Rising in Silence: Is Circle Undervalued in the Red Ocean of Stablecoins?

- Core Viewpoint: The article analyzes the competitive landscape between Circle and Tether in the stablecoin market. It points out that against the backdrop of tightening regulations, compliance-focused Circle (USDC) is challenging Tether's (USDT) dominance in offshore markets by leveraging its regulatory advantages, institutional partnerships, and ecosystem development. It also discusses Circle's strategic shift from relying on interest income to diversifying into ecosystem services.

- Key Elements:

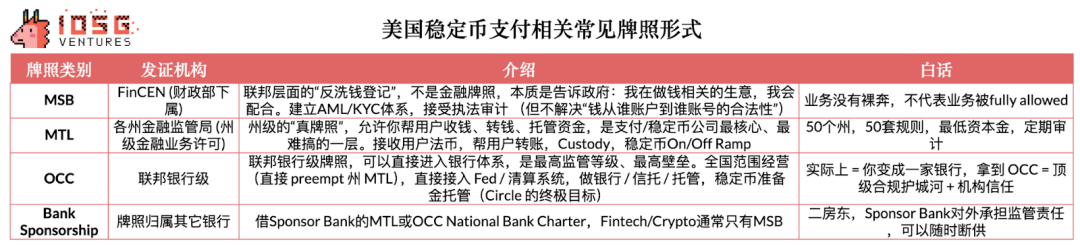

- Diverging Regulatory Paths: China is cracking down on offshore stablecoins, while the US and Europe are pushing for compliance (e.g., the US GENIUS Act). This creates conditions for compliant issuers like Circle to enter the mainstream financial system, while Tether faces ongoing regulatory pressure.

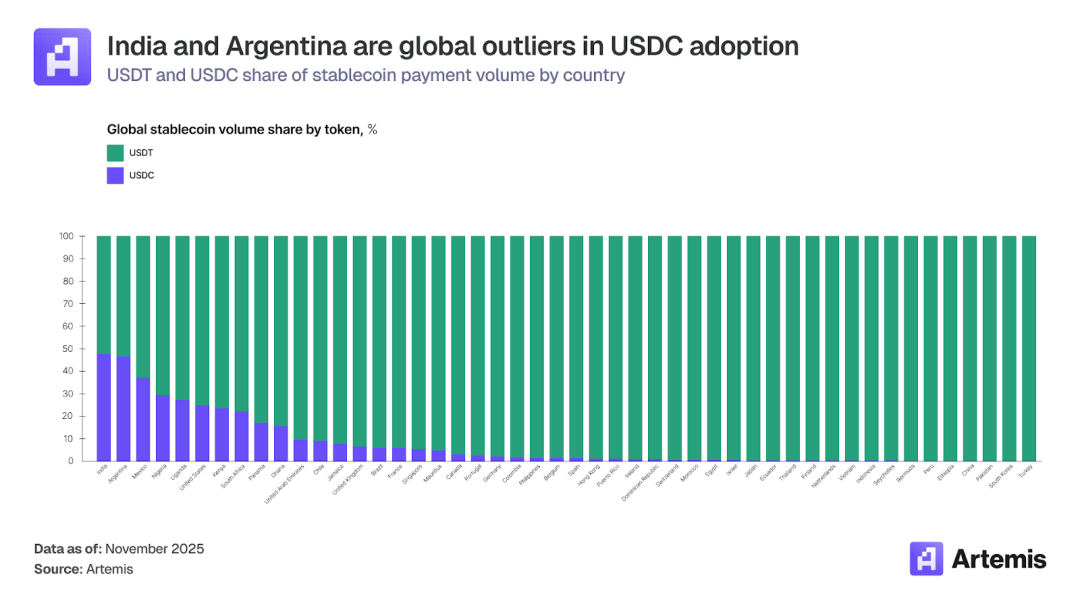

- Evolving Market Landscape: Tether still dominates offshore markets, but Circle's USDC net supply grew by $32 billion over the past year. Circle has also gained significant market share (48% and 46.6% respectively) in emerging markets like India and Argentina through its crypto card business.

- Circle's Financial and Ecosystem Advantages: Circle's Q3 2025 revenue reached $740 million, primarily from reserve interest. Simultaneously, it is actively expanding its cross-chain protocol (CCTP), settlement partnerships with Visa, and building the ARC public chain and payment network (CPN) to create diversified revenue streams and a strong ecosystem moat.

- Business Model Comparison: Tether's business model advantage lies in not needing to share profits with partners and having more flexible reserve assets, potentially leading to higher returns. Circle, however, shares approximately 50% of its interest income with Coinbase and employs an extremely conservative reserve strategy (e.g., short-term US Treasuries).

- Short-term Challenges and Long-term Value: In the short term, Circle faces challenges such as declining interest rates compressing interest income, a single revenue model, selling pressure from stock lock-up expirations, and market short-selling pressure. However, in the long run, its compliance status, network effects, and ecosystem development are undervalued by the market. A DCF model suggests an intrinsic value ($142/share) higher than the current market price.

Original Author: Frank, IOSG

1. Circle vs Tether: The Full-Scale War of 2026

On December 12, 2025, Circle received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to establish a national trust bank—the First National Digital Currency Bank. Once fully approved, this key milestone will provide top global institutions with fiduciary digital asset custody services, accelerating the stablecoin market cap to $1.2 trillion within three years. Riding this momentum, Circle successfully went public in 2025, and with the increased circulation velocity of USDC, it has become the stablecoin issuer most closely connected with institutional investors. As of now, its valuation has reached $23 billion.

▲ Source: IOSG Ventures

Although Tether, the market leader in stablecoins, maintains high profitability exceeding $13 billion, its parent company faces ongoing commercial reputation and regulatory pressures. For example, S&P recently downgraded Tether's reserve rating from "Strong" to "Weak," and Juventus Football Club rejected its acquisition offer. On November 29, the People's Bank of China held a special meeting to crack down on virtual currency trading, explicitly pointing out that stablecoins have deficiencies in customer identification and anti-money laundering, and are often used for money laundering, fraud, and illegal cross-border fund transfers. The regulatory focus essentially targets the offshore stablecoin system represented by USDT. USDT dominates emerging markets in Asia, Latin America, and Africa, with a market share exceeding 90% in East Asia. A significant portion of its circulation occurs in off-chain P2P and cross-border fund activities, long operating outside the regulatory system. Regulators view it as a "grey dollar system" that exacerbates capital flight and financial crime risks.

▲ Source: Visa Onchain Analytics

In contrast, the path taken by the U.S. and the EU is not a comprehensive crackdown but rather bringing stablecoins into the regulatory system through high compliance. For example, the U.S. GENIUS Act explicitly requires stablecoins to establish 1:1 high-quality reserves, monthly audits, federal or state-level licenses, and prohibits the use of high-risk assets like Bitcoin and gold as reserves.

In other words, China aims to suppress the "shadow dollar system of offshore stablecoins" at the source, while the U.S. and Europe are trying to establish a "controlled, compliant, and regulated digital dollar system." The commonality between these two paths is: neither is willing to let opaque, high-risk, unauditable stablecoins occupy a systemic position. This means compliant issuers like Circle can enter the financial system, while offshore stablecoins like Tether will gradually be excluded from developed markets in the future. This is also why Tether has recently begun vigorously developing its USAT, its first U.S.-compliant stablecoin.

▲ Source: Artermis

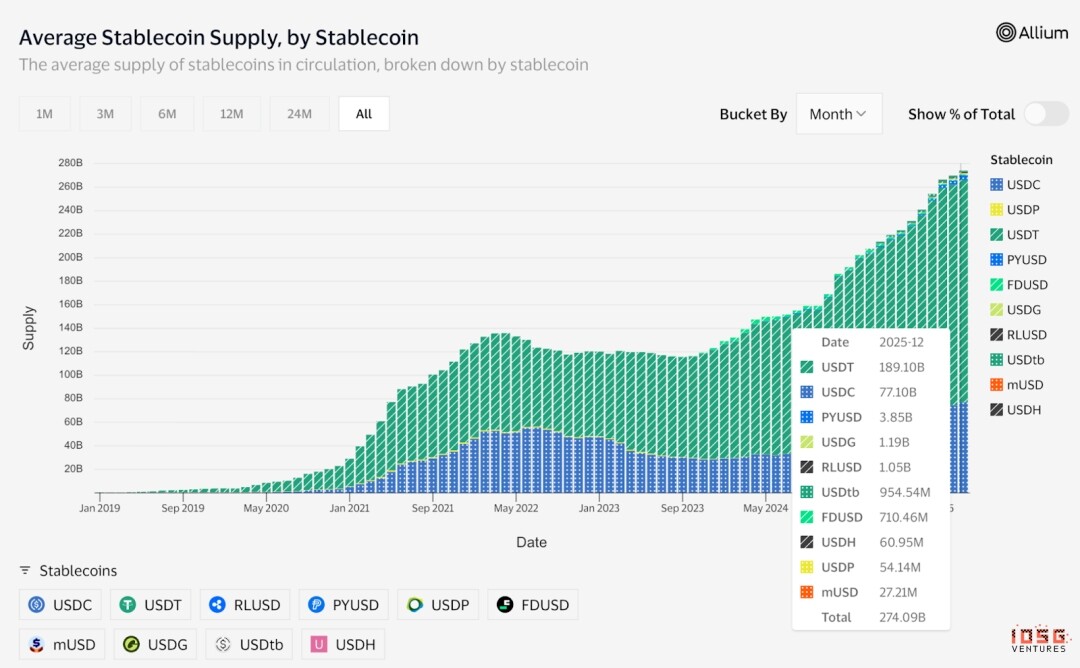

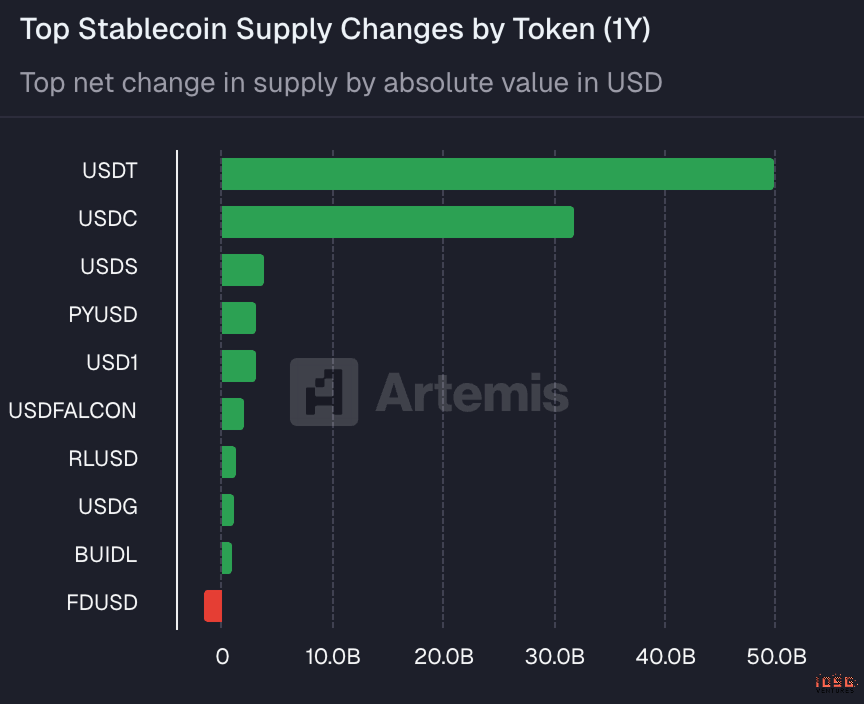

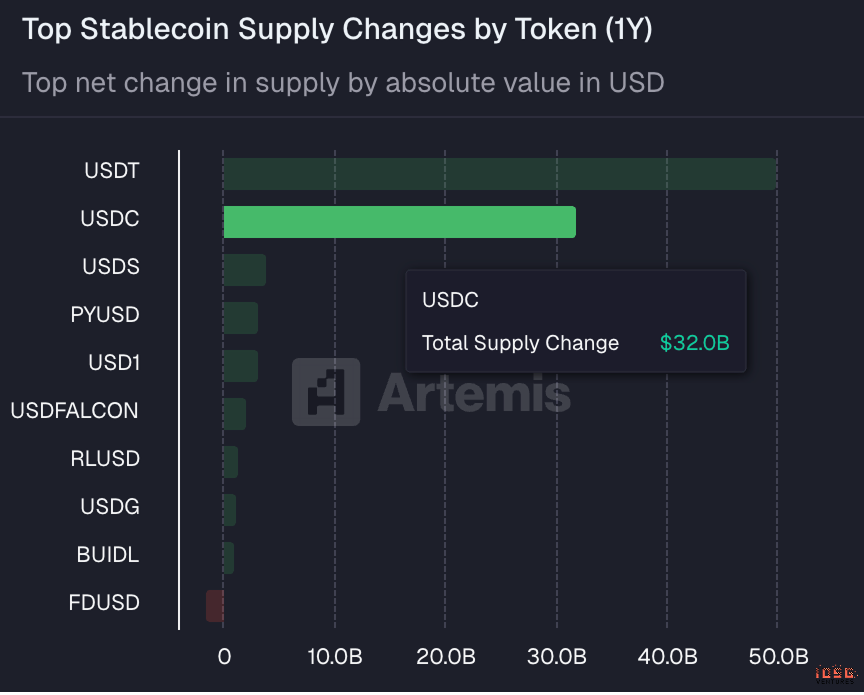

Although Tether may still maintain dominance in offshore and emerging markets, over the past year, Circle's USDC net supply also increased by $32 billion, second only to USDT's $50 billion.

However, Circle has also made significant progress in challenging Tether's offshore and emerging markets, achieving market shares of 48% and 46.6% in India and Argentina, respectively. The primary reason for the increased presence of Circle's USDC in these offshore markets is the explosive growth of crypto card businesses in recent years.

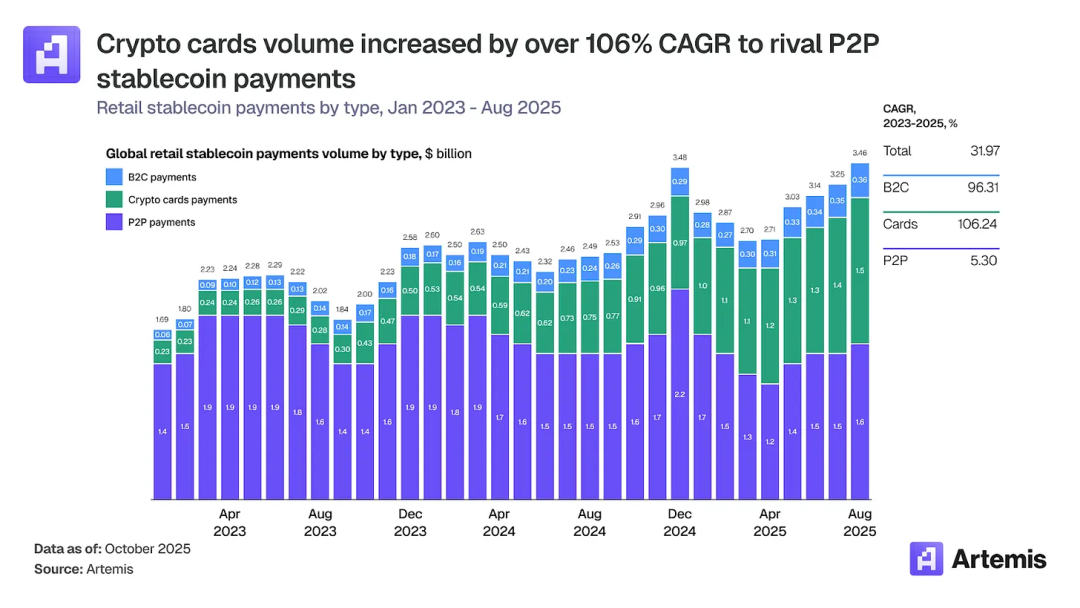

▲ Source: Artermis

Crypto cards enable users to spend stablecoin and cryptocurrency balances at traditional merchants and have become one of the fastest-growing segments in digital payments. Transaction volume grew from approximately $100 million per month in early 2023 to over $1.5 billion by the end of 2025, representing a compound annual growth rate of 106%. On an annualized basis, this market now exceeds $18 billion, comparable to peer-to-peer stablecoin transfers ($19 billion), which grew only 5% over the same period.

▲ Source: Artermis

The opportunity for stablecoin cards lies in addressing real needs in many offshore markets, not just serving as a gimmick. Many users in India still cannot access credit through traditional banks, and cryptocurrency-backed credit cards precisely address this need. Meanwhile, people in Argentina face severe inflation and currency devaluation. Stablecoin debit cards help people preserve value by holding assets pegged to the U.S. dollar.

Because stablecoin cards need to connect to the Visa or Mastercard network to transact with local merchants, USDC naturally becomes the most suitable compliant stablecoin, thus gaining significant transaction volume share in these offshore regions and countries where stablecoin cards are popular. From this, we can see Circle and Tether intensifying competition in each other's areas of strength, and it's still difficult to say who has the upper hand in the short term.

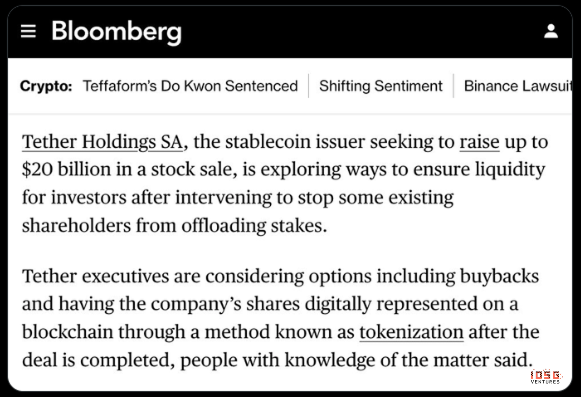

Of course, from a valuation perspective, they are not on the same scale at all. USDT's OTC Valuation reached $300B, and there are also Bloomberg news reports that it recently raised up to $20 billion at a valuation of $500 billion. In contrast, Circle's latest market cap is only $18.5 billion.

▲ Source: Bloomberg

This premium in Tether's valuation stems from many factors besides its market monopoly, but the primary one is the advantage of Tether's business model, which does not require sharing profits with Coinbase like Circle does. According to Circle's S-1 filing, Coinbase receives 100% of the reserve yield for USDC held on its platform. For USDC outside its own platform, such as those held on other exchanges, DeFi protocols, or personal wallets, the interest income generated is split 50/50 between Circle and Coinbase.

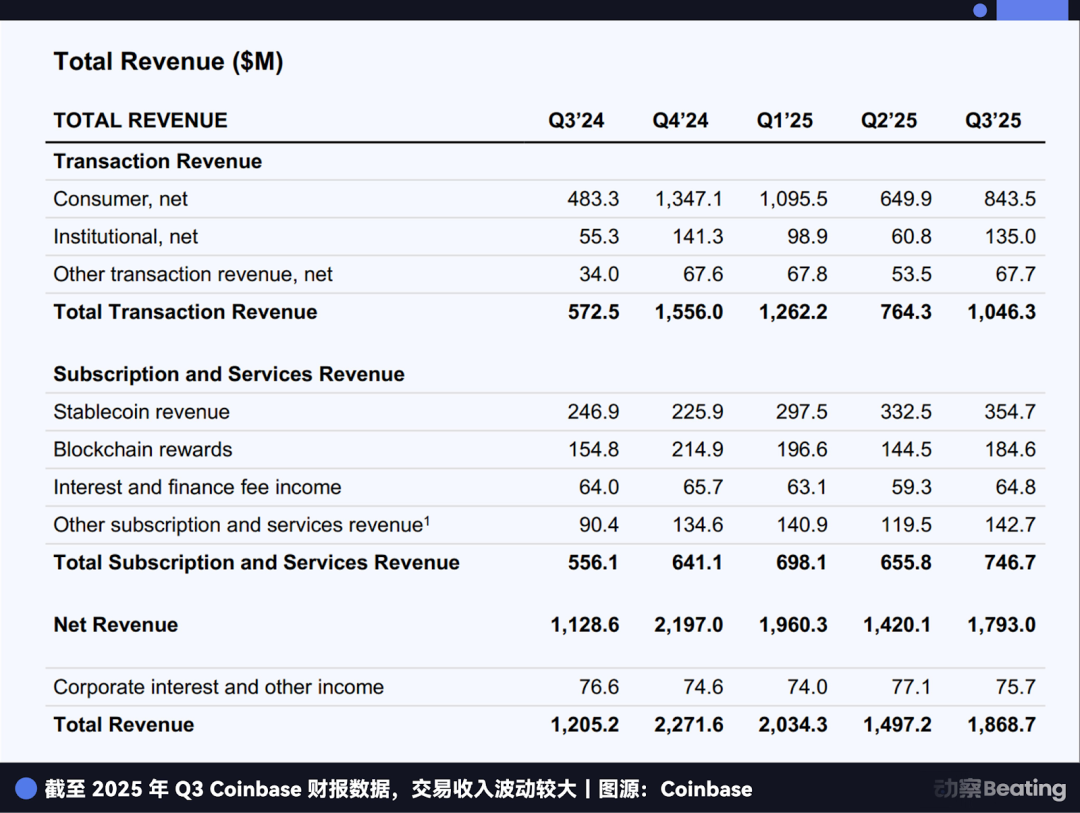

▲ Source: Beating

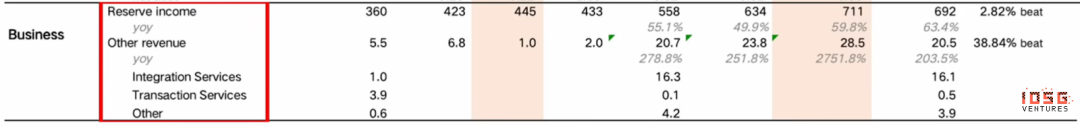

According to Beating's compilation, Coinbase's revenue in Q3 2025 reached $354.7M, which is 50% of Circle's own interest income of $711M during the same period. In other words, for every $2 in interest Circle earns, $1 goes to Coinbase.

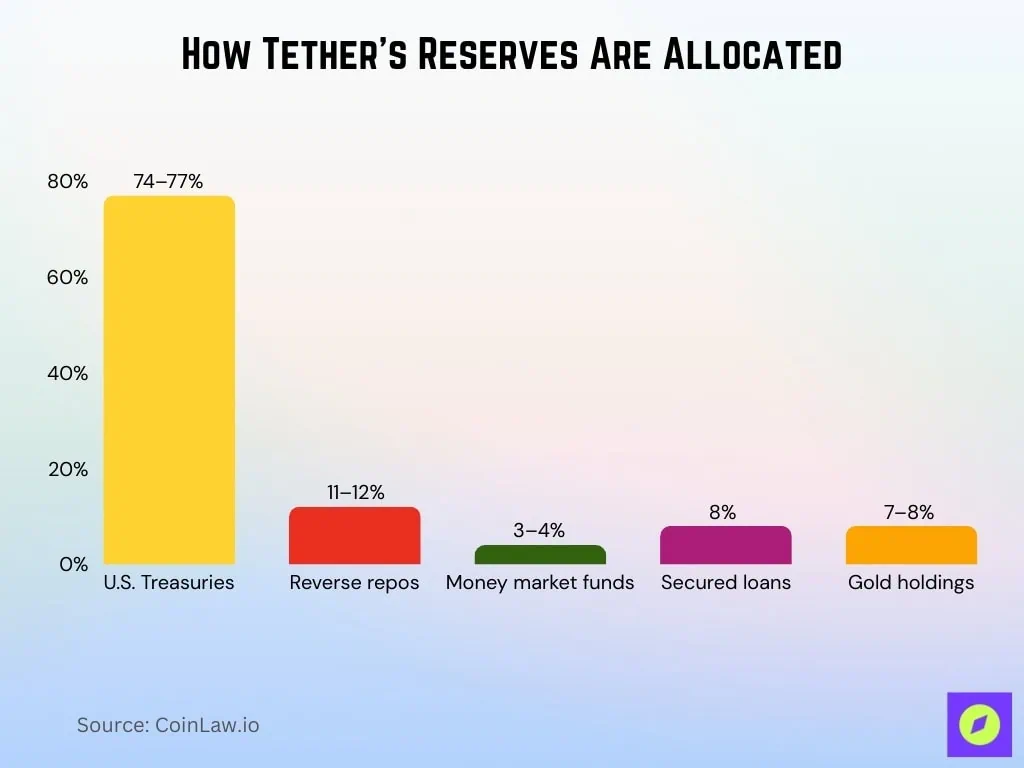

Besides not having to share profits, Tether's USDT has another huge advantage: it does not need to follow collateral restrictions. If Circle adopts an extreme reserve "conservative strategy": 85% in short-term U.S. Treasuries with maturities not exceeding 90 days and overnight reverse repurchase agreements, 15% in cash and equivalents, all custodied by BlackRock or BNY, with monthly audit reports issued by accounting firm Grant Thornton LLP, ensuring 1:1 coverage of circulation with reserves and real-time verifiability.

▲ Source: CoinLaw

In comparison, we can see that USDT's collateral is more diversified than Circle's, leading to higher reserve yields, which is particularly important in the macro context of spreading market risk aversion and rising gold prices.

This makes one wonder: if taking the path of "high compliance + regulatory whitelist," is a compliant stablecoin itself a good business?

2. Circle's Financial Report: A Quarter of Comprehensive Growth in Q3

First, we can review Circle's primary revenue model and income situation as a stablecoin company. Circle's stablecoins are backed 1:1 by cash and short-term U.S. Treasuries as collateral for minting. In a high-interest-rate environment, these reserve assets can generate substantial interest income.

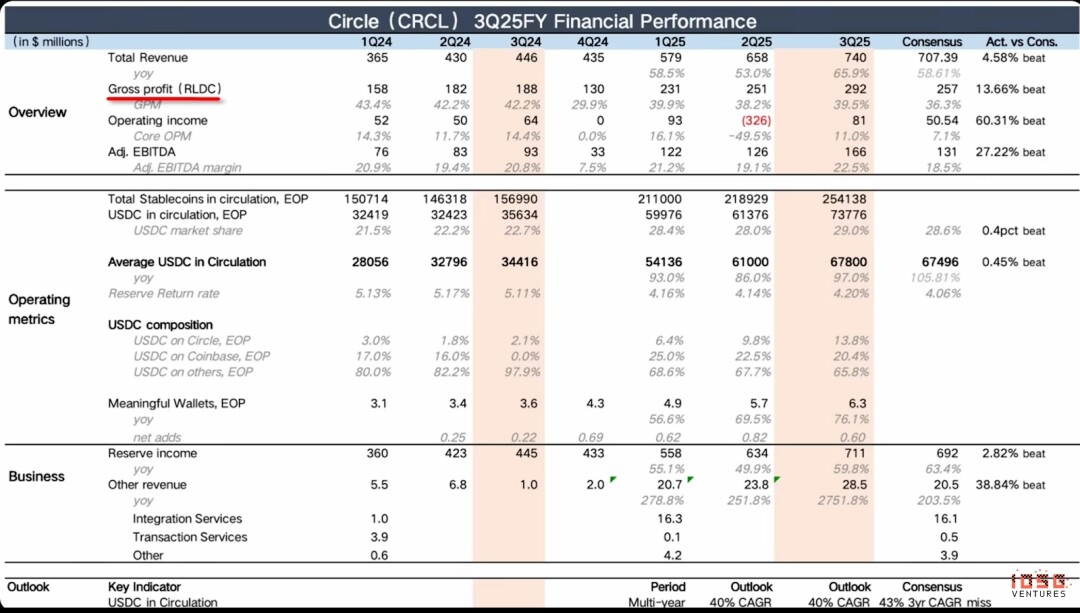

In the third quarter of this year, Circle's revenue reached $740M (of which interest income alone generated $711M), beating expectations of $707M, with a YoY growth of 66%. However, MoM growth slightly declined from 13.6% last quarter to 12.5% this quarter, though overall it remains at a similar level.

USDC circulation nearly doubled, and the Adjusted EBITDA margin reached 22.5%. This rare combination of growth and profitability makes it stand out in the fintech sector, becoming one of the few examples in the industry with both high growth and high margins.

▲ Source: Circle Q3 Earnings

This quarter, the company's quarterly total profit (RLDC) reached $292M, significantly exceeding market expectations, with growth rates essentially flat compared to the previous two quarters. RLDC (Revenue Less Distribution and other Costs) is calculated as: total revenue minus distribution, transaction, and other related costs. The RLDC Margin is the percentage of RLDC relative to total revenue, used to measure the profitability of the core business.

Operating Income also significantly beat market expectations, whereas last quarter's Operating Income was negative, mainly due to one-time equity incentives, including $424M in SBC (Share-Based Compensation) and $167M in Debt Extinguishment Charge. Therefore, for easier comparison, we use Adjusted EBITDA, which adds back non-core, one-time expenses like depreciation, amortization, taxes, and equity incentives to reflect the recurring operational performance of the main business. Looking at Adjusted EBITDA performance, both YoY and QoQ growth accelerated, with a YoY increase of 78% and a QoQ increase of 31%, also significantly beating market expectations.

We can see that Circle's core revenue source is the interest generated by reserve assets. However, this revenue model is very fragile and directly affected by macro interest rates. Therefore, Circle's biggest challenge is whether it can quickly transform its single, fragile stablecoin revenue model and develop diversified revenue streams.

▲ Circle Q3 Earnings

Therefore, the financial report focuses on the growth rate of other revenue and the growth rate of other revenue's share in overall revenue. As long as these two items continue to grow, it indicates Circle's revenue model is steadily improving. Conversely, if the growth rate of these items declines, it would be a relatively bearish signal.

Other revenue was $28.5M, significantly exceeding market expectations. However, given the base of only $1 million in the same period last year, the YoY data has limited reference value. More meaningful QoQ data shows a growth rate of 20% this quarter, accelerating from 15% last quarter, indicating this revenue segment is indeed growing rapidly. However, "other revenue" still accounts for less than 4% of total revenue, and it will take time to change Circle's single revenue structure.

Nevertheless, this is still a positive signal. Expecting a fundamental transformation of the revenue model within just half a year is unrealistic; the current steady QoQ growth has laid a good foundation for future diversification.

▲ Source: Circle Q3 Earnings

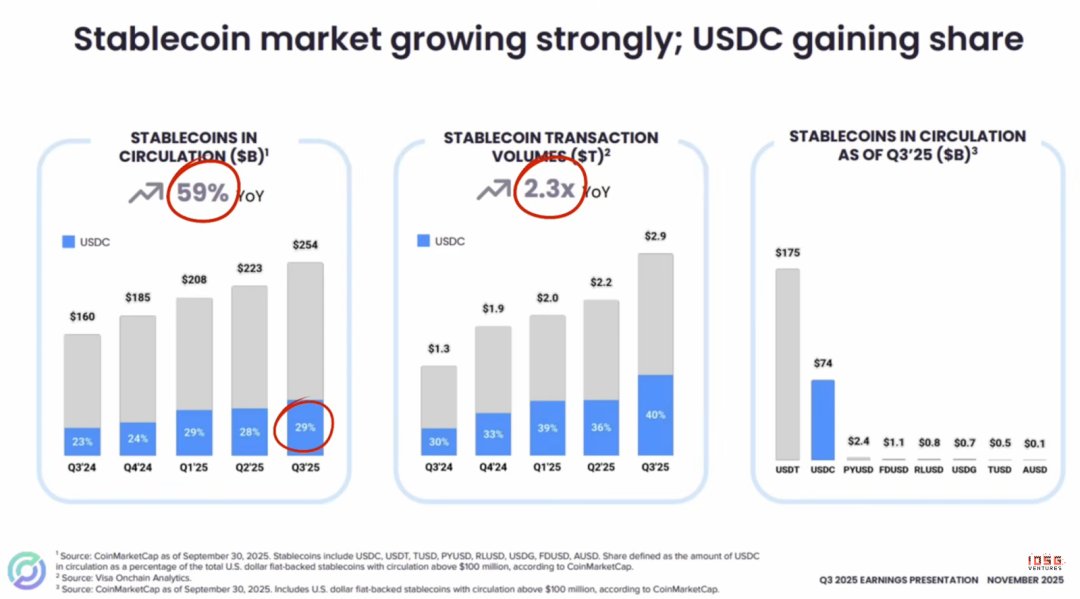

Analyzing from a more macro perspective, the stablecoin market is experiencing rapid growth, with its overall circulation increasing by 59% YoY, and on-chain transaction volume reaching 2.3 times that of the same period last year, showing enormous market potential.

Against this backdrop, USDC's performance is particularly outstanding, with its market share steadily climbing to 29%. Notably, even amidst recent competition from emerging stablecoins like Phantom $CASH, USDC's upward trend has not been interrupted.

There is a common concern in the market: as more stablecoins are issued, will USDC no longer be the best stablecoin choice? From platforms offering "stablecoin issuance as a service" (like from Bridge to M0 to Agora) to numerous enterprises entering the field, these phenomena seem to indicate the industry will fall into excessive competition (involution), eroding long-term profitability. However, this view largely ignores a key market reality.

The growth in USDC's market share is primarily attributed to the favorable environment created by regulatory advancements like the Genius Act. As a leader in compliant stablecoins, Circle occupies a unique strategic high ground. Globally, whether in the U.S., Europe, Asia, or regulated regions like the UAE and Hong Kong, mainstream institutions tend to prefer compliant infrastructure partners like Circle, which offer trust, transparency, and liquidity; otherwise, their related businesses would be difficult to conduct.

Therefore, concerns that emerging stablecoins in the market might challenge USDC's market position are difficult to substantiate. On the contrary, USDC can not only solidify its second-place position for a long time but also has the strength to challenge the market leader with its unparalleled compliance advantages. The network scale effect barrier during this period could be 2-3 years.

▲ Source: Circle Q3 Earnings

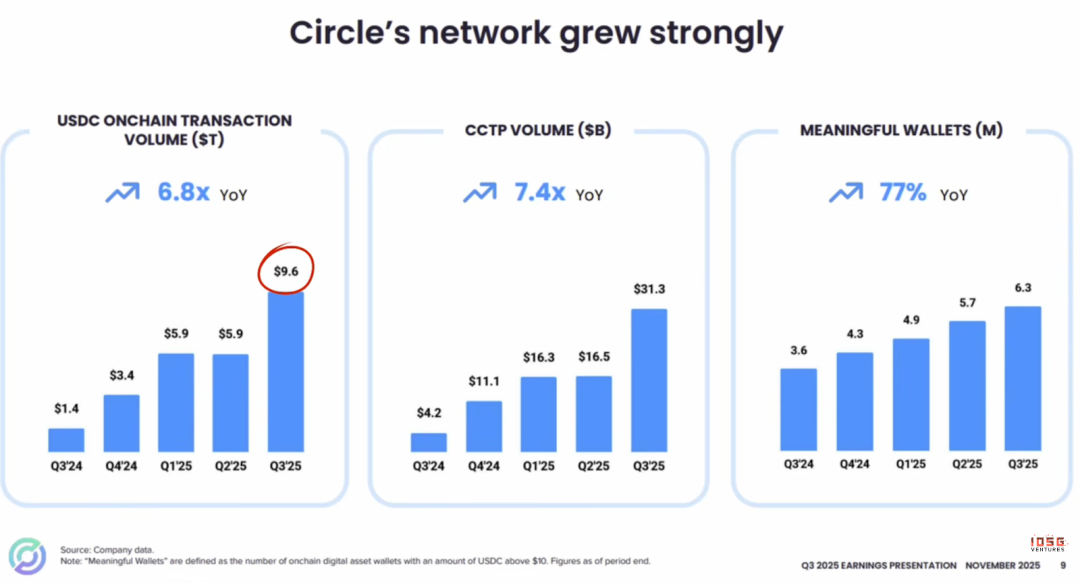

USDC's on-chain activity is experiencing explosive growth. Its on-chain transaction volume has surged to $9.6 trillion, 6.8 times that of the same period last year.

This growth is attributed to the success of its Cross-Chain Transfer Protocol (CCTP). CCTP enables seamless, unified transfer of USDC across different blockchains by burning on the source chain and natively minting on the destination chain, avoiding the complexity and risks of traditional cross-chain bridges.

Overall, whether it's on-chain transaction volume, CCTP usage data, or the growth in the number of active wallets (with balances greater than $10), all indicators clearly point to the same conclusion: USDC's adoption rate and network velocity are continuously and significantly expanding.

▲ Source: Visa

Regarding ecosystem partnerships, Visa announced on December 16th that it is opening its U.S. network to USDC stablecoin settlement services, allowing U.S