Today, the news that "FTX CEO Sam's Bitfinex account has a floating loss of more than 13 million US dollars" has brought the newly rising FTX exchange to the forefront.

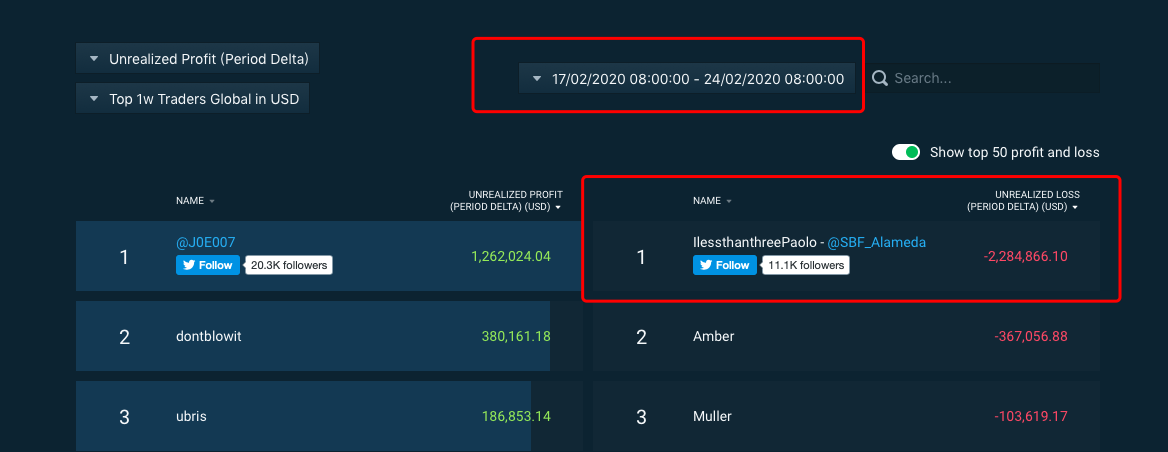

Bitfinex leaderboard data shows that since February 24, the account of Sam Bankman Fried, the CEO of FTX, has had a floating loss of US$13.12 million on Bitfinex. This news has caused many people to question Sam's misappropriation of user assets.

Although later, it was confirmed by the official reply and account inquiry that Sam Bankman Fried’s move was to implement the hedging strategy with personal funds as the founder of Alameda Research, a market maker. He also stated that he has never traded with user assets.

However, this incident still caused heated discussions in the industry. Is it reasonable for the founder of the exchange to end the transaction by himself? Does an exchange that integrates liquidity, matching, economics and other businesses have too much authority?

secondary title

The beginning and end of 13 million book losses

image description

(Screenshot of FTX CEO Sam’s account floating loss)

Zhao Dong, the founder of Renrenbit, posted a screenshot and commented on Weibo: "It is dangerous for the boss of the exchange platform to fry coins by himself. I don't know whether the boss of FTX is using the funds of FTX Exchange customers to speculate coins or his own funds. Bearing such a huge floating loss at Bitfinex..."

Odaily checked the data and found that FTX boss Sam’s account on Bitfinex generated a floating loss of 2.28 million last week (February 17-February 24).

The huge floating loss data caused doubts about FTX in the market. Zhao Dong then asked FTX CEO Sam on Twitter if he had misappropriated the assets of FTX users. , Bitfinex has a significant discount relative to other markets.”

Not long after, Sam tweeted again to explain: One of the best ways to trade in the past month is to take advantage of the spot/futures spread. If you are long spot BTC and short perpetual contracts, you will make a profit of about 0.20% through hedging! Especially by going long (spot) on Bitfinex to hedge against shorting (other exchanges) perpetual contracts.

FTX Exchange also responded quickly, and published an article titled"Hedge Arbitrage Trading Strategy"answer. The article mentioned that in the past month, the futures have greatly premiumd to the spot, so an obvious way to hedge and arbitrage is to short the futures and go long the spot.

According to the announcement, BTC spot on Bitfinex is cheaper than on other exchanges, so it is more cost-effective to do long BTC on Bitfinex:“We are long spot on Bitfinex, and then short futures on other exchanges, with an average daily arbitrage of 20 basis points from the funding rate.”

The announcement further explained that when the market rises, it realizes profits through the spot funding rate; when the market falls, it realizes profits through the futures funding rate.

It is not difficult to see that the core idea of the announcement is: no matter whether the market is going up or down, the spot/futures spread strategy used by FTX is profitable.

"The floating loss is only 12 million. Before the exchange was opened, 3 of the top 10 profitable accounts on BitMex belonged to Sam's boss." Some netizens commented this way.

secondary title

Newcomers to Derivatives Trading

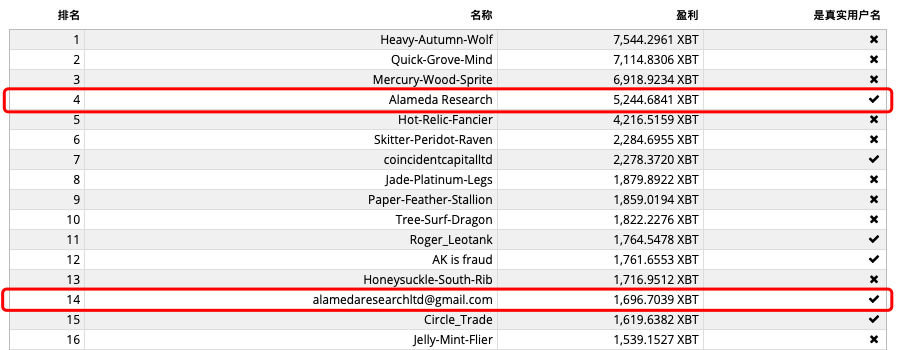

In fact, after the departure of Jane Street, the most mysterious trading company on Wall Street, Sam founded Alameda Research, a secondary market quantification company, which later became one of the largest liquidity providers and market makers in the digital currency market. To provide liquidity, the founding team of FTX is also from the Alameda Research team.

The Alameda Research team once undertook the selling pressure of nearly 10,000 BTC for the Binance team in a short period of time. The founder of Binance, CZ, also publicly praised his contribution to the depth of the Binance spot market. Ranked on the BitMex Profit Ranking List, there are rumors in the industry that its daily trading volume was as high as 600 to 1 billion US dollars, and some data have conservatively estimated that the team's profit in the entire cryptocurrency market exceeded 10,000 BTC.

After the establishment of the FTX derivatives exchange, Alameda Research under Sam also became a market maker for FTX. In addition to a wide range of derivatives, after cooperating with the Alameda team, FTX avoided the liquidity problems of small exchanges at the beginning of its birth. Of course, this has also become the biggest selling point of FTX - providing a higher trading depth than other exchanges.

After receiving investment from Binance in December last year, the popularity of FTX accelerated even more. In February of this year, amidst the positive trading sentiment, FTX set a new record. The average daily trading volume in February increased by 55.8% compared with January.

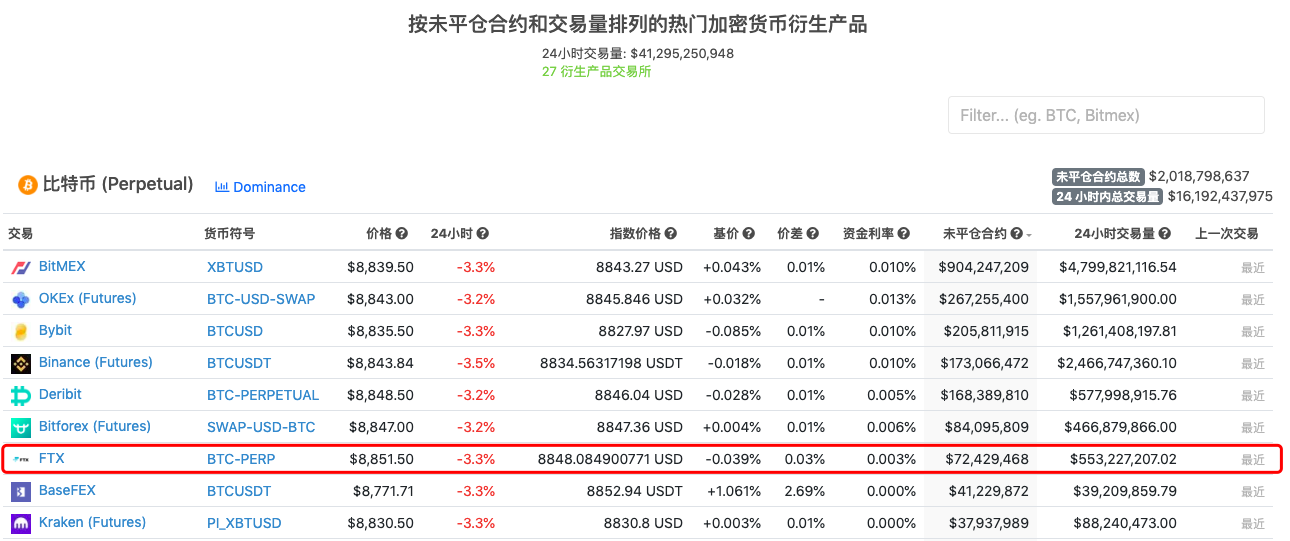

Odaily consulted CoinGecko data and found that among the popular derivatives exchanges ranked according to the current open interest and trading volume, FTX ranked seventh on the entire network with 72.42 million open interest.

In a financing document, FTX also expects to achieve a net profit of US$40 million in 2020, and is expected to achieve performance growth at a rate of three times its net profit every year in the next three years.

In a financing document, FTX also expects to achieve a net profit of US$40 million in 2020, and is expected to achieve performance growth at a rate of three times its net profit every year in the next three years.

secondary title

Pros: Cross-platform arbitrage hedging by market makers is fine; Cons: One person plays multiple roles, the risk factor is too high

Although the data mentioned above by Sam responded to the source of its huge floating losses, it did not answer the market's doubts about the exchange's next competition.

Today, the evaluation of the FTX event in the circle is basically divided into two types.

"Any exchange that gambles in person must be careful." After the incident, someone gave such an evaluation.

As Zhao Dong said, nowadays, the owner of the exchange platform has become a "dangerous" thing in the hearts of users. Since the beginning of the year, the crisis of the exchange’s inability to cash has caused panic in the market. Now that FTX’s books are floating and losing money, some people questioned that since FTX is already a referee, it should not leave the competition.

Xu Kun, vice president of strategy at OKEx, also gave a similar view on Zhao Dong’s Weibo: “In traditional markets, practitioners may have conflicts of interest with their own businesses when participating in transactions, and may also have access to information that affects securities prices in advance. , so they are prohibited from participating in the transaction.”

In the view of Zhengfang, who supports FTX, it is impossible for the Alameda account to only play one side, and the operation method of cross-platform arbitrage and hedging by market makers is "no problem".

Michael, the founder of a mainstream exchange, believes that based on a safe strategy, FTX must not hold a large number of open positions in terms of liquidity supply.

He said that in order to provide liquidity for FTX, Alameda will definitely hedge across exchanges: "Assuming that Alameda is the main market maker of FTX contracts, if all FTX users are long, then their market maker positions in FTX are all Short positions, so they have to go to other markets to open long positions of the same amount. If they don’t go to other markets to hedge, he will really bet against users.”

In fact, among the voices of opponents, people are criticizing the issue of fairness-how can exchanges have all the data, how can they make transactions? Moreover, FTX Exchange is divided into multiple roles, and several businesses such as liquidity, matching, and brokerage are not separated.

Some exchange practitioners directly questioned Odaily: "Look at what orders are placed by users, other large institutions, and large customers, and then go to other exchanges to trade on their own. This is really bad. Maybe it will be in the short term. Make some money, but it will hurt users and the industry even more in the long run. People will not trust this industry. In the end, no one will come to play in this industry, and all practitioners will be over?"

According to Michael’s analysis, in fact, large exchanges, especially contract exchanges, need to cooperate with large liquidity providers, but FTX may (let) Alameda do it by itself, and Alameda should have most of Sam’s private funds.

Indeed, in traditional markets, cross-market arbitrage and hedging are routine operations for liquidity services. However, the difference between the currency circle and the traditional financial circle is that the supervision of traditional targets is relatively complete. For example, foreign exchange trading platforms are set up by region, and the trading platforms follow local laws and regulations. Retail investors use service platforms provided by brokers. Transparent.

Xu Kun further analyzed that in traditional investment banks and securities firms, there are generally strict firewall measures and internal control mechanisms between proprietary trading and trading services for customers, and supervision will also be reviewed from time to time. Although FTX emphasizes its strict internal division of labor, and the company and customer accounts are separated, the prevention and control scope of the firewall design is far beyond the division of funds, but also includes whether customer transaction data is shared, and insider transaction guidelines.

"A huge floating loss in a certain account of the person in charge of the exchange will not only have an impact on the market, but also have a negative impression on the credibility and neutrality of the platform." Xu Kun said that the liquidity of OKEx is mainly provided by cooperation The market maker plan includes access standards, market making requirements and relevant preferential policies, etc., which are also open and transparent.

Even in the currency circle, large exchanges generally use cooperative third-party liquidity providers. They did not know each other's strategies or exchange data before. This is still a complete chain. However, the newly-emerging FTX obviously chose "to do it yourself if you have the ability".

An industry insider added to Odaily: If one day, his positions in other places are blown out and he needs to keep replenishing his positions, even if he doesn’t use the user’s funds now, will he not use them in the future? Who is watching? After all, we cannot see the internal transfers of the exchange.

In the final analysis, the discussion falls on the lack of perfect supervision links in the currency circle, and it is in an endless loop that cannot be compared with traditional finance.

There is no evidence on how the off-chain exchanges manage user assets. Perhaps the CEO of FTX is good at trading, and users have nothing to do with it. However, in the absence of supervision, exchanges should be more self-disciplined, fair, and transparent.

In the short term, using third-party cooperative liquidity providers who do not know each other's strategies is a promising solution. At least for the current currency circle, the hand of supervision has been missing, and the invisible hand of the market can no longer be lost.