The Big Year for Crypto IPOs: The Path to Public Markets for "Pick-and-Shovel" Players

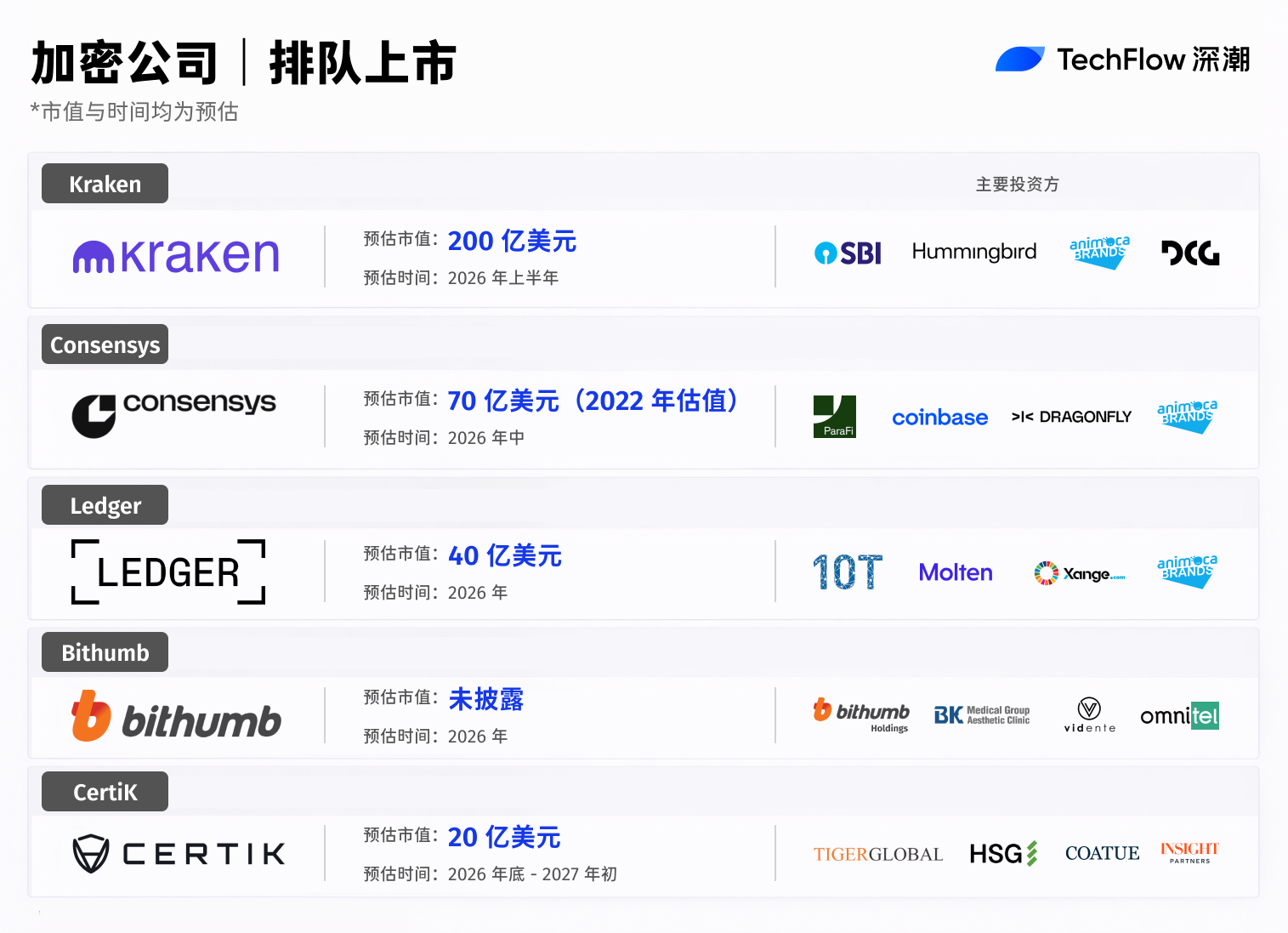

- Core Viewpoint: Multiple core crypto infrastructure companies are queuing up for IPOs in 2026, reflecting Wall Street's recognition of compliant crypto businesses. However, each company faces different risks and challenges, and after going public, they will still need to prove their long-term value as financial infrastructure to the market.

- Key Elements:

- Kraken: As a compliance benchmark, it is expected to go public in the first half of 2026 with a valuation of $20 billion. Its Q3 2025 revenue was $648 million, and it has received investments from traditional market makers like Citadel.

- Consensys: A core service provider in the Ethereum ecosystem, with products like MetaMask, plans to go public in mid-2026. However, it needs to reconcile potential conflicts between its token (MASK) and shareholder interests.

- Ledger: The leading hardware wallet company is transitioning to software services, targeting a valuation exceeding $4 billion. Its growth depends on its ability to lower the barrier to entry for self-custody products.

- Bithumb: South Korea's second-largest exchange is seeking to go public in 2026, primarily to rebuild market trust, but its historical governance issues are a key risk.

- CertiK: A top security auditing firm plans an IPO, with its valuation once reaching $2 billion. However, its past controversial incidents (such as the dispute with Kraken) may affect investor trust.

- Industry Background: A warming regulatory environment (e.g., the SEC dropping lawsuits) and pressure from private market capital structures are jointly driving this wave of crypto company listings.

Original Author: David, TechFlow

In 2025, crypto companies raised $3.4 billion in the U.S. stock market.

Circle and Bullish each raised over $1 billion, and Gemini surged 14% on its Nasdaq debut. By January 2026, BitGo rang the opening bell on the NYSE, jumping 24.6% on its first day with a market cap of $2.6 billion.

These pioneers proved one thing: Wall Street is willing to pay for compliant crypto infrastructure.

The pipeline for 2026 is even thicker. Kraken, Consensys, and Ledger are all queuing up for IPOs, with valuations ranging from billions to $20 billion. Even the security auditing firm CertiK announced its IPO plans at Davos.

Exchanges, wallets, custody, security... the "water sellers" of the crypto industry are collectively heading to the public markets.

When will these companies go public, what are their valuations, and what are the risks? Let's look at them one by one.

1. Kraken, The $20 Billion Compliance Case Study

Estimated Market Cap: $20 billion

Estimated Timeline: First half of 2026

Kraken is one of the oldest crypto exchanges, founded in 2011, a year earlier than Coinbase. However, its IPO is coming five years later than Coinbase's. During this gap, it faced an SEC lawsuit, settlement negotiations, and business restructuring, ultimately securing a dismissal from the SEC in March 2025.

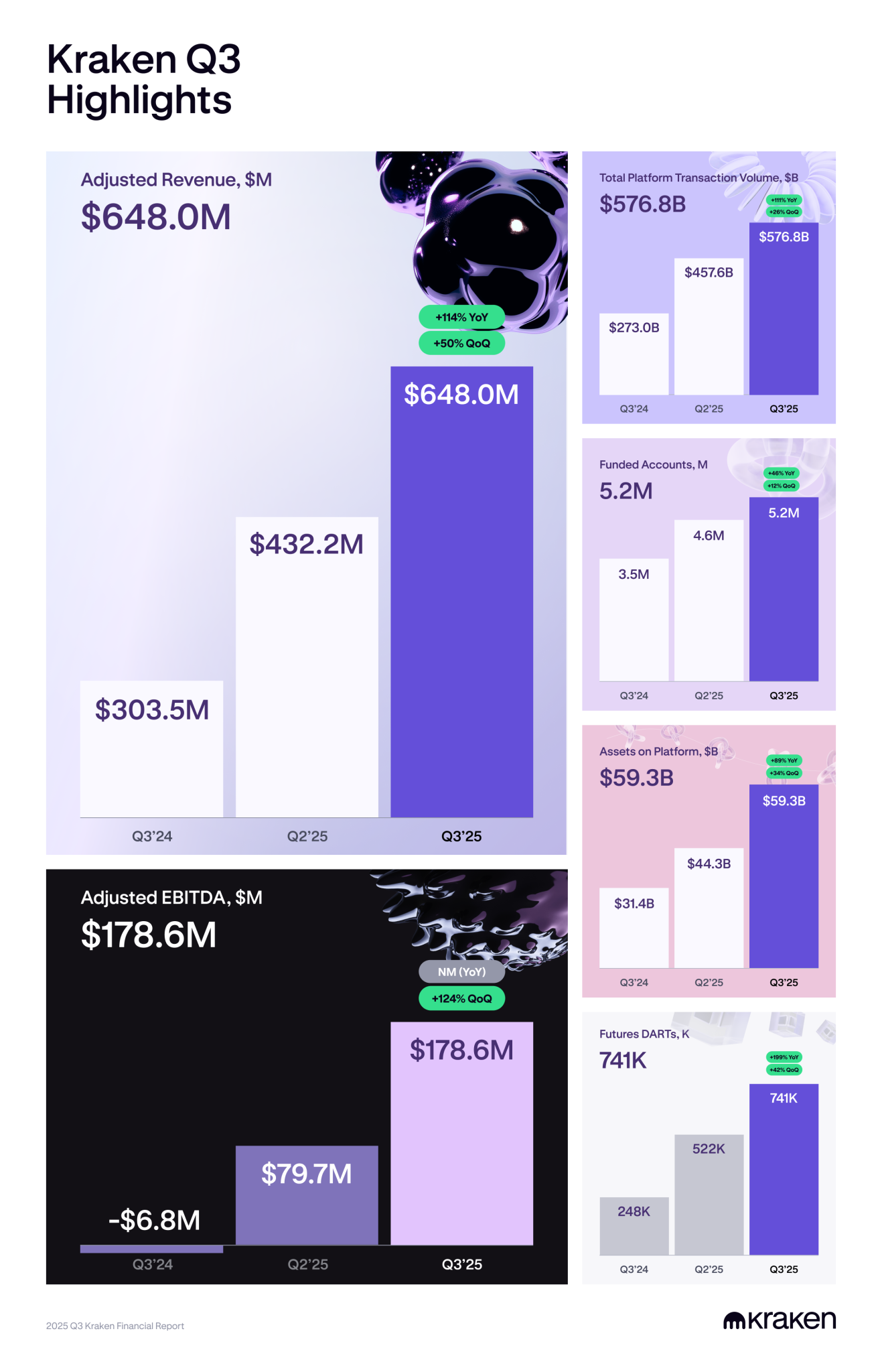

Its financials are solid:

2024 revenue was $1.5 billion, with adjusted EBITDA exceeding $400 million. In Q3 2025, single-quarter revenue hit $648 million, a 50% year-over-year increase. Assets under management on the platform reached $59.3 billion, with quarterly trading volume of $576.8 billion.

In November 2025, Kraken completed an $800 million pre-IPO funding round at a $20 billion valuation. The investor list included Citadel Securities, Jane Street, and DRW. The entry of these top traditional finance market makers signals their bet that crypto exchanges will become part of financial infrastructure.

In the same month, Kraken confidentially filed its S-1, targeting a public listing in the first half of 2026.

If successful, it will become the second major crypto exchange to list on U.S. stock markets after Coinbase, and the first company to complete the full IPO process in the "post-Gensler era."

2. Consensys, MetaMask's Parent Company Wants to Go Public

Estimated Market Cap: $7 billion (2022 valuation)

Estimated Timeline: Mid-2026

Consensys owns some of the most valuable products in crypto: the MetaMask wallet with 30 million monthly active users, the Infura node service underpinning most Ethereum dApps, and the Linea L2 network. It is the "plumber" of the Ethereum ecosystem, with almost every developer using its tools.

Founded by Ethereum co-founder Joseph Lubin, the company was valued at $7 billion in a $450 million funding round in 2022. It is now working with J.P. Morgan and Goldman Sachs to prepare for an IPO, targeting mid-2026.

The prospectus is expected to highlight revenue from MetaMask Swaps. This feature allows users to trade tokens directly within the wallet, charging a 0.875% fee per transaction. In 2025, MetaMask also added native Bitcoin support, expanding from a pure EVM wallet to a multi-chain wallet, attempting to keep users within its ecosystem.

The suspense around Consensys' IPO lies in its simultaneous work on the MASK token and the IPO. How will these be coordinated? Could the interests of token holders and shareholders conflict? This issue may become a new case study in crypto company governance.

3. Ledger, The Hardware Wallet with a Software Story

Estimated Market Cap: $4 billion

Estimated Timeline: 2026

Ledger has sold over 6 million hardware wallets, safeguarding more than $100 billion worth of Bitcoin for users. But it doesn't want to be just a "device seller."

For the past two years, CEO Pascal Gauthier has frequently appeared in New York. The story he tells investors is: Ledger aims to become the "Apple of self-custody."

The key to this transformation is Ledger Live, an application that integrates hardware wallets, software wallets, staking, and DeFi interactions. The goal is to shift from selling hardware to selling subscription services, moving from one-time revenue to recurring revenue.

Wall Street is buying this story.

On January 23, the Financial Times reported that Ledger is in talks with Goldman Sachs, Jefferies, and Barclays for a NYSE IPO, targeting a valuation exceeding $4 billion. This is nearly triple its $1.5 billion valuation in 2023.

This valuation is supported by performance.

The company's revenue reached hundreds of millions of dollars in 2025, which Gauthier called a "record year." After the FTX collapse, the phrase "Not your keys, not your coins" regained popularity, driving both institutions and retail towards self-custody.

Last year, the crypto industry saw a record $17 billion in thefts, which ironically became a selling point for Ledger.

However, hardware wallets are still too difficult for the average person to use. Ledger's growth ceiling depends on its ability to lower this barrier.

4. Bithumb, The Korean Veteran's Comeback Fight

Estimated Market Cap: Undisclosed

Estimated Timeline: 2026

Listing Venue: South Korea's KOSDAQ (also considered Nasdaq)

Bithumb was once South Korea's largest exchange before being overtaken by Upbit. Now Upbit holds over 80% of the Korean market, while Bithumb has only 15% to 20%.

In 2024, Bithumb launched a zero-fee campaign, boosting its market share back to around 25%. This was a battle of burning cash for users, likely to build momentum for its IPO.

Samsung Securities is the underwriter. The original plan was to list on South Korea's KOSDAQ in the second half of 2025, with Nasdaq also considered. Currently, the timeline appears delayed to 2026.

However, Bithumb states this IPO is not for fundraising. The company holds over 400 billion won (approximately $300 million) in financial assets and is not short on cash. The purpose of the listing is to "build market trust" by subjecting internal governance and finances to public audit.

This statement comes against a backdrop of continuous troubles for Bithumb in recent years.

In 2023, it was raided by the Korean tax authority on suspicion of fraudulent trading. Several executives were investigated for alleged listing bribes, and former CEO Lee Sang-jun stepped down. A service outage in 2017 led to a six-year lawsuit, resulting in a court order to compensate users.

For the IPO, the company made personnel changes. Former Chairman Lee Jung-hoon returned to the board; he was previously acquitted of fraud charges related to an acquisition. The new CEO is his close associate.

South Korea has 18 million crypto users, with daily trading volume often exceeding that of the stock market.

Bithumb's IPO is a signal of the institutionalization of the Korean crypto market. However, given its historical baggage, investors will scrutinize its governance issues.

5. CertiK, The Controversial Leader in Security Audits

Estimated Market Cap: $2 billion

Estimated Timeline: Late 2026 - Early 2027

On January 23 at the Davos Forum, CertiK CEO Ronghui Gu announced the company is advancing its IPO plans.

This is the largest security auditing firm in crypto, founded in 2018, headquartered in New York, serving over 5,000 clients, with audited code protecting assets worth approximately $600 billion.

Its investor list is indeed impressive: Binance is the earliest and largest financial backer, with SoftBank Vision Fund, Tiger Global, Sequoia, and Goldman Sachs also on board. Its valuation reached $2 billion during its Series B3 funding round in 2022.

But CertiK is also one of the most controversial companies in crypto.

Last year's Kraken incident was significant. CertiK discovered a vulnerability in Kraken that could credit accounts arbitrarily and transferred about $3 million during testing. CertiK called it a "white hat operation"; Kraken called it extortion. The public spat damaged CertiK's reputation, though the funds were eventually returned.

Earlier, CertiK also audited Cambodia's Huione Guarantee platform. This platform was used for money laundering, selling hacking tools and personal data, and even selling stun guns to scam compounds in Southeast Asia. CertiK later apologized, but the incident highlighted risk control issues within the security company itself.

Ronghui Gu said the IPO is the "natural next step for the continued expansion of our products and technology."

But once the IPO prospectus is public, these controversies will be repeatedly questioned by investors. Whether CertiK can rebuild trust is its biggest challenge on the path to listing.

Overall, the clustering of crypto company IPOs in 2026 is likely not a coincidence.

The regulatory environment is changing. SEC Chair Gensler is gone; the new chair is more crypto-friendly, with lawsuits against Kraken and Consensys dropped. The window of opportunity is open, and everyone is rushing in.

Capital structures have also reached their limits. These companies have raised many rounds in the private market, with an increasing number of shareholders and employee options becoming harder to liquidate. Coinbase has been public for five years, proving crypto companies can survive in public markets. Those in line have no reason to wait further.

However, for ordinary investors, this batch of IPOs requires differentiation.

Kraken and Ledger have real revenue and clear business models; Consensys has the gateway product MetaMask but is simultaneously working on a token, with the relationship between shareholders and token holders not yet clarified. CertiK has brand recognition but also controversy, while Bithumb is a purely Korean domestic story.

When you can buy, first understand what you're buying.

For the companies, going public is just the beginning.

Whether they can stand firm in the public market depends on their ability to shift the label from "crypto" to "financial infrastructure." It took Coinbase five years to convince Wall Street it wasn't just a trading platform.

For those following, the road ahead is still long.