One year later, what can the crypto market still trade?

- Core Viewpoint: The article points out that crypto-native primary market innovation is drying up, new asset supply faces a gap, and the secondary market is undergoing a structural shift. Trading focus is moving from "new coin narratives" to tokenized traditional assets and on-chain prediction markets, seeking new speculative vehicles and liquidity sources.

- Key Elements:

- Structural Contraction in the Primary Market: Data shows that between 2022 and 2025, the decline in the number of early-stage funding rounds in the crypto industry (63.9%) far exceeded the overall decline (49.4%). Funding for native protocols (e.g., L1, DeFi) has dropped significantly, weakening the industry's ability to generate new supply.

- Fund Return Cycle Gap: Taking a veteran fund as an example, funds established between 2014-2017 delivered excellent returns (TVPI 6x–40x), while funds established after 2020 mostly have returns stuck on paper (TVPI 1.0x–2.0x) with extremely low DPI, reflecting the unsustainable structure of primary market excess returns.

- Paradigm Shift of Meme Coins: Meme coins are no longer "altcoin alternatives." Their core has evolved into a short-term game of attention and liquidity, with extremely short lifecycles, becoming specialized, pure speculative tools rather than long-term value assets.

- Tokenized Assets Become the New Narrative: Exchanges are focusing on the on-chain tokenization of traditional assets like stocks and precious metals, aiming to introduce the volatility and trading logic of traditional financial markets to address the shortage of native asset supply. For instance, Hyperliquid's daily silver trading volume once exceeded $10 billion.

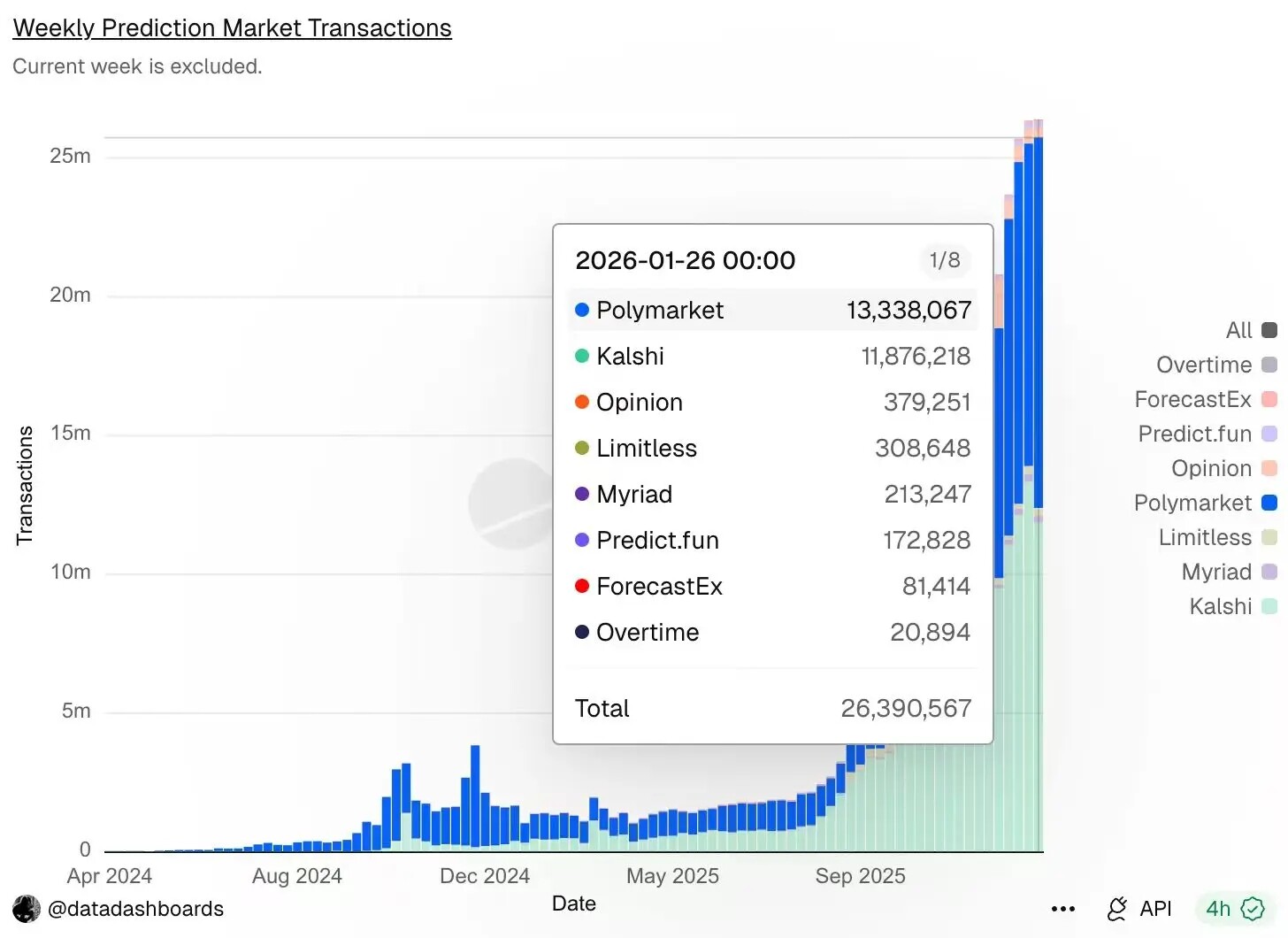

- Prediction Markets Capture External Uncertainty: Prediction markets (e.g., Polymarket) treat non-crypto events like macroeconomics and politics themselves as tradable assets. Trading activity in these markets has hit new highs in a narrative-scarce environment, providing the market with new, low-barrier speculative vehicles.

Original | Odaily

Author | Mandy (@mandywangETH), Azuma (@azuma_eth)

This weekend, amidst internal and external troubles, the crypto market suffered another bloodbath. BTC is currently hovering around the $76,000 mark, which is the average cost basis for many strategies, while altcoins are in such a state that looking at their prices makes one want to gouge their eyes out.

Behind this bleak scene, after recent conversations with projects, funds, and exchanges, a question keeps recurring in my mind: What exactly will the crypto market be trading one year from now?

And the more fundamental question behind it is: If the primary market stops producing "the secondary market of the future," what will the secondary market be trading in a year? What changes will happen to exchanges?

Although the death of altcoins has long been a cliché, the market hasn't lacked projects over the past year. Projects are still queuing up for TGEs every day. As a media outlet, we are still frequently connecting with project teams for marketing campaigns.

(Note: In this context, when we say "projects," we mostly refer narrowly to "project teams"—simply put, projects benchmarked against Ethereum and its ecosystem, including underlying infrastructure and various decentralized applications, and specifically "token-issuing projects." This is the foundation of what our industry calls native innovation and entrepreneurship. Therefore, we will temporarily set aside Meme coins and platforms emerging from traditional industries entering crypto.)

If we pull the timeline back a bit, we'll find a fact we've all been avoiding: These projects about to TGE are "existing old projects." Most of them raised funds 1–3 years ago and are only now finally reaching token issuance, or even being forced to issue tokens due to internal and external pressures.

This seems like a kind of "industry inventory clearance," or to put it more harshly, queuing up to complete their lifecycle. Once they issue tokens, giving an account to the team and investors, they can lie flat and await death, or spend the money in their accounts hoping for a miraculous turnaround.

The Primary Market is Dead

For "old-timers" like us who entered the industry during the ICO era or even earlier, have experienced several bull-bear cycles, and witnessed the industry's dividends empowering countless individuals, there's a subconscious belief: Given enough time, new cycles, new projects, new narratives, and new TGEs will always emerge.

However, the reality is we are far from our comfort zone.

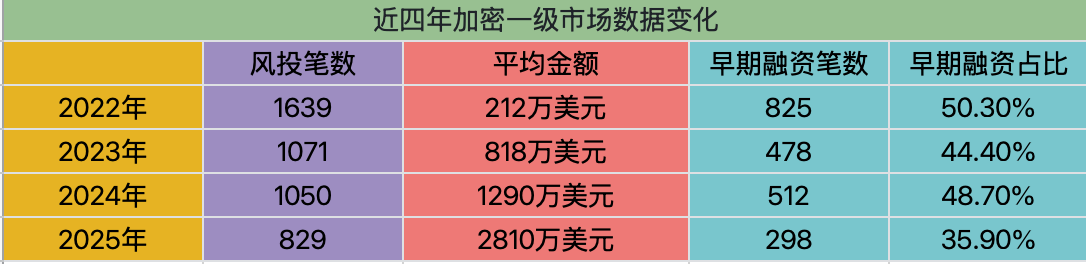

Let's look at the data directly. Over the recent four-year cycle (2022-2025), excluding special primary market activities like M&A, IPOs, and public offerings, the number of financing deals in the crypto industry has shown a clear downward trend (1639 ➡️ 1071 ➡️1050➡️829).

The reality is even uglier than the data. The change in the primary market is not just an overall shrinkage in amount but a structural collapse.

Over the past four years, the number of early-stage financing rounds (including angel, pre-seed, and seed rounds), representing the industry's fresh blood, has shown a steeper decline (825 ➡️ 298, a 63.9% drop) compared to the overall decline (49.4%). The primary market's ability to supply blood to the industry has been shrinking.

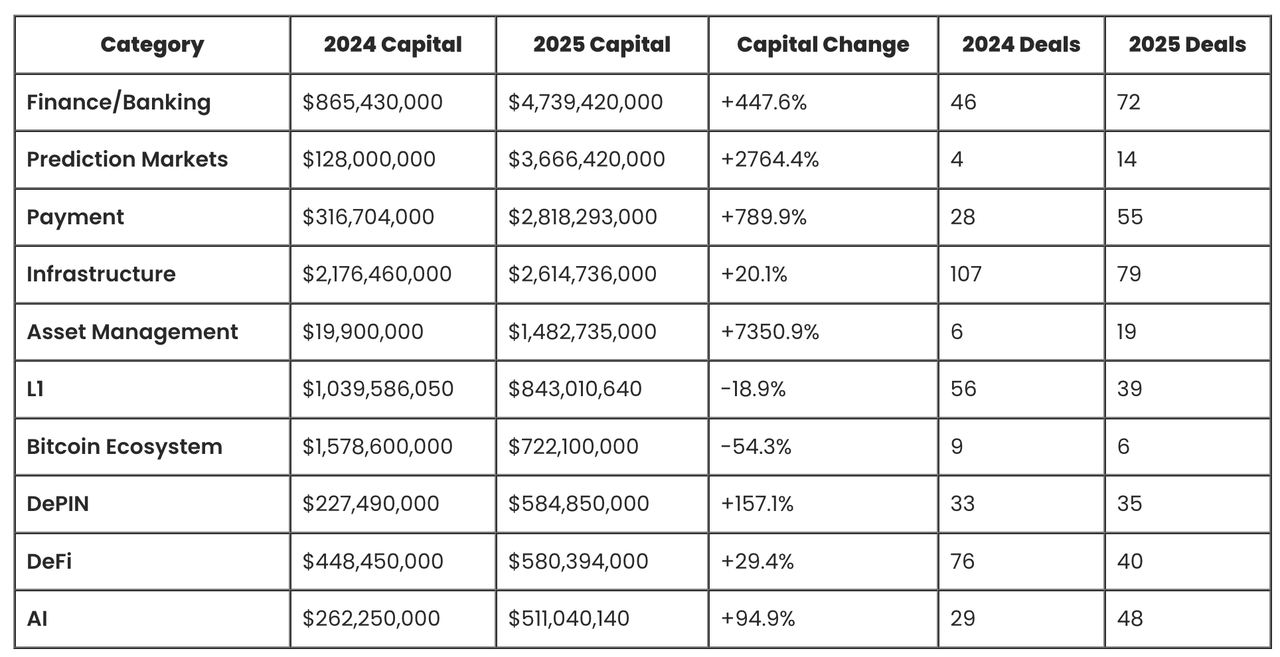

A few sectors showing an upward trend in deal count are financial services, exchanges, asset management, payments, AI, etc., which apply crypto technology, but their relevance to us is limited. Frankly, most won't "issue tokens." In contrast, native "projects" like L1, L2, DeFi, and social have seen a more significant decline in financing.

Odaily Note: Chart sourced from Crypto Fundraising

A commonly misinterpreted data point is that while the number of financing deals has sharply decreased, the average deal size has increased. The main reason is the "mega-projects" mentioned earlier capturing large amounts of capital from traditional finance, significantly raising the average. Additionally, mainstream VCs tend to double down on a few "super projects," such as Polymarket's multiple rounds of hundred-million-dollar financing.

From the crypto capital side, this top-heavy vicious cycle is even more pronounced.

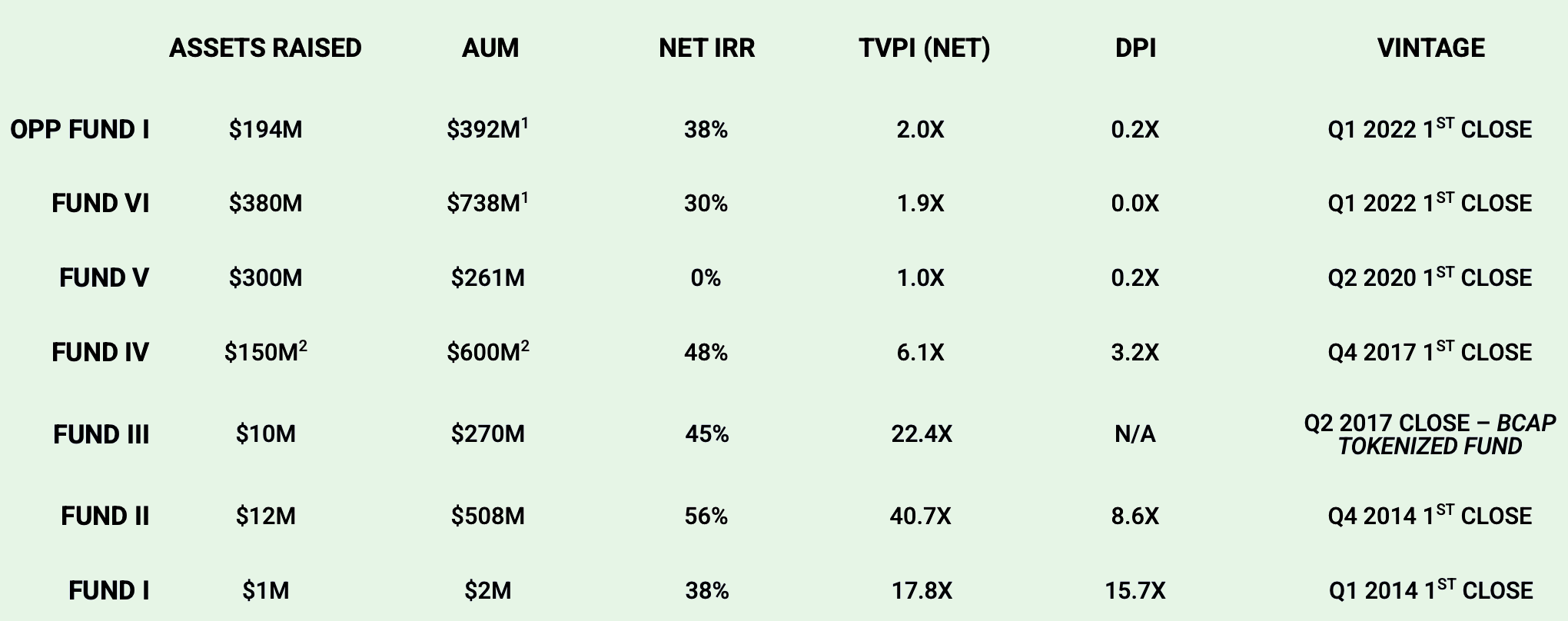

Not long ago, a friend outside the circle asked me about a well-known, super-old crypto fund raising capital. After looking at their deck, he asked me in confusion why their returns were "so poor." The table below shows real data from that deck. I won't name the fund, only extracting its fund performance data from 2014-2022.

We can clearly see that between 2017 and 2022, this fund's IRR and DPI changed significantly—the former represents the fund's annualized return level, reflecting more of the "paper profit-making ability," while the latter represents the actual cash return multiple already returned to LPs.

Looking at different vintages, this set of fund returns shows a very clear "cycle断层": Funds established between 2014–2017 (Fund I, II, III, IV) significantly outperformed, with TVPI generally in the 6x–40x range and Net IRR maintained at 38%–56%. They also already have high DPI, indicating these funds not only have high paper gains but have also completed large-scale realization, capturing the era红利 of early crypto infrastructure and leading protocols from 0 to 1.

Funds established after 2020 (Fund V, Fund VI, and the 2022 Opportunity Fund) clearly dropped a tier, with TVPI mostly concentrated in the 1.0x–2.0x range and DPI close to zero or extremely low, meaning returns mostly remain on paper and cannot be converted into real exit收益. This reflects that against the backdrop of rising valuations, intensified competition, and declining project supply quality, the primary market cannot replicate the超额收益 structure driven by "new narratives + new asset supply" of the past.

The real story behind the data is that after the DeFi Summer hype in 2019, valuations for crypto-native protocols in the primary market were inflated. When these projects finally issued tokens 2 years later, they faced weak narratives, industry tightening, exchanges holding the lifeline and临时修改 terms, leading to普遍不尽人意的 performance, even市值倒挂. Investors became弱势群体, and fund exits became difficult.

However, these周期错配 funds could still create a表象 of false prosperity in parts of the industry. It wasn't until近 2 years, when some massive明星 funds were raising capital, that the惨烈真实数据 became直观.

The fund I used as an example currently manages nearly $3 billion, which further说明 it's a mirror to observe the industry cycle—doing well or not is no longer a question of individual project selection; the大势已去.

While established funds now find fundraising步履维艰, they can still survive, lie flat, eat management fees, or pivot to investing in AI. Many more funds have already shut down or转向二级.

For example, the current "Ethereum奶王" in the Chinese market,老板易理华, who remembers that not long ago he was a representative figure in primary, investing in over a hundred projects annually?

Meme is Not the Substitute for Altcoins

When we say crypto-native projects are drying up, a counterexample is the爆发 of Meme.

Over the past two years, a说法 has been反复提起 in the industry: The substitute for altcoins is Meme.

But looking back now, this conclusion has actually been proven wrong.

In the early days of the Meme wave, we played Meme the way we played "mainstream altcoins"—screening所谓的基本面, community quality, narrative合理性 from大量 Meme projects, trying to find the one that could survive long-term, constantly换血, and eventually grow into Doge, even the "next Bitcoin."

But today, if someone still tells you to "hold Meme," you'd think they're out of their mind.

Current Meme is a mechanism for instant monetization of热度: a博弈 of attention and liquidity, a product批量制造 by Dev and AI tools,

an asset形态 with an extremely short lifecycle but a持续不断的 supply.

It no longer aims to "survive" but aims to be seen, traded, and utilized.

Our team also has several consistently profitable Meme traders. Clearly, they focus not on a project's future but on节奏, diffusion speed,情绪结构, and liquidity路径.

Some say Meme is unplayable now, but in my view, after Trump's "最后一割," Meme has truly matured as a new asset形态.

Meme was never a substitute for "long-term assets"; it has returned to attention finance and liquidity博弈本身. It has become purer, more残酷, and less suitable for most普通 traders.

Seeking Solutions Outward

Asset Tokenization

So when Meme走向专业化, Bitcoin走向机构化, altcoins萎靡, new projects即将断层, what can we普普通通 folks who enjoy value research, comparative analysis, have投机属性, yet aren't purely高频赌概率, want sustainable development, play with?

This question doesn't just belong to retail.

It also lies before exchanges, market makers, and platforms—after all, the market cannot forever rely on higher leverage and more aggressive derivative products to maintain activity.

In reality, when the entire固有逻辑 begins to倾覆, the industry has long started seeking solutions向外延.

The direction we are all discussing is repackaging traditional financial assets into链上可交易 assets.

Stock tokenization and precious metal assets are becoming the top priority for exchange布局. From一众 centralized exchanges to the decentralized platform Hyperliquid, this path is seen as the key to破局. The market has also given positive feedback—during the most疯狂 days for precious metals last week, daily silver trading volume on Hyperliquid一度突破 $1 billion. Tokenized stocks, indices, precious metals, and other assets once occupied half of the top ten trading volume spots,助推 HYPE to surge 50% short-term under the "全资产交易" narrative.

Admittedly, some current slogans like "providing new choices, low门槛 for traditional investors" are still言之尚早,不现实.

But from a crypto-native perspective, it might solve internal problems: After the supply and narratives of native assets slow down, old coins萎靡, and new coins断供, what new trading reasons can crypto exchanges still offer the market?

Tokenized assets are easy for us to上手. In the past, we researched: public chain ecosystems, protocol revenue, token models, unlock节奏, and narrative space.

Now, the research objects are starting to become: macro data, financial reports, interest rate expectations, industry cycles, and policy variables. Of course, we've already been studying many parts of this.

本质上, this is a migration of投机逻辑, not a simple品类扩展.

Listing gold tokens, silver tokens isn't just adding a few more币种. What they真正试图引入 is new trading narratives—bringing the波动与节奏 originally belonging to traditional financial markets into the internal crypto trading system.

Prediction Markets

Besides bringing "external assets" on-chain, another direction is bringing "external uncertainty" on-chain—prediction markets.

According to Dune data, although crypto行情暴跌 over the weekend, prediction market trading activity不降反增, with weekly交易笔数 reaching a new historical high of 26.39 million. Polymarket led with 13.34 million trades, followed closely by Kalshi with 11.88 million.

We won't赘述 the development prospects and规模预期 of prediction markets here. Odaily has been writing at least 2 articles analyzing prediction markets daily recently... You can search for them yourself.

I want to discuss from a币圈 user perspective: Why do we play prediction markets? Is it because we're all赌狗?

Of course.

Actually, for a long time, altcoin traders本质上 weren't betting on technology but on events: Will it get listed? Is there a partnership announcement? Is it going to issue a token? Is it launching a new feature? Is there a regulatory利好? Can it蹭到 the next narrative?

Price is just the result; the event is the起点.

Prediction markets, for the first time,拆开 this from an "implied variable in the price curve" into an object that can be directly traded.

You no longer need to buy a token to indirectly bet on whether a certain outcome will happen; you can directly bet on "whether it will happen" itself.

More importantly, prediction markets适应 the current environment of "new project断供, narrative scarcity."

When tradable新增资产 become fewer, market attention反而更加集中在 macro, regulation, politics,大佬行为, and major industry节点上.

In other words, tradable "标的" are decreasing, but tradable "events" are not减少, even becoming更多.

This is why the liquidity that has truly跑出来 in prediction markets in recent years almost全部 comes from non-crypto-native events.

It本质上 is bringing external world uncertainty into the internal crypto trading system. From a trading experience perspective, it's also more友好 to original币圈 traders:

The core question is极度简化为 one—Will this outcome happen? And, Is this current probability贵?

Unlike Meme, the门槛 for prediction markets isn't execution speed but信息判断 and结构理解.

Saying this, doesn't it feel like I can try this too?

Conclusion

Perhaps the so-called币圈 will eventually消亡 in the not-too-distant future. But before消亡, we are still折腾. When "new-coin-driven trading" gradually退场, the market always needs a new投机载体 with低参与门槛,具备叙事传播性, and capable of可持续发展.

Or rather, the market won't消失, it will only迁移. When the primary market no longer produces the future, what the secondary market can truly trade are these two things—the uncertainty of the external world, and tradable narratives that can be反复重构.

What we can do is perhaps提前适应 another投机范式迁移.