Reviewing Arthur Hayes' 2025: All Hype Calls Ultimately Lead to Profit-Taking

- Core Viewpoint: The article reviews Arthur Hayes' market operations in 2025, revealing the essence of a top trader's "actions not matching words." He leverages public hype calls to attract liquidity while simultaneously executing cool, even ruthless, on-chain trades (such as selling at highs, rotating positions) to profit or hedge risks. His loyalty lies with market volatility, not with any specific project.

- Key Elements:

- For projects where he held early allocations (e.g., HYPE, ETHFI), he employed a "publicly hype, privately dump" strategy. After using his influence to hype the tokens at high prices, he liquidated his holdings for profit when liquidity was ample or during token unlocks.

- Attempts to "revive" outdated narratives (e.g., BIO in the DeSci sector, WILD in the metaverse concept) met with failure, resulting in significant losses on related investments, demonstrating that his influence is not omnipotent.

- He generated market attention by loudly hyping ZEC and calling for withdrawals, while secretly selling transparent assets like ETH to acquire ZEC. This completed a position rotation and ultimately allowed him to relatively exit the top compared to the worse-performing ETH.

- His operational logic shows that Ethereum plays the role of a "capital reserve" in his portfolio, which can be sold as needed to chase new narratives or bottom-fish other assets.

- The article's core advice is to focus on his actual on-chain trading behavior rather than his public statements, as his exploitation of market "volatility" takes precedence over any project belief.

Original Author: angelilu, Foresight News

Looking back at the past year of 2025, Arthur Hayes remains the big winner who evokes both admiration and frustration.

As the founder of BitMEX and arguably the most prolific crypto KOL when it comes to writing "essays," every one of his "calls" in 2025 managed to stir up retail trading enthusiasm. However, looking back at 2025, you might suddenly realize that if you had jumped in every time he made a call, the result would be that he profited, while you lost.

On Twitter, he loudly proclaimed "Bitcoin to one million dollars" and "ETH surging to $10,000," but on-chain, Arthur Hayes would always inadvertently sell assets he once touted. If we lay out all his operations from last year, you'll see the extremely calm, even cold-blooded, trading record of a top-tier trader.

We can break down his operations into three categories.

VC Tokens: "Publicly Promote, Privately Dump"

Hayes's most controversial operations usually involve projects where he holds early-stage allocations. This is essentially an uneven game: perhaps he's already made a 10x profit selling at $50, while your losses are just beginning when you buy at $60.

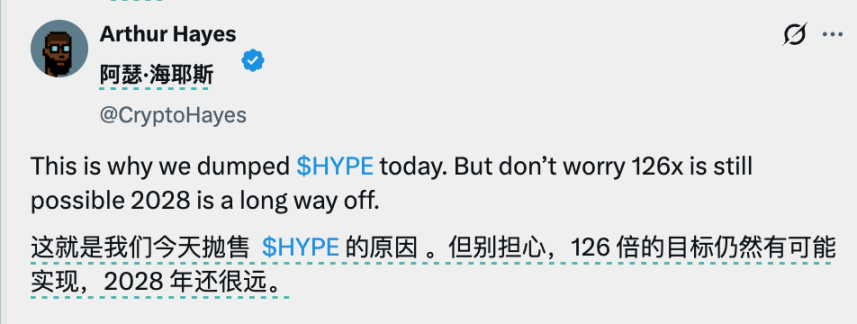

The most classic script played out with Hyperliquid (HYPE). As an early investor with extremely low-cost tokens, his operational logic is brutally simple:

Step one: Use his influence to promote the token at high prices, constructing a grand narrative (e.g., "HYPE 100x in three years").

Step two: Once tokens unlock or liquidity is sufficient, decisively exit the position.

For example, in August last year, Hayes predicted at a Tokyo conference that HYPE would see 100x growth and made a high-profile purchase. Just one month later, he liquidated his position before HYPE's price dropped, profiting millions of dollars, citing the reason as "avoiding unlock risks."

However, HYPE wasn't completely abandoned. In mid-January 2026, Hayes purchased approximately $499,000 worth of HYPE again after a three-month hiatus.

The same story repeated itself with tokens like ETHFI and ATH, which followed similar scripts.

But think about it: if you were Arthur Hayes, what would you do? To achieve profits with large capital, this seems like the standard playbook: first, present a market analysis convincing enough to persuade listeners; when believers flock in, the market naturally validates his prophecy.

For whales, the only window to quietly exit is precisely when the crowd is most fervent and liquidity is at its peak.

The "Old Narratives" He Couldn't Revive

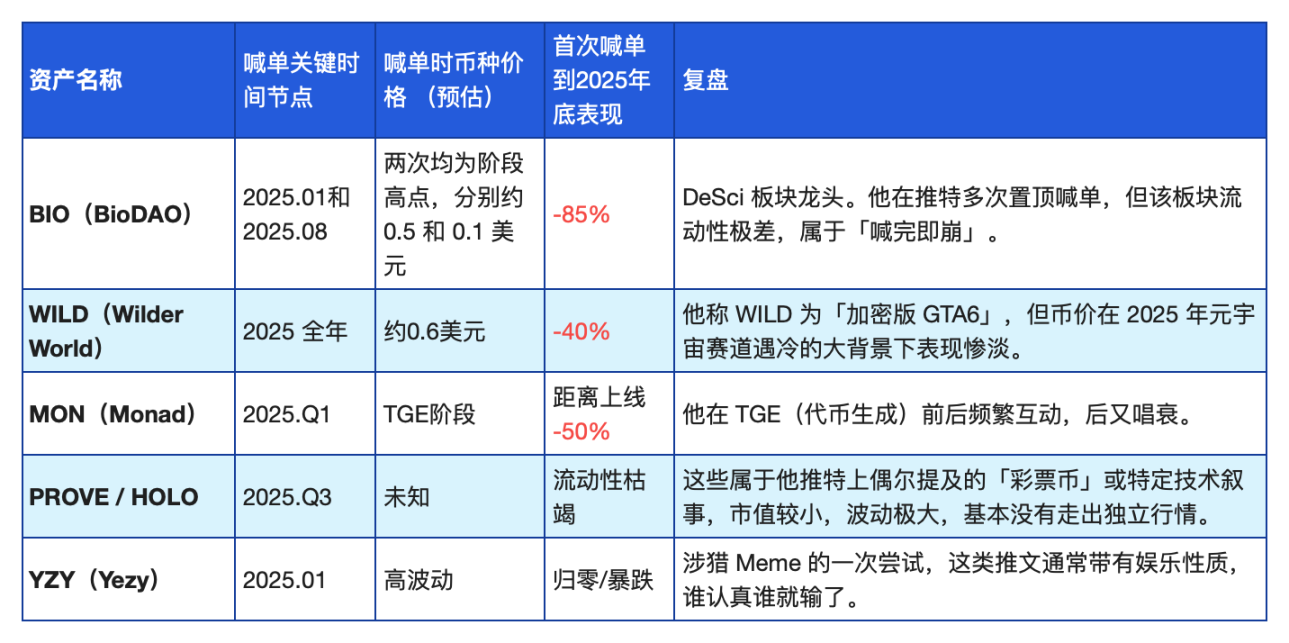

After reviewing Hayes's successful promotional narratives, we find that Hayes also has his misses. This is especially true when he tries to "revive" some old or niche sectors.

In early 2025, his family fund Maelstrom published a long and profound article titled "Degen DeSci," expressing strong optimism for the DeSci (Decentralized Science) sector. He listed a portfolio including BIO, GROW, and others...

The results are clear for all to see: the DeSci sector almost completely collapsed, with many tokens down over 85% from their highs. Hayes built a position of $1.1 million worth of BIO again in August and ultimately deposited 7.66 million BIO into Binance in late November, potentially incurring a loss of $640,000 (-58%).

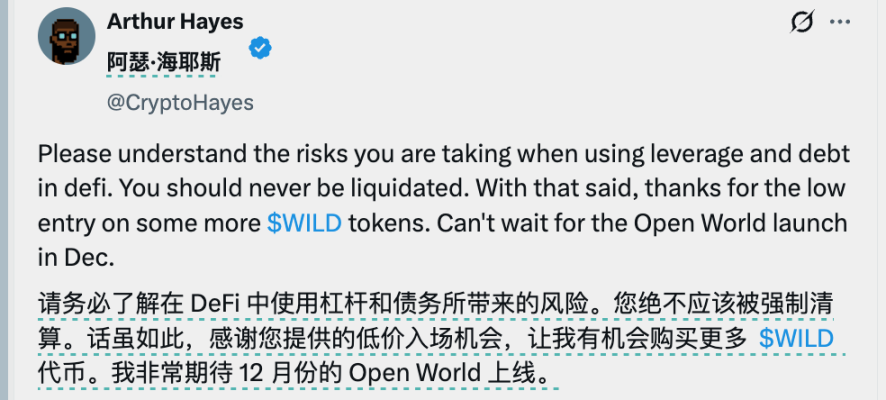

Then there's Wilder World (WILD), which he called the "crypto version of GTA6." He promoted it all year, only for its price to sink along with the metaverse concept.

Most of the tokens Hayes promotes have some degree of hype at a specific stage. A summary is shown in the chart below:

The "Smokescreen" of ZEC

This might be Hayes's most brilliant and intriguing operation of 2025.

On the surface, Hayes fervently promoted Zcash (ZEC). He claimed that after hearing advice from Silicon Valley heavyweight Naval at a private dinner during Token 2049, he immediately bought millions of dollars worth. In November last year, he shouted the slogan "target $10,000."

Hayes even initiated a withdrawal movement, urging everyone to withdraw their tokens to the chain to lock up liquidity.

Many watched his wallet to see if he was secretly selling ZEC. The result: he didn't sell; he was even accumulating more.

Perhaps the real purpose of Hayes creating this ZEC frenzy was: to sell ETH and swap it for whatever was rising fast at the time.

Hayes had actually taken a few "swipes" at ETH before this. Although he loudly proclaimed in 2025 that ETH would rise to $10,000, he experienced several "flip-flops" in between. He sold approximately $13.34 million worth of ETH and other tokens on August 2nd but expressed regret about taking profits on August 9th, saying he had to buy back in.

On November 15, 2025, precisely when he was heavily promoting ZEC, Lookonchain monitored him transferring millions of dollars worth of ETH and ENA to Binance. On the same day, Hayes publicly declared on Twitter that he had "Aped more ZEC." On-chain analyst EmberCN also pointed out that the funds from this sale were highly likely used as "ammunition" for accumulating more ZEC.

Due to ZEC's privacy features, his transparent ETH holdings were sold and replaced with opaque assets. On-chain, we can only see him "exiting" (selling ETH) but cannot quantify the scale of his "entry" (buying ZEC).

However, in the final two weeks of 2025, Hayes sold another 1,871 ETH (approximately $5.53 million) and used the proceeds to buy back the DeFi assets he had abandoned a month earlier.

This is a very cold-blooded signal: in his logic, Ethereum is the "cash reserve" in his investment portfolio. He sells it when he needs money to buy new narratives (ZEC), and he sells it when he needs money to bottom-fish old sectors (DeFi).

In the end, you realize he used ZEC's price surge to attract the entire market's attention, then quietly completed his portfolio rotation while everyone was discussing the "privacy renaissance." It wasn't until early 2026, when ZEC plummeted due to internal team conflicts, that everyone discovered Hayes, although his holdings shrank, successfully exited the top of ETH, which performed worse during that phase.

How to Understand Arthur Hayes?

After reviewing this year, you'll find Hayes is exactly as written in his X profile background picture: he is not a "believer" HODLer but an extremely shrewd businessman.

He uses words to build dreams to attract liquidity; he uses on-chain operations to harvest profits to mitigate risks; he dares to quickly admit mistakes when he's wrong (like abandoning ETH) to preserve capital.

Therefore, his articles are still worth reading because his macro judgments have been validated. But before you press the "buy" button, take one extra step: don't just listen to what he says; go see what his on-chain wallet is doing.

After all, in this brutal market, his loyalty to "volatility" far exceeds his faith in any single project. And volatility is precisely the money transferred from the pockets of retail traders to the pockets of traders.