Sorry, this time I must bet on AI's demise

- Core Viewpoint: By comparing the purchasing power of U.S. stock indices with gold, the article reveals that the nominal price growth of U.S. stocks over the past two decades has been primarily driven by the devaluation of the U.S. dollar, rather than genuine productivity gains. It further points out that during the current period of global fiat currency system restructuring, the productivity improvements brought by AI may struggle to offset the impacts of debt growth and currency devaluation.

- Key Elements:

- Measured in gold, the purchasing power of the S&P 500 Index (SPX) and the Nasdaq 100 Index (QQQ) has not returned to its 1999 level over the past 27 years, and has even depreciated for most of that time.

- Data shows that since 1999, the U.S. dollar has depreciated by 69% against gold, SPX has depreciated by 68%, and QQQ has depreciated by 30%, indicating that stock market growth has been primarily fueled by currency devaluation.

- The current global debt has reached over three times global GDP. The productivity gains from AI would need to be exponential to offset the rampant growth of debt interest.

- The article argues that if AI leads to extreme deflation, it could threaten the existing fiscal systems and power structures of sovereign states, which are based on inflation and debt.

- Against the backdrop of fiat currency system restructuring, the author suggests focusing on hard assets like gold and Bitcoin, and being cautious of assets based on future credit.

Original Author: Crypto Skanda (X: @thecryptoskanda)

The meteoric rise of US stocks, particularly the AI sector, over the past year is evident for all to see, with AI-related QQQ holdings surging nearly 30% within a year. The Trump administration has repeatedly stated that AI development will bring significant deflation and drive economic prosperity.

However, for ordinary people, this prosperity feels extremely unreal:

- Unemployment rates are rising, not just in the US, but in countries worldwide;

- Despite economic data not fully reflecting it, civilians in almost every country can tangibly feel the widespread increase in prices;

- Commodity currencies don't lie: the Thai Baht has risen over 10% annually (0.88 correlation with gold), and the Chilean Peso over 12% (0.8 correlation with copper).

Perhaps, as an ordinary person, your feeling is correct.

US Stocks Haven't Really Risen Much

If you compare SPX and QQQ, two indices representing the top of the US stock market and the economic effects of the emerging AI sector, with gold, you'll make a completely different discovery:

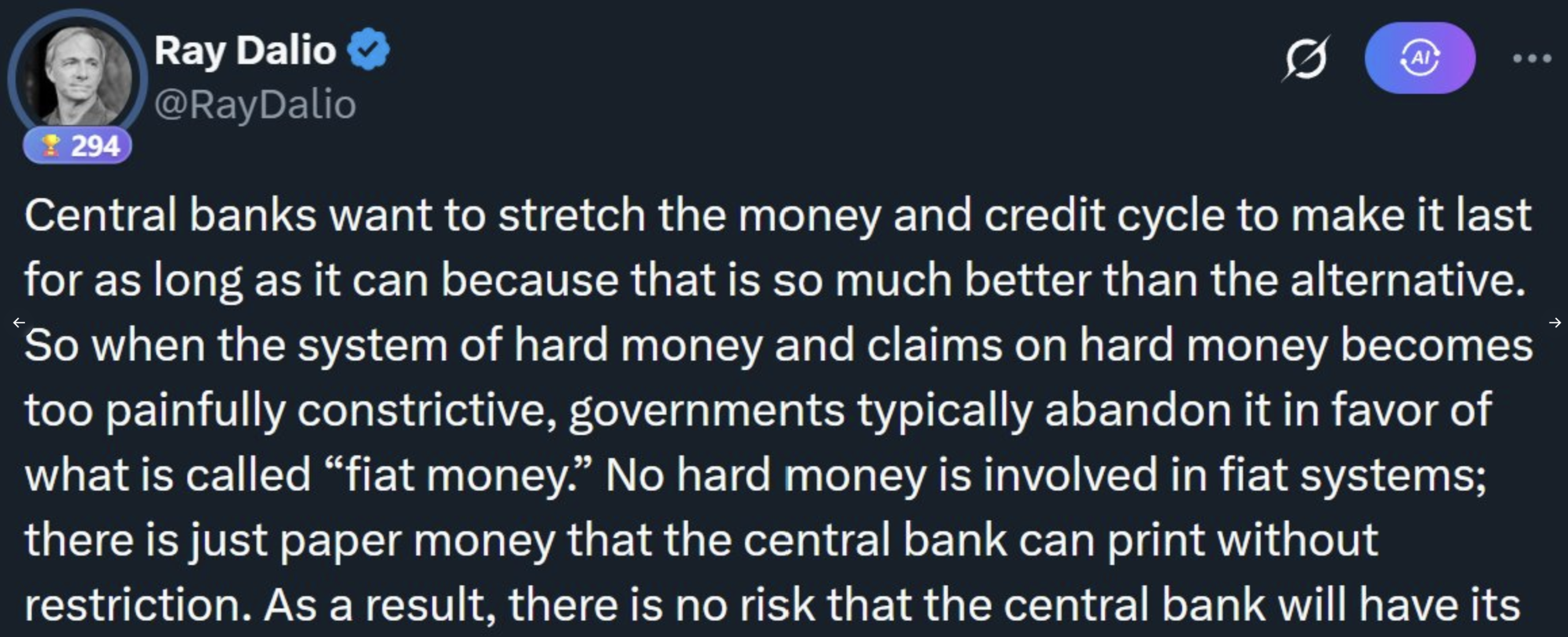

Comparison of the purchasing power of QQQ and SPX against gold from March 1999 (QQQ's inception) to the present; the top chart uses QQQ's inception purchasing power as the baseline, the bottom chart uses the SPX/Gold and QQQ/Gold ratios as units.

It reveals a truth many overlook: Although US stocks have seen massive gains over the past 27 years, if gold is used as a benchmark, the purchasing power of most stock investors has not actually returned to its 1999 level.

Roughly divided into 4 periods:

1. Dot Com Bubble Era (1999-2002)

This was the extreme overextension of human fiat credit expansion on the "fantasy of a productivity miracle."

Ratio Performance:

- SPX/Gold: Encountered an epic resistance level around 5.5 (1 unit of S&P for 5.5 ounces of gold).

- QQQ/Gold: Touched the historical ceiling of 0.40.

The final outcome was an 80% drop in the purchasing power of SPX/QQQ against gold from the 2000 peak to the end of 2002.

2. The Great US Stock Rout & The Golden Decade (2003 - 2011)

The financial crisis (2008) erupted, global confidence in fiat currency collapsed, and capital flooded into gold for safety.

- During this phase, SPX/Gold broke through multiple support levels, eventually finding historic support in the 0.6 - 0.7 range.

- QQQ/Gold: Bottomed around 0.03 (this was the moment tech stocks were cheapest relative to gold).

Although the nominal price of US stocks began to rebound after 2009, because gold rose even faster (to $1900), the "gold purchasing power" of US stocks didn't truly bottom until 2011.

3. US Stock Recovery / Tech Premium Period (2012 - 2023)

The era of low interest rates and quantitative easing. The growth speed of tech giants represented by FAANG finally outpaced the speed of the money printer.

However, with the experience of the past 20 years, we naively realize: this "productivity fantasy" has a certain self-limiting nature and doesn't seem to be directly linked to "productivity" itself.

- SPX/Gold: Attempted to return to the 2.5 resistance level but failed multiple times.

- QQQ/Gold: Performed strongly, rising from 0.03 to 0.25, but this 0.25 became the key resistance zone for this decade.

4. Trump Fiat System Restructuring Period (2024 - 2026)

As Trump took office and restructured US relations with allies and other nations, the US actively broke many assumptions underlying international trade and monetary order. The global fiat system post-1971 entered a restructuring period, and commodities may be monetized.

- Gold Price: $5,000 / oz

- SPX/Gold Ratio: Fell back to 1.39

- QQQ/Gold Ratio: Fell back to 0.12

In plain terms, US stocks priced in USD are hitting new highs, but if priced in gold, US stocks haven't risen and are even testing support levels downwards.

The Real Illusion and "False" Progress

Ray Dalio said the essence of the central bank fiat system is to replace limited hard currency with infinitely printable paper money, making governments technically unable to go bankrupt on an accounting level—if they can't repay, they just print. This is essentially borrowing from the future, at the cost of plundering the purchasing power of the next generation. In the past, there were runs on gold; now, runs can only go to buying commodities.

"If you debase the currency, everything goes up."

One of the best yardsticks for measuring actual currency devaluation is M2 growth rate. If we overlay M2 growth rate onto the historical performance of SPX and QQQ:

This chart has three lines:

- Black Dashed Line: Represents the M2/Gold exchange rate. This is the Fed's money printer. You can see it declining all the way, meaning the USD has depreciated by 69% relative to gold.

- Blue Solid Line: SPX500/Gold exchange rate. Represents "ordinary US stocks"—the real purchasing power of the S&P 500 priced in gold. This line almost coincides with the black dashed line.

- Orange Solid Line: QQQ / Gold. Represents "tech growth." It outperformed the black dashed line but still remains below its 1999 level.

This means, compared to 1999, 27 years ago:

- The USD depreciated by 69% against gold.

- SPX depreciated by 68%.

- QQQ depreciated by 30%.

Or, converted:

Almost 99% of SPX's growth was solely due to USD debasement, while for QQQ, 60-70% of growth was due to USD debasement, with only about 30% attributable to real technological productivity progress.

Looking at the present, gold's growth rate has already surpassed the combined speed of M2 money printing and stock market growth. If, during the fiat system restructuring cycle, the USD's purchasing power halves again, it will offset all the growth brought by AI technological progress.

The idea that stocks always go up is an illusion; only the portion that outpaces M2 represents truly earned purchasing power. The depreciation rate of all assets in your hands is far faster than you imagine.

By the way, the USD's M2 growth rate (YoY) over the past year is 4.6%, while China's is 8.5%.

The monetization of commodities is real and happening.

Humanity Can Have No Future, But Will Never Stop Plundering

Technological Explosion is the Premature Baby of Fiat Leverage

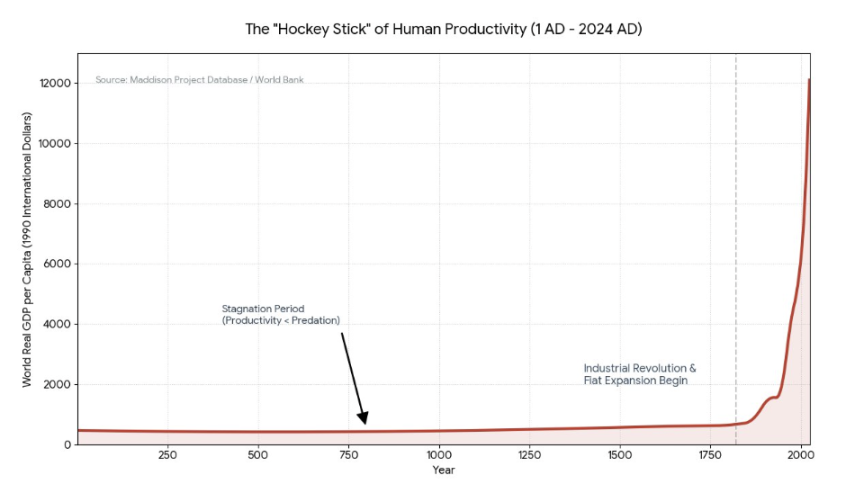

For thousands of years before the 19th century, human civilization saw extremely slow technological progress, yet social structures, power hierarchies, and population reproduction remained highly stable. It wasn't until the 19th century that large-scale productivity explosions and the rise of the middle class emerged during the gold standard era. But this was not a purely technological miracle; it was highly synchronized with the credit expansion of the transition from the gold standard to the fiat system.

This illustrates two truths:

- The Underlying Color of Technological Explosion: The so-called technological explosion largely stems from financial leverage overdrawing the future.

- The Non-essential Nature of Development: Development is far from a rigid necessity for human civilization. Even if financial leverage breaks, humanity would simply revert to its long-term norm—a low-efficiency but extremely stable "long-cycle equilibrium."

Plundering is the Norm, Production is the Premium

If you are familiar with the first principle of thermodynamics, "production" is essentially entropy reduction (transforming disordered resources into ordered wealth through technological means), which requires consuming enormous energy and information; whereas "plundering" is essentially energy transfer (directly acquiring others' ordered wealth through violence or contracts).

Plundering is far more efficient than production. The so-called "progress" of the past two centuries is essentially a strategic optimization of the fiat system: interest groups discovered that instead of directly seizing existing wealth, it's better to induce all of humanity into a "productivity race" through money printing, thereby creating a larger plunderable base.

When AI Productivity Threatens the Plunder Protocol

If AI cannot serve the core goal of "amplifying the plunderable base," then AI can absolutely be allowed to fail:

- Threat to Public Finance: If AI leads to extreme deflation (extremely low prices, devalued labor), sovereign state finances operating on "inflation and debt" would go completely bankrupt—because heavy debts must be diluted by devalued currency.

- Threat to Power: If AI makes individuals too powerful, enabling them to detach from centralized distribution systems, the chains of power would become ineffective.

When the excess of "production" threatens the foundation of "plundering," interest groups will have ample motivation to let the AI revolution fail, or be indefinitely delayed.

The Debt Clock and Ultimate Zero-Sum

Current global debt has reached over 3 times global GDP. This means that AI's boost to productivity (TFP growth rate) must reach an unprecedented exponential level just to barely offset the疯狂 growth of debt interest.

However, facing AI, the traditional logic of "war-induced clearing" has become ineffective.

- Change in Asset Nature: Core assets are no longer land and factories, but fragile and invisible algorithms, computing power, and data.

- Winner-Takes-All Prisoner's Dilemma: In the past, after wars determined winners and losers, the victor established order (e.g., the Bretton Woods system), and the defeated joined the system, producing together under new productivity standards. With AI, it's "winner-takes-all"—once a country achieves a generational lead in AGI, other countries, even the vast majority of the population, may become unnecessary.

Therefore, countries would rather choose inefficient "sovereign fragmentation" than accept the high-risk "intelligence dependence."

Ultimately, whether from an individual or a ruler's perspective, there is a tendency to delay the arrival of AI's complete form:

- For Individuals: Any sovereign-less AGI accessible to individuals could mean "loss of property rights" and a dark future of infinite harvesting.

- For Regimes: Unless they can find a "new protocol" that can maintain rule and repay debts even in a deflationary environment, they absolutely do not wish for AI productivity to be rapidly unleashed.

Betting on AI's "Death"—What Are You Really Betting On?

Essentially, you are betting on three things:

1. Shorting the Race Between "Exponentially Growing Credit" and "Linearly Growing Productivity"

The essence of the fiat system is debt. To sustain this system, nominal GDP growth must outpace debt interest in the long run. If the productivity boost from AI cannot lift GDP to exponential levels, the result is the death of the monetary system, replaced by non-sovereign commodities.

2. Going Long on Hard Assets and Anti-fragile Assets

Going Long: Gold, Bitcoin, scarce minerals, energy infrastructure—these physical and mathematically "entropy-reducing assets."

Going Short: Long-term sovereign bonds, paper contracts, social welfare promises—these credit assets based on future taxation.

3. Shorting Organizational Efficiency

Even if AI produces technology, human political organization, distribution systems, and bureaucratic structures will hinder the conversion of these technologies into actual tax revenue and economic growth, thus failing to fill the debt black hole.

In summary, what ultimately determines whether you place a bet is your answer to this question:

Is money printed faster, or is GDP from AI-produced goods faster?

Betting on AI losing is betting on physical laws and debt mathematics; betting on AI winning is betting on technological singularity and the luck of human evolution.

For now, the speed of the money printer (M2) remains a resistance level that AI temporarily cannot surpass.

Conclusion

Given the current situation, most of us may not live to see the day of official retirement age, or rather, before that, most of us will have already become economically irrelevant.

Since the long-term future's promise to each individual has been extinguished, then enter the fray now and join the great macro game.

Note: The title is just a ragebait. I don't really care if AI lives or dies. But if you've read this far, then I've succeeded.