Fearless of Bull or Bear: The Crypto Survival Code

- Core Thesis: The cyclical recovery of the cryptocurrency market does not stem from superficial technological or product innovations, but relies on a deeper "consensus upgrade"—the ability of people to form new, large-scale collaborative behavioral patterns around cryptocurrencies. True success lies not in short-term windfalls, but in the ability to survive multiple cycles and preserve wealth.

- Key Elements:

- Consensus vs. Narrative: A narrative is a shared story; consensus is shared action. Narrative alone leads to short-term euphoria; only when narrative combines with action can a genuine macro-cycle begin.

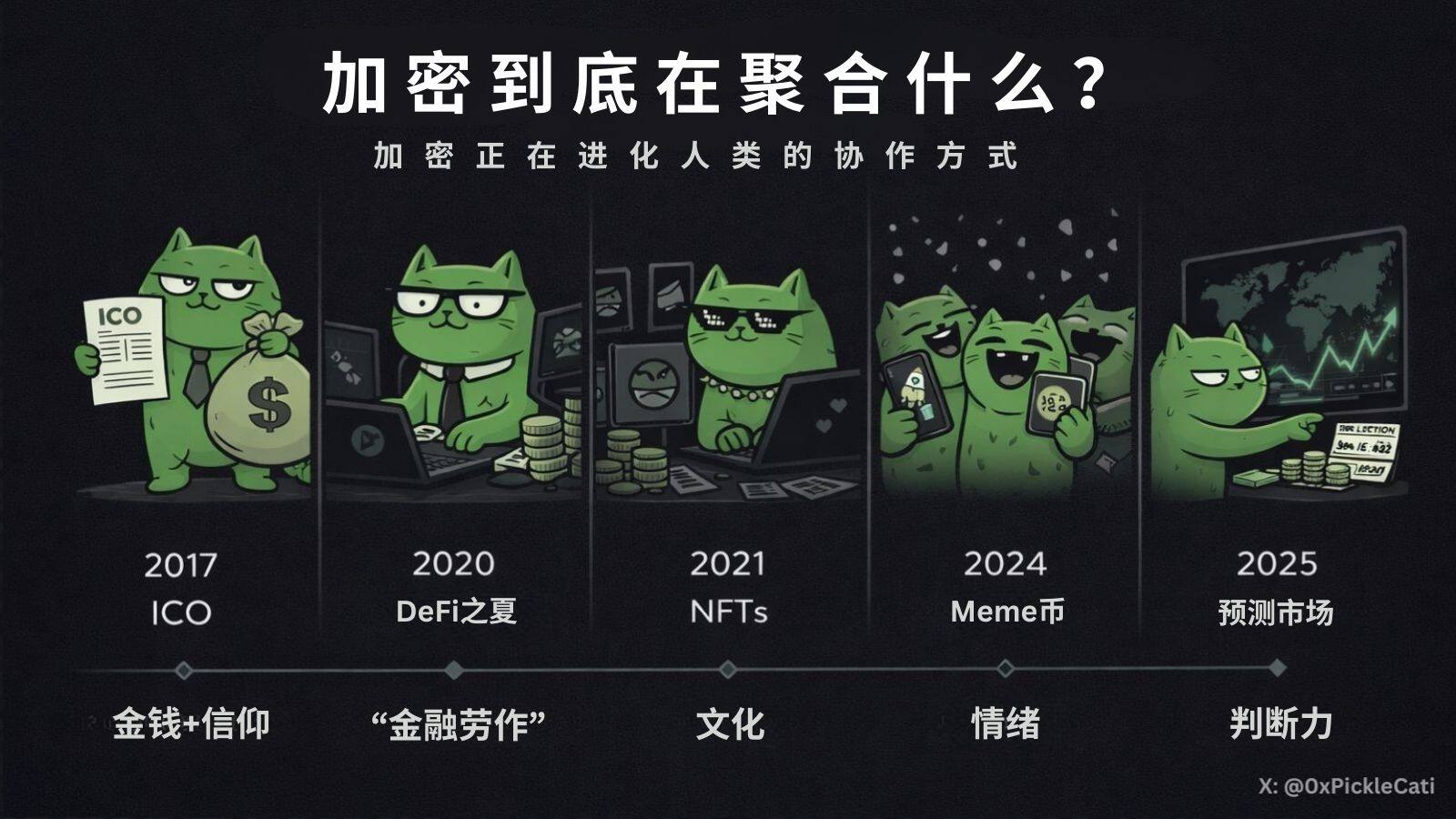

- Historical cases reveal the path of consensus evolution: from ICOs (coordinating capital and belief), DeFi Summer (aggregating financial labor), NFTs (aggregating cultural identity) to Memecoins (aggregating sentiment). Each breakthrough into mainstream awareness represents the formation of a new mode of collaboration.

- The key to identifying a "consensus upgrade" versus a "dead cat bounce" is observing behavioral changes, such as non-utilitarian participation from outsiders, passing the test of incentive decay, and forming daily habits.

- Personal survival strategies require building a multi-dimensional framework: this includes understanding the underlying logic of cycles, mastering hard skills like on-chain data analysis to identify opportunities and risks, and leveraging networks to gain informational advantages.

- Long-term survivors possess two key traits: having a structured, resilient belief system independent of price, and establishing a value anchoring system encompassing conceptual, temporal, behavioral, and belief dimensions.

Original author: Pickle Cat (X: @0xPickleCati)

I bought my first Bitcoin in 2013.

As an old-timer who has lived through over a decade of cycles up to 2026, I've seen ten thousand ways this market can crush people.

Over this long stretch of time, I've discovered what seems to be an undeniable iron law:

That is, in this space, the definition of "winning" is never how much money you've made.

Everyone who has touched this space has made money at least once. No matter how green they are, no matter how small their capital, they've all been a temporary "genius."

So what is "winning" really? It's making money and, years later, still being able to hold onto that money.

In other words, if you want to change your destiny through crypto, you first need to realize this isn't a contest of "who makes the most" or "who gets the biggest multiplier," but a contest of "who survives the longest."

But reality is harsh. Most "geniuses" become fuel. Only a small fraction successfully survive to the next cycle, and among those survivors, the ones who truly achieve compound interest and snowball their wealth are even rarer.

After 10/11, market sentiment returned to the familiar, boring period I know.

That day, I lost many friends I thought would fight alongside me in crypto for years to come. Although this kind of "goodbye" has played out countless times, whenever it happens, I still instinctively open up the fragmented reflections I've written down over the years.

I think it's time to organize them. To figure out that ultimate question: What exactly, are there any replicable traits, that allow someone to survive in crypto until the end?

For this, I also talked to a few old friends who are still active in crypto, and thus, this article was born.

This article is my exclusive insight, a labor of love. It will attempt to explain the following points:

- Why can some people survive in this cyclical "bloodbath," while others can only retreat in defeat?

- How to maintain hope when being tormented unbearably in a bear market?

- What must you do to become the kind of person described above?

To thoroughly understand this principle, we must first return to basics. Please forget everything others have told you about this space.

"The only true wisdom is in knowing you know nothing."

— Socrates

The article will briefly explain the history of crypto and its essence. The vast majority of new entrants ignore these elements. After all, understanding this isn't as exciting (or painful) as immediately opening a position to make (or lose) money.

But based on my personal experience, it's precisely these overlooked aspects that are the secret to being fearless through bull and bear markets. As the philosopher George Santayana said: "Those who cannot remember the past are condemned to repeat it."

In this article, I will help everyone understand:

I. What exactly can bring the crypto bull market back? How to distinguish "the start of a trend" vs. "a dead cat bounce"? This includes 3 case studies and a basic "judgment criteria" you can use directly.

II. What exactly must you do to increase your probability of catching the "next big trend"?

III. What are the replicable commonalities among those who can survive multiple bloody cycles and continue to make money?

If you've ever had your wallet "decentralized" in crypto, then this article is written for you.

I. The Real Driving Force That Pulls Crypto Out of Stagnation

Whenever people ask why the crypto market is stuck, the answers are almost always the same:

A new narrative hasn't been born yet!

Institutions haven't fully entered yet!

The technological revolution hasn't exploded yet!

Blame those predatory market makers and KOLs!

It's all because so-and-so exchange/project/company messed up!

These factors are indeed important, but solving them has never been the real reason for ending a crypto winter.

If you've lived through enough bull and bear cycles, you'll see a clear pattern:

Crypto's resurgence has never been because it became more like the traditional system, but because it once again reminded people of the suffocating aspects of the old system.

Crypto's stagnation is not due to a lack of innovation, nor is it just a liquidity problem.

It's essentially a failure of coordination—more precisely, stagnation occurs when the following three fail simultaneously:

- Capital has no interest

- Sentiment is exhausted

- The current consensus can no longer explain "why we should care about this space"

In such a situation, price weakness is not because crypto is "dead," but because there are no new elements to allow new participants to form a concerted effort.

This is the root of most people's confusion.

They always think the next cycle will be triggered by some "better, more explosive" product, feature, or new narrative. But these are only the effects, not the cause. The real turning point only appears after a deeper consensus upgrade is completed.

If you can't see this logic, you'll only continue to be led by market noise, becoming the easiest-to-harvest fodder for those pushing bags.

This is why there are always people chasing the "next hot thing," trying to be the ultimate diamond hands, only to always find themselves entering too late, or worse—buying the air within the air.

If you want to develop real investment acumen, the kind that lets you discover opportunities early, rather than being dumped on a week after every project launches, you first need to learn to distinguish:

The Difference Between Consensus and Narrative

The truth is, the one thing that has always pulled the crypto world out of winter each time is: the evolution of consensus.

"Consensus," in this space, refers to humanity finding a new way to use cryptocurrency as a medium to financialize some "abstract element" (like belief, judgment, identity, etc.) and engage in large-scale coordination around it.

Please note carefully: Consensus is absolutely not equivalent to narrative. And most people's cognitive bias starts right here.

A narrative is a story shared by many.

Consensus is action taken by many.

Narratives are spoken; consensus is acted upon.

Narratives attract attention; consensus retains the crowd.

- Only narrative without action → Short-term frenzy

- Only action without narrative → Evolution behind the scenes

- When both are present → A true major cycle begins

To understand the intricacies here, you need to take a long-term view and approach it from a broader perspective.

When you quickly review crypto's brief history, you'll find:

The underlying layer of all narratives is essentially aggregation—and that is consensus.

In 2017, ICOs were the ultimate "gathering" skill of that era. It was essentially a coordination mechanism that gathered people who believed the same story, pooling their capital and belief in one place.

Basically saying: "I have a PDF and a dream, wanna bet?"

Later, IDOs took this "gathering" to decentralized exchanges, turning fundraising into a permissionless, free-for-all "ritual".

Then came the 2020 DeFi Summer, which aggregated "financial labor". We became the back-office staff of the bank that never sleeps: lending, collateralizing, arbitraging, searching day and night for that 3000% APY, praying every night it wouldn't rug when we woke up.

Next was 2021 NFTs, which aggregated not just capital, but people resonating with a shared culture, aesthetic, or idea. Everyone was asking: "Wait, why am I buying a picture?" "That's not just a picture, that's culture."

Everyone was looking for their own "tribe." Your little picture was your passport, a digital "insider" badge, your ticket to exclusive group chats and high-end gatherings.

By the 2024 Meme coin era, this trend was undeniable. Now, people barely cared about technology. What it truly aggregated was emotion, identity, and collective inside jokes.

You weren't buying a whitepaper anymore. You were buying the phrase "those who know, know, and you understand why I'm laughing (or crying) hehe." You were buying a "community" that made you feel less alone when the price dropped 80%.

Now, we have prediction markets. They aggregate not emotion, but judgment, a shared belief about the future. And these beliefs truly achieve borderless flow.

Take the US presidential election, a global focal event. If you're not American, you have no vote. But in prediction markets, while you still can't vote, you can bet on your conviction. Here, the real shift becomes obvious.

Cryptocurrency is no longer just moving money; it's redistributing the power of "who gets to say."

With each cycle, a new dimension is integrated into this large system: Money, belief, financial labor, culture, emotion, judgment, ____? What will be next?

You'll find that every breakout in crypto is essentially about gathering people in a new way. Each stage brings not just more users, but a new reason for people to stay—that's the key.

The focus has never been the token itself. Tokens are just the topic that brings everyone together so they can play. What's really flowing in this system are things that can carry increasingly large-scale native consensus.

To put it bluntly: What's flowing through those pipes isn't really "money." It's us, learning how to reach larger and more complex consensus without a boss overseeing us.

To understand this more thoroughly, look at this simple "Three-Fuel Model":

- Liquidity (macro risk appetite, dollar liquidity, leverage capacity, etc.) is like oxygen injected into the market. It determines how fast prices can move.

- Narrative (why people care, how it's explained, shared language) attracts attention. It determines how many people look here.

- Underlying consensus building (shared actions, repeated behaviors, decentralized coordination methods) affects persistence. It determines who truly stays when prices stop giving returns.

Liquidity might temporarily push prices up. Narrative might briefly ignite attention. But only new consensus building can give people a way to act together for mutual benefit beyond mere buying and selling.

This is why many so-called crypto mini-bull runs often fail to become real bull runs: they have liquidity, they spin a good story, but people's actual consensus remains unchanged.

So, how to distinguish a "dead cat bounce" from a true "consensus upgrade"?

Don't look at price first—look at behavior. True consensus upgrades often reveal similar signals over time, changing the way we "play" together.

It always starts with behavior first, not price.

If you want to learn to distinguish this yourself, just looking at concepts is useless. You need to review crypto history, learn and summarize from it, to have a chance of spotting the key points during the next consensus upgrade.

Below are 4 sections: 3 extended case studies I've compiled, and finally a basic checklist you can use to identify if the next consensus upgrade is coming, and how to judge if the behavior driven by a narrative will truly persist.

Extended Case 1: The Flourishing of 2017 ICOs vs. Early Experiments

BTC and ETH prices during the ICO frenzy (mid-2017 - mid-2018)

This was the first time crypto figured out how to coordinate people and capital on a massive, global scale. Tens of billions of dollars flowed on-chain, not into mature products, but into ideas.

Of course, there were early experiments before this. For example, Mastercoin in 2013, Ethereum's own crowdfunding in 2014, etc. These were interesting but remained niche. They hadn't yet created a globally shared behavioral pattern that could suck everyone into the same orbit.

In crypto's early days, the playbook was simple:

Mine, trade, hold, buy stuff with it (like on the dark web).

Sure, there were plenty of "get rich quick" Ponzi schemes, but we didn't have a defined, standard way for a group of strangers to collectively bet on the same dream on-chain.

The DAO in 2016 was crypto's real "aha" moment. It proved strangers could pool funds using just code. But honestly... the tools were primitive, the tech fragile, and it got hacked to oblivion. The behavioral pattern appeared, but it wasn't sustainable.

Then 2017 arrived, and everything became "mass-producible".

Ethereum and the (now more mature) ERC-20 standard turned token issuance into an assembly line. Suddenly, the "underlying logic" of participating in crypto underwent a revolution:

- Fundraising events went fully on-chain, becoming the new normal.

- Whitepapers became "investment vehicles."

- We traded "Minimum Viable Product" for "Minimum Viable PDF."

- Telegram became financial infrastructure directly.

This new "trending" behavior brought in millions and fueled an epic bull run. But more importantly, it permanently reshaped crypto's DNA.

Even after the bubble burst, we never reverted to the "old mode." The idea that anyone, anywhere could crowdfund for a protocol was firmly rooted.

Yes, most ICOs back then were outright scams or Ponzis. This dirty stuff existed before 2017 and still exists now in 2026. But the way people coordinated work and deployed capital had changed forever. That's the so-called "consensus upgrade."

Extended Case 2: 2020 DeFi Summer vs. Fake Bulls

BTC and ETH prices during DeFi Summer (June 2020 - September 2020)

This era was also a true "consensus upgrade," because even without explosive price growth, people started using crypto assets as "financial tools." This was completely different from the ICO era—where price increases and user behavior fed off each other symbiotically.

Before 2020, aside from the ICO frenzy, the crypto experience was basically "