Who Is Secretly Accumulating 100 Million LINK?

- Core Insight: On-chain analysis has identified an unknown entity that secretly accumulated approximately 100 million LINK (10% of its total supply) through 48 anonymous wallets between August 2025 and January 2026. The highly coordinated operations, designed to avoid market volatility, suggest a strategic accumulation likely conducted by a large institution.

- Key Elements:

- All 48 wallets were found to hold roughly 2 million LINK each, exhibiting highly consistent transaction patterns. All purchases originated from the same Coinbase hot wallet address, indicating control by a single entity.

- The accumulation strategy leveraged the high-liquidity window following the market crash on October 10, 2025. Thirty-nine wallets were created during this period, allowing for substantial purchases in a low-key manner without significantly driving up the price.

- The accumulation scale reached 10% of the total supply (100 million tokens), and the operation demonstrated institutional-grade sophistication, ruling out the possibility of speculative action by a high-net-worth individual.

- Analysis speculates that large traditional financial institutions like BlackRock or JPMorgan Chase are potential behind-the-scenes entities, as their development strategies in tokenization align with the motivation to hold LINK as a strategic reserve for infrastructure.

- This large-scale accumulation may signal LINK's critical application in future financial infrastructure and could have a significant market impact due to potential follow-on institutional purchases or risks associated with concentrated holdings.

Original Author: LinkBoi

Original Compilation: AididiaoJP, Foresight News

Based on in-depth on-chain data analysis, while studying the top 100 wallets by LINK holdings, I discovered an unusual pattern.

Multiple wallets hold almost identical amounts of LINK, each around 2 million tokens, and hold no other assets. Initially, I identified 8 to 9 similar wallets, but further investigation revealed these were just the tip of the iceberg.

Ultimately, I found a total of 48 wallets with nearly identical LINK balances and highly consistent transaction patterns. Based on this consistency, I believe they are controlled by the same entity.

In other words, between August 2025 and January 2026, an entity cumulatively acquired approximately 100 million LINK, accounting for 10% of its total supply.

Clearly, this entity is making great efforts to remain hidden. Its accumulation strategy was meticulously designed to avoid drawing attention or impacting market prices.

Why Conclude These Wallets Belong to the Same Entity?

Several key pieces of evidence support this:

- Each wallet holds approximately 2 million LINK.

- All wallets were created between August and November 2025.

- All purchases originated from the same Coinbase hot wallet address: 0xA9D1e08C7793af67e9d92fe308d5697FB81d3E43.

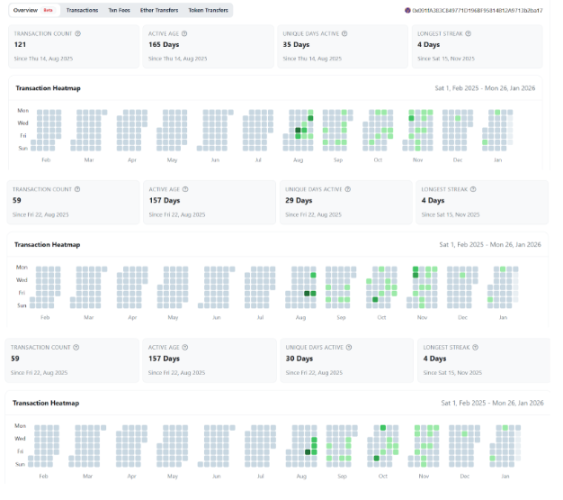

The most compelling evidence is the transaction heatmap comparison. The heatmaps of these wallets are strikingly similar, executing similar quantities of LINK transactions on the same dates, following the same accumulation rhythm.

There are slight timing differences: wallets created later made larger initial purchases, while earlier ones were more gradual. But after the initial phase, all wallets began consistently buying on the same dates each month.

For example, observing wallets 54, 55, and 56, the August data shows slight variations, but transaction behavior from September to January is almost perfectly synchronized. This pattern repeats across all 48 wallets, as if operating on the same schedule.

The link showsthese 48 walletsand their transaction heatmaps for readers to verify themselves.

Why Did the Market Show No Reaction to the 10% Supply Accumulation?

The answer is simple: the entity worked hard to avoid disturbing the market.

They used anonymous wallets with no public institutional affiliations and structured their purchases in batches to avoid sudden demand spikes. The goal was clear: accumulate LINK discreetly without triggering market follow-on or speculation.

To achieve this, they capitalized on a rare market event.

The Market Crash of October 10th

According to Raoul Pal, market makers were unable to access APIs at the time, causing severe imbalance in the crypto market. Simultaneously, tariff concerns triggered panic selling, flooding order books with sell orders. With a lack of buyers to absorb them, the market experienced a free-fall.

To prevent a complete collapse, exchanges were forced to intervene, placing large buy orders to absorb the selling pressure, thereby accumulating significant crypto asset inventories.

In the weeks following the crash, these assets were gradually released back into the market throughout October and November, creating sustained selling pressure and abnormally abundant liquidity.

This was the perfect timing for stealth accumulation.

The entity behind these wallets used this liquidity window to absorb large amounts of LINK while avoiding price increases. Notably, 39 out of the 48 wallets were created precisely in October and November, the period of highest liquidity.

Two Possible Motivations

One is opportunistic accelerated accumulation. The entity viewed the market crash as a rare chance to speed up its accumulation timeline, a process that might otherwise have taken several more months.

The other is an urgent strategic reserve. The entity may have had an urgent need to acquire LINK and used the crash-induced liquidity to discreetly build its position, avoiding price volatility. Whether this urgency stemmed from strategic needs or external pressure remains unclear.

Impact on Exchange Balances

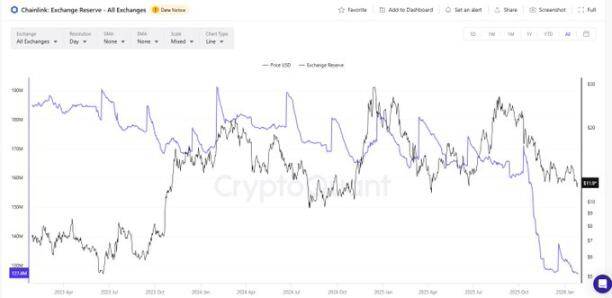

The buying spree from the new wallets closely coincides with the sharp drop in LINK balances on exchanges from October to November, as shown by CryptoQuant data.

This decline corresponds exactly to the creation of 39 new wallets, each accumulating approximately 2 million LINK during this period.

Who Could Be the Entity Behind This?

The pool of possibilities for accumulating 10% of LINK's supply is significantly narrowed.

Chainlink Labs

Less likely. Chainlink officially holds around 300 million LINK as non-circulating supply, which is publicly labeled and accounted for in planning. Furthermore, Chainlink has publicly announced weekly $1 million LINK buybacks; secretly hoarding nearly $1 billion worth of LINK simultaneously would contradict its public stance.

However, the timing is noteworthy: accumulation began on August 11, 2025, just 4 days after Chainlink announced its reserve mechanism, which could have signaled long-term confidence to the outside world.

BlackRock

This is one of the more plausible speculations. With $14 trillion in assets under management, BlackRock has repeatedly stated that tokenization is the future of financial markets. Its $3+ billion BUIDL fund heavily relies on Chainlink's CCIP, Proof of Reserve, and data services.

Holding 100 million LINK could help it secure a strategic position in tokenization infrastructure. Relative to its size, this allocation is small but significant. Secret accumulation also makes sense; announcing a large purchase upfront would likely have significantly driven up the price.

JPMorgan Chase

Also a strong possibility. This trillion-dollar asset bank is rapidly expanding its blockchain division (Kinexys, formerly Onyx) and has become one of the most active traditional institutions in tokenized assets and cross-chain finance.

Its tokenized money market, fund flow projects, and multiple public chain settlements in 2025 all rely on Chainlink's CCIP, runtime environment, and oracle data streams. Holding 100 million LINK could help establish a strategic position in interoperability and oracle infrastructure between its permissioned chains and public chains, ensuring priority access, staking rewards, and reducing dependency risk.

Interestingly, JPMorgan's actions around the October 10th crash are worth pondering. Just days before the crash, the bank issued a bearish report highlighting the vulnerability of crypto-related stocks amid geopolitical risks. Although the crash was primarily driven by external factors, the coincidence of a bearish report followed by a liquidity vacuum raises speculation that a large institution might have used the opportunity to discreetly build a position.

Financial Infrastructure Institutions (e.g., DTCC, SWIFT)

Less likely. Such institutions typically do not hold strategic token reserves. More importantly, if Chainlink were to become a core part of their future infrastructure, DTCC or SWIFT would be unlikely to tolerate an unknown entity controlling 10% of LINK's supply—this would pose an unacceptable systemic risk.

Another detail is worth noting:

All 48 wallets were created between August and November 2025, with the last one established on November 20th—just two days before SWIFT's activation of the new ISO 20022 standard, a project in which Chainlink is a participant.

While the timing coincidence is not causal evidence, it is hard to ignore. If LINK is to play a significant role in future financial communication, settlement, or interoperability infrastructure, establishing a strategic reserve beforehand is a reasonable long-term move.

For institutions aiming for long-term integration rather than short-term speculation, locking in supply early reduces execution risk, mitigates price impact, and lessens dependence on future market liquidity.

High-Net-Worth Individual

Extremely unlikely. 100 million LINK is worth over $1 billion. The number of individuals capable of mobilizing capital of this magnitude is very small, and concentrating it into a single crypto asset without a clear strategic purpose is even rarer.

My View

I believe this is almost certainly the work of a large institution. Without deep market knowledge and institutional-grade execution capabilities, accumulating 10% of the supply without moving the price would be impossible.

The intensified buying during the high-liquidity period following the October 10th crash particularly points to institutional behavior. They understood that high liquidity allowed frequent purchases without driving up the price. This level of coordination is far beyond the capability of an average individual investor.

It is also noteworthy that the accumulated amount is exactly 100 million LINK, precisely one-tenth of the total supply. This indicates the scale was intentionally set, not randomly accumulated, reflecting a long-term strategic intent for the project.

Accumulating 100 million LINK is unlikely to be solely for speculative purposes. It suggests potential future utility for the token. The entity appears to be preparing for a future where Chainlink underpins critical financial infrastructure and is building a reserve accordingly.

Until the entity's identity is revealed, uncertainty remains. However, the fact that a single entity may have accumulated 10% of LINK's supply for future use is itself significantly bullish.

What Happens Next?

If the buyer is a large institution, the subsequent impact could be very positive. Other asset managers and infrastructure providers might scramble to build their own LINK reserves, but replicating this slow, stealthy accumulation process is nearly impossible. Latecomers may be forced to buy at higher prices, significantly pushing up the price.

Simultaneously, concentration risk cannot be ignored. Controlling 10% of the supply implies significant influence, and with the entity's intentions unknown, its future actions remain a key variable.

The following points are clear:

- This accumulation is real.

- Its strategy is highly sophisticated.

- The scale involved is extraordinary.

Whether this is early positioning by a large institution or something else, it is one of the most noteworthy on-chain patterns in LINK's history.