Weekly Token Unlocks: HYPE to Unlock Tokens Worth Approximately $300 Million

- Core Viewpoint: Two major projects, Hyperliquid and Ethena Labs, are about to undergo large-scale token unlocks involving significant amounts, which may impact their respective projects and market liquidity.

- Key Elements:

- Hyperliquid will unlock approximately 9.92 million tokens, valued at around $300 million based on the current market price. It is positioned as a high-performance, fully on-chain open financial system.

- Ethena Labs will unlock approximately 212 million USDe stablecoins, valued at about $31.06 million. Its mechanism relies on spot collateral and futures short hedging to maintain stability and provide yield.

- The unlock events for both projects involve specific and publicly disclosed release schedules, indicating that their unlock plans are pre-determined and transparent.

- Hyperliquid aims to integrate liquidity, applications, and trading into a unified platform, while Ethena's USDe is an algorithmic stablecoin that combines staking yield with funding rate arbitrage.

Hyperliquid

Project Twitter: https://x.com/HyperliquidX

Project Website: https://hyperfoundation.org/

This Unlock Amount: 9.92 million tokens

This Unlock Value: Approximately $300 million

Hyperliquid is a high-performance blockchain built with the vision of creating a fully on-chain, open financial system. Liquidity, user applications, and trading activities synergize on a unified platform, aiming to encompass all financial activities.

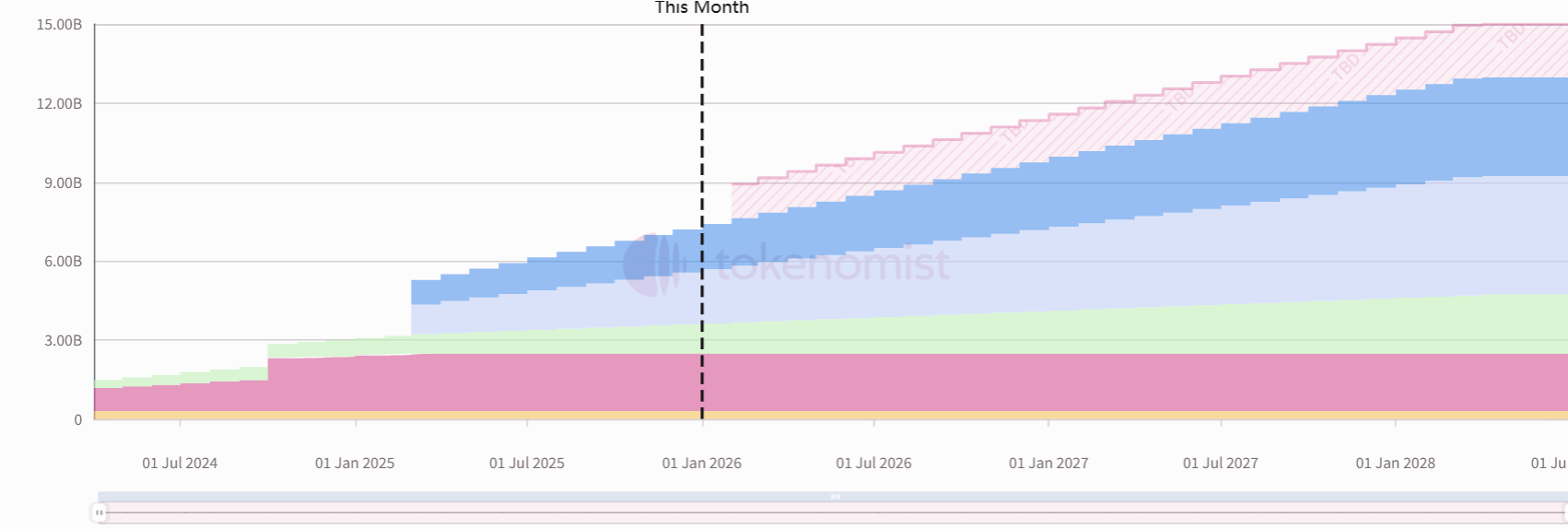

The specific release schedule is as follows:

Ethena

Project Twitter: https://x.com/ethena_labs

Project Website: https://www.ethena.fi/

This Unlock Amount: 212 million tokens

This Unlock Value: Approximately $31.06 million

The algorithmic stablecoin USDe, launched by Ethena Labs, currently relies on collateral such as BTC and stETH and their inherent yield. It simultaneously creates short positions on Bitcoin and ETH to hedge delta exposure and utilizes perpetual/ futures funding rates to maintain its peg and provide yield. Essentially, it uses the yield from the spot holdings to offset the losses from the equivalent short positions, achieving balance while capturing ETH staking rewards and funding rates from the short positions.

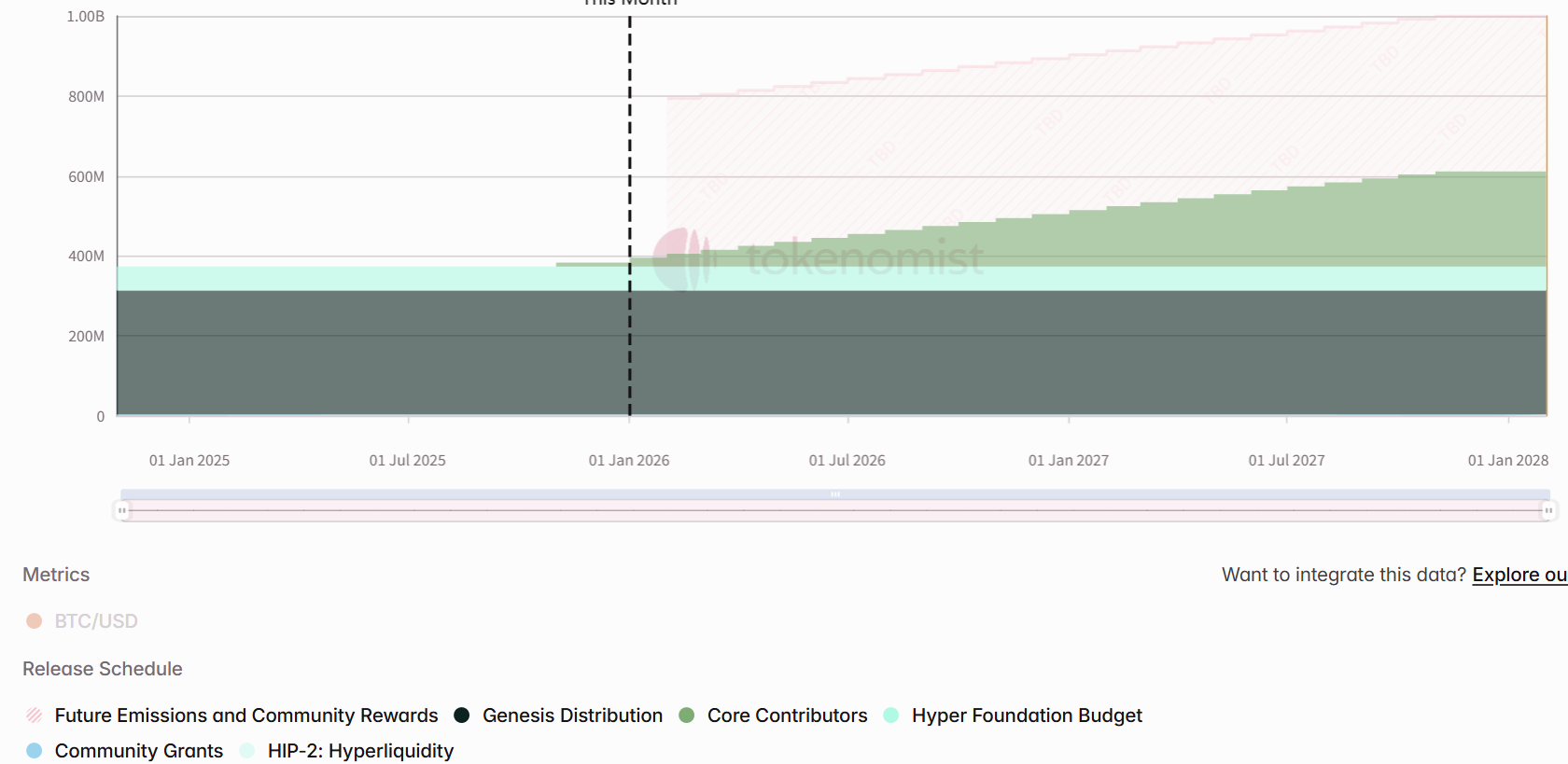

The specific release schedule is as follows: