Silver is soaring, can tokenized silver amplify leverage further?

- Core View: Silver prices recently hit a record high, with gains surpassing those of Bitcoin and gold over the same period, increasing market attention; the article outlines currently liquid tokenized silver assets and major leveraged trading channels, and analyzes the macro drivers behind this rally.

- Key Elements:

- Silver prices broke through $117 per ounce intraday to reach a record high, with a cumulative increase of approximately 517% since 2017, surpassing the gains of Bitcoin (approx. 500%) and gold (slightly below 300%) over the same period.

- The overall market cap of the tokenized silver sector is about $446 million, with relatively liquid assets being Kinesis Silver (KAG, market cap $406 million) and iShares Silver Trust (SLV, market cap $39.5 million).

- Multiple trading platforms offer leveraged silver contract trading, such as Hyperliquid, Binance (supporting 20x leverage), and Bitget, with Binance's XAG/USDT contract recording a 24-hour trading volume of $1.32 billion.

- Analysts believe that international tensions triggered by Trump's policies, the preference for Fed rate cuts, and the U.S. designation of silver as a critical mineral are the core macro factors driving the silver price increase.

- In terms of market behavior, expectations of supply tightness, safe-haven demand, and retail investment shifting from high-priced gold to silver have collectively fueled this silver rally.

Original|Odaily(@OdailyChina)

Author|Wenser(@wenser 2010)

Silver, the precious metal asset once dubbed "poor man's gold," is sweeping across global markets with storm-like momentum. The reason is none other than its staggering price surge.

Recently, the price of silver briefly broke through $117 per ounce, reaching a new all-time high. Consequently, since the peak of the 2017 crypto cycle, silver has officially surpassed Bitcoin's gain (approximately 500%) and gold's gain (slightly below 300%) with a cumulative increase of about 517%. According to data from the 8marketcap website, the current silver price is around $110, with a market capitalization reaching $6.18 trillion, ranking second among global assets, just behind gold. Such an astonishing trend naturally triggers fervent market interest. Beyond purchasing silver funds or physical silver through traditional brokerages or offline stores, tokenized silver might also be an option, especially the leveraged contracts offered by exchanges and on-chain Perp DEXs.

Current State of Silver Tokens: Only 2 Assets with Relatively Good Liquidity

According to Coingecko website data, the overall market capitalization of the tokenized silver sector is currently around $446 million, with a 24-hour increase of approximately 5.6%. Specifically, the silver tokens with relatively better liquidity are the following 2:

Kinesis Silver (KAG): Market Cap Currently Around $406 Million

Like the gold token KAU, the KAG silver token is issued by the UK-based digital asset utility platform Kinesis, registered in the Cayman Islands. Major trading platforms include Kinesis Money, BitMart, the UAE exchange Emirex, and others.

It is understood that KAG is backed by fully insured and regularly audited vaults (globally distributed storage), with each token pegged to 1 ounce of investment-grade silver. It supports global real-time payments, allows for physical silver redemption, and has no storage fees.

Its potential risks are similar to those of Tether, the issuer of the XAUT gold token. This token heavily relies on the asset credibility of the issuer and faces certain regulatory uncertainties. Additionally, limited by its smaller market cap, market depth is relatively modest. Market volatility may lead to premiums or discounts, making it more reliant on trading platforms for order matching.

Nevertheless, information from the Coingecko website shows that KAG's 24-hour trading volume is approximately $5.5 million, already ranking second in trading volume within the silver token market.

iShares Silver Trust (SLV): Market Cap Currently Around $39.5 Million

A silver-tracking token launched by Ondo Finance, pegged to the iShares Silver Trust (SLV) ETF, which holds corresponding physical silver.

Its advantages include tracking a regulated traditional SLV ETF, offering good liquidity, and supporting instant minting or redemption (for non-US users). It combines traditional finance with blockchain convenience, has institutional-grade backing, and eliminates the need to directly handle physical silver.

Its potential risks lie in its primary reliance on the asset credibility of issuers like BlackRock and Ondo; it does not support physical silver ownership or direct redemption. It includes certain ETF management fee costs. US users face trading restrictions and potential securities regulatory limitations.

Major trading platforms include centralized exchanges such as Gate, Bitmart, Bitget, and AscendEX.

It is worth mentioning that SLV also supports contract trading, with leverage up to 10x.

Information from the Coingecko website shows that SLVON's 24-hour trading volume is approximately $21.2 million, ranking first in trading volume within the silver token market.

Besides the two major silver tokens KAG and SLVON, the silver token Silver rStock (SLVR) launched by the Solana ecosystem stock tokenization platform Remora Market, and the silver token Gram Silver (GRAMS) pegged to 1 gram of silver launched by Token Teknoloji A.Ş are also spot tokens. However, their market capitalization and liquidity are extremely low, and their price deviation from physical silver is greater compared to KAG and SLVON. Trading is not recommended.

Silver Leveraged Trading Platforms: Hyperliquid, Binance, Bitget, and Other Exchanges

Beyond spot silver tokens, many tokenized US stock trading platforms, on-chain Perp DEXs, CEXs, and DEXs have already opened leveraged contract trading for silver, supporting leverage up to 20-100x. The following are specific trading platforms for readers' reference:

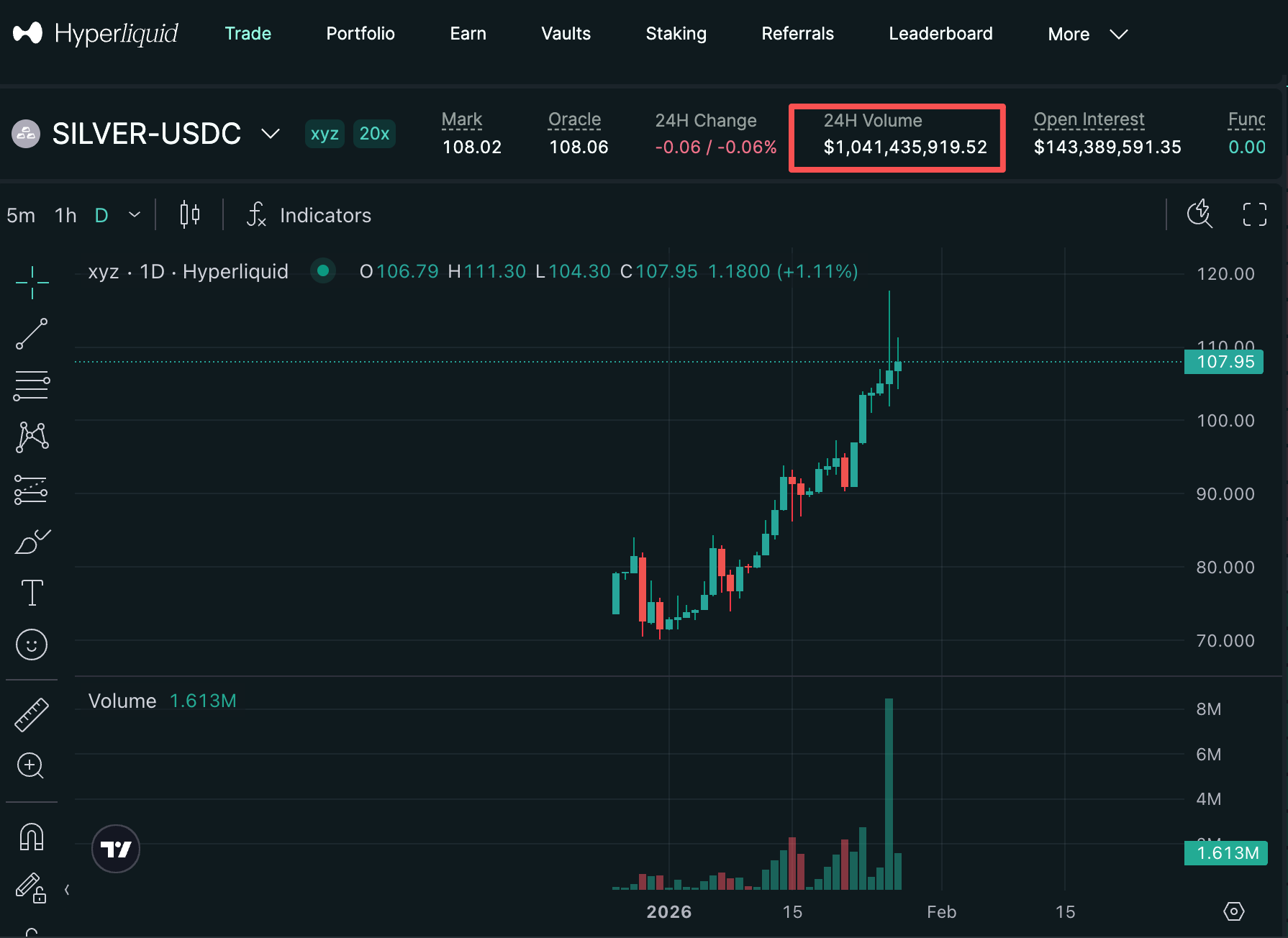

Channel One — Hyperliquid: https://app.hyperliquid.xyz/trade/xyz:SILVER. The SILVER/USDC contract trading pair has a 24-hour trading volume exceeding $1 billion.

Channel Two — Binance: https://www.binance.com/zh-CN/futures/XAGUSDT. Supports leveraged trading for the XAG/USDT pair, with leverage up to 100x. Currently, the 24-hour trading volume is $1.32 billion. According to an official announcement, this trading pair was officially launched on January 7th (at that time, the official announcement indicated leverage up to 50x). On the other hand, the latest news shows that Binance will change the price index composition for the gold token XAU/USDT contract on January 29, 2026.

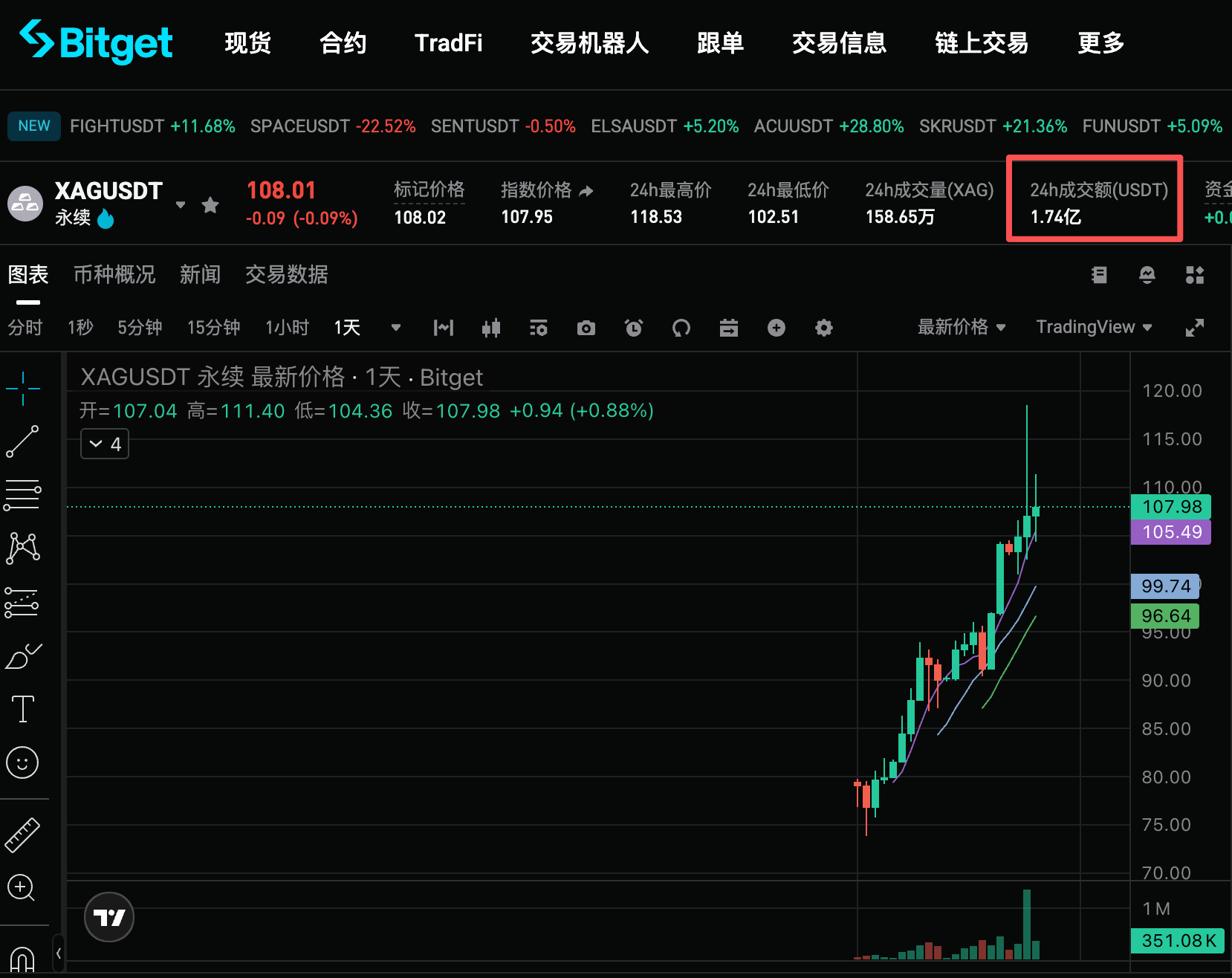

Channel Three — Bitget: https://www.bitget.site/zh-CN/futures/usdt/XAGUSDT. Supports leveraged trading for the XAG/USDT pair, with leverage up to 50x. Currently, the 24-hour trading volume is $174 million.

Conclusion: Trump's Hawkish Policies and Rate Cut Preference Will Be the Best Catalyst for Precious Metals

Looking back, the international political and economic tensions caused by Trump's administration, the winds of tariff trade wars, and the preference for Federal Reserve rate cuts are the best catalysts for rising precious metal prices. Specifically for silver, beyond past reasons like supply tightness and its importance as a fundamental raw material, risk-off assets and the US stance are crucial.

J. Safra Sarasin strategist Claudio Wewel pointed out that the continuous surge in silver prices stems from the market's reduced expectations for US rate cuts and silver's newly acquired status as a critical mineral. The US Department of the Interior listed silver as a critical mineral in November, increasing the possibility of the US imposing tariffs on this metal. He noted that this exacerbates long-term supply tightness and prompts US importers to accelerate silver purchases. Meanwhile, retail investors, finding it difficult to buy gold at its historical highs, are turning to silver as a safe-haven asset.

In other words, silver's primary rise stems from both "scarcity" and "safe-haven appeal." Combined with the renewed tensions in the Middle East, the price peak for silver may still be far from over.