The Ultimate Guide to Perp DEX Airdrops in 2026

- Core Insight: The competitive focus for Perpetual Decentralized Exchanges (Perp DEXs) in 2026 has shifted from technology to incentives. Airdrops and points programs have become the core means of attracting users and liquidity, providing participants with opportunities to earn rewards through strategic trading.

- Key Elements:

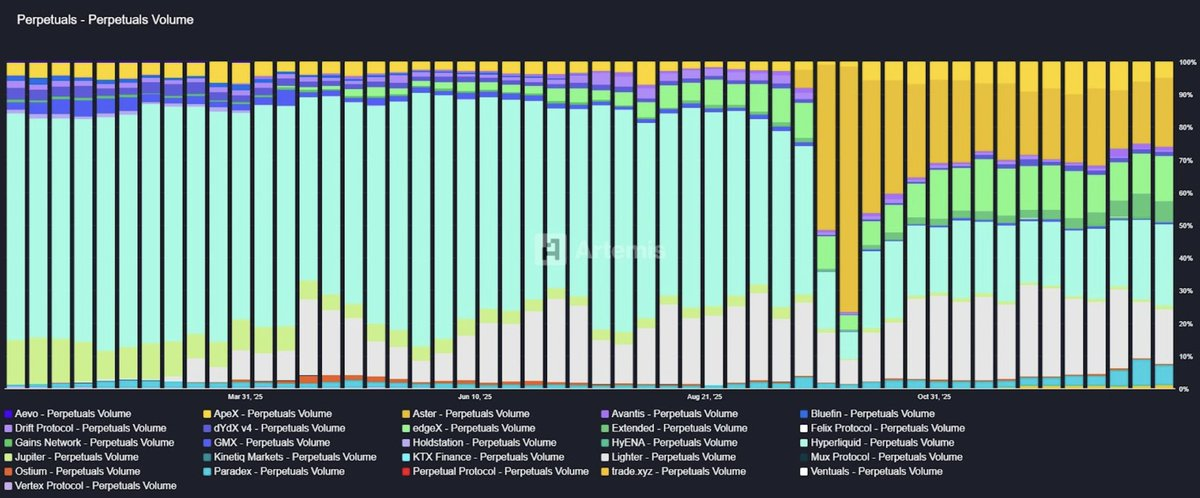

- Significant Industry Growth: The trading volume in the Perp DEX sector grew from $647.6 billion in 2023 to over $1.2 trillion in 2025, with its market share rising to 26% during the market crash in October 2025.

- Changing Competitive Landscape: Hyperliquid's market share dropped from over 70% to around 20%, while emerging platforms like Variational pose a substantial threat through incentives such as airdrops, points programs, and even refunds for trading losses.

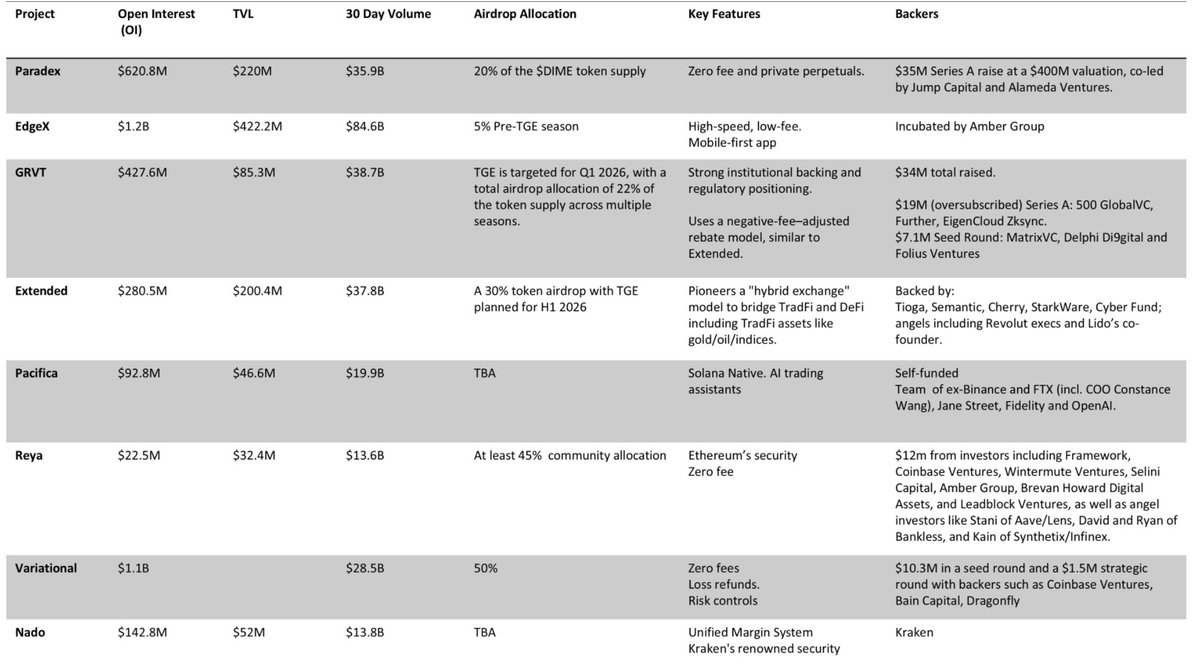

- Key Platform Selection: Based on data such as trading volume and open interest, the article lists 8 Perp DEXs with active points programs, including Paradex, edgeX, GRVT, Extended, Pacifica, Reya, Variational, and Nado.

- Core Participation Strategy: Introduces the funding rate arbitrage strategy. By simultaneously opening equal-sized long and short positions on different DEXs, one can hedge price risk while capturing funding rate profits and accumulating trading volume to earn points.

- Strategy Risks and Tools: This strategy requires guarding against liquidation and negative funding rate risks. Tools like @LorisTools and @fundingviewapp can be used to aggregate information, discover opportunities, or automate operations.

Original Author: Stacy Muur

Original Compilation: TechFlow

Introduction: With the massive success of Hyperliquid, the perpetual contract decentralized exchange (Perp DEX) sector has entered a phase of intense competition. The crypto market experienced significant volatility in 2025, yet the trading volume in this sector surpassed $1.2 trillion.

This article, written by senior researcher Stacy Muur, systematically outlines the 8 most noteworthy Perp DEX projects with active points programs for 2026. It also details practical strategies for low-risk volume generation and airdrop farming using Funding Rate Arbitrage. For investors looking to capture a share of the trillion-dollar derivatives market, this is an invaluable guide for navigating pitfalls and seizing opportunities.

Full Text Below:

This guide covers 8 leading Perp DEXs with active points programs worth farming, along with proven strategies and tools. Ready? Let's begin.

Introduction

Since the advent of Hyperliquid, Perp DEXs have entered their most competitive phase. Trading volume in this sector grew from $647.6 billion in 2023 to over $1.2 trillion in 2025. Even during the market crash on October 10-11, 2025, its share of global perpetual futures trading rose to 26%.

Caption: Data source Artemis

At that time, Hyperliquid accomplished what was considered impossible. They built an exchange that genuinely challenged Binance and captured over 70% of decentralized perpetual trading volume.

However, new Perp DEXs have begun to emerge, with new platforms appearing daily.

But why are we seeing so many onchain perps now? Is it because of Hyperliquid's massive success?

While this is certainly true, and Perp DEXs have become a lucrative sector, the fundamental reason is: Before 2025, competition among Perp DEXs was primarily focused on technology. It relied on higher-performance L1s, more advanced ZK proof systems, and higher-throughput DA (Data Availability) layers. But in 2025, competition shifted from technology to incentives.

The current state of the industry shows increasing pressure from emerging Perp DEXs offering comparable latency, lower fees, and attractive incentive programs.

Caption: Data source Artemis

Today, Hyperliquid's market share has fallen to around 20%, with new platforms posing a substantial threat. For example, Variational has attracted attention and users not only through airdrops/points programs but also through its trading loss refunds.

In October 2025, trading volume reached a record $1.2 trillion, nearly double the total of the previous month. This was primarily driven by incentives, namely points programs and airdrops. The sector has become one of the most successful narratives in airdrop farming. Protocols are preparing to distribute millions of dollars in airdrops to bootstrap liquidity and user activity.

This article analyzes various opportunities within the Perp DEX space and highlights practical farming strategies.

8 Perp DEXs to Watch

The main risks associated with Perp DEXs are: some platforms have no intention of issuing tokens at all, and some end up being worthless and not worth the time investment (e.g., those that exist primarily to extract trading fees from users). Therefore, the core question is never "Can I farm it?" but rather "Is it worth farming?"

This section identifies Perp DEXs worth investing time in based on data from DefiLlama as of January 16, 2026, considering trading volume, Open Interest (OI), user growth, and fee economics.

1. Paradex V2

Paradex is a privacy-focused Perp DEX built on Starknet's first appchain. It offers zero trading fees, deep liquidity covering hundreds of crypto assets and pre-IPO assets, atomic settlement, and institutional-grade privacy features through a mobile-optimized interface.

Architecturally, it is designed as a unified DeFi ecosystem (Paradex Ecosystem), consisting of the Paradex Exchange, Paradex Chain, and XUSD (a native synthetic dollar powered by the $DIME token).

Core Features:

- Offers up to 50x leverage across multiple markets

- Low fees: Maker 0.02%, Taker 0.05%

- Cross-margin functionality

- Utilizes ZK-Rollup technology with Ethereum-level security

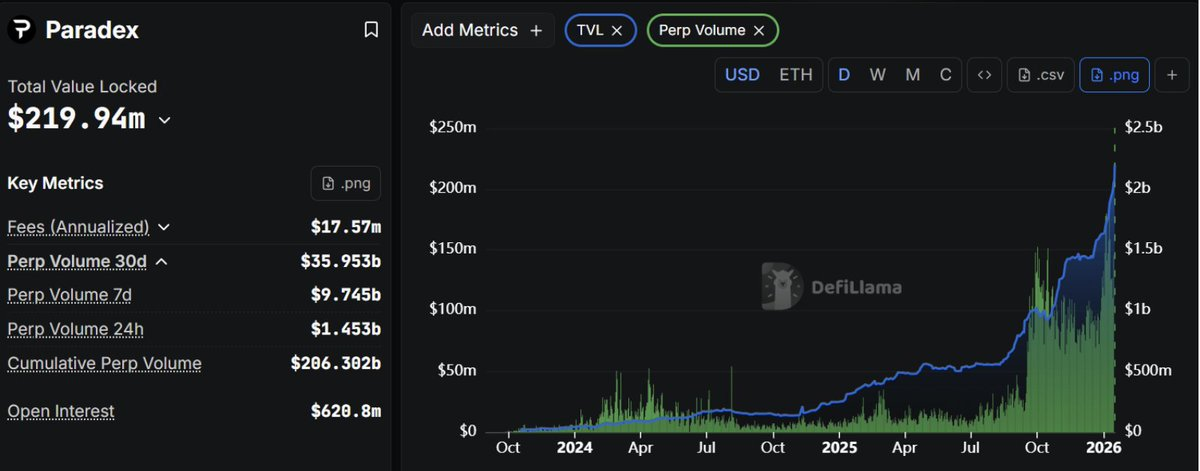

Caption: Source Defillama

Paradex has demonstrated impressive growth to date:

- TVL: ~$220 million (nearly 6x growth from $25 million at the start of 2025)

- Cumulative Volume: $206 billion

- Open Interest: ~$620 million

- 30-Day Volume: $36 billion

Points Program:

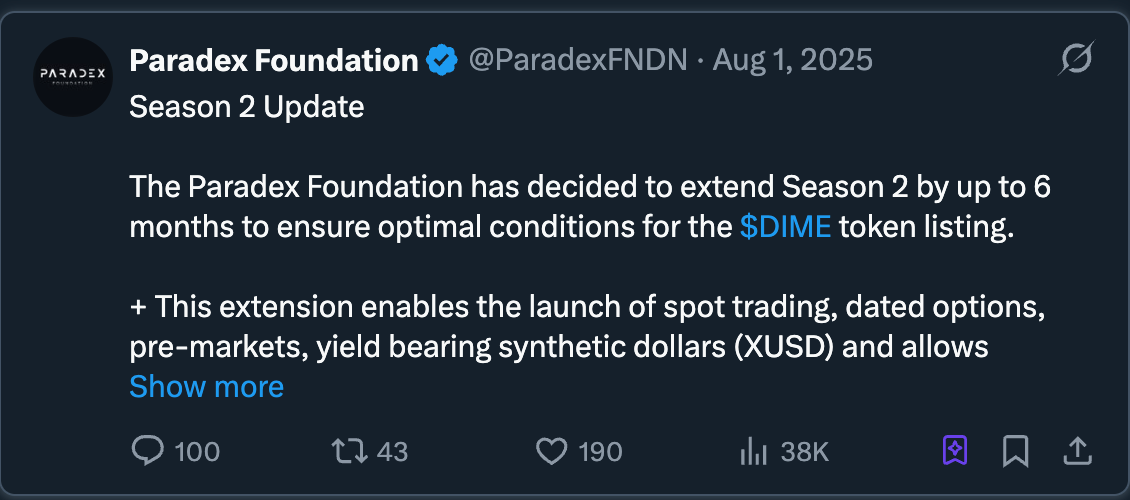

The Paradex Foundation has decided to extend Season 2 by up to 6 months to ensure optimal conditions for the $DIME token listing. This extension will support the launch of spot trading, periodic options, pre-IPO trading, and the yield-bearing synthetic dollar (XUSD).

The airdrop campaign's Warm-up and Season 1 ran from February 1, 2024, to January 2, 2025. Paradex is now in Season 2, distributing 4 million XP (points) weekly to active traders every Friday.

How to Participate:

- Register and set up an account on Paradex, connecting an EVM-compatible wallet.

- Set a nickname. Link X/Discord for anti-sybil checks and to receive a community XP boost.

- Deposit USDC and start trading.

- Earn Position XP (holding positions), Fee XP, and even Liquidation XP.

- Provide liquidity by depositing into the USDC Vault to earn Vault XP.

- Share an invite link to earn 10% of the invitee's XP. Invitees receive a 5% XP boost.

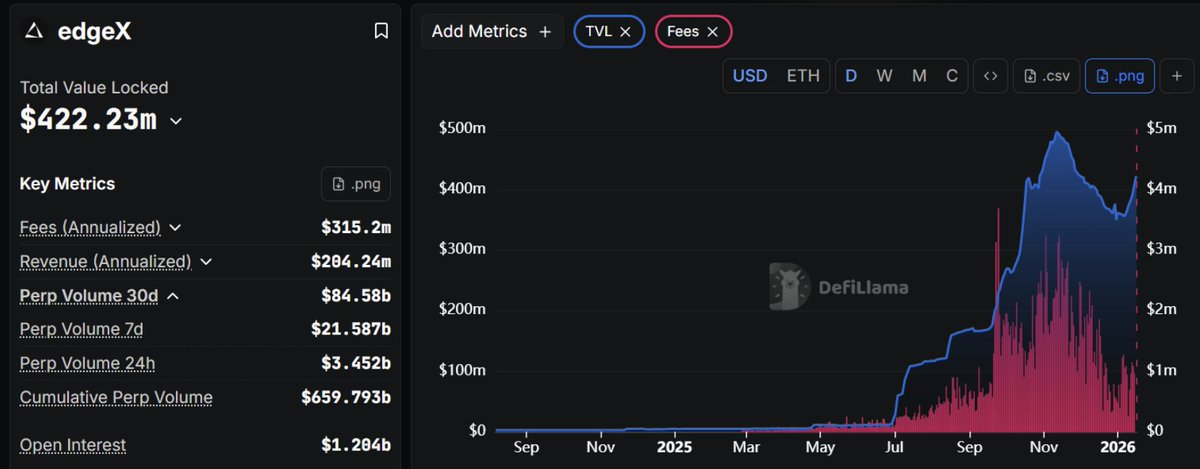

2. edgeX

edgeX is a Layer 2 (L2) exchange offering perpetual and spot trading. Initially incubated by Amber Group on StarkEx ZK-rollup and launched as a ZK-rollup-based Perp DEX, it is now transitioning to the EDGE Chain: an Ethereum L2 built specifically for high-throughput financial applications.

Core Features:

- Built on StarkNet (zk-Rollup) for fast settlement

- Up to 50x leverage

- Maker 0.02% / Taker 0.05% (one of the cheapest Perp DEXs)

- Based on a Central Limit Order Book (CLOB) model

Market Performance:

- Weekly Volume: $21.59 billion

- 30-Day Volume: $84.58 billion (consistently in the top 5)

- Open Interest: $1.2 billion

- TVL: $422 million

Points Program: edgeX recently concluded its 27-week 'Open Season' points program. The Pre-TGE season launched on January 7, 2026, aiming to reward organic platform usage with XP. XP is distributed weekly until TGE (expected on or before March 31).

How to Participate:

- Create your trading account: https://pro.edgex.exchange/referral/MUUR

- Deposit and start trading. Prioritize spot trading for a 3x XP multiplier on volume.

- Trade directly on the edgeX mobile app for a 1.2x XP boost.

- Hold MARU tokens to unlock additional 1.05x–1.15x XP multipliers. Register as a Messenger for a 1.05x–1.1x XP boost.

- Perpetual trading losses account for 10% of XP distribution. Increase total volume as it contributes 60% to the weekly XP allocation.

3. GRVT

GRVT (pronounced "Gravity") is a Perp DEX founded in 2023, built within the zkSync ecosystem using a modular ZK Stack architecture. It operates as an L3 Validium appchain optimized for high-performance perpetual trading while inheriting Ethereum-level security through zero-knowledge proofs.

Core Features:

- Privacy-focused exchange

- Combines a self-custodial L2 (ZK/Validium) settlement layer with an off-chain CLOB

- ZKsync Atlas enables high-performance perps to be composable with Ethereum

- L3 design allows GRVT to prioritize throughput and latency without sacrificing cryptographic proofs

Growth Metrics:

- TVL: ~$85 million

- Cumulative Volume: $214.21 billion

- Open Interest: ~$427 million

- 30-Day Volume: $38.7 billion

Points Program: After a long development period, GRVT officially launched its points incentive system in 2024. It is currently in Season 1, rewarding users for trading activity, liquidity, and open interest.

How to Participate:

- Register an account and deposit funds.

- Open positions to generate points, with special emphasis on maintaining positions as their weight has increased.

- Participate in the referral program to earn additional fee rebates.

4. Extended

Extended (formerly X10) is a high-performance perpetual DEX on Starknet built by a former Revolut team. While initially focused on perps, the protocol is expanding towards a unified margin model supporting spot trading and integrated lending.

Core Features:

- Hybrid architecture: Off-chain CLOB for matching and risk control + on-chain settlement

- Offers up to 100x leverage on crypto and traditional finance (TradFi) assets

- Unified margin via XVS vault shares, integrating lending and liquidity

- Markets include synthetic TradFi assets

Market Performance:

- TVL: $200 million

- 30-Day Volume: $37.8 billion

- Open Interest: $280 million (YTD growth 45.2%)

Points Program: On April 30, 2025, Extended launched its points program, distributing 1.2 million points weekly between traders and liquidity providers (LPs).

How to Participate:

- <