Making Millions on Polymarket by Predicting the Weather

- Core Viewpoint: This article analyzes the strategies of two top traders, neobrother and Hans323, on Polymarket, revealing advanced profit models in prediction markets based on data-driven approaches and asymmetric risk. It emphasizes the importance of professional models and capital management.

- Key Elements:

- Trader neobrother focuses on weather prediction markets, employing a "temperature ladder" strategy. He densely places low-priced orders within high-probability temperature ranges, covering costs and generating profits through the massive returns from a few high-odds positions.

- neobrother's trading is highly automated, with a cumulative 2,373 predictions. He relies on precise meteorological models (such as ECMWF or GFS) and real-time data sources, risking minimal capital for potential returns of hundreds of times.

- Trader Hans323 is a "black swan hunter," skilled at placing heavy bets on low-probability events (e.g., 2%-8%). He leverages extremely asymmetric risk-reward ratios, with a single bet of $92,000 yielding a profit of $1.11 million.

- Hans323's strategy resembles Taleb's "barbell strategy." He does not pursue a high win rate but relies on the success of a few extremely high-odds bets to cover numerous trial-and-error costs. His operations span multiple verticals including politics, sports, and culture.

- The article warns ordinary users that when following top traders, one should not only look at their win rate. It's crucial to consider their capital scale and risk skewness and to implement personal risk controls, as the capacity to withstand significant losses varies from person to person.

Original Author: Ma He, Foresight News

If someone told you that some savvy traders could make money by predicting the weather and temperature, would you believe it?

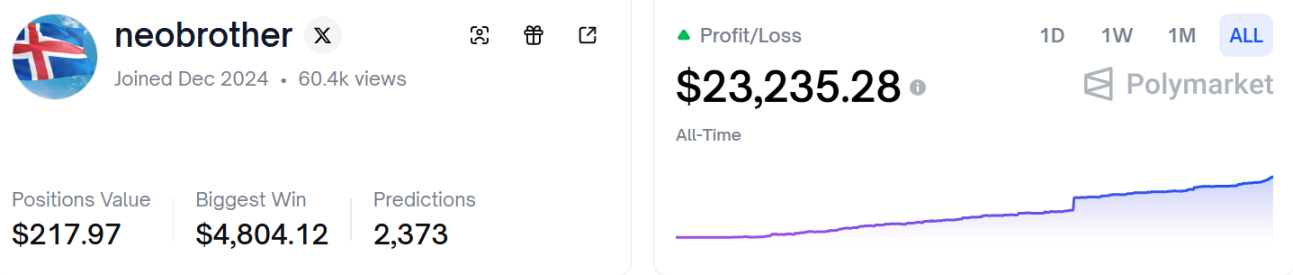

The trader named neobrother in the image above has been aggressively betting on the weather in various cities on Polymarket, accumulating over $20,000 in profits so far. He is not a reckless gambling speculator, but a highly data-driven, vertically specialized expert skilled in leveraging odds. neobrother's trading history is almost exclusively concentrated in Weather Markets, specifically the daily maximum temperatures in major global cities (Buenos Aires, Miami, Ankara, Chicago, New York).

He doesn't bet on "general trends," only on "precision," acting like a grid arbitrageur in the meteorological field.

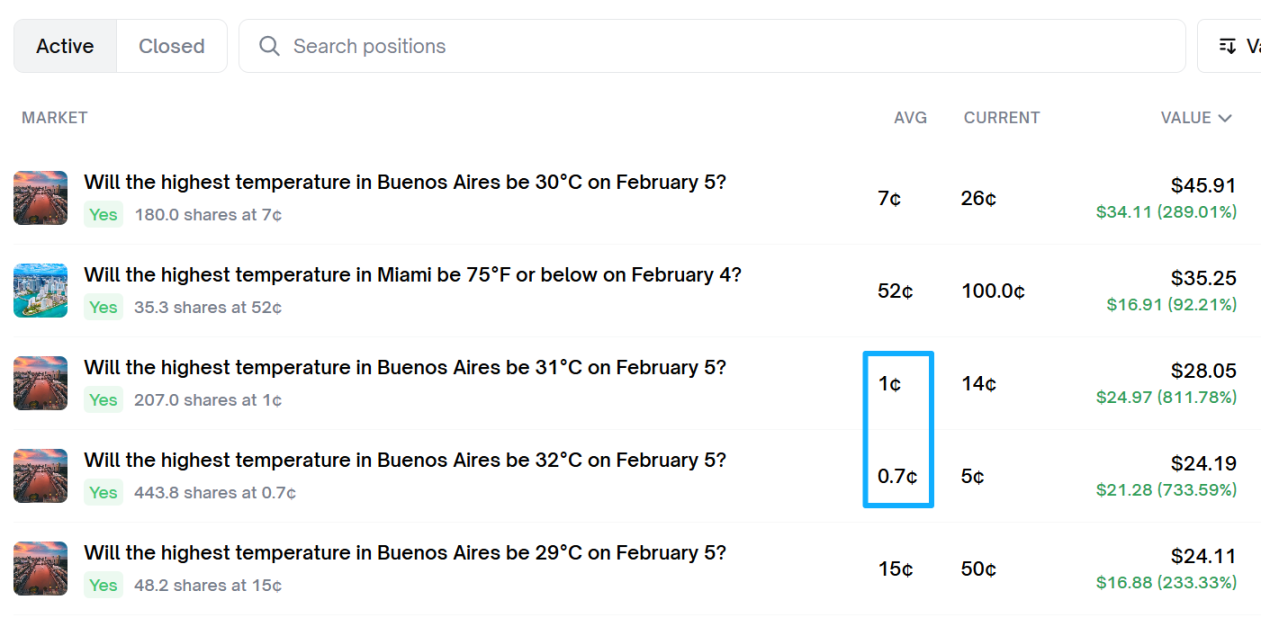

Taking the Buenos Aires temperature prediction as an example, he didn't just bet on a single temperature. Instead, he employed a "temperature laddering" strategy, simultaneously buying "Yes" for 29°C, 30°C, 31°C, 32°C, 33°C, and even 34°C+. This approach is similar to a "strangle" in options or "grid trading." By placing dense, low-cost orders (0.2¢ - 15¢) within the temperature range most likely to occur, as long as the final temperature falls within this range, the super-high returns from one or two positions (like the 811.78% return from 31°C) can cover the losses from all other ladder steps and generate massive profits.

Furthermore, he excels at capturing extremely low-probability profit opportunities. The unit price for most of the prediction markets he buys into is extremely low. For instance, his average purchase price for the Buenos Aires 32°C position was only 0.7¢. This entry price implies he obtained a potential odds multiplier close to 142x. The screenshot shows this position has already risen to 5¢ (a 733% increase).

He can use minimal cost to chase the sharp price volatility caused by deviations in weather forecasts. This style requires a deep understanding of meteorological models (like ECMWF or GFS) and the decisiveness to go undercover when market prices react with a lag.

These 2,373 predictions indicate his trading is extremely frequent and highly automated/systematized. This is most likely a quantitative or semi-quantitative trader who uses scripts to monitor changes in weather forecasts in real-time and places orders. He doesn't lock up large amounts of capital in a single position. Instead, he continuously uses tiny costs to chase returns of several hundred times, quickly withdrawing profits or reinvesting them for the next round of compounding.

He likely possesses a more accurate and real-time weather prediction source than most retail users on Polymarket (possibly connected to a meteorological agency API). Politics and sports have too much noise, while weather is pure physics and mathematics. As long as the model is accurate enough, this is his endless ATM.

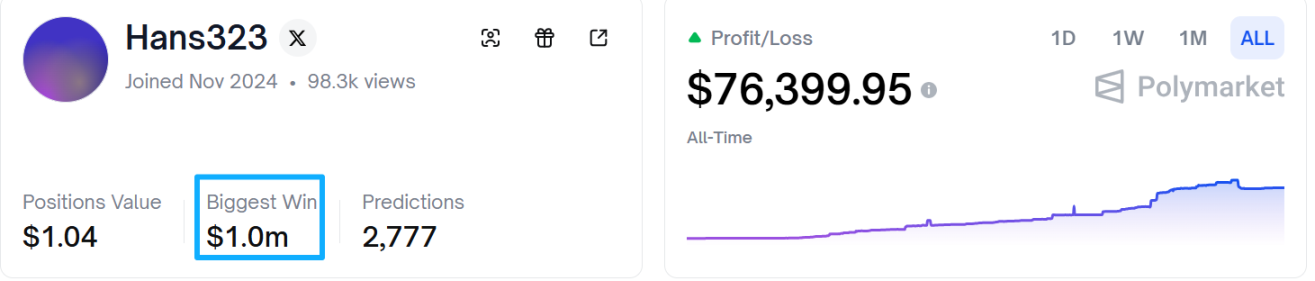

If this trader is a "weather geek" precisely calculating storms in a lab, then Hans323 is the "black swan hunter" and "top odds master" on Polymarket. In a London weather prediction, he dared to place a single bet of $92,000 when the win probability was only 8%, wildly profiting $1.11 million.

Hans323's operations have transcended simple prediction; he is conducting large-scale capital harvesting by exploiting **extremely asymmetric risk-reward ratios**.

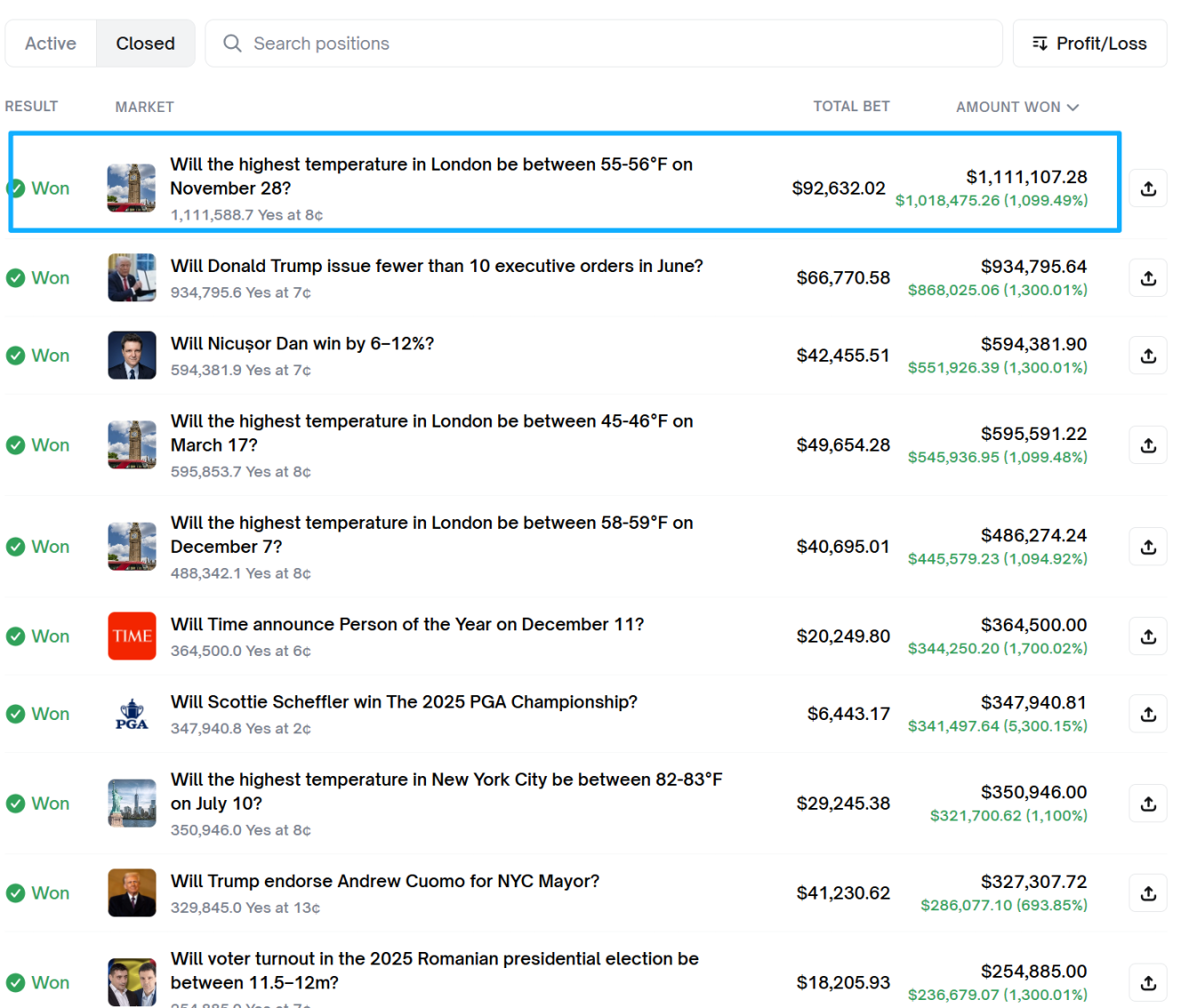

Observing his winning records, his purchase prices are typically between 2¢ and 8¢. In prediction markets, this represents the market's perceived probability of the event occurring as only 2% to 8%. An ordinary player might invest only $10 in a 2¢ contract, but Hans323 dares to invest $92,632 at the 8¢ price point (the London temperature contract).

This strategy resembles hedge fund manager Nassim Taleb's "barbell investment" approach. He doesn't care if 90% of his predictions fail, because hitting just one 1,100% or even 5,300% return is enough to cover the costs of thousands of trials.

Unlike neobrother's "full ladder coverage," Hans323 tends to invest heavily in specific, statistically biased narrow points, which requires immense confidence and underlying model support.

Additionally, reviewing all his historical trades, this trader might be an all-rounder, possibly backed by a powerful data scraping team or intelligence sources in vertical fields. For example, in politics: betting that Trump would issue fewer than 10 executive orders in June (entered at 7¢); in sports: decisively buying when Scottie Scheffler's odds to win the PGA were extremely low (2¢); and in culture: successfully predicting Time Magazine's Person of the Year (6¢). This player has achieved good results in all these areas.

While making money is one thing, ordinary users tracking the trading records of Polymarket experts shouldn't just look at their win rates. They must also pay attention to tracking their capital skewness and maintain their own risk control. Because the same significant loss can have vastly different levels of impact for different individuals.