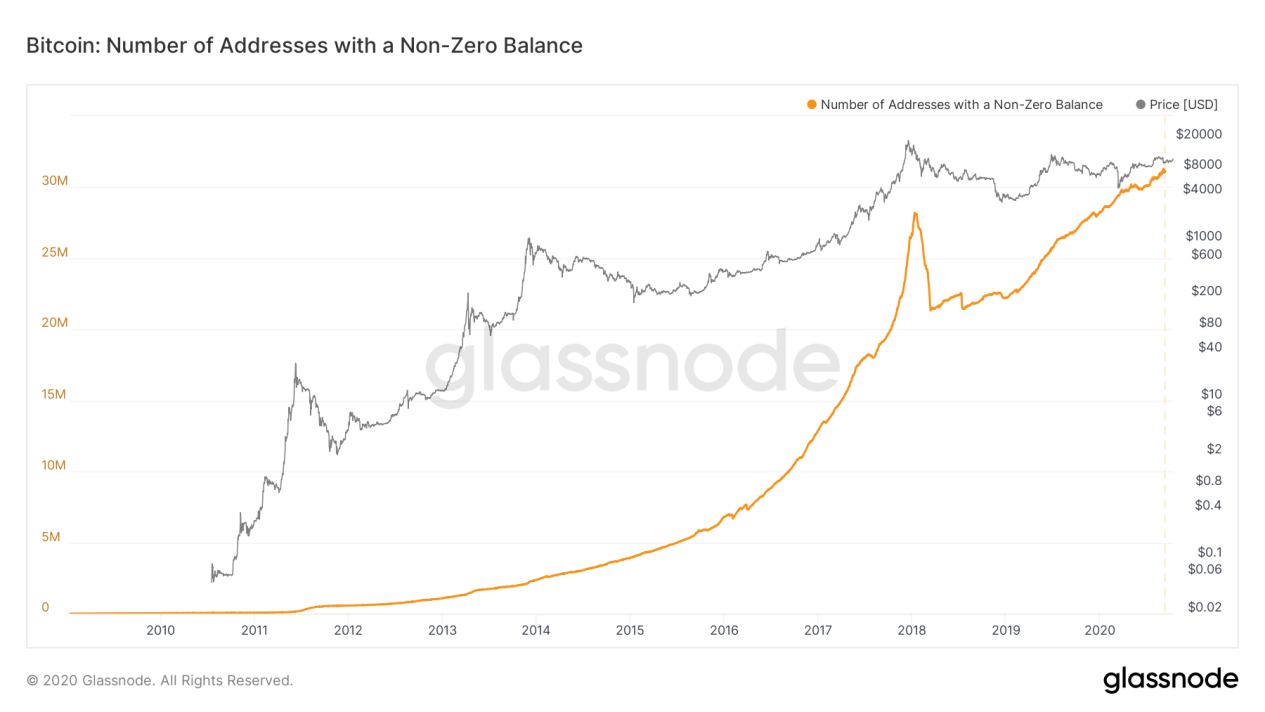

หลังจากสิ้นสุดตลาดกระทิงรอบที่แล้ว นักลงทุนจำนวนมากที่ได้รับคำสั่งซื้อขายในราคาสูงถูกบังคับให้แล่เนื้อของพวกเขาและออกจากตลาดในช่วงหน้าหนาวของราคาสกุลเงิน ส่งผลให้ที่อยู่ Bitcoin จำนวนมากว่างเปล่า และจำนวนที่อยู่ที่ใช้งานอยู่และที่อยู่ที่ไม่ใช่ศูนย์ยังคงลดลง ตั้งแต่ปี 2020 แม้ว่า Bitcoin จะผันผวนอย่างรุนแรงภายใต้อิทธิพลของโรคปอดอักเสบคราวน์ใหม่และตลาดการเงินโลก เนื่องจากการมาถึงของการลดครึ่งที่สามและสภาพแวดล้อมทางเศรษฐกิจระหว่างประเทศที่ทวีความรุนแรงขึ้นซึ่งกระตุ้นความต้องการแหล่งหลบภัย นักลงทุนจำนวนมากขึ้นเรื่อยๆ ตลาดบิตคอยน์

คำอธิบายภาพ

จำนวนที่อยู่ Bitcoin ที่ไม่ใช่ศูนย์ ที่มา: glassnode

คำอธิบายภาพ

ชื่อเรื่องรอง

การรับรู้มูลค่ายังคงเพิ่มขึ้น

คำอธิบายภาพ

คำอธิบายภาพ

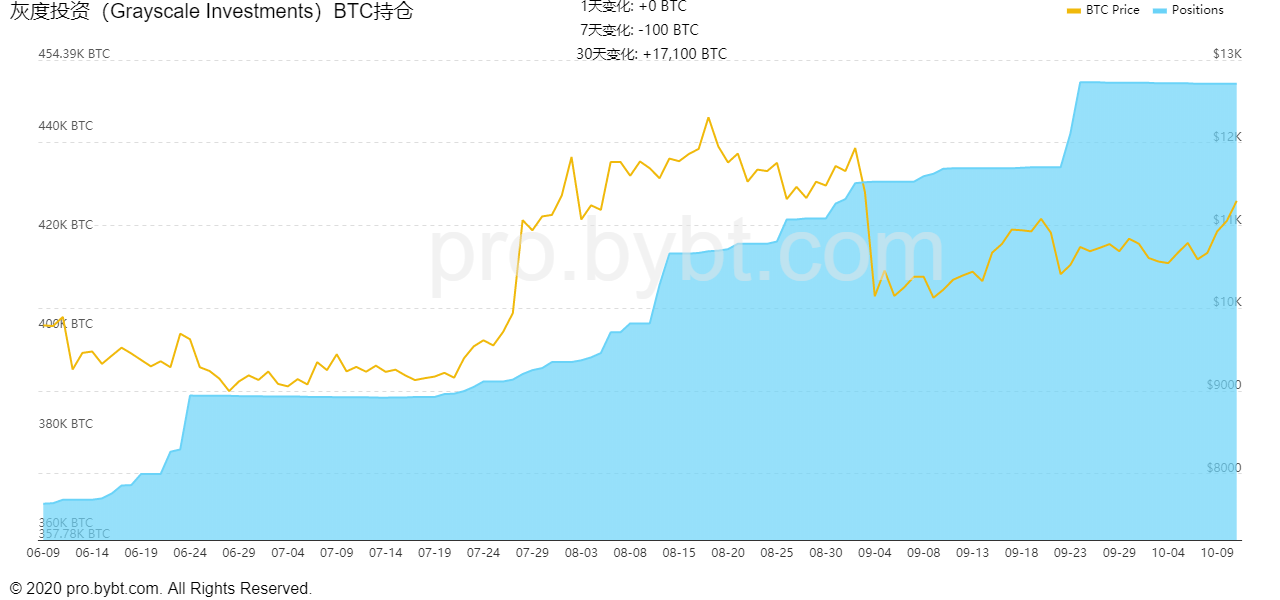

การถือครอง Bitcoin Trust ระดับสีเทาและราคา Bitcoin ที่มา: pro.bybt.com

คำอธิบายภาพ

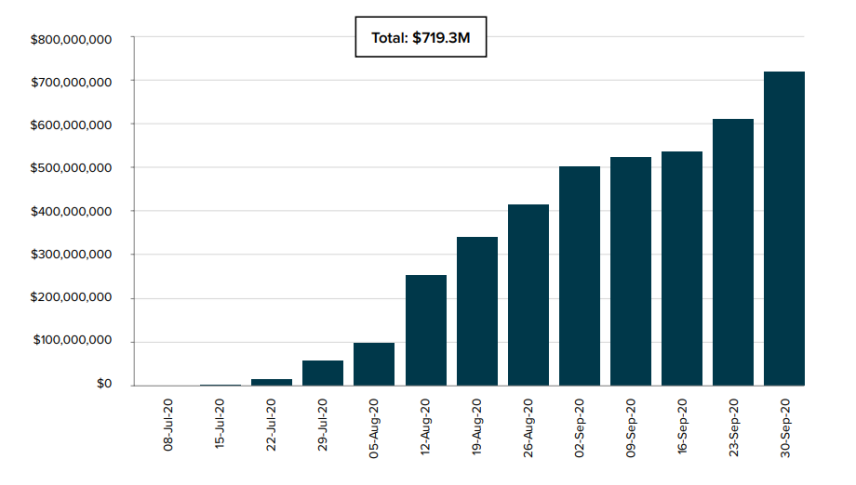

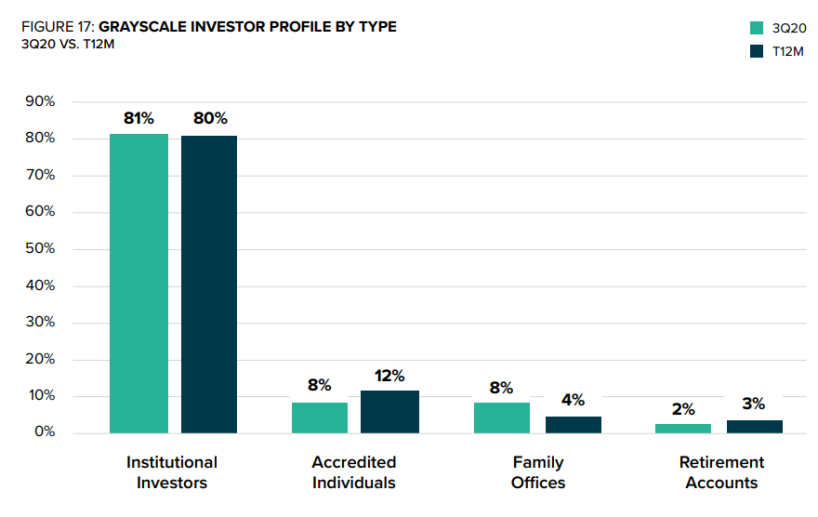

โครงสร้างนักลงทุนของ Greyscale Bitcoin Trust ในไตรมาสที่สามของปี 2020 ที่มา: greyscale

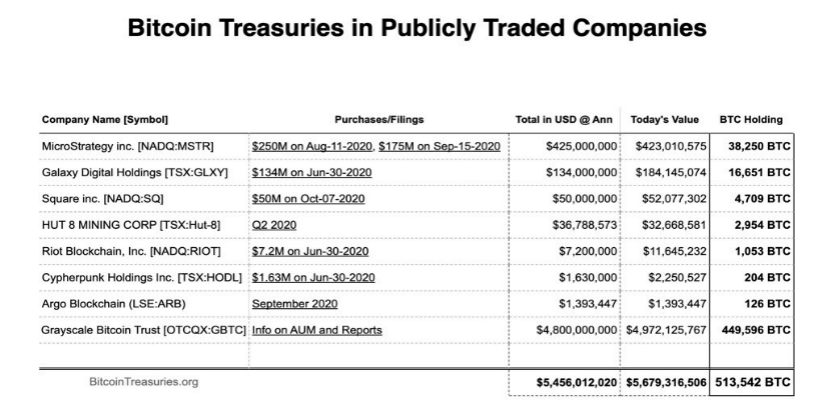

การถือครอง Bitcoin ของบริษัท/สถาบันมหาชน ที่มา: bitcointreasuries.org

การถือครอง Bitcoin ของบริษัท/สถาบันมหาชน ที่มา: bitcointreasuries.org

ชื่อเรื่องรอง

ความสามารถในการกู้คืนวิกฤตอย่างรวดเร็ว

ในเดือนมีนาคม 2020 ตลาด cryptocurrency ได้รับผลกระทบจากเสียงสะท้อนของตลาดการเงินทั่วโลก และ Bitcoin ประสบกับการลดลงอย่างรวดเร็วในระยะสั้น โดยลดลงมากกว่า 40% ภายใน 24 ชั่วโมง กลายเป็นเหตุการณ์หงส์ดำที่ใหญ่ที่สุดในตลาด Bitcoin ในปีนี้ .

คำอธิบายภาพ

ชื่อเรื่องรอง

ปัจจัยสามประเภทที่ทำให้ประชาชนเข้าใจผิดเกี่ยวกับ Bitcoin

ข้อเท็จจริงได้พิสูจน์แล้วว่า Bitcoin ไม่เพียงแต่ไม่ตายตามกำหนดตามความตั้งใจของสื่อ แต่พัฒนาอย่างราบรื่น Bitcoin ได้แสดงให้เห็นอย่างชัดเจนถึงความสามารถในการเกิดใหม่อันทรงพลังของ Nirvana ด้วยเหตุการณ์ "ความตาย" ซ้ำๆ หลังจากประสบกับการปราบปรามด้านกฎระเบียบ การดิ่งลง การฮาร์ดฟอร์กและข้อสงสัยต่างๆ ความแข็งแกร่งของเครือข่าย Bitcoin ได้รับความเข้มแข็งอย่างต่อเนื่องและกลุ่มฉันทามติก็แข็งแกร่งขึ้น มันคือ ยิ่งใหญ่ขึ้นเรื่อย ๆ มูลค่าของมันยังคงเป็นที่รู้จักและมีความสามารถในการซ่อมแซมได้อย่างรวดเร็วในช่วงวิกฤต สิ่งเหล่านี้ คือการแสดงออกของการต่อต้านความเปราะบางของ Bitcoin สาเหตุที่ประชาชนเข้าใจผิดเกี่ยวกับ Bitcoin สามารถแบ่งออกได้เป็นสามสาเหตุดังต่อไปนี้:

1. ความเฉื่อยทางปัญญาเราอยู่ในโลกที่รวมศูนย์ ความมั่งคั่งของคนส่วนใหญ่ถูกเก็บไว้โดยธนาคาร เครดิตของเราจำเป็นต้องได้รับการพิสูจน์โดยบุคคลที่สาม และระบบความรู้ของเราจำเป็นต้องได้รับการพิสูจน์โดยคุณวุฒิการศึกษาหรือใบรับรองทักษะ ชีวิตประจำวันของเราคุ้นเคยกับการพึ่งพาความไว้วางใจจากบุคคลที่สาม ก่อให้เกิดความเฉื่อยทางปัญญาที่สั่งสมมานานนับพันปี เมื่อเปลี่ยนไปใช้โลก Bitcoin ที่ไม่มีศูนย์กลางแล้ว หลายคนไม่สามารถหลุดพ้นจากความเฉื่อยทางปัญญาที่มีอยู่ได้

2. เกณฑ์การเรียนรู้สำหรับคนทั่วไป เกณฑ์การเรียนรู้ของ Bitcoin นั้นค่อนข้างสูง โครงสร้างความรู้พื้นฐานของ Bitcoin เกี่ยวข้องกับเศรษฐศาสตร์ วิชาว่าด้วยเหรียญ วิทยาการคอมพิวเตอร์ วิทยาการเข้ารหัสลับ ทฤษฎีเกม ฯลฯ สำหรับคนส่วนใหญ่ การจะมีความเข้าใจอย่างลึกซึ้งเกี่ยวกับ Bitcoin อย่างน้อยต้องมีความเข้าใจตามวัตถุประสงค์ของสาขาเหล่านี้ในเวลาเดียวกัน การเรียนรู้ แถบคือ ค่อนข้างสูง คนเกียจคร้าน เรียนวิชายากเป็นทุกข์ ใครเล่าจะไม่อยากสบาย นี่แหละคือปฏิจจสมุปบาท

3. การลงทุนผิดพลาดหรือคนรอบข้างลงทุนผิดพลาดเกี่ยวกับเชน ฮิลล์ แคปปิตอล

เกี่ยวกับเชน ฮิลล์ แคปปิตอล

สนับสนุนโดยทีมงานมืออาชีพที่มีภูมิหลังหลากหลายวัฒนธรรม สมาชิกของแผนกหลัก - ฝ่ายวิจัยการลงทุน ฝ่ายการค้า และฝ่ายควบคุมความเสี่ยงล้วนมาจากมหาวิทยาลัยและสถาบันที่มีชื่อเสียงทั้งในและต่างประเทศ พวกเขามีพื้นฐานทางการเงินที่มั่นคง การวิจัยการลงทุนที่ยอดเยี่ยม ความสามารถและความกระตือรือร้นของตลาด ความสามารถที่ละเอียดอ่อน ความกลัวในตลาดและความเสี่ยงสูง ฝ่ายวิจัยการลงทุนผสมผสานการวิจัยพื้นฐานที่เข้มงวดกับแบบจำลองทางคณิตศาสตร์และสถิติเพื่อให้ได้กลยุทธ์การลงทุน เช่น "Pure Alpha" และ "Smart Beta" และในไม่ช้าจะส่งออกรายงานการวิจัยระดับสถาบันและรายงานการตรวจสอบวิเคราะห์สถานะโครงการ

สนับสนุนโดยทีมงานมืออาชีพที่มีภูมิหลังหลากหลายวัฒนธรรม สมาชิกของแผนกหลัก - ฝ่ายวิจัยการลงทุน ฝ่ายการค้า และฝ่ายควบคุมความเสี่ยงล้วนมาจากมหาวิทยาลัยและสถาบันที่มีชื่อเสียงทั้งในและต่างประเทศ พวกเขามีพื้นฐานทางการเงินที่มั่นคง การวิจัยการลงทุนที่ยอดเยี่ยม ความสามารถและความกระตือรือร้นของตลาด ความสามารถที่ละเอียดอ่อน ความกลัวในตลาดและความเสี่ยงสูง ฝ่ายวิจัยการลงทุนผสมผสานการวิจัยพื้นฐานที่เข้มงวดกับแบบจำลองทางคณิตศาสตร์และสถิติเพื่อให้ได้กลยุทธ์การลงทุน เช่น "Pure Alpha" และ "Smart Beta" และในไม่ช้าจะส่งออกรายงานการวิจัยระดับสถาบันและรายงานการตรวจสอบวิเคราะห์สถานะโครงการ