Odaily Planet Daily reports that Hong Kong-listed Hong Kong and China Gas Company Limited has announced it has secured a HK$100 million credit line from Chong Hing Bank to complete its RWA tokenization project. The project is reportedly powered by Ant Financial's Jovay Layer2 blockchain, and key financial and operational data will be uploaded to the blockchain in real time. (Aastocks)

According to Odaily Planet Daily, CertiK's "2025 Skynet Digital Asset Treasury Report" outlines global regulatory developments: the implementation of the US "CLARITY Act" and the EU's MiCA Act is driving the industry into an "era of high-certainty regulation," and small and medium-sized institutions with insufficient compliance capabilities will face the risk of being eliminated.

The report points out that the future composition of DAT assets will extend from cryptocurrencies to tokenized real-world assets (RWA) and central bank digital currencies (CBDCs). Furthermore, AI-driven compliance monitoring will become the industry standard. As regulation becomes more certain, companies with sound governance and strong compliance awareness will have a greater market advantage. The report believes that security and compliance will continue to determine long-term company valuations, driving the DAT market into a new phase of "operational robustness."

According to a Hong Kong Stock Exchange announcement on November 2nd, Lion Capital Holdings, a Hong Kong-listed company, announced that it will issue mortgage-backed convertible bonds maturing in 2026 to raise approximately HK$273 million (US$35 million). It has already signed an agreement with asset management company LMR Partners to subscribe to the relevant bonds. The final net proceeds are expected to be approximately US$33,565,000 (approximately HK$260,800,000), which will be used to support the development of its digital finance and real-world asset (RWA) tokenization framework.

According to a recent report by Odaily, Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered Bank, predicts that the total market capitalization of tokenized real-world assets (RWAs), excluding stablecoins, will surge from approximately $35 billion currently to $2 trillion by the end of 2028, an increase of about 56 times. He expects "most of the on-chain activity" to occur on Ethereum due to its long-term stability and network effects. The report points out that the adoption of stablecoins paves the way for the on-chaining of other asset classes, including money market funds (MMFs) and stocks.

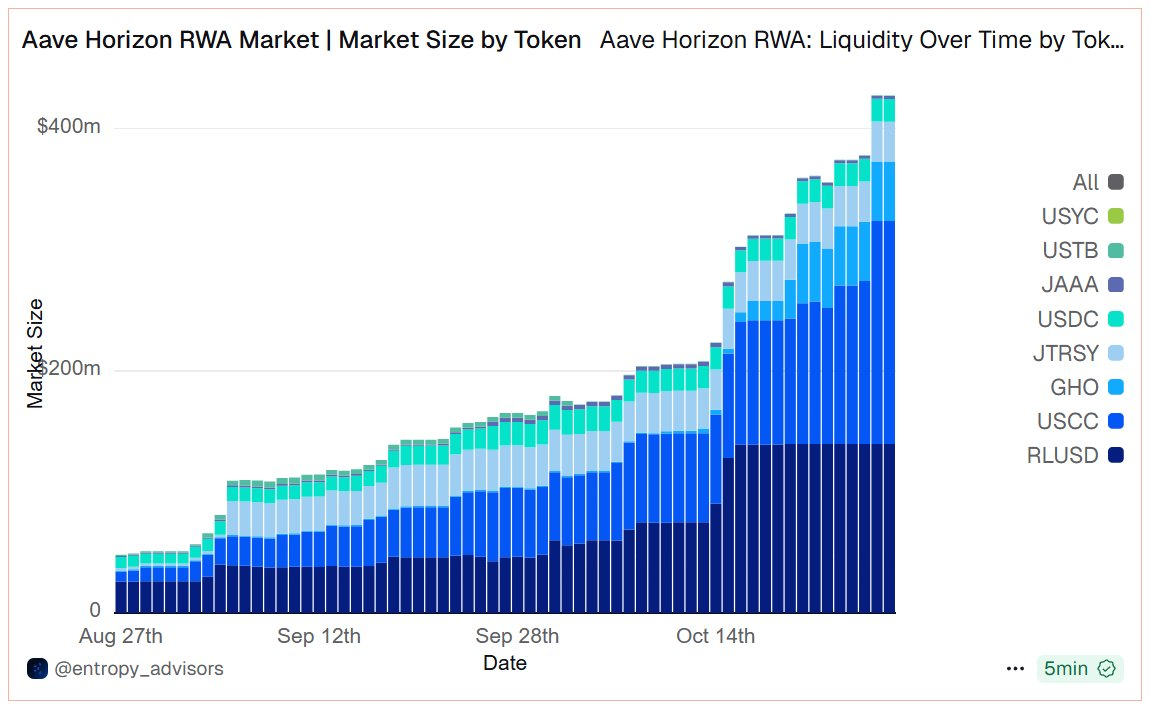

According to Odaily Planet Daily, on-chain analyst Ali stated in an article published on the X platform that the Aave Horizon RWA market size has exceeded $425 million. Recent growth has primarily come from Superstate Inc.'s Crypto Carry Fund (USCC), whose market size has expanded to over $180 million.

Lending activity in this market has exceeded $110 million, with $64 million borrowed in RLUSD, $29 million in GHO, and $16 million in USDC. To attract capital, RLUSD has kept its borrowing rate below 3%, while GHO and USDC rates are slightly above 4%, with USDC rates also boosted by additional incentives on Merkl.