$55,000 Will Be Bitcoin's Make-or-Break Line

- Core View: Based on mathematical model analysis, the article points out that Bitcoin's current cycle top gain (estimated at approximately 1.8x) has been severely compressed. If the price falls below the key support level (e.g., $55,000), it would signal a risk of structural failure for its classic four-year growth cycle model.

- Key Elements:

- Historical data shows a continuous decline in Bitcoin's cycle top gain multiples: from 15.9x (2013-2017) down to 3.5x (2017-2021), with the current cycle projected at only about 1.8x, indicating an extremely narrow upside potential.

- Mathematical model calculations indicate that with the current 1.8x gain, to maintain a bull market structure, the maximum allowable drawdown is approximately 44%. Bitcoin's drawdown from around $126,000 to $60,000 has already breached this critical threshold.

- The $55,000 level is a critical make-or-break line. Sustained trading below this price would imply that the cycle bottom could be significantly lower than the previous all-time high of $69,000, potentially leading to a stagnation of long-term growth momentum.

- The market may evolve along three potential paths: volatility contraction (glory), failure of the cycle framework (destruction), or the emergence of new demand drivers (such as sovereign nation adoption) to reset the growth curve.

- The core contradiction at present is: Bitcoin's potential for gains has been significantly compressed, yet its volatility has not decreased correspondingly. This high-risk, low-potential-return model is unsustainable.

Original Author: Dom

Original Compilation: Luffy, Foresight News

Bitcoin's price touched $60,000 last week. Under the model of diminishing returns, this is by no means simple noise. The market is touching the most fragile link in the entire four-year cycle and the logarithmic growth framework.

When the gains at the peak of Bitcoin's cycle have been significantly compressed, if a historically deep correction occurs again, the appeal of its classic cycle will be completely invalidated.

This is not a prediction; it's a mathematical law.

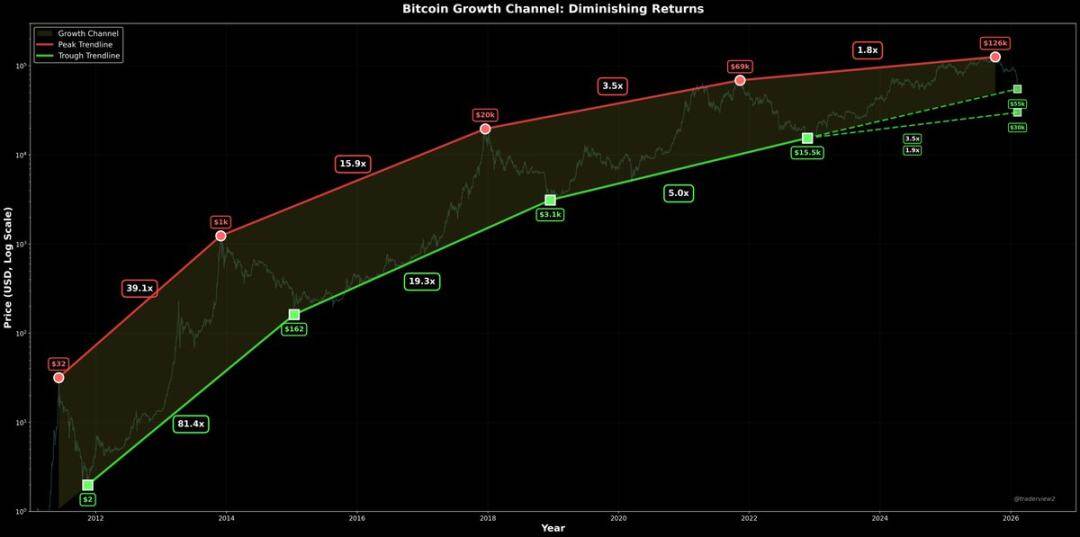

Cycle Peak Gains Are Compressing

Historical peaks of Bitcoin cycles:

- 2013: ~$1,242

- 2017: ~$19,700

- 2021: ~$69,000

- 2025: ~$126,000

Multiples of gains between cycle peaks:

- 1,242 → 19,700 = 15.9x

- 19,700 → 69,000 = 3.5x

- 69,000 → 126,000 = 1.8x (weakest in history)

This 1.8x multiple says it all. Compared to history, the upside potential in this cycle is minimal. This pattern cannot withstand a significant drop; otherwise, Bitcoin's growth will completely flatten.

This 1.8x gain is the core truth of the current market. Relative to historical levels, Bitcoin's upside potential is now extremely narrow. This cycle pattern can no longer bear a major pullback; otherwise, Bitcoin's long-term growth momentum will completely stagnate.

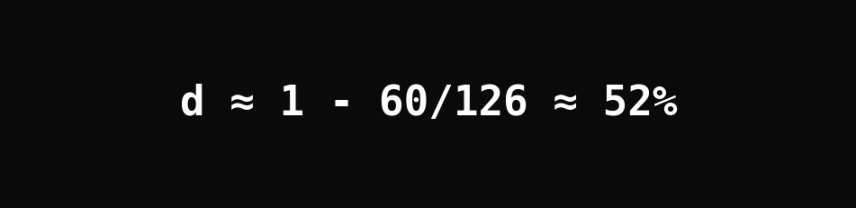

Pure Mathematical Constraint Formula

Definitions:

- m = Cycle peak multiple = Current cycle peak ÷ Previous all-time high

- d = Pullback ratio from the peak (in decimal form)

Then, the relative level of the next cycle's bottom equals the current peak gain multiple multiplied by the remaining price ratio after the pullback.

To ensure the next cycle's bottom does not fall below the previous all-time high, the following condition must be met:

Plugging in current cycle data: Previous ATH ≈ $69,000, Current cycle peak ≈ $126,000, we get:

Current peak multiple ≈ 1.8x. To maintain an intact bull market structure, the maximum allowable pullback is about 44%. Currently, Bitcoin's pullback has already breached this critical threshold.

From around $126,000 to $60,000, Bitcoin's pullback has exceeded the 44% "safety limit" mentioned above.

This means that if the previous all-time high was supposed to act as a structural bottom support, the current market is forcibly breaking through this support, forcing the market to deliver a final verdict.

$55,000 is the Critical Life-and-Death Line

If Bitcoin falls to $55,000, two key signals will emerge:

- Pullback magnitude reaches 56%, far exceeding the 44% allowable limit.

- The bottom price will be 20% lower than the previous all-time high ($69,000).

Once the price remains below $55,000, it means the market accepts that in this weak cycle with only a 1.8x gain, the cycle bottom can be significantly lower than the previous all-time high.

The subsequent impact will be: If the next cycle still maintains a 1.8x gain multiple, Bitcoin's price will rise from $55,000 to $99,000, and long-term growth momentum will stagnate. This is essentially a structural failure of the growth model; the market must change.

This is the core contradiction: Bitcoin's profit potential has been greatly compressed, but volatility has not decreased proportionally. It's still a highly volatile market, yet peak gains have shrunk drastically. Such a cycle model is simply unsustainable.

Technical Support Around $55,000

From a technical perspective, the mid-$55,000 range possesses extremely strong structural support, mainly including:

- 3000-day trendline (spanning over 8 years)

- Volume-Weighted Average Price (VWAP) of the 2022 cycle low

- Support extension from the previous cycle's all-time high ($69,000)

Let's ponder: Why would an asset whose core belief is "long-term ultra-high returns" break below this triple-layered structural support built up over years? Especially against the backdrop of convenient investment channels like ETFs being officially launched, such a price action completely contradicts the long-term growth trend.

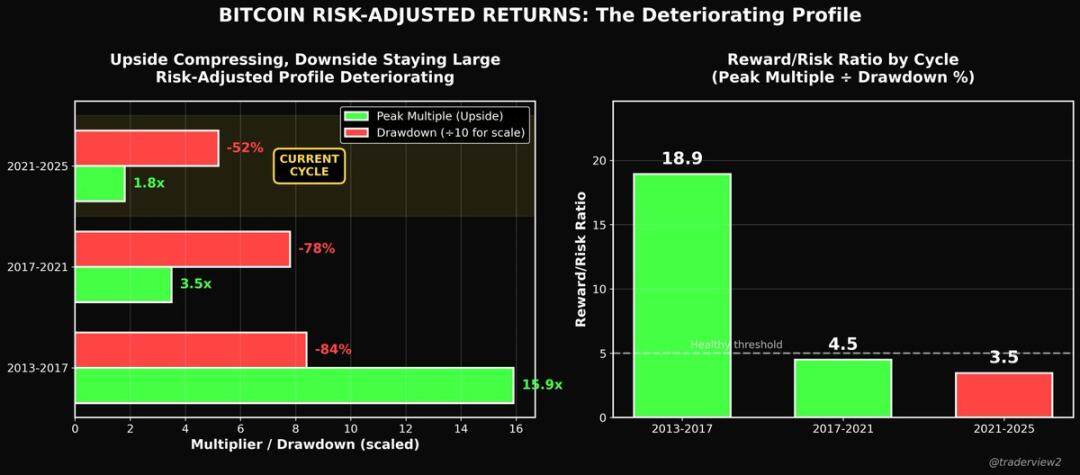

The Cliff of Risk-Adjusted Returns

This contradiction makes Bitcoin's entire cycle logic black and white: If the cycle peak multiple continues to shrink while the pullback magnitude does not proportionally decrease, Bitcoin's risk-reward ratio will deteriorate completely:

- The potential upside over a four-year cycle is only 20% to 50%

- The downside risk could still reach 50%

- Cycle trading would lose all meaning.

Faced with this dilemma, the market has only three ways out:

- Volatility contracts significantly (Path to Glory)

- The four-year cycle framework completely fails (Path to Ruin)

- A new demand driver emerges, resetting the growth curve and ending the trend of continuously decaying gain multiples.

ETFs are the most frequently mentioned potential driver, but in reality, ETFs are already live. To truly reset the growth curve, three types of forces are more needed: large-scale structural capital allocation, adoption at the sovereign nation level, or sustained, price-insensitive rigid demand.

The Harsh Reality: Why This Cycle is So Different

When I entered the crypto market in 2017, the entire industry was full of hope and innovative energy. People firmly believed these blockchain networks could bring real solutions to the world.

Nearly nine years later, it's hard to assert that any large crypto ecosystem has truly achieved sustainable mainstream utility value matching the promises made back then.

This cycle has harvested countless participants, with the vast majority of tokens showing almost no performance. More and more people are realizing the market's truth: For most crypto assets, this is essentially a PvP game where participants rely on leverage, liquidations, and capital rotation to profit from other participants, not from the asset's intrinsic value growth.

The market's selection rule has never failed: In the long run, the vast majority of cryptocurrencies will go to zero. Bitcoin, along with a few quality assets in the crypto space, still has a chance to escape this fate and achieve genuine value breakthrough.

The Choice Between Glory and Ruin

The Path to Glory

Bitcoin achieves a "breakthrough upgrade": Volatility contracts significantly, pullback magnitudes are far lower than historical levels, and the previous all-time high zone re-establishes itself as solid structural support. Although the cycle peak multiple shrinks, the asset's stability improves markedly, the risk-reward ratio optimizes greatly, truly becoming a sustainable long-term investment.

The Path to Ruin

The four-year cycle framework completely fails. Not that Bitcoin itself dies, but the cycle logic that sustained it for years no longer holds. Volatility remains at historical highs, but profit potential continues to compress. The previous all-time high no longer acts as bottom support; the past growth channel becomes a historical relic. Bitcoin may still experience periodic rallies in the future, and adoption may continue, but the former cycle规律 will no longer be the market's dominant rule.

The Path to Reset

A powerful new demand driver emerges, completely breaking the model of decaying gain multiples and reshaping Bitcoin's growth curve. This could come from large-scale structural capital allocation, widespread sovereign adoption, or passive institutional buying forming long-term support.

Another Hidden Risk: The Long-Term Protocol Layer Test

This is not the core factor affecting the market currently, but it's worth long-term attention: In the long run, Bitcoin must prove it can evolve at the protocol layer, especially possessing quantum resistance. The core of the quantum issue concerns Bitcoin's ownership security and protocol upgrade coordination, not mining itself. The security of early Bitcoin (like Satoshi's holdings) is the real potential threat.

If Bitcoin hopes to become a long-lasting asset, it must ultimately pass the test of "completing protocol upgrades without destroying market trust." It's like a background timer, not yet triggered, but always a significant hidden risk for Bitcoin's long-term development.

Simple Judgment Criteria

If, after the washout, Bitcoin reclaims and holds above $69,000: The cycle structure is preserved, and the path to glory remains highly possible.

If Bitcoin's price remains between $55,000 and $69,000: The market is under maximum pressure, and the cycle model faces its final test.

If Bitcoin's price stays below $55,000: Against the backdrop of a weak cycle with a 1.8x peak multiple, a structural breakdown occurs, and the market格局 is highly likely to undergo a fundamental shift.

Conclusion

Bitcoin cannot long possess two traits simultaneously: low-gain asset, high-drawdown asset. If risk-adjusted returns still have meaning, the two cannot coexist long-term.

Bitcoin touching around $60,000 is precisely the market testing this life-and-death boundary in real-time. Once the price breaks below the $50,000 range, all debate ends. The market will deliver its final verdict, either towards glory or into ruin.