This article comes fromMedium, original author: Regan Bozman

Odaily Translator |

Odaily Translator |

As an emerging industry, people will always hear some new encryption fund names in the market from time to time. If you're trying to figure out which crypto funds are still in operation, it feels like -- girls meet high numbers: no solution.

To this end, Regan Bozman, who once worked for AngelList and Handy and is currently the head of CoinList's business operations, tried to sort out the slightly chaotic crypto investment market, helping investors navigate the maze of capital and grasp the annual financing trend. Next, let Mr. Odaily (WeChat: o-daily) and everyone take a look at how Regan Bozman analyzes it:

In fact, back in September 2018, Regan Bozman released an overview of cryptocurrency investor profiles and a real-time database of all funds active in the crypto investment space. The reason why I started researching this topic is that many entrepreneurs in the crypto industry always say that financing is an extremely difficult challenge. Cryptocurrency investing is a fast-changing world: SAFTs, side pockets, SPVs are entering the mining industry, and many in the industry don't know which investors are reputable and which investment terms are suitable for crypto industry.

(Odaily Jun o-daily Note: The side pocket mechanism refers to the mechanism of separating assets that are difficult to reasonably value from the fund portfolio assets for independent management, and other fund assets are still stored in the main pocket; SPV, that is, Special Purpose Vehicle, Special-purpose vehicles refer to the purchase and packaging of securitized assets and the issuance of asset-based securities based on this in the process of offshore asset securitization to raise funds from foreign investors.)

Although the financing of the encryption industry has developed to a certain extent, transparency still needs to be further improved. Many crypto funds (often launched after receiving funding from the initial coin offering boom of 2017) have now quietly closed, while many new crypto funds have also started to enter. Not only that, some traditional venture capital funds have begun to try to launch funds dedicated to cryptocurrencies, but at the same time many traditional funds that have entered the encryption industry have slowed down or stopped investing in this field-although we can still invest in many cryptocurrencies I saw some investment information on the official website of the fund, but in fact most of them have no practical use and significance.

In this article, we will focus on analyzing three aspects:

1. Utilize a comprehensive real-time database, Dove Mountain Data, to analyze all funds investing in the cryptocurrency industry;

3. Share the opinions of some famous investors on the current financing trend of the encryption industry.

secondary title

1. Analysis of funds investing in the cryptocurrency industry

Dove Mountain Data is a real-time database that researches and collects information on various investors actively investing in cryptocurrency companies and projects, aiming to help entrepreneurs understand the financing process of the encryption industry.

How to tell if a fund is actively investing in the crypto industry? We think a rough definition is whether there have been publicly announced cryptocurrency investments in the past year. It should be noted, however, that the data is far from perfect, as some cryptocurrency industry investments are “unproven” in many cases. For example, Greylock is actively deploying funds, but if according to public information, their last investment was to participate in Coinbase’s D round of financing in 2017, so in this case, although Greylock is a large-scale encryption fund, it cannot Put it in the fund category of "actively investing in the encryption industry", but I believe they will definitely be included in this category in the future.

Based on the above definitions, we have compiled the top ten active crypto funds are:

1. Fund name: 1confirmation

Is it only involved in the encryption industry: yes

Country/Region: United States

Established: 2017

Assets under management: USD 50 million to USD 100 million

Key Person: Nick Tomaino

Portfolio: Coinbase, dYdX, Harbor, OpenSea, Authereum, BloXroute Labs, Commonwealth, Tendermint, Veil, Forte

2. Fund name: 1kx

Is it only involved in the encryption industry: Yes

Country/Region: Europe

Established: 2017

Assets under management: unknown

Key Person: Lasse Clausen

Portfolio: Nervos, Arweave, Flexa, Terra

3. Fund name: 9Yards Capital

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 2018

Assets under management: unknown

Key Person: David Fisher

Portfolio: Unknown

4. Fund name: A. Capital

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 2013

Assets under management: $250 million

Key Person: Kartik Talwar

Portfolio: Aztec, Bison Trails, Coinbase, NEAR Protocol

5. Fund name: a16z Crypto

Is it only involved in the encryption industry: Yes

Country/Region: United States

Established: 2018

Assets under management: $250 million

Key Person: Chris Dixon

Portfolio: Anchorage, Arweave, AVA Labs, Basis, BlockTower Capital, Celo, Chia Network, Coinbase, Compound, CryptoKitties

6. Fund name: Abstract Ventures

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 2018

Assets under management: unknown

Key Person: Ramtin Naimi

Portfolio: Brave, Ripple, Compound, Polychain, AVA Labs, Blockfolio, dYdX, Harbor

7. Fund name: Accel

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 1983

Assets under management: $250 million

Key Person: Amit Kumar

Portfolio: Chainalysis, Circle, Drip Capital, FalconX, Oasis Labs

8. Fund name: Accomplice

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 2015

Assets under management: $250 million

Key Person: Amit Kumar

Portfolio: Circle, CoinList, O(1) Labs, NEAR Protocol, Balancer Labs, Bison Trails

9. Fund name: Arrington XRP Capital

Is it only involved in the encryption industry: Yes

Country/Region: United States

Established: 2018

Assets under management: USD 100 million to USD 250 million

Key Person: Michael Arrington

Portfolio: Unknown

10. Fund name: Bain Capital Ventures

Are you only involved in the encryption industry: No

Country/Region: United States

Established: 2018

Assets under management: $250 million

Portfolio: Compound

secondary title

2. Financing trends in the encryption industry

Some "players" have left the crypto industry investing game.

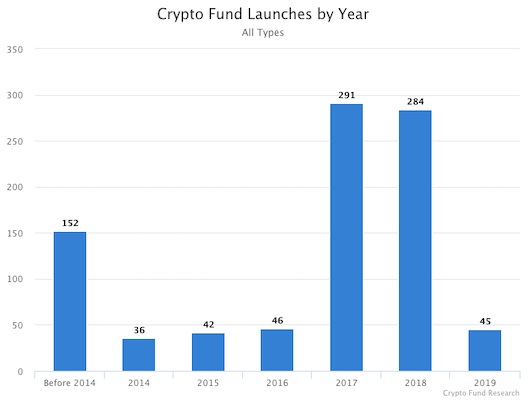

As the chart above shows, there haven’t been many crypto funds in the market since the 2017/2018 crypto bull run. (Source: Crypto Fund Research)

The crypto bear market of 2018-2019 has brought many victims to the entire industry, some of which are upstart crypto funds that participated in the initial public offering in 2017, because many initial public offering projects simply cannot bring returns to crypto funds over time. This situation has even continued until recently. As recently as mid-March 2020, some crypto funds still failed to stop the bleeding, and many crypto funds, including Adaptive Capital and Cambrial Capital, were still falling.

Some funding sources have seen industry strife, which has also led to them having to focus inward. For example, at the beginning of 2018, Bitmain was developing rapidly and attracted the attention of many venture capital investors. It was reported that it recorded a profit of US$4 billion that year, and led Circle’s US$110 million financing in May of that year. . However, a failed bet on Bitcoin Cash, a failed IPO and a bitter internal power struggle have diminished the importance of the bitcoin mining giant in the overall cryptocurrency ecosystem.

There are also some encryption funds that have suffered dismal performance entirely because of their own "incompetence". For example, RChain raised a multi-million dollar round in September 2017, and later decided to launch an ecosystem fund, Reflective Ventures. In April 2018, Reflective Ventures proudly announced that it had invested over $6 million in four blockchain companies. However, just a year later, it was discovered that RChain was managing its funds like a drunken sailor, and they actually spent more than half of the financing on an audio codec. Not only that, but one of the founding partners of Reflective Ventures was charged with financial crimes by the US Securities and Exchange Commission (SEC).

In this case, some crypto industry "players" began to form their own alliances of investment funds

During the 2017-2018 bull market, many crypto fund managers reaped huge profits. In this crowded market, there are not only established traditional funds like a16z (June 2018 - fund size 300 million US dollars), but also some rising stars, such as:

1. BlockTower Capital (January 2018 - fund size 140 million US dollars);

2. Dragonfly Capital Partners (October 2018 - fund size 100 million US dollars);

3. Multicoin Capital (June 2018 - fund size 75 million USD);

4. Pantera Capital (August 2018 – fund size 100 million US dollars);

5. Paradigm (October 2018 – fund size 400 million US dollars);

6. Placeholder Capital (July 2017 - fund size 100 million US dollars);

7. Polychain Capital (June 2018 - fund size 1 billion US dollars).

While many of the crypto funds mentioned above are still investing in the cryptocurrency industry, three funds have clearly distanced themselves from the rest: a16z Crypto ($825 million AUM), Paradigam (AUM of US$400 million), Polychain Capital (AUM of approximately US$600 million). These flagship funds are all from the United States, and their asset management scale exceeds 250 million US dollars. In the past two years, they mainly invested in round A and round B financing, including:

1. Argent (March 2020 – $12 million);

2. Amber (February 2020 - $28 million);

3. Celo (April 2019 - $25 million);

4. Compound (November 2019 - $25 million);

5. Dfinity (August 2018 - $102 million);

6. Oasis Labs (July 2018 - $45 million);

7. StarkWare (October 2018 - $30 million).

With the continuous development of the encryption industry, it is expected that more and more companies will start to raise later-stage funds, so these fund companies are bound to become more important in the entire ecosystem.

And some crypto funds are starting to focus on new assets

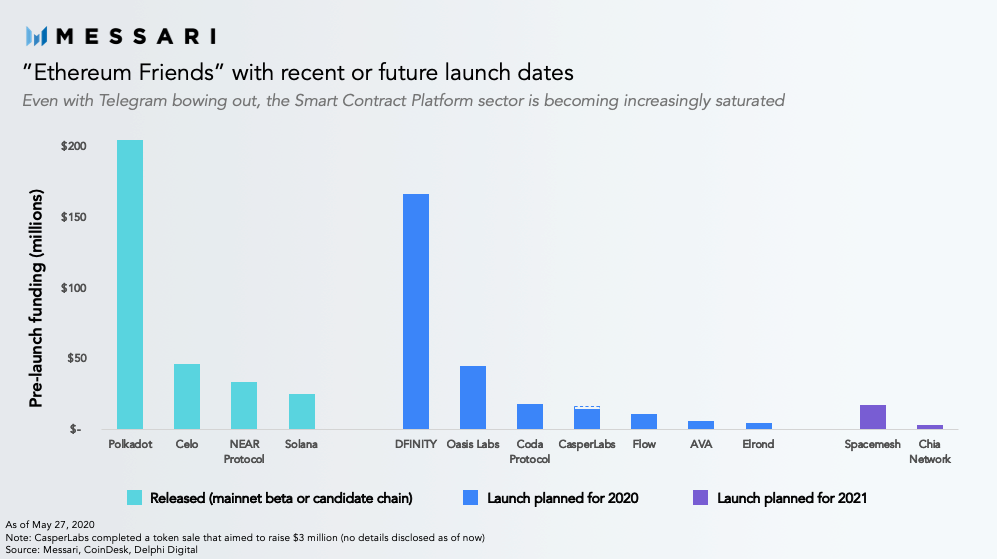

There are some crypto funds that went public in 2019 or later, which is also considered to be a relatively new wave of cryptocurrency funds, and these funds seem to be very different from those that appeared in the 2017-2018 bull market. The size of traditional encryption funds established around 2017 is usually more than 100 million US dollars, and will invest heavily in the field of smart contract platforms, while the scale of encryption funds established around 2019 is usually relatively small (fund management scale is almost less than 50 million) U.S. dollars), and these crypto funds seem to be more interested in investing in blockchain financial applications, such as decentralized finance (commonly known as DeFi), rather than looking for the "next Ethereum killer."

Of course, part of the reason for this shift in investment center is driven by the market. During the 2017-2018 bull market, many of the most prominent smart contract platforms were about to launch, and private funds were eager to invest in this space. At the same time, DeFi is exploding as an investable asset class, with ethereum-based stablecoins in circulation exceeding $10 billion (an increase of more than 800% in the past 12 months), and May 2020 has seen even more Centralized exchange trading volume breaks record $700M (+325% growth over past 12 months).

Whatever the reasons, this shift in investment center is a far cry from where big funds have historically deployed their money. As an example, nearly half of a16z's publicly disclosed investments in crypto projects are in layer 1 blockchains (Arweave, Celo, Chia, Dapper Labs, DFINITY, and Oasis). It’s worth pointing out here that some of them — like Arweave and Chia — belong to application-specific blockchains rather than smart contract platforms, though a16z has also invested in a number of decentralized finance companies including Decomed, dYdX, and MakerDAO, But despite this, a16z's investment direction in the encryption industry is still very clear, that is, a large part of its investment portfolio is the first layer of blockchain.

Another thing to note is that the size of crypto investment rounds is getting smaller and smaller these days, and the start-up capital raised by projects is also shrinking. Compared with 2019, the number of completed encryption industry financing transactions decreased by 2% year-on-year, and the financing amount decreased by 30%. The transaction scale showed a downward trend compared with last year. At this stage, only the top DeFi projects can gain significant market and investment attraction, but even so, many DeFi projects with large asset management scale are still unable to raise more than US$5 million in venture capital, such as:

1. InstaDApp (AUM of over US$40 million);

2. Set (the asset management scale is more than 12 million US dollars);

Recently, Balancer and Futureswap, two decentralized finance projects, have also successfully launched with relatively small funds.

text

VCs starting to look elsewhere?

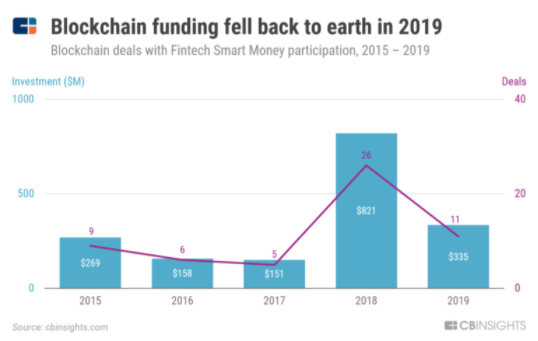

Top U.S. venture funds have slashed investments in the blockchain industry since 2019 (Image: CB Insights)

Overall, interest in the cryptocurrency industry from traditional venture capital firms has shown a downward trend. In 2020, it seems difficult to see an investment frenzy like that in 2018, let alone a Silicon Valley venture capital investment of US$133 million in an encryption company that has just been established for only one year (in April 2018, the stable currency project Basis received Google Ventures , Bain Capital, a16z, ZhenFund, Ceyuan, Digital Currency Group and other well-known investment companies invested US$133 million). Of course, there are still some funds that are actively investing in the crypto industry — a number of crypto companies have successfully raised funding from top VCs in the past few months, including:

1. Argent (invested $12 million by Index);

2. Arweave (USV invested $8.3 million);

3. Atomic Loans (invested by Initialized for $2.4 million);

4. Bison Trails (or Kleiner Perkins for $25 million).

A major reason for this sign of investment slowdown is that the crypto asset class is still in its infancy and its development may be slower than investors expect. In contrast to the fast-growing, high-margin "software-as-a-service" (SaaS) companies that traditional VCs often see, crypto companies seem to have other incredible risks, often involving market, legal, and technology. The head of a top venture capital fund focused on Series A financing revealed that it is difficult for them to invest in a company/project without an obvious way to make a profit. At this stage, they found that most cryptocurrency companies still need to face to many challenges.

secondary title

3. Investors’ views

Some investors who are very friendly to the encryption industry have shared their views on the financing trends in this field. Let Mr. Odaily (WeChat: o-daily) and everyone take a look at how several industry leaders view the trends in the encryption investment industry:

1. Alex Pack, from the venture capital firm Dragonfly:

The most interesting change to fundraising in the cryptocurrency industry is that you get a clear picture of how cryptocurrencies are going. Cryptocurrencies are a new asset class, so VCs investing in this space will need to innovate to be successful. Almost all of the top crypto funds are spun off from traditional VC firms in some way, and gone are the days of traders driving token deals in the past. But the problem is that the investments made by traditional VC firms are themselves largely cyclical lows right now, and cryptocurrencies are growing so fast and in such a wide variety that outsiders and traditional investors alike have trouble keeping up.

2. Devin Walsh, from the venture capital company Coinfund:

In 2019, the crypto space saw a number of middleware protocols, including Graph and 3Box, bring many pleasant experiences for Web3 developers and network participants. Not only that, but in the past 6 months, we have also seen a surge in the number of encryption protocols released to the mainnet, some protocols have begun to deploy important upgrades, and many new teams are developing new products. It is important to support the growth of the next phase of the project. For the rest of 2020 and the upcoming 2021, we will see continued development of decentralized network governance, expanding core development tools and middleware products, and various methods of attracting new users. This all excites me.

3. Jason Choi from venture capital firm Spartan Group:

In 2017, the crypto industry was full of IPOs, but now that the industry has started to wake up from the hangover, you find it in a different world: money is illusory, governments are mistrusted, and big tech companies are bigger than ever Be more aggressive at any time. In this context, traditional investors in the macroeconomic field such as Paul Tudor Jones have begun to invest in Bitcoin, and venture capital funds such as a16z are also continuing to invest new funds in the encryption industry to accelerate the promotion of the decentralized economy 's arrival

Expect to see more and more business consolidation as the industry matures, so there should be many high-profile acquisitions in the crypto space, especially those trying to institutionalize or develop into digital banks Cryptocurrency exchanges, and these exchanges themselves are very well-funded. Increasingly thoughtful tokenization models based not only on speculation, but also on usage to generate value, these “incentives” will also open the door to more fundamentally driven long-term capital.

4. Santiago Roel Santos from ParaFi Capital, a venture capital firm:

So far, most cryptocurrency industry investment methods are very much like narrative-centric long-term call options (for example, a common encryption industry narrative is: Bitcoin will become digital gold), and some venture capital firms are investing on the first layer. Investing is based on this style and gets a disproportionate amount of attention and funding.

However, a new class of crypto-assets is emerging, especially in the DeFi space, and venture capital firms can not only value these projects using traditional valuation techniques (such as discounted cash flow), but also according to predefined codes. Cryptoeconomics and on-chain activity value certain tokens, so you'll find many crypto businesses with high growth and profitability potential. If I told you: Protocol A is growing +100% YoY, EBITDA/Free Cash Flow margin is 80%, Dividend remains healthy and P/E is 40x, then you might think that relative to public or private market peers, this Crypto projects are vastly undervalued. Firms like ParaFi are taking a fundamental analysis approach to valuing crypto assets, they argue. Not all cryptoassets are created equal, but historically, cryptoassets are highly correlated, so as the crypto market matures, investors should pay more attention to the fundamentals.

5. Spencer Noon, from venture capital firm DTC Capital:

At this stage, the funding landscape for crypto startups has never been healthier, and lately you’ve seen big crypto funds like a16z Crypto, Paradigm, and Polychain popping up in the industry. Each crypto fund has an experienced investment team and manages hundreds of millions of dollars, which means they are able to raise a lot of money on their own. This trend will have a major impact on the funding environment of the encryption industry, and will promote the healthy development of Series A and subsequent financing rounds. But on the other hand, the current scale of the encryption industry may not be able to make quick profits for venture capital funds. As the scale of large traditional investment funds continues to grow, they will spend less and less time on early-stage investments. On the contrary, we will gradually see more professional funds in the encryption industry, especially some encryption funds investing in the seed round stage.

secondary title

Summarize

Summarize

Fundraising activity in the crypto industry has changed a lot over the past 18 months. You’ll see a number of smaller pre-launch rounds and more focused investment strategies emerging, which is a sign that the crypto investment environment is becoming healthier. On the other hand, if more and more traditional VC firms shun the crypto industry, then only a few crypto funds are capable of leading larger late-stage rounds, which could lead to late-stage capital crunch for the crypto industry. risk.