ARK Invest: Stablecoins, the Cornerstone of the Next-Generation Monetary System?

- Core Viewpoint: Through historical comparison, this article elaborates on stablecoins as a modern revival of privately issued currency. Their emergence stems from market demand for efficient cross-border payments. Currently, in emerging markets, they have become crucial tools for value storage and payment. Furthermore, under the framework of the U.S. GENIUS Act, they may build a more efficient and stable new model of free banking through technological transparency and high-quality reserve assets.

- Key Elements:

- Historical Origins and Legitimacy: Stablecoins are viewed as a modern version of private money from the U.S. "Free Banking" era prior to 1913, with their legal status strengthened by the GENIUS Act.

- Genesis and Early Development: USDT was born in 2014 to solve the arbitrage challenge of slow and costly USD transfers between global Bitcoin exchanges. It later became the dominant stablecoin through multi-chain expansion.

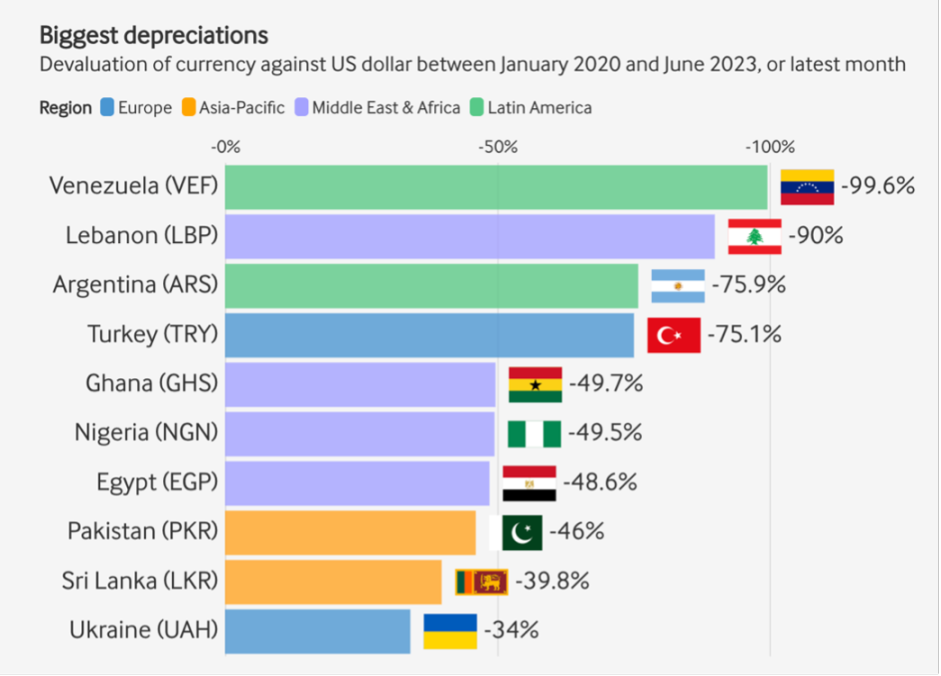

- Driven by Emerging Market Demand: From 2020 to 2023, in high-inflation countries like Venezuela and Argentina, USDT transitioned from a speculative tool to a core means for the public to preserve value, save, and make payments.

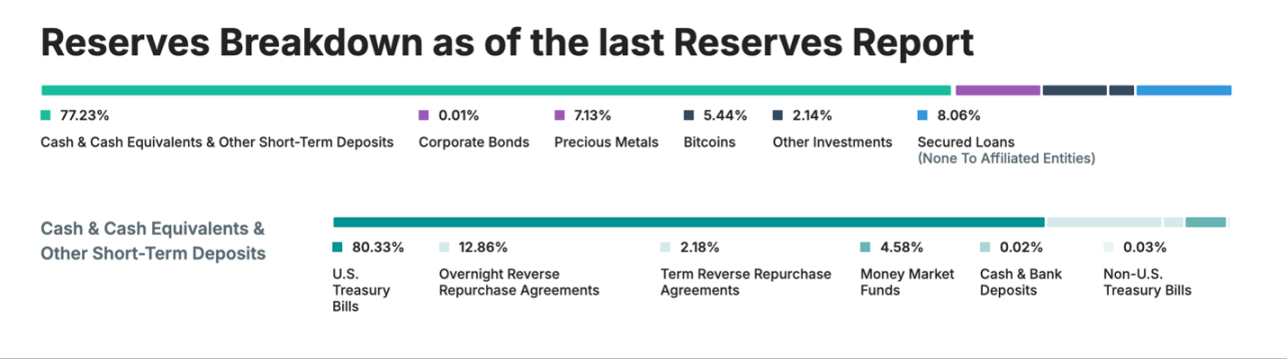

- Current Scale and Structure: As of the end of 2025, USDT's supply reached $187 billion, accounting for 60% of the market. Its reserve assets primarily consist of U.S. short-term Treasury bills, held in custody and audited by independent institutions.

- Technology Addressing Historical Flaws: Compared to 19th-century "wildcat banking," modern stablecoins effectively reduce fraud and redemption risks through blockchain transparency, high-quality reserves, and global liquidity markets.

- Future Development Directions: These include serving commodity settlement, launching new products targeting developed markets (e.g., USAT), and exploring new stablecoin models pegged to commodity indices or backed by Bitcoin/gold.

Original Author: Lorenzo Valente, Director of Digital Asset Research at ARK Invest

Original Compilation: Chopper, Foresight News

In 2025, the supply, trading volume, and number of active users of stablecoins all reached historic highs, driven by the enactment of the GENIUS Act, which legalized the status of stablecoins as privately issued digital currencies.

The views in this article stem from an interview on the Bitcoin Brainstorm podcast by ARK Invest, featuring guests Paolo Ardoino, CEO of Tether; renowned economist Dr. Arthur Laffer; and Cathie Wood, CEO and CIO of ARK Invest. In the discussion, we explored the similarities between stablecoins and privately issued money before 1913 (the year the U.S. government designated the Federal Reserve as the sole issuer of U.S. dollars). Arthur Laffer compared the current explosive growth of blockchain-based private dollars to the monetary system before the Fed ended the era of "free banking."

While the underlying technological infrastructure of stablecoins is new, privately issued money is not a novel concept. In fact, private money was a foundational element in the establishment of the U.S. economy.

Against this backdrop, this article will address three core questions: How did stablecoins come into being? What is the underlying technology of stablecoins? What is the future trajectory for stablecoin development?

How Did Stablecoins Come into Being?

In 2014, Giancarlo Devasini launched USDT and the Tether platform, at a time when the digital asset industry was still in its infancy. The crypto ecosystem was in its "wild west" era, characterized by a lack of regulation, security concerns, fragile infrastructure, and a global trading market dominated by a handful of exchanges like Kraken, Bitfinex, Coinbase, Poloniex, and Bitstamp. The bankruptcy of Mt. Gox, then the world's largest Bitcoin exchange, in February 2014 further highlighted the industry's fragility.

At that time, other exchanges were located in different jurisdictions and primarily traded the only mainstream token of the era—Bitcoin. Although Bitcoin trading had become globalized, arbitrageurs seeking to profit from price differences across exchanges faced significant challenges in moving U.S. dollars quickly and cheaply between banks, brokers, and countries to capitalize on these opportunities. For instance, if Bitcoin was priced at $115 on Kraken and $112 on Bitfinex, an arbitrageur would ideally sell Bitcoin on Kraken, transfer the dollars to Bitfinex, and buy back Bitcoin at $112. However, in practice, such fund transfers often took one to two days.

It was the efforts of Giancarlo and Paolo that made USDT the solution to this problem, enabling the internet-speed transfer of a dollar equivalent. Initially launched in July 2014 under the name "Realcoin," USDT was built on the Omni Layer protocol atop the Bitcoin network, predating the emergence of smart contract chains like Ethereum. In November 2014, the project was officially rebranded as Tether and introduced three tokens pegged to fiat currencies: USDT (pegged to the U.S. dollar), EURT (pegged to the euro), and JPYT (pegged to the Japanese yen).

In 2015, Bitfinex, one of the world's leading exchanges, began supporting USDT and established the first deep liquidity pool. From 2017 to 2019, Tether expanded USDT's issuance network from Omni to Ethereum, and later to public chains like Tron, Solana, and Avalanche, while continuously improving transaction speed, reducing fees, and enhancing cross-chain interoperability. In 2019, USDT became the most traded crypto asset globally, with daily transaction volume even surpassing that of Bitcoin. By the end of 2019, when competitors claimed their stablecoins were backed 100% by cash or cash equivalents, Tether first disclosed that its reserve assets included commercial paper rated A1 and A2, and announced plans to gradually shift reserves towards U.S. Treasury bills and cash.

The COVID-19 pandemic propelled USDT into a period of rapid growth. Over the two years from 2020 to March 2022, as the global financial system came under immense pressure, USDT's supply surged 25-fold from $3.3 billion to $80 billion, driven primarily by emerging markets. USDT's core use case evolved from being a tool for speculation and arbitrage in crypto markets to a "lifeline" for hedging against local currency depreciation.

From 2020 to 2023, as local currencies in emerging market countries like Venezuela, Lebanon, and Argentina depreciated sharply against the U.S. dollar, their citizens increasingly turned to USDT to preserve asset value. For many, USDT served as a savings account, payment tool, and store of value. As countries restricted offline transactions and access to black-market dollars diminished, younger generations began teaching their parents and grandparents how to use this "digital dollar." People could now hold dollar-denominated assets via USDT from home—a faster, more secure, and scalable method that didn't rely on fragile banking systems or highly volatile local currencies.

Depreciation of some national currencies relative to the U.S. dollar. Data source: rwa.xyz, as of December 31, 2025

What is the Current State of Stablecoin Development?

Currently, Tether's issued USDT supply stands at $187 billion, commanding a 60% market share, making it the largest stablecoin in the digital asset industry. Its only significant competitor is Circle's USDC, with a supply of $75 billion. USDT has over 450 million global users, adding approximately 30 million new users per quarter. Tether is headquartered in El Salvador and regulated there, with its reserve assets custodied by Cantor Fitzgerald.

The U.S. government has taken strategic notice of Tether. The vast majority of Tether's balance sheet consists of U.S. Treasury bills, with holdings comparable to some developed nations, making it one of the largest and fastest-growing sources of demand for U.S. Treasury debt.

Tether's reserve assets. Data source: Tether, as of December 31, 2025

As of January 2026, Tether's reserve assets, excluding corporate bonds, gold, Bitcoin, and secured loans, include overcollateralized assets exceeding $5 billion, far surpassing the total liabilities of USDT in circulation. With stablecoin supply continuing to grow, Tether's dominance in emerging markets solidifying, and the GENIUS Act enacted, some observers note striking parallels between the current banking landscape and the Free Banking Era of the late 19th century—a period critics often cite when discussing the risks of privately issued money.

In the interview, Dr. Arthur Laffer argued that stablecoins will introduce a new, more efficient form of free banking to the United States, and that negative perceptions are unfounded. Critics claim that private entities like Tether and Circle issuing stablecoins could recreate the chaos of 19th-century "wildcat banking." Dr. Laffer explained that 19th-century private banknotes often traded at a discount because users had to assess the creditworthiness of the issuing institution themselves, and the U.S. government did not guarantee these notes. They were essentially liabilities of individual banks, redeemable for hard currency like gold or silver only if the issuing bank remained solvent. Both Dr. Laffer and Brian Domitrovic, a historian at the Laffer Center, pointed out that before the U.S. federal government established the Federal Reserve in 1913, various forms of money competed domestically.

Dr. Laffer further elaborated that in 1834, the U.S. government set the price of gold at $20.67 per ounce, establishing a gold standard, but did not guarantee the redemption of every banknote in circulation. The redeemability of a banknote depended entirely on the issuing bank's balance sheet and market reputation. This mechanism violated the principle of "unconditional payment." Despite this, prices remained remarkably stable over the long term: from 1776 to 1913, the year the Fed was created—a span of 137 years—cumulative inflation in the U.S. was 0%, with prices fluctuating slightly around a fixed par value without long-term upward or downward trends.

Some free banking systems outside the U.S. performed even better, notably Scotland (1716-1845) and Canada (1817-1914). These systems achieved low inflation and extremely low bank failure rates, with their banknotes circulating essentially at par. Part of this success was due to the establishment of competitive redemption mechanisms and clearinghouse systems, both of which imposed market discipline on banks. In contrast, in the United States (1837-1861), restrictive state regulations hindered development, such as prohibiting branch banking and requiring banks to hold risky state government bonds as collateral. After a period of turbulence in the early 1840s, the average discount rate for "broken bank notes" (currency from failed banks) in the U.S. fell below 2%. Interestingly, this figure matches the Fed's current inflation target. During this period, the U.S. economy experienced strong growth, laying the financial groundwork for the full-scale industrial revolution following the Civil War in 1865.

Stablecoins share many similarities with the currency of that era. Both are privately issued liabilities backed by reserve assets. However, modern technology and regulatory oversight have addressed many of the flaws of the "wildcat banking" era. Stablecoins are not constrained by branch banking rules because they are inherently global and digital. Today, functions similar to clearinghouses exist in the form of highly liquid secondary markets, exchanges, and arbitrage mechanisms that ensure stablecoins maintain their peg to market prices. Compared to the illiquid state bonds held by U.S. free banks in the late 19th century, the collateral quality for regulated issuers (like cash and Treasury bills under the GENIUS framework) and some unregulated issuers (like Tether) is significantly higher. Fraud risk for large issuers is also greatly reduced due to regular audits, on-chain transparency, and federal regulation.

Just as free banking systems arose where central banking was weak or non-existent, stablecoins have emerged to fill a void left by inefficient, heavily regulated, and costly banking and payment systems. In the 18th and 19th centuries, railroads, telegraphs, and advanced printing technology propelled free banking. Today, blockchain and global internet infrastructure are the core drivers of stablecoin development.

The U.S. Free Banking Era ended with the Civil War and the National Banking Acts, which federalized control over currency issuance. The U.S. suspended the gold standard early in the Civil War. During the war (1861-1865), states required banks to hold state bonds as reserve assets, creating demand for those bonds. Simultaneously, the U.S. government imposed a tax on all bank-issued currency not backed by high-quality federal bonds, ultimately forcing free bank notes out of circulation. The U.S. returned to the gold standard in 1879, and the 1870s and 1880s became one of the fastest-growing periods in U.S. history.

With the U.S. economy growing far faster than the government, the requirement for note issuers to hold substantial federal bonds as reserves became nonsensical. As the supply of federal bonds couldn't meet reserve requirements, banks were forced to frequently contract their note issuance, leading to deflation and bank panics. Ultimately, Congress passed the Federal Reserve Act in 1913, nationalizing the reserve system and creating the Federal Reserve.

Before 1913, during bank panics, private clearinghouse systems and interbank scrip agreements could provide significant liquidity. However, federal regulation that tied note issuance to federal bond reserves constrained the money supply. After the Fed's creation in 1913, the U.S. began experiencing persistent inflation: the Consumer Price Index has soared over 30-fold. In stark contrast, during the century before the Fed's establishment, under a gold standard, bimetallism, and competitive currency issuance, cumulative U.S. inflation was 0%, even as the Industrial Revolution took full hold.

The Future Direction of Stablecoins

Stablecoin issuers like Tether and Circle cannot actively issue or redeem tokens to maintain the peg. Only whitelisted institutions that comply with Anti-Money Laundering/Customer Identification Program (AML/CIP) requirements can mint new USDT by depositing cash or redeem tokens by returning them to Tether. The peg is maintained by institutional arbitrage mechanisms, while Tether and Circle promise that every USDT and USDC in circulation is redeemable for $1.

Dr. Laffer believes this model holds significant value in emerging markets and high-inflation economies. However, for widespread adoption in developed nations, a more advanced stablecoin model is needed: one that maintains its peg to the dollar but also appreciates in sync with inflation, thereby preserving purchasing power for goods and services.

Based on the recently enacted GENIUS Act, Tether co-founder Paolo Ardoino believes any stablecoin that distributes yield directly to users should be classified as a security and regulated by the U.S. Securities and Exchange Commission (SEC). Currently, interest-bearing "tokenized money market funds" are only available to accredited investors. Dr. Laffer, however, envisions future stablecoins pegged to a basket of goods and services indices and backed by reserves of long-term assets like Bitcoin and gold.

Indeed, Tether has already launched gold-backed stablecoin Alloy (AUSDT) and tokenized gold product XAUT. As Ardoino stated, this structure allows users to trade using these value-stable instruments while maintaining long positions in assets like Bitcoin and gold; as the collateral assets appreciate, users' borrowing capacity increases.

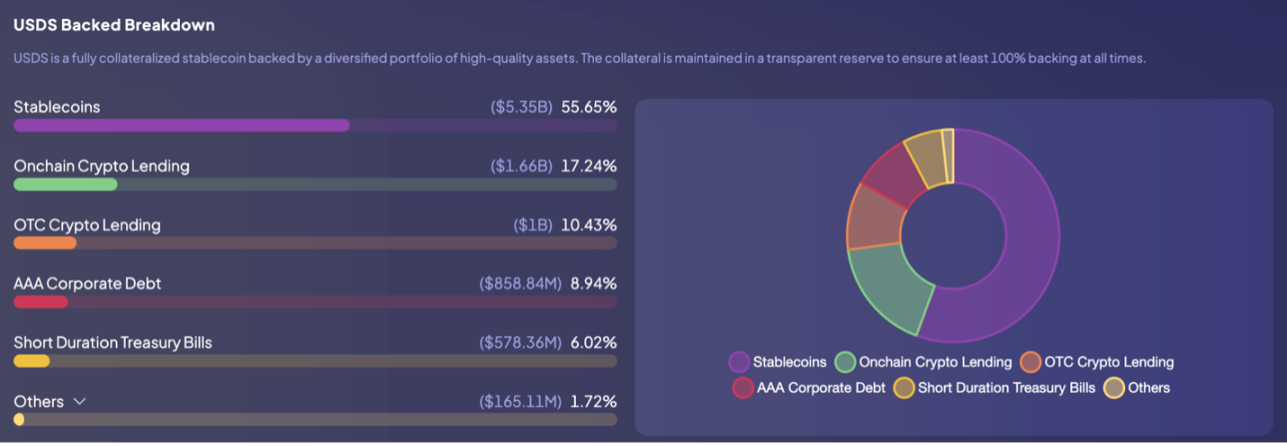

It's worth noting that this model is not new to the crypto space. One of the earliest and most resilient experiments in decentralized finance (DeFi)—the Sky protocol (formerly MakerDAO)—pioneered the concept of crypto-collateralized stablecoins. Sky, a decentralized bank, issues the dollar-pegged stablecoin USDS. Users can deposit assets like Ethereum into smart contracts to borrow USDS. To ensure solvency, all loans are overcollateralized, with automatic liquidation triggered if collateral value falls below a safety threshold. Currently, USDS is introducing a diversified collateral portfolio to minimize risk while maximizing efficiency and yield.

Composition of collateral backing USDS

To further stabilize the peg, Sky introduced the Peg Stability Module (PSM), enabling direct swaps between USDC and USDS. Arbitrageurs can use this module to keep USDS's price near $1, while also providing liquidity and redeemability for the stablecoin, compensating for the price volatility of crypto collateral. Beyond its transactional function, Sky also offers a savings mechanism through the interest-bearing token sUSDS, whose yield is derived from interest paid by borrowers, tokenized money market funds, U.S. Treasury bills, and DeFi investment returns. In other words, USDS serves as both a medium of exchange and a global savings tool.

Following the GENIUS Act, many observers are watching how Tether will enter the U.S. market. In Ardoino's view, one of the fastest-growing use cases for stablecoins is the settlement of commodity trades. An increasing number of commodity traders recognize stablecoins as the most efficient settlement tool. In 2025, Tether began providing settlement services for oil trades, driving a significant surge in global commodity market demand for USDT.

Ardoino stated that if a stablecoin is not integrated into the local economy, it typically serves only as a temporary settlement layer, eventually being converted back to local currency. However, in emerging markets with unstable local currencies, USDT functions not only as a payment tool but also as a savings and store of value, allowing it to circulate and be widely used locally.

Tether understands that the U.S., Latin America, and Africa are distinct markets. In developed nations, people can access electronic dollars through platforms like Venmo, Cash App, and Zelle. In the coming months, Tether plans to launch a new stablecoin, USAT, specifically designed for developed markets in the United States. The entry of the world's largest stablecoin issuer into the world's largest financial market is a development worth close attention.