Global top influencer MrBeast becomes a trump card for Tom Lee

- Core Viewpoint: Beast Industries, the holding company behind global top influencer MrBeast, has secured investment from BitMine Immersion Technologies (BMNR) and plans to explore integrating DeFi into its financial services platform. This marks a shift in its business model from high-cost content-driven operations towards building a sustainable economic ecosystem that merges finance and traffic.

- Key Elements:

- The investor, BMNR, is led by renowned Wall Street analyst Tom Lee. Its investment aims to bet on the programmable future of attention gateways, rather than merely chasing influencer hype.

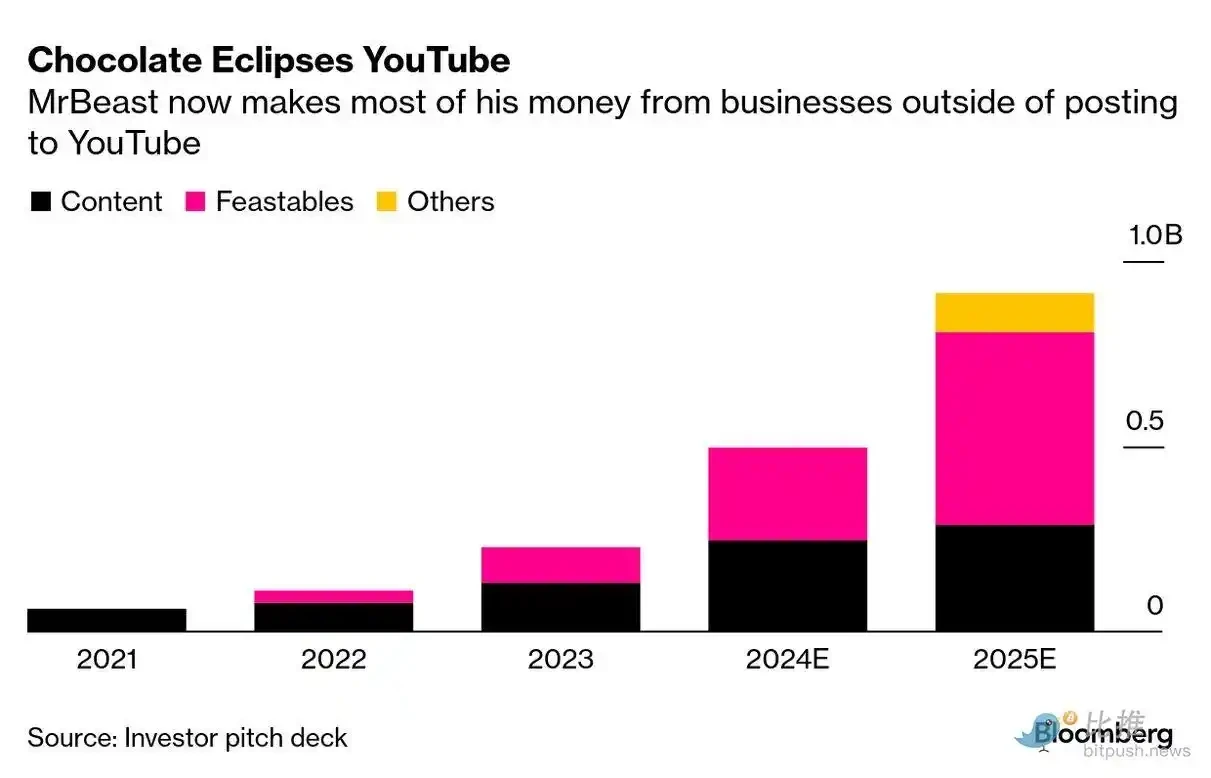

- Beast Industries generates over $400 million in annual revenue with an estimated valuation of around $5 billion. However, its core video business is extremely high-cost and low-margin, leaving the company in a state of continuous expansion and cash strain.

- The company's chocolate brand, Feastables, contributes approximately $250 million in annual sales, providing stable profits. Its success relies on the low-cost traffic driven to the brand by MrBeast's video content.

- MrBeast's personal wealth is highly concentrated in company equity, and he has described himself as being in a "negative cash" state. His business model depends on reinvesting almost all revenue into content production to generate traffic.

- The "DeFi integration into the financial services platform" explored in this collaboration may point towards low-cost payment settlement, programmable account systems, or decentralized equity structures, aiming to build long-term economic relationships with users.

Original author: Seed.eth, BitpushNews

$200 million is the figure just announced today.

BitMine Immersion Technologies (BMNR), chaired by renowned Wall Street analyst Tom Lee, announced an investment to acquire a stake in Beast Industries, the holding company behind the globally top-tier influencer MrBeast. Meanwhile, in its official statement, Beast Industries mentioned that the company will explore how to "integrate DeFi into the upcoming financial services platform."

At first glance, this news seems like another familiar crossover: traditional finance, crypto, influencers, and entrepreneurship. On one side is the YouTube overlord with a cumulative global subscriber count exceeding 400 million, whose single video can make algorithms favor you. On the other side is Wall Street's top analyst most adept at narrating crypto stories, skilled at weaving grand blockchain concepts into balance sheets. Everything seems perfectly logical.

The Path of MrBeast

Looking back at MrBeast's early videos, it's hard to connect them with today's Beast Industries, valued at $5 billion.

In 2017, Jimmy Donaldson, who had just graduated from high school, uploaded a video of himself counting continuously for 44 hours—"Challenge: Count to 100,000!" The content was simple, almost childish, with no plot, no editing, just a person facing the camera, repeating numbers over and over. Yet, it became the turning point of his content career.

He was not yet 19 at the time, with only about 13,000 channel subscribers. After the video was released, it quickly surpassed a million views, becoming the world's first viral phenomenon of its kind.

Later, in an interview recalling that period, he said one sentence:

"I wasn't really trying to go viral; I just wanted to know if the outcome would be different if I was willing to put all my time into something no one else was willing to do."

Jimmy Donaldson succeeded in building his channel, becoming the MrBeast everyone knows today. But more importantly, from that moment on, he developed an almost obsessive belief: attention is not a gift of talent but something earned through investment and endurance.

Treating YouTube as a Company, Not a Creative Platform

Many creators, after gaining popularity, choose to "play it safe": reduce risk, increase efficiency, and turn content into a stable cash flow.

MrBeast chose the opposite path.

He has repeatedly emphasized one thing in multiple interviews:

"Basically, all the money I earn gets spent on the next video."

This is the core of his business model.

By 2024, his main channel's subscriber count had exceeded 460 million, with cumulative video views surpassing 100 billion. But behind this lies extremely high costs:

· The production cost for a single top-tier video consistently ranges from $3 million to $5 million;

· Some large-scale challenges or philanthropic projects can cost over $10 million;

· The first season of "Beast Games" on Amazon Prime Video was described by himself as "completely out of control in production," and he admitted in an interview: losses amounted to tens of millions of dollars.

When he said this, he showed no regret:

"At this level, you can't save money and still expect to win."

This sentence can almost be taken as the key to understanding Beast Industries.

Beast Industries: $400 Million in Annual Revenue, but Thin Profits

By 2024, MrBeast consolidated all his businesses under the name Beast Industries.

From public information, this company has far exceeded the scope of a "creator's side hustle":

· Annual revenue exceeds $400 million;

· Businesses span content production, FMCG retail, licensed merchandise, and tool-based products;

· Following the latest round of financing, the general market expectation for its valuation is around $5 billion.

But it's not easy.

MrBeast's YouTube main channel and Beast Games bring massive exposure but consume almost all the profits.

In stark contrast to the content business is his chocolate brand, Feastables. Public information shows that in 2024, Feastables' sales were approximately $250 million, contributing over $20 million in profit. This marked the first time Beast Industries had a stable, replicable cash flow business. By the end of 2025, Feastables had entered over 30,000 physical retail stores across North America (including Walmart, Target, 7-Eleven, etc.), covering the United States, Canada, and Mexico, significantly enhancing the brand's offline sales capabilities.

MrBeast has admitted on multiple occasions that video production costs are getting higher and even "increasingly harder to recoup." Yet, he still insists on pouring substantial funds into content production because, in his view, this is not simply paying for videos but buying traffic for the entire business ecosystem.

The core moat of the chocolate business is not production but the ability to reach consumers. While other brands need to spend huge sums on advertising exposure, he just needs to release one video. Whether the video itself is profitable is no longer important; as long as Feastables can continue to sell, this business loop can keep running.

"I'm Actually Broke"

In early 2026, MrBeast revealed in a Wall Street Journal interview that he was broke, sparking heated discussion:

"I'm basically in a 'negative cash' state right now. They all say I'm a billionaire, but there's not much money in my bank account."

This statement is not "humble bragging" but a natural result of his business model.

MrBeast's wealth is highly concentrated in unlisted equity; although he holds just over 50% of Beast Industries' shares, the company continues to expand and pays almost no dividends; he personally even deliberately avoids keeping cash.

In June 2025, he admitted on social media that because he had spent all his savings on video production, he even had to borrow money from his mother to pay for his wedding.

As he later explained more bluntly:

"I don't look at my bank account balance—it affects my decision-making."

And the fields he invests in have long extended beyond content and consumer goods.

In fact, as early as the 2021 NFT boom, on-chain records show he purchased and traded multiple CryptoPunks, some of which were sold for as much as 120 ETH each (worth hundreds of thousands of dollars at the time).

However, as the market entered a correction phase, his attitude became more cautious.

The real turning point lies in the fact that the "MrBeast" business model itself has reached a critical edge.

When an individual controls a global top-tier traffic gateway but remains in a state of high investment, cash constraints, and expansion reliant on financing, finance is no longer just an investment option but becomes an infrastructure that must be restructured.

The proposition repeatedly discussed within Beast Industries in recent years has gradually become clear: how to make users not just "watch content and buy goods" but enter a long-term, stable, and sustainable economic relationship?

This is precisely the direction traditional internet platforms have attempted for years: payments, accounts, credit systems. And at this juncture, the emergence of Tom Lee and BitMine Immersion (BMNR) has steered this path toward more structural possibilities.

Partnering with Tom Lee to Build a DeFi Foundation

On Wall Street, Tom Lee has always played the role of a "narrative architect." From early explanations of Bitcoin's value logic to emphasizing the strategic significance of Ethereum on corporate balance sheets, he excels at translating technological trends into financial language. BMNR's investment in Beast Industries is not chasing influencer hype but betting on the programmable future of attention gateways.

So, what exactly does DeFi mean here?

Currently, the public information is extremely restrained: no token issuance, no yield promises, no exclusive financial products for fans. But the phrase "integrate DeFi into the financial services platform" points to several possibilities:

- A lower-cost payment and settlement layer;

- A programmable account system for creators and fans;

- Asset recording and equity structures based on decentralized mechanisms.

The imagination is vast, but the real challenges are also clearly visible. In the current market, whether native DeFi projects or traditional institutions exploring transformation, most have not truly established a sustainable model. If they cannot find a differentiated path in this fierce competition, the complexity of financial business may instead erode the core capital he has accumulated over the years: fan loyalty and trust. After all, he has publicly stated many times:

"If one day what I do hurts my audience, I'd rather do nothing."

This statement will likely be repeatedly tested in every future attempt at financialization.

So, when the world's strongest attention machine seriously starts building financial infrastructure, will it become the next-generation platform or an "overly brave" crossover?

The answer won't be revealed quickly.

But one thing he understands better than anyone: the greatest capital is not past glory but the right to "start over."

After all, he's only 27.