The crypto market is not dead; it's just entering a "reshuffle" phase.

- Core View: The current crypto market is undergoing a structural shift from speculative frenzy to pragmatic development. This is evidenced by a sharp decline in speculative developers and token launches, while core developers, compliance processes, and the actual user base continue to grow steadily. The industry is entering a phase of consolidation and value accumulation.

- Key Elements:

- Optimization of Developer Structure: Part-time and novice developers have largely exited, but the number of full-time and senior developers (with over 2 years of experience) remains near historical highs, indicating a solid core development force.

- Token Bubble Burst: Of the over 20 million tokens launched in 2025, 53.2% have become "dead tokens," with 86.3% of token failures concentrated in 2025, signaling a significant retreat of market speculation.

- Clear Ecosystem Divergence: Developer numbers continue to grow in the Bitcoin (+42%), Ethereum (+10.1%), and Solana (+51.9% over two years) ecosystems, while some early competitive public chains are declining.

- Industry Announcements Shift Towards Pragmatism: Announcements from leading projects have shifted from launching new products to optimizing existing experiences, partnering with traditional financial institutions, and technical upgrades. Hype has decreased, but practical value has increased.

- Regulation-Driven Compliance: The passage of the GENIU Act and several companies obtaining banking licenses are driving the industry towards compliant development, resulting in a slower but more standardized development pace.

- Continuous User Base Penetration: Global cryptocurrency holders have reached 716 million, with higher penetration rates in countries lacking traditional financial services, demonstrating its practical utility in filling financial gaps.

- Capital and Innovation Focus on Leaders: Venture capital investment in 2025 grew by 44%, but the number of deals fell by 33%, indicating capital concentration towards leaders. Industry innovation is shifting from breakthrough to incremental and faces competition for capital and talent from the AI sector.

Original Author: Ignas

Original Compilation: Luffy, Foresight News

Everyone can feel it: the enthusiasm in the crypto market has waned, with a significant decrease in new token launches and industry announcements.

Your Twitter timeline has grown quiet, dominated by AI-related posts and clickbait content. But is this reality, or simply a perception driven by sentiment?

Look at the data: this is the real market situation. However, the truth behind it is far more worthy of investigation than the simplistic conclusion that "cryptocurrency is dying."

Number of Developers

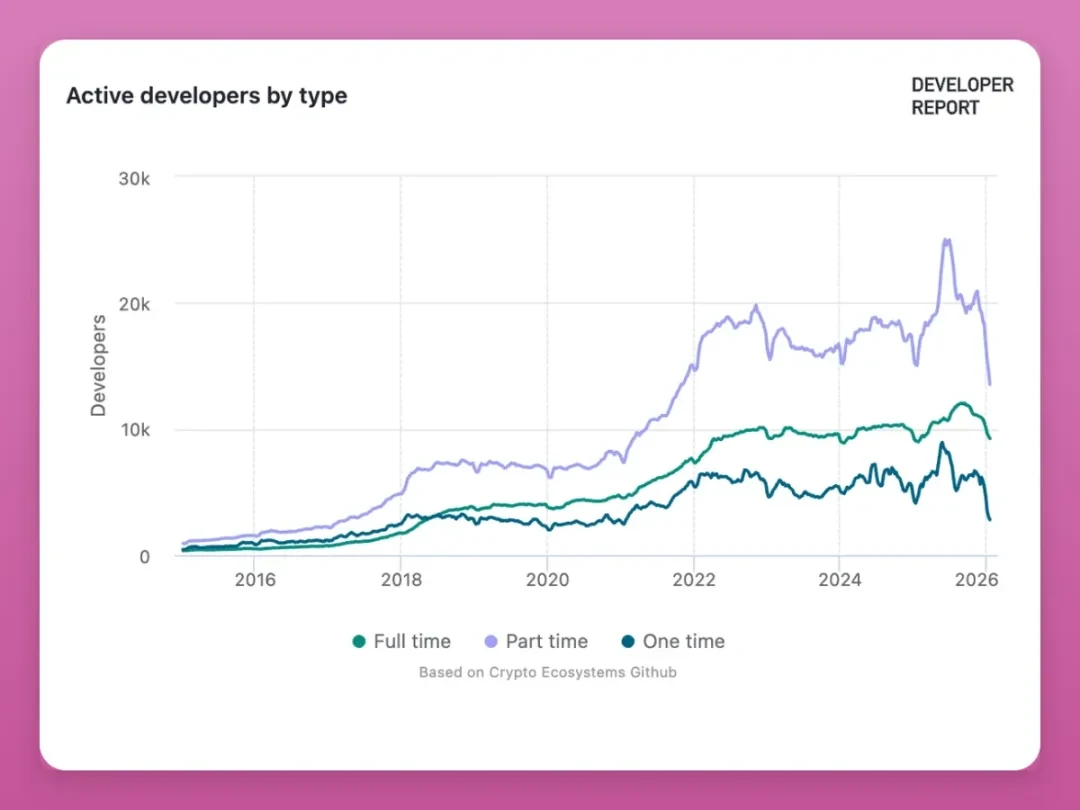

First, let's look at the changes in the number of active developers across different categories:

Source: Electric capital dashboards

- Part-time Developers: Surged to 25,000 by mid-2025, now plummeted to around 12,000.

- One-time/Contributing Developers: Sharply decreased from 8,000 to 2,800, hitting a new low since 2020.

- Full-time Developers: Steadily grew to a historical peak of 12,000; currently showing a slight decline but the overall trend remains stable.

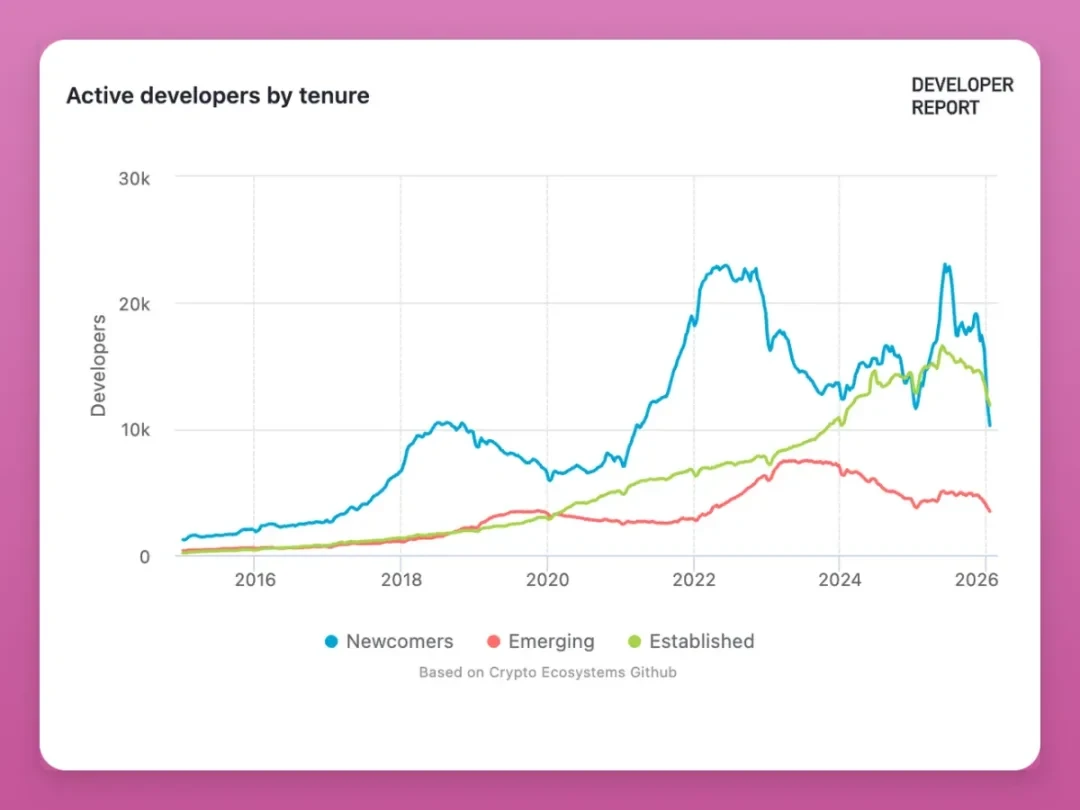

Now, let's examine the distribution of developers by years of experience:

- New Developers: Peaked at 23,000 in 2022, surged again in mid-2025, now fallen to around 10,000.

- Junior Developers (~1 year of experience): Down 50% from a peak of 8,000, currently around 4,000.

- Experienced Developers (2+ years of experience): Steadily grew to a historical peak, with a slight recent decline.

The current decline in developer numbers is primarily due to the departure of part-time and new developers. During the 2024-2025 market cycle, a large influx of developers entered the industry, seeking quick profits through airdrops and token incentives. When these benefits disappeared, they chose to leave.

However, even with the decline, the number of full-time and experienced developers (2+ years) remains near historical peaks.

Notably, in previous bear markets, the number of full-time, experienced developers continued to grow. This current bear market shows a declining trend, which deeply concerns me.

Who Left, Who Stayed

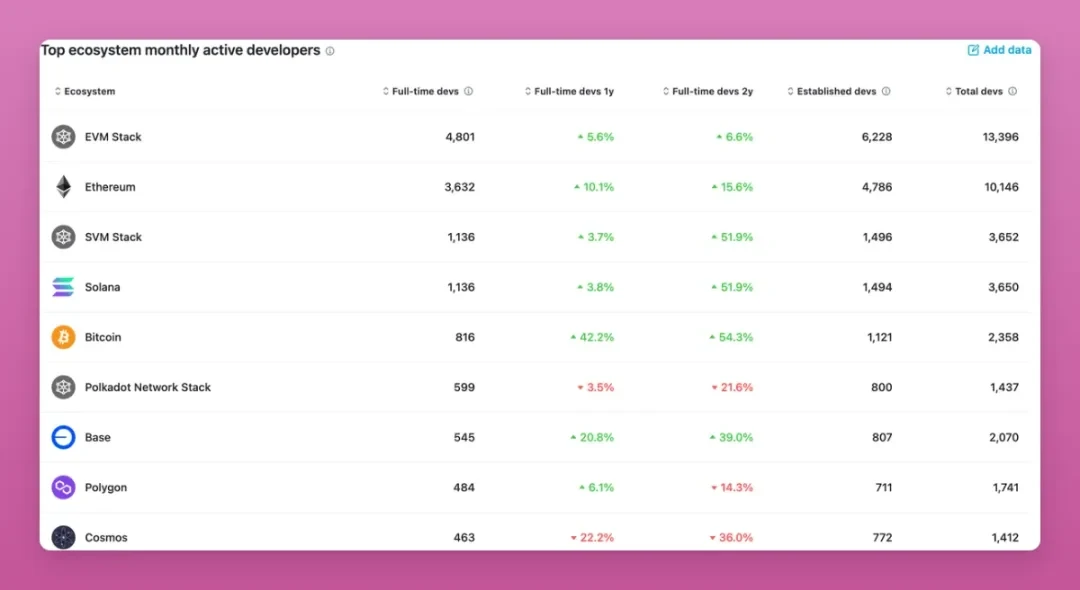

Looking at developer count changes across various blockchain ecosystems, the market outlook is not entirely bleak:

- Bitcoin Ecosystem: Developer count grew by 42%. This surprising growth is driven by Ordinals, inscriptions, and Layer 2 developments attracting many developers back.

- Ethereum Ecosystem: Grew by 10.1%, with a total of 10,146 developers, maintaining its dominant industry position. Its Layer 2, Base, is also developing well.

- Solana Ecosystem: Increased by 3.8% year-over-year, but has grown 51.9% over two years!

Meanwhile, competitive public chains that emerged in 2021 (Polkadot, Cosmos) are declining. For complete data, refer to the relevant industry report.

The number of full-time developers on leading public chains is actually still growing. The previously mentioned decline in developer numbers is only reflected in the part-time and novice groups; core developers have not left.

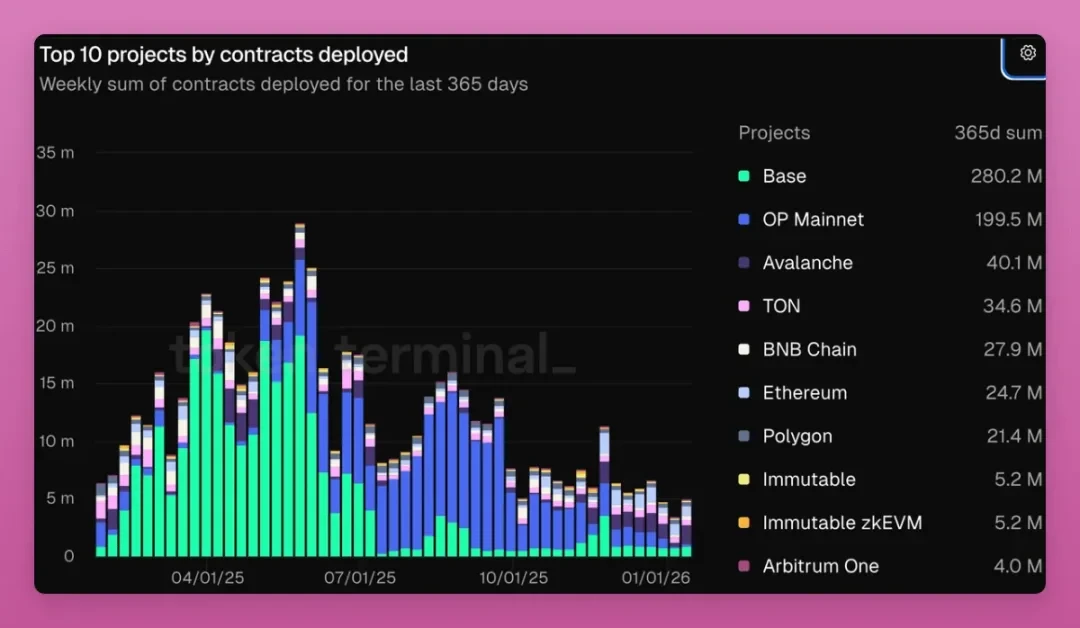

Side note: It's worth noting that the number of contracts deployed on blockchains has also declined.

Since July 2025, the speculative altcoin and meme coin frenzy on Base subsided, leading to a significant drop in on-chain activity. Including Solana's ecosystem would make this data even more dismal. This phenomenon directly triggered subsequent chain reactions...

Token Launches Stagnate

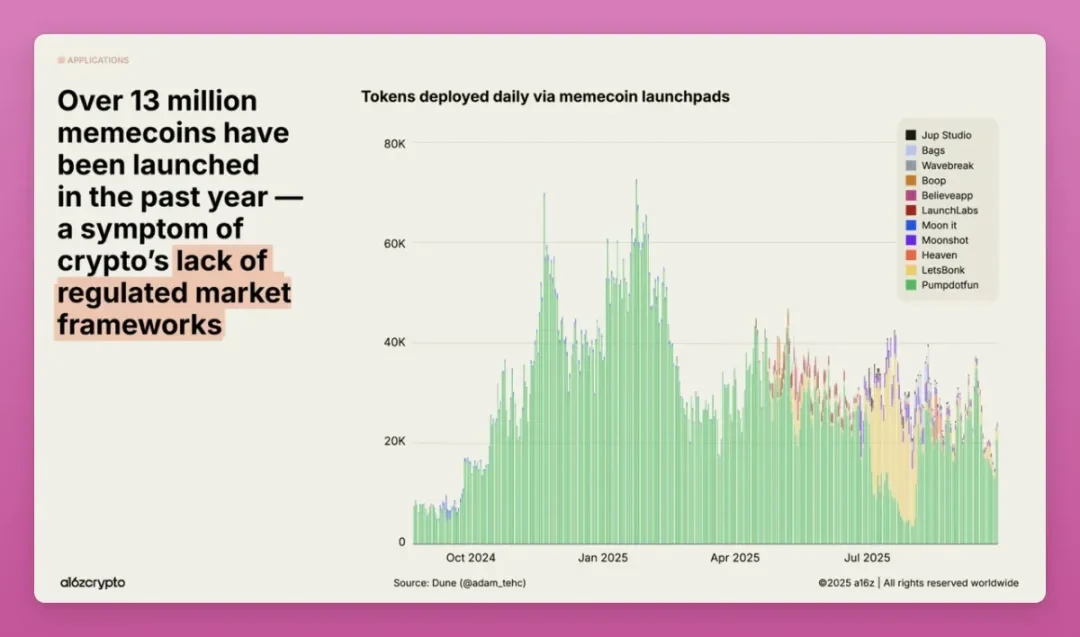

Over the past year, over 13 million meme coins were launched, but the number of token launches in September 2025 decreased by 56% compared to January.

Source: a16z

We are launching more tokens than ever before. According to CoinGecko data, the number of tokens launched in the market over the past 5 years is as follows:

- 2021: 428,383

- 2022: 724,706

- 2023: 835,183

- 2024: 3,032,501

- 2025: 20,170,928

I think everyone can see the trend, right?

According to CoinGecko statistics, 53.2% of the tokens they track have now become "dead tokens" (trading volume below $1,000 for three consecutive months).

86.3% of these token deaths are concentrated in 2025. In 2025 alone, 11.6 million crypto tokens exited the market.

The NFT market has also been hit hard. Contrary to common belief, while the NFT market experienced a rally, it failed to sustain the momentum.

In 2024, the market saw a modest 4x increase, then crashed. In 2025, it saw another 3x increase, only to fall back again.

Current NFT market trading volume is far from its 2022 peak, but the number of monthly active buyers continues to grow.

Although a16z's report attributes buyer growth to "collectible demand," I believe this growth is actually driven by Zora-style social posts, which turn social platform content into financially tradable NFTs.

Layoffs Resurface

The last crypto bear market (2022-2023) severely impacted the industry's job market:

Data from Milk Road shows crypto companies had layoff rates as high as 50%:

- Crypto.com: Laid off 2,700 people (over 50% of staff)

- Coinbase: Laid off 2,000 people (36% of staff)

- Kraken: Laid off 1,100 people (30% of staff)

After the market recovery in 2024-2025, Coincub's Web3 Jobs Report noted that the Web3 industry added 66,494 new jobs in 2025, a 47% rebound from 2024.

They found:

- Germany cooled: Job openings plummeted from 22,000 in 2022 to 1,256 in 2025.

- US grew: Added 21,000 jobs (26% increase).

- 70% of jobs are still remote.

- Compliance-related jobs increased by 35% year-over-year.

"Talent demand in the Web3 industry has rebounded, with more diverse needs covering compliance, security, and the integration of AI with Web3."

However, after a relatively stable 2025, industry layoffs have returned:

- Polygon Labs: Laid off up to 30% of staff after spending $250 million on multiple crypto asset acquisitions.

- MANTRA: Conducted undisclosed-scale layoffs after its OM token plummeted 90%.

- Consensys: Laid off at least 7% in July 2025.

- OKX: Conducted global business restructuring with undisclosed layoff scale.

- DappRadar (a platform I was once very bullish on): Shut down completely in November 2025.

Furthermore, the acquisitions of Lens and Farcaster inevitably led to team adjustments.

As a co-founder of a KOL studio, I can clearly feel the operational pressure on major projects. Due to reduced collaboration opportunities, KOLs have also lowered the prices for paid posts.

Shift in Project Announcement Trends

I'll use Polygon's 2025 announcements as a case study. Its core business deliveries for the year were as follows:

Technical Upgrades

- Heimdall v2 Mainnet (July 2025): Reduced finality time from 90 seconds to 4-6 seconds.

- AggLayer v0.3 (Q3 2025): Enabled cross-chain liquidity sharing.

- Madhugiri Hard Fork (December 2025): Increased transaction processing capacity by 33%.

Enterprise Partnerships

- Partnered with Revolut to support stablecoin transfers.

- Partnered with Mastercard to enable wallet username verification.

- Issued FRNT stablecoin in Wyoming (the first US state-issued stablecoin).

Internal Adjustments

- 30% layoffs.

- Spent over $250 million on multiple acquisitions (Coinme, Sequence).

I remember in 2021-2022, announcements from Polygon and other public chains were like this: launching new public chains, releasing new token standards, securing new NFT project partnerships, signing celebrity endorsements.

Now, the vast majority of leading projects show the same trend: announcements have shifted from "We will launch a brand new product" to "We will optimize the existing product experience" and "Traditional financial institutions are using our technology."

Admittedly, Avalanche once announced plans to acquire its most successful meme coin, but that plan was quickly abandoned. Instead, the platform is now fully advancing decentralized physical infrastructure integration and real-world asset tokenization.

Overall, industry announcements today, while less flashy, hold more practical value.

Another notable change is that token prices no longer show significant volatility following announcements. The market no longer pays for single technical upgrades.

This makes the crypto market less fun for speculation, but it's a necessary price for the industry to achieve scaled adoption.

User Activity: Performance is Acceptable

Despite the slowdown in product delivery, user adoption and industry penetration are still increasing, at least in the overall trend.

According to a16z data, global cryptocurrency holders have reached 716 million, but active users are only 40-70 million, a gap of 90%.

The data I find most compelling is the correlation analysis between crypto penetration and the unbanked population ratio: countries with higher unbanked populations have higher cryptocurrency ownership rates. Cryptocurrency is filling the service gaps of the traditional financial system.

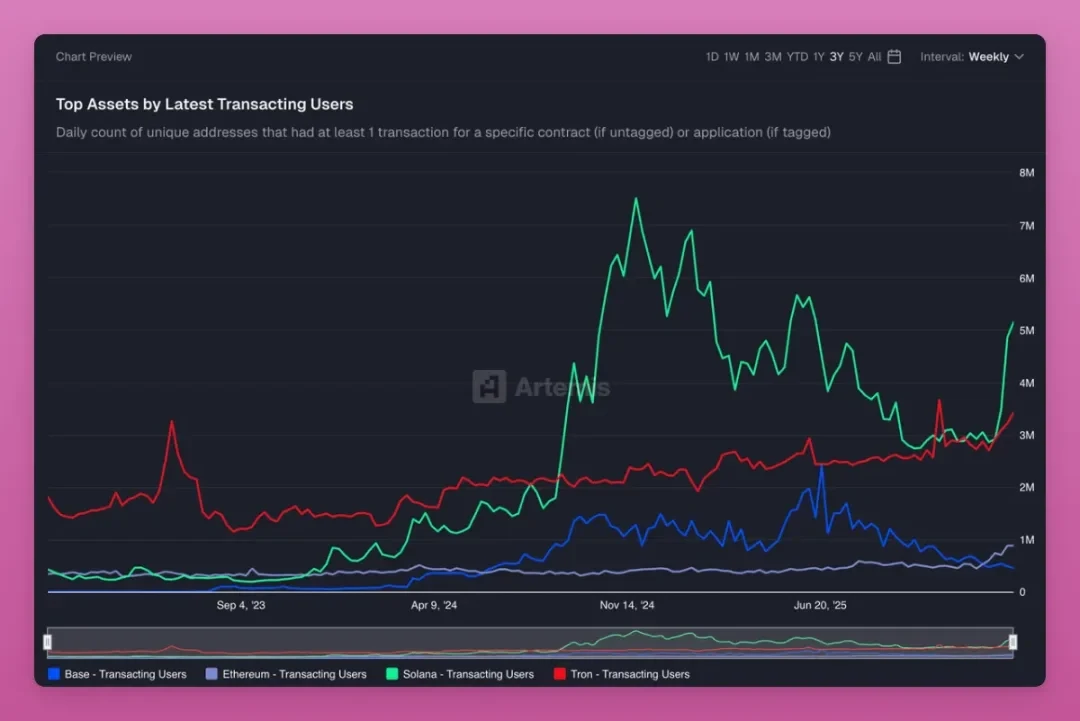

Regardless, the number of active cryptocurrency users is sending positive signals.

Solana's active address count is finally recovering, Ethereum's user activity is increasing (thanks to scaling hard forks), and Tron's users never left on a large scale. Tron's user activity might be the clearest case of non-speculative application in the crypto industry.

What Else Has Changed?

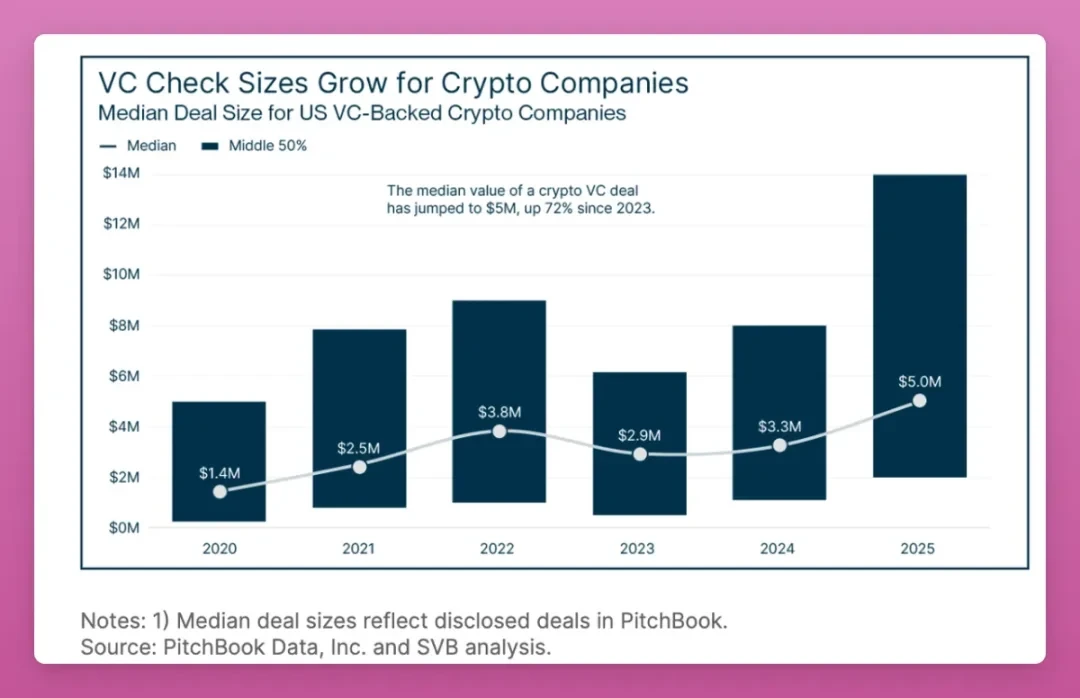

Venture Capital Situation

In 2025, venture capital funding in the crypto space reached $16 billion, a 44% increase from 2024.

However, the number of deals decreased by 33%, indicating capital is flowing more towards a few leading companies.

The median valuation for seed rounds has also increased by 70% since 2023.

Currently, well-funded leading teams still have enough capital to continue development, but it has become much harder for new startups to secure funding.

Industry Innovation: Low-Hanging Fruit is Gone, AI May Be the New Driver

In 2020, you could just fork the Compound protocol, make minor tweaks, and attract billions in Total Value Locked (TVL). But by 2025, all conventional DeFi primitives have been built. New projects must solve more complex industry problems to establish themselves.

Breakthrough innovations are becoming rarer; the industry has entered a phase of incremental innovation.

This is also why I believe the entire industry should boldly experiment with Vibe Coding for smart contracts: although many projects will fail, this exploration will drive industry innovation!

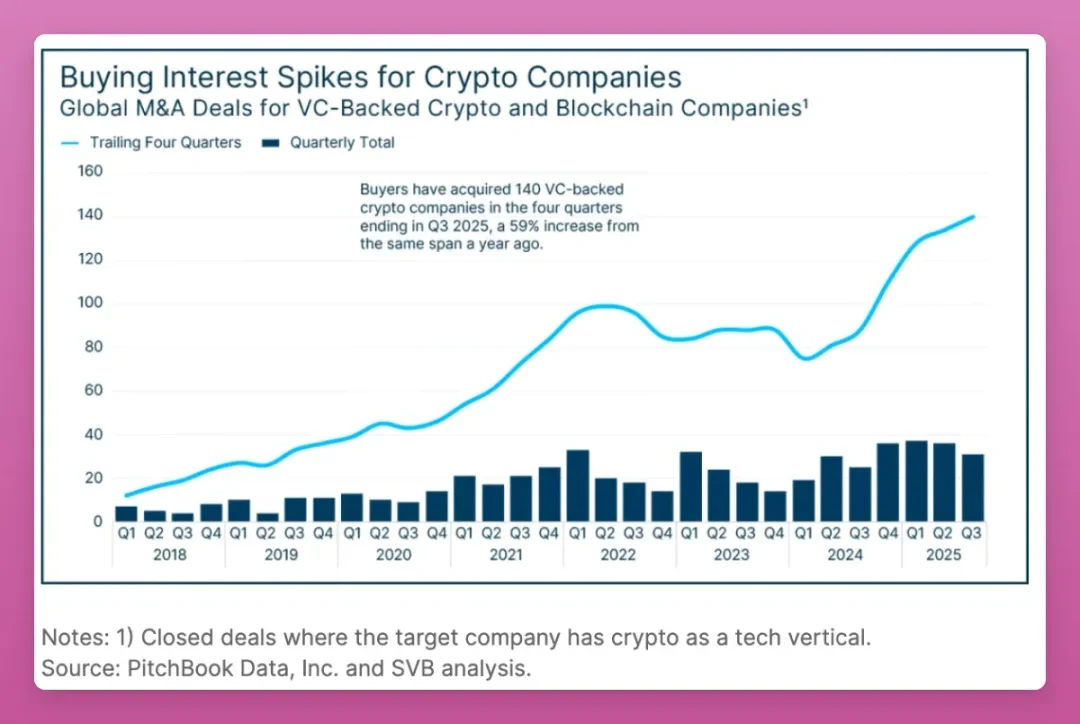

Industry Consolidation Accelerates

The number of mergers and acquisitions has hit a record high.

In the four quarters ending Q3 2025, over 140 venture-backed crypto companies were acquired, a 59% year-over-year increase.

Source: Silicon Valley Bank

Coinbase acquired Deribit for $2.9 billion; Kraken acquired NinjaTrader for $1.5 billion.

In an interview at the Davos Forum, Brian Armstrong stated that M&A activity in the crypto industry will continue to increase.

Industry survivors are accelerating consolidation, but they are acquiring companies, not the tokens we hold.

Regulatory Clarity Changes Industry Incentive Direction

In July 2025, the GENIU Act was passed, Circle completed its IPO, and five crypto companies received banking charters from the US Office of the Comptroller of the Currency (BitGo, Circle, Fidelity Digital Assets, Paxos, Ripple).

These events have pushed industry projects towards compliant development, slowing the development pace and reducing public information, replacing the previous "build fast, launch fast" model.

Companies are no longer rushing to issue tokens; instead, they are choosing to go public. This approach is less attractive and has caused crypto-native participants to miss out on the benefits.

AI Captures the Attention of Crypto-Native Speculators

Venture capital is flowing into AI, and retail attention has shifted accordingly.

Now, my social feed is split roughly 50/50 between AI-related content and crypto content. Even if I try hard to filter out irrelevant content, I can't block it all, otherwise my feed would only contain my own posts.

A significant amount of talent and capital that might have flowed into the crypto industry is now directed towards AI.

Implications for Ordinary Investors

The old investment strategy was: find newly launched projects, get in early, and sell during the token generation event for profit.

This strategy assumed a constant stream of new projects entering the market and that token prices wouldn't fall significantly.

The new investment strategy might be: find protocols with actual revenue, hold during the平淡期 (flat period) of industry infrastructure construction, and wait for real demand growth driven by traditional financial institution integration or increased industry penetration.

I also mentioned this view in my article "Crypto Truths and Lies for the Year 2026". I believe protocols achieving institutional-grade adoption, like Pendle, Chainlink, or leading lending protocols, will outperform the broader market.

Another strategy is: hold stablecoins and wait patiently for the next bull market.

Currently, the actual usage of cryptocurrency (stablecoin transactions, DEX volume, protocol fees) is growing, while the industry's delivery pace (new project launches, developer activity, industry announcements) is slowing. This is a classic sign of industry consolidation.