March is destined to be an unforgettable month for the cryptocurrency industry. On March 11, the World Health Organization declared the outbreak of the novel coronavirus a global pandemic. The virus has changed the way societies around the world operate, and the knock-on effects on the economy led to an unprecedented sharp drop in the crypto market on March 12, which inevitably had an impact on the Maker system. It is gratifying that the Maker protocol and the community have withstood this test. This crisis has brought severe challenges to Maker and the entire DeFi ecosystem, and it has also opened the door to many new opportunities.

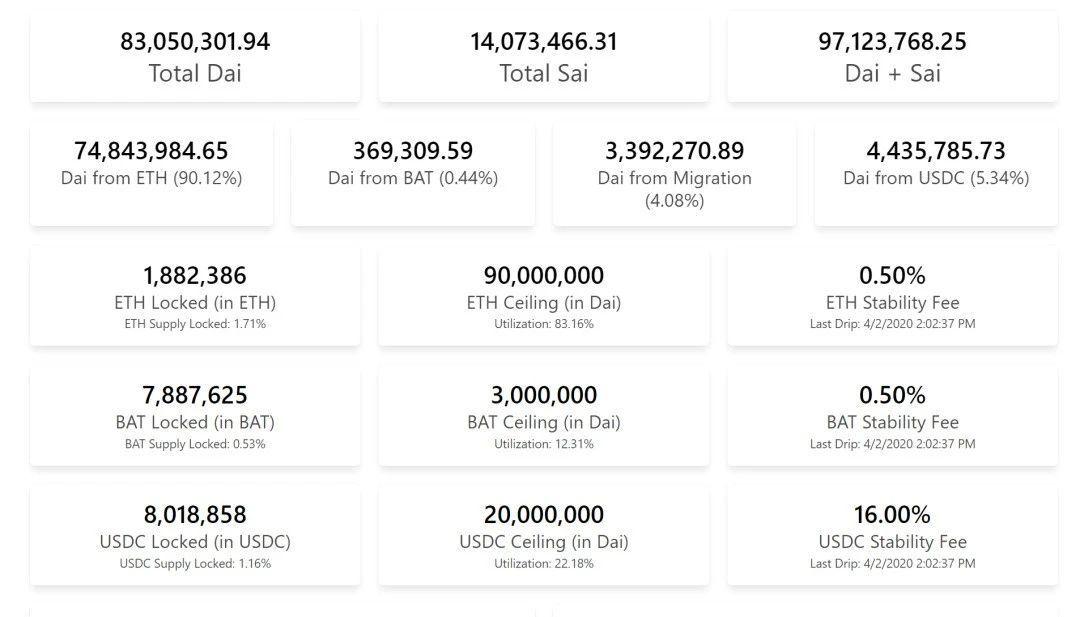

Before we get into the details, let’s take a look at the latest data on Multi-Collateral Dai:

Total Dai: 83.05 million

The total amount of mortgaged ETH to borrow Dai: 74.84 million (90.12%)

The total amount of mortgaged BAT borrowed Dai: 36.93 million (0.44%)

Mortgage USDC to borrow Dai amount: 4.43 million (5.34%)

Mortgage ETH to borrow Dai Stable rate: 0.5%

Mortgage BAT to borrow Dai Stable rate: 0.5%

Dai Deposit Rate: 0%

Dai Deposit Rate: 0%

Total Dai in DSR: 24.13 million (29.06%)

image description

Data source: Daistats.com

The impact of the sharp market drop on Maker

The short-term plunge in the cryptocurrency market on March 12 put the Maker protocol and governance to a huge test. The Maker community integrates forces to adjust and manage the system in a completely decentralized manner. Read the related summary report:

Maker Debt Auction

Market conditions on March 12 caused the Maker protocol to accumulate a debt deficit of around $5 million. From March 19th, the Maker agreement began to conduct debt auctions to restructure the system's debts by automatically increasing the issuance of MKR. On March 30, the entire debt deficit was successfully and completely restructured.

Full handover of MKR control

On March 25, the Maker Foundation announced that it has completely transferred the control of MKR to the governance community, which means that the foundation no longer has the control over the issuance and destruction of MKR, and will be 100% managed by smart contracts controlled by MKR holders voting. This is an important step towards making MakerDAO fully decentralized.

Added USDC as a collateral asset

On March 16, MakerDAO passed an executive vote to add the stablecoin USDC as collateral for Dai. USDC is the third collateral type after ETH and BAT. Users can use Oasis.app to open the Maker vault to mortgage USDC to generate Dai.

Multiple asset trading pairs are listed on Oasis Trade

Oasis Trade, a decentralized trading platform owned by Maker, has added WBTC, TUSD, PAX, LINK and Dai trading pairs, further increasing its adoption rate, thereby making it easier to trade between DeFi protocols. Oasis Trade is the earliest decentralized trading platform on Ethereum, which completely matches transactions on the chain without handling fees. 👉 oasis.app/trade.

Dai Game Integration Bounty Program

Thanks to its stable and permission-free features, Dai has received natural popularity in blockchain games. At present, dozens of games have integrated Dai and Maker elements.

On March 10th, Maker launched the Dai game integration bounty program, integrate Dai in your game, and win up to 5,000 Dai developer rewards. Learn more:https://blog.makerdao.com/

The Chinese version of the new white paper is released

The Maker Foundation released the Chinese version of the new white paper (translated by EthFans.org), introducing the Multi-Collateral Dai (MCD) protocol and the update of the Maker system in a simpler and easier-to-understand language. View the interactive version of the official website:https://makerdao.com/zh-CN/whitepaper

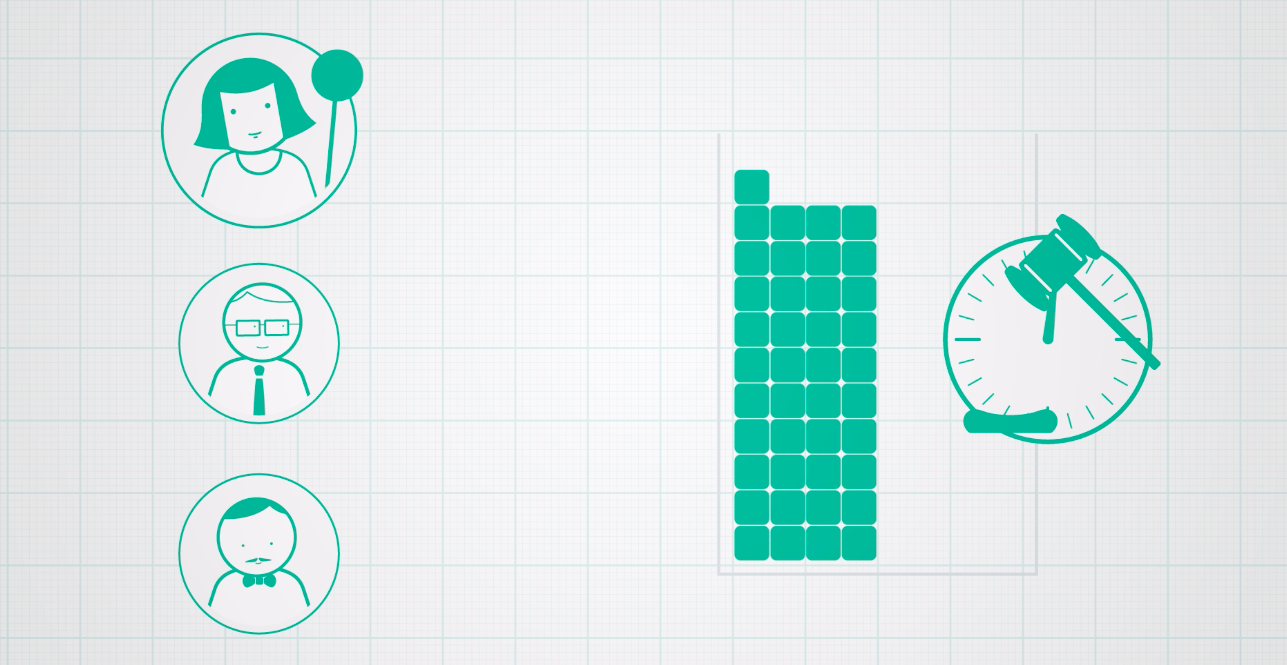

Multi-Collateral Dai Auction Mechanism Tutorial

Through video tutorials, understand the multi-collateral Dai system in a simple way:

"Detailed Explanation of MakerDAO Collateral Auction Mechanism"

governance update

governance update

Voting History:

Voting History:

March 30: Reduce USDC stability fee to 16% (approved)

March 17: Added stable currency USDC as a collateral asset (approved)

March 16: Reduce Dai deposit interest rate to zero, launch auction circuit breaker mechanism (approved)

product integration

product integration

The smart contract wallet MYKEY deeply integrates the Dai deposit interest rate, and users can deposit Dai to earn interest through its "financial management" function with one click.

community activity

community activity

Maker representatives participated in the Ethereum Community Conference (ETHCC3) held in Paris, France from March 3rd to 5th. We partnered with Kyber and Unlock to give attendees a 15% discount on buying tickets in Dai.

Jacek Czarnecki of Maker's European legal team shared the topic: legal issues and practical data of decentralized finance (DeFi).

Watch address:https://youtu.be/X6lc3hvlOHI

Gustav Arentoft, Head of European Commercial at Maker, talks with Centrifuge's Lucas Vogelsang about how DeFi can bring real-world assets on-chain.

Watch address:https://youtu.be/qPkrWjKwi8Q

On March 5th, Charles St. Louis, technical advisor to the Maker Foundation, hosted a roundtable discussion on DAO at DAOfest during French Blockchain Week.

join us

Coming soon

For more recent events of Maker, you can check:

https://makerdao.com/zh-CN/events

join us

To get updates from Maker at any time, please follow our WeChat official account below.

https://makerdao.com/en/careers/listing?gh_jid=4329753002

get updates

To get updates from Maker at any time, please follow our WeChat official account below.