As the official launch of Ethereum 2.0 is approaching, the surrounding service battlefield is gradually rising.

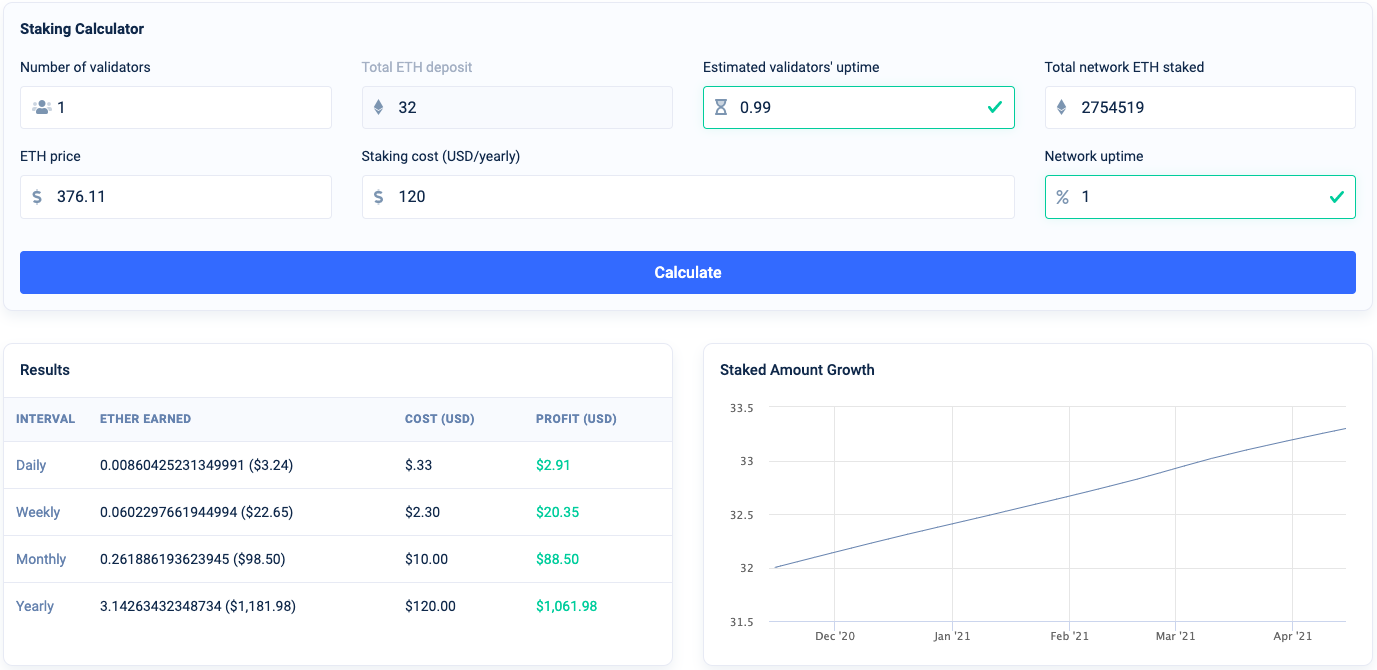

After the consensus mechanism is switched to PoS, miners need to continue to participate in mining by staking ETH. BeaconScan provides an ETH 2.0 Staking revenue calculationsmall tools, based on assumptions such as "2,754,519 ETH participating in Staking", "node annual operating cost of 120 US dollars", "node online time is 99%" and other assumptions, the currency-based annual income of pledging 32 ETH for mining is about 8.8%.

(Note: 2754519 ETH is the currentMedallaTestnet staking data. All variables are only hypothetical conditions, and the actual data is subject to the official launch of the mainnet. )

(Note: 2754519 ETH is the currentMedallaTestnet staking data. All variables are only hypothetical conditions, and the actual data is subject to the official launch of the mainnet. )

Compared with the various DeFi projects that have been popular before, the annualized rate of return of 8.8% does sound slightly lower, but compared to DeFi, Staking is inherently low-risk and low-yield. It is expected that when Ethereum 2.0 is officially launched, there will still be Many users participate in Staking mining.However, judging from the current parameter settings, the threshold of ETH 2.0 Staking mining is enough to keep many ordinary investors out.

First, the minimum requirement to participate in ETH 2.0 Staking mining is 32 ETH (currently priced at $12,000). Of course, in order to avoid excessive concentration of node power, a node can only pledge 32 ETH at most, that is, if you hold 64 ETH, you must operate two verification nodes.

Second, individual operation of a verification node requires considerable expertise and costs, roughly estimated at $120 per year.

Again, there is a Slash mechanism in ETH 2.0, which is simply a punishment mechanism, that is, the network will punish nodes with non-compliant behaviors (including offline time too long).

Finally, since Phase 0 does not support accounts, asset transfers, and running smart contracts, participating in ETH 2.0 Staking means that assets will be locked for a long period of time, and users need to consider the risk of currency price fluctuations during this period.

Although it will take time for the mainnet to go live, there are already some projects on the market that are deploying staking-related services.On October 6th, Rocket Pool released support for EthereumMedallatestnetbeta product, we will try out the product to explore whether this project can solve the pain points of ordinary user participation.

First, let’s summarize the principle of Rocket Pool’s staking service. This project introduces a concept of so-called “token-based staking”. Goerli ETH) into the Rocket Pool contract, and get a corresponding amount of rETH, rETH value = Staking principal + Staking income generated over time. rETH can be freely traded, which means that the liquidity of ETH that was originally pledged will also be released.

From a practical point of view, after completing the wallet link (the author uses MetaMask), the user can switch ETH to rETH with one click, and two-way conversion is also possible when there is sufficient liquidity. As shown in the figure above, the current price of rETH is slightly higher than ETH itself, which means that rETH has included the Staking revenue generated over time.

Through this model, users only need to perform some simple operations to realize ETH 2.0 staking. The specific node deployment and operation and maintenance will be completed by another role in the network - the node operator (node operator). In order to attract more People become node operators, and Rocket Pool allows this role to charge ordinary users a certain commission, which is 20% in the beta version (the ratio can be adjusted). However, greater income also means greater responsibility, and becoming a node operator requires an individual to pledge at least 16 ETH.

Since the user's ETH is aggregated and then the node operator performs specific operations, ordinary investors who participate in ETH 2.0 Staking through Rocket Pool no longer need to comply with the minimum requirement of 32 ETH. In fact, the beta 2.5 version has reduced the minimum amount for users to participate in Staking to 0.01 ETH, and there is no upper limit.

In dealing with the Slash penalty mechanism, Rocket Pool chooses the method that any loss caused by node failure will be shared by the entire network. The advantage of this method is that the impact on individual users can be minimized by dispersing risks; the disadvantage is that for some node operators with more professional skills, they may not be willing to share their own interests with other nodes. bound.

To sum up, for the four pain points of ordinary investors participating in ETH 2.0 Staking, Rocket Pool can solve the following problems:

32 ETH Threshold:can be solved.

Professional skills requirements and node construction, operation and maintenance costs:partially resolved.Users still need to pay a certain commission to the node operator when staking. As far as the beta version is concerned, the figure of 20% is obviously too high.

Slash risk:Basically solved.The question that remains to be seen is whether the commission rewards for established node operators can cover the loss of benefits they are forced to pay due to other node failures.

Liquidity of pledged assets:Basically solved.The rETH mechanism is somewhat like the concepts of "equivalent bonds" and "corresponding derivative coins" proposed by Stafi and Kira respectively, but these concepts have not been verified by large-scale adoption. Will the early release of the liquidity that should be locked in bring potential Leverage risk still needs to be further tested by the market.

As of the publication, Rocket Pool has 483 node operators, and the Goerli ETH in pledge has reached 139,168.

White Paper Portal

Stkr(White Paper Portal) is a brand-new PoS infrastructure protocol built by the blockchain cloud service platform Ankr, which allows users to control their own asset ownership (only entrust the right to use the asset) at the same time, in a small form (less than 32 ETH) Hard requirement) Participate in Staking mining of PoS protocols such as ETH 2.0. The specific product of Stkr has not yet been released. The official website gives the release date as the fourth quarter of this year. Odaily will try it out as soon as the product is released.

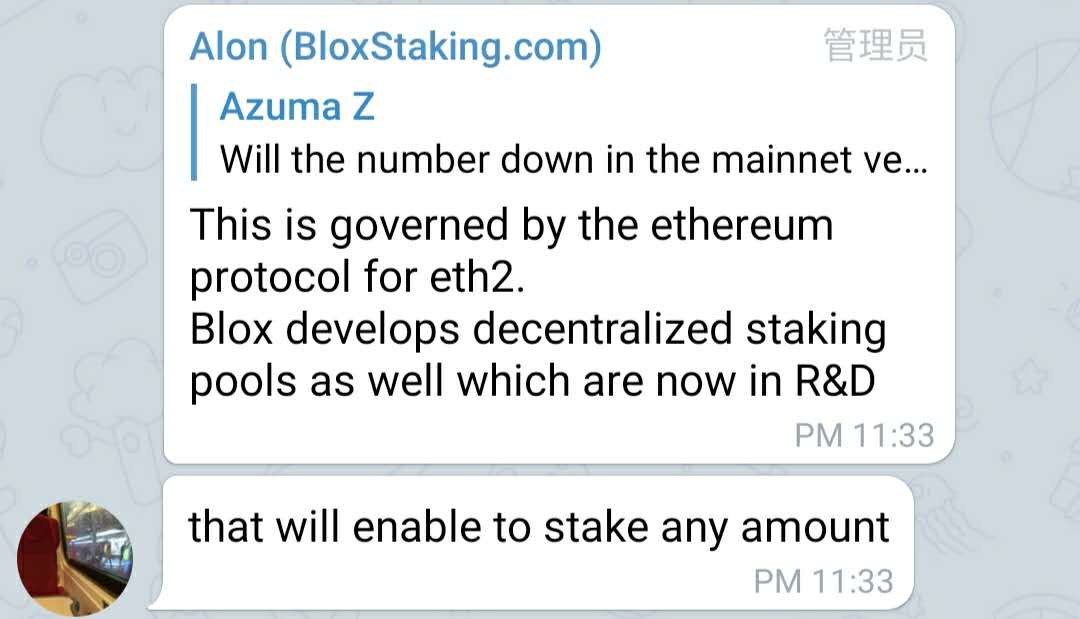

Blox Staking(beta version portal) just released a beta product that supports Medalla this Monday. The main feature of this product is non-custodial, that is, users do not need to give up their private keys, and can execute transactions through remote signing. At present, the beta version of Blox Staking still has a minimum threshold of 32 ETH. After seeking official confirmation, Blox CEO Alon Muroch responded to Odaily that Blox’s decentralized Staking pool has entered the research and development stage and can support the use of any amount of ETH in the future Staking. In addition, Blox Staking mentions that the product has a built-in Slash protection mechanism, but the exact working mechanism is unclear.

secondary title

Related Gadget Links

BeaconScan ETH 2.0 Staking Profit Calculator: https://beaconscan.com/staking-calculator;

Rocket Pool beta version: https://beta.rocketpool.net/;

MetaMask wallet: https://metamask.io/;

Request address: https://faucet.goerli.mudit.blog/.