Will IBIT Really Trigger a Full Market Liquidation?

- Core Viewpoint: The recent sharp volatility in the Bitcoin market is closely related to the trading activity of spot ETFs (especially BlackRock's IBIT). However, the market's common linear causal logic equating ETF secondary market selling with spot selling is flawed. The true price transmission mechanism involves market makers (APs) transferring pressure from the ETF share market to the Bitcoin spot or futures market when hedging risks.

- Key Elements:

- During the market crash on February 5th, IBIT recorded record-breaking trading volume and put option activity, but there was no net redemption. Instead, there was net share creation, which contradicts the traditional explanation of "panic redemptions causing the decline."

- ETFs are divided into the primary market (share creation/redemption, directly affecting custodied BTC) and the secondary market (share trading). Secondary market trading itself does not directly change the amount of custodied BTC; ordinary investors' buying and selling only involves turnover within the securities market.

- Even if redemptions occur, the BTC selling by Authorized Participants (APs) may not necessarily happen through public trading platforms. Data shows that the total net BTC redeemed by all US spot ETFs that day was less than 6,000 coins.

- The key transmission path is: When IBIT shares trade at a discount in the secondary market due to selling pressure, APs, to arbitrage, will buy the discounted shares and immediately hedge the price risk by selling BTC spot or opening futures short positions, thereby transmitting the pressure to the Bitcoin market.

- After completing the hedge, APs can choose to sell IBIT shares in the secondary market for profit without necessarily conducting a primary market redemption. Therefore, official net inflow/outflow data may not fully reflect their actual impact on the market.

Original Author: ChandlerZ, Foresight News

When the market experiences a sharp decline, narratives often quickly seek an identifiable source.

Recently, the market has begun to delve into discussions about the crash on February 5th and the nearly $10,000 rebound on February 6th. Jeff Park, an advisor at Bitwise and Chief Investment Officer at ProCap, believes that the connection between this volatility and the Bitcoin spot ETF system is closer than outsiders imagine, with key clues concentrated in the secondary market and options market of the iShares Bitcoin Trust (IBIT) under BlackRock.

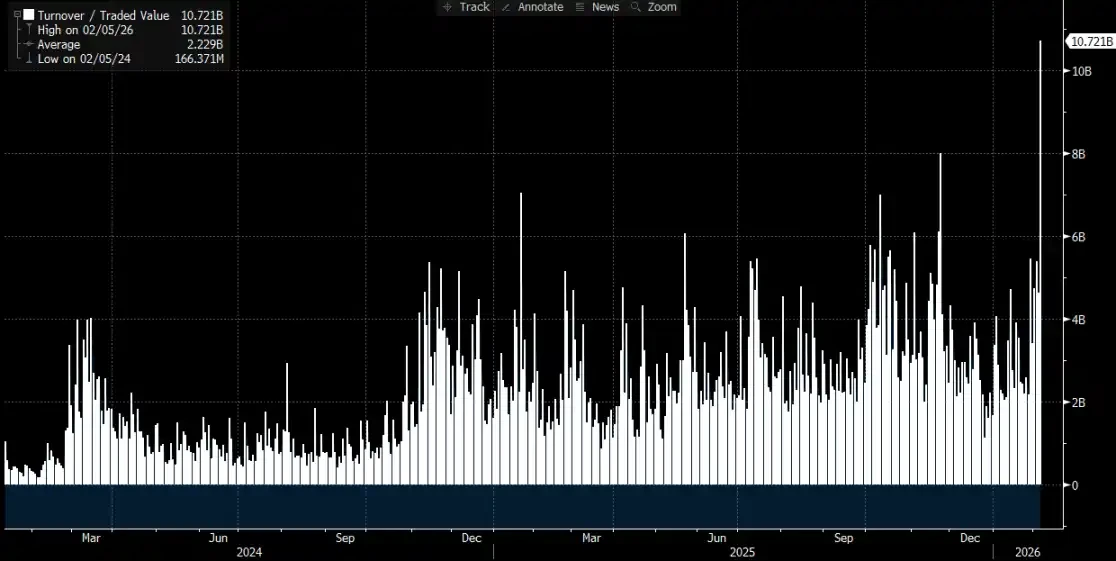

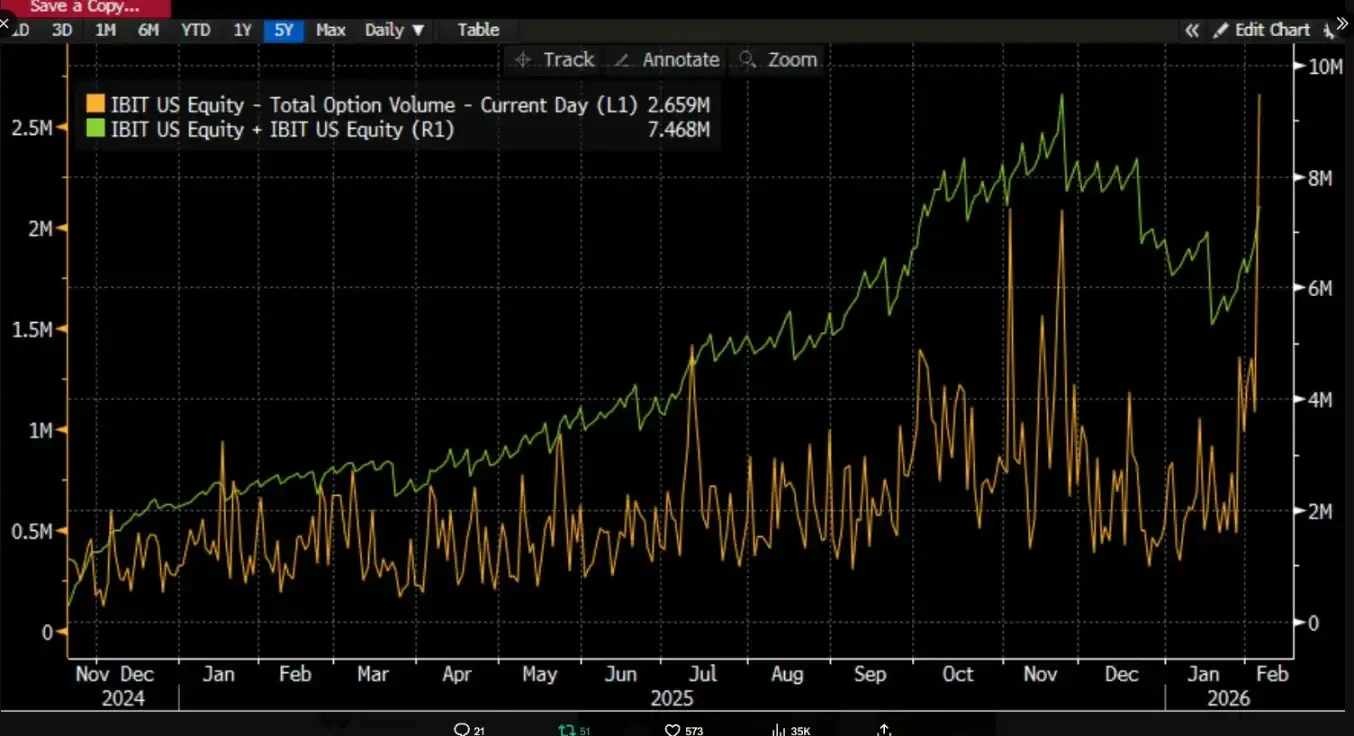

He pointed out that on February 5th, IBIT saw record-breaking trading volume and options activity, with transaction sizes significantly higher than usual, while the options trading structure leaned towards put options. More counterintuitively, based on historical experience, if prices experience a double-digit drop in a single day, the market typically sees significant net redemptions and capital outflows. However, the opposite occurred. IBIT recorded net creations, with new shares driving an increase in scale, and the entire spot ETF portfolio also saw net inflows.

Jeff Park believes that this combination of "crash coexisting with net creations" weakens the explanatory power of the single narrative that ETF investor panic redemptions caused the decline. Instead, it aligns more with internal deleveraging and risk reduction within the traditional financial system. Under derivative and hedging frameworks, traders, market makers, and multi-asset portfolios were forced to reduce risk. Selling pressure came more from position adjustments and hedging chain squeezes within the paper money system, ultimately transmitting the shock to Bitcoin prices through IBIT's secondary market trading and options hedging.

Many market discussions easily connect "IBIT institutional liquidation" and "the market being driven to crash" into a single sentence. However, without dissecting the mechanism details, this causal chain can easily get the sequence wrong. The trading target in the ETF secondary market is ETF shares; only creations and redemptions in the primary market correspond to changes in the underlying BTC held in custody. Directly and linearly mapping secondary market trading volume to equivalent spot selling lacks several logically necessary explanatory steps.

The So-Called "IBIT Triggered Large-Scale Liquidation" is Actually a Debate About the Transmission Path

The controversy surrounding IBIT mainly focuses on which layer of the ETF market and through what mechanism the pressure is transmitted to the BTC price formation side.

A more common narrative focuses on net outflows in the primary market. Its intuition is simple: if ETF investors redeem in panic, issuers or authorized participants need to sell the underlying BTC to meet redemption payments. This selling pressure enters the spot market, causing price drops that further trigger liquidations, leading to a stampede.

This logic sounds complete but often overlooks a fact. Ordinary investors and the vast majority of institutions cannot directly subscribe to or redeem ETF shares; only authorized participants can perform creations and redemptions in the primary market. The commonly cited "daily net inflows/outflows" in the market generally refer to changes in the total share count in the primary market. No matter how large the secondary market trading volume is, it only changes the holders of the shares, not the total share count automatically, and certainly does not automatically cause increases or decreases in the custodied BTC.

Analyst Phyrex Ni stated that the liquidation Parker mentioned is actually the liquidation of the IBIT spot ETF, not Bitcoin liquidation. For IBIT, what is bought and sold in the secondary market is only the IBIT "ticket," whose price is anchored to BTC, but the trading activity itself is merely a transfer of ownership within the securities market.

The only stage that truly touches BTC occurs in the primary market, namely share creation and redemption, and this channel is executed by APs (which can be understood as market makers). During creation, new IBIT shares require APs to provide corresponding BTC or cash consideration. The BTC enters the custody system, is subject to regulatory constraints, and cannot be freely used by issuers or related institutions. During redemption, the custodied BTC is handed over to the AP, who completes the subsequent disposal and settles the redemption funds.

ETFs essentially have a two-tier market. The primary market mainly involves the purchase and redemption of Bitcoin, with liquidity almost entirely provided by APs. In essence, it's similar to generating USDC with USD. Moreover, APs rarely circulate BTC through trading platforms, so the primary function of spot ETF purchases is to lock up Bitcoin liquidity.

Even if redemptions occur, APs' selling actions may not necessarily go through public markets, especially not necessarily through trading platform spot markets. APs themselves may hold inventory BTC or can use more flexible methods to complete delivery and fund arrangements within the T+1 settlement window. Therefore, even during the large-scale liquidation on January 5th, the BTC redeemed by BlackRock investors was less than 3,000 coins. The total BTC redeemed by all US spot ETF institutions was less than 6,000 coins, meaning the maximum amount of Bitcoin sold into the market by ETF institutions was 6,000 coins. Furthermore, these 6,000 coins may not all have been transferred to trading platforms.

The IBIT liquidation Parker mentioned actually occurred in the secondary market, with a total trading volume of approximately $10.7 billion, the largest ever for IBIT. It did indeed trigger some institutional liquidations. However, it's important to note that this liquidation was only of IBIT, not Bitcoin liquidation. At the very least, this liquidation did not transmit to IBIT's primary market.

Therefore, the sharp decline in Bitcoin only triggered IBIT liquidation but did not cause BTC liquidation due to IBIT. The trading target in the ETF secondary market is essentially the ETF itself, with BTC merely serving as its price anchor. What can impact the market is, at most, the liquidation triggered by BTC selling in the primary market, not IBIT. In reality, although BTC's price dropped over 14% on Thursday, the net outflow of BTC from ETFs only accounted for 0.46%. On that day, BTC spot ETFs held a total of 1,273,280 BTC, with a total outflow of 5,952 BTC.

The Transmission from IBIT to Spot

@MrluanluanOP believes that when long positions in IBIT are liquidated, concentrated selling occurs in the secondary market. If natural buy-side demand is insufficient to absorb it, IBIT will trade at a discount to its implied net asset value (NAV). The larger the discount, the greater the arbitrage opportunity, incentivizing APs and market arbitrageurs to buy the discounted IBIT, as this is part of their basic profit-making operations. As long as the discount covers costs, theoretically, professional capital will always be willing to step in, so there's no need to worry about "no one absorbing the selling pressure."

However, after absorbing the shares, the problem shifts to risk management. After APs take on the IBIT shares, they cannot immediately redeem them at the current price to realize cash; redemptions involve time and process costs. During this period, the prices of BTC and IBIT can still fluctuate, exposing APs to net exposure risk, prompting them to hedge immediately. Hedging methods could involve selling spot inventory or opening short BTC positions in the futures market.

If hedging involves spot selling, it directly pressures the spot price. If hedging involves futures shorting, it first manifests as changes in spreads and basis, then further impacts the spot market through quantitative trading, arbitrage, or cross-market trading.

After completing the hedge, the AP holds a relatively neutral or fully hedged position, allowing more flexibility in deciding when to handle these IBIT shares. One option is to choose to redeem them with the issuer on the same day, which would appear as redemptions and net outflows in the official inflow/outflow data after market close. Another option is to temporarily not redeem, waiting for secondary market sentiment to recover or prices to rebound, then directly sell the IBIT back into the market, completing the entire transaction without involving the primary market. If IBIT returns to a premium or the discount narrows the next day, the AP can sell its holdings in the secondary market to realize spread profits while closing the previously established futures short positions or buying back the previously sold spot inventory.

Even if the final share disposal primarily occurs in the secondary market, and significant net redemptions may not appear in the primary market, transmission from IBIT to BTC can still occur. This is because the hedging actions taken by APs when absorbing discounted positions transfer pressure to BTC's spot or derivatives markets, forming a pathway where selling pressure in IBIT's secondary market spills over into the BTC market through hedging behavior.