Visa Revelation: The 50-Year Cycle of Stablecoin "Fragmentation Dilemma"

- Core Viewpoint: The current stablecoin market faces a fragmentation dilemma similar to the credit card industry in the 1960s. Learning from Visa's successful model of building a cooperative organization rather than relying on a single issuer to integrate the network could be a key path for stablecoins to achieve mainstream adoption and network effects.

- Key Elements:

- The core of Visa's success lies in its independent, cooperative third-party structure, which aligned incentives among banks and created compound network effects, rather than relying on technological or capital advantages.

- The current stablecoin-as-a-service model (e.g., Anchorage Digital) exacerbates market fragmentation, leading to hundreds of stablecoins operating independently, unable to form a unified network effect.

- Stablecoin liquidity is fragmented due to different token codes, with applications only accepting the most liquid coins, hindering the adoption of new stablecoins.

- The ideal solution is to establish an independent third-party cooperative similar to Visa, allowing issuers and applications to join, share reserve earnings, and have governance rights.

- This model aims to integrate issuers and protocols under the same token, creating internally circulating revenue and powerful network effects, preventing value leakage.

Original Author: Nishil Jain

Original Compilation: Block Unicorn

Preface

In the 1960s, the credit card industry was in chaos. Banks across the United States were trying to establish their own payment networks, but each network operated in isolation. If you held a Bank of America credit card, you could only use it at merchants that had agreements with Bank of America. When banks tried to expand their business to other banks, all credit card payments encountered the problem of interbank settlement.

If a merchant accepted a card issued by another bank, the transaction had to be settled through its original check clearing system. The more banks that joined, the more settlement problems arose.

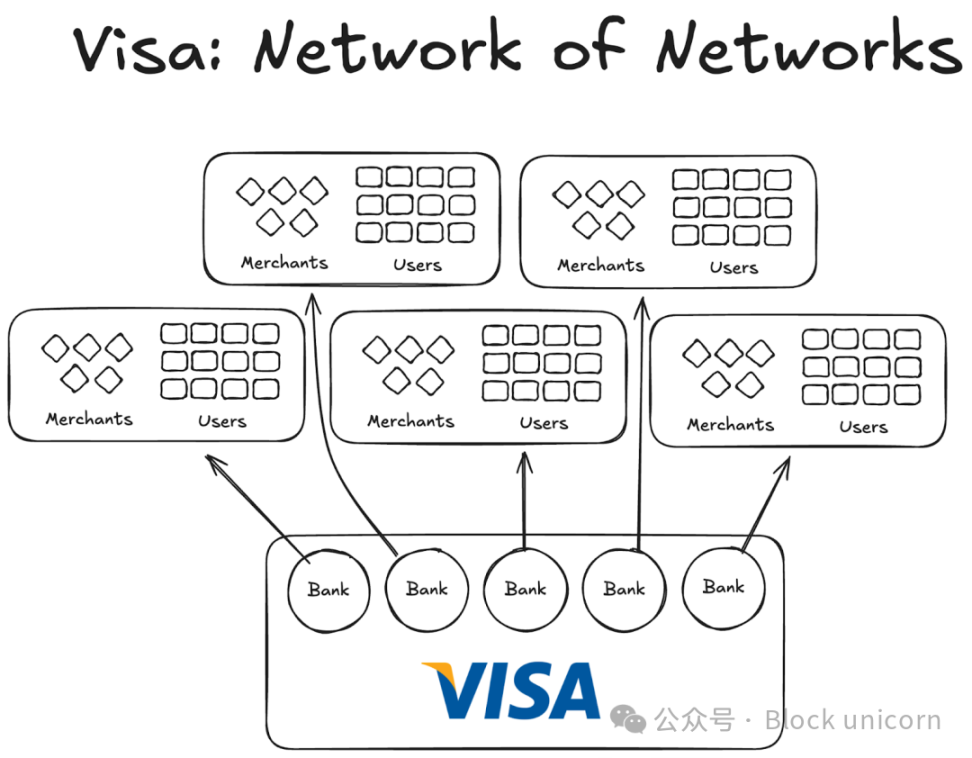

Then Visa emerged. While the technology it introduced undoubtedly played a huge role in the bank card payment revolution, its greater success lay in its global universality and its success in getting banks worldwide to join its network. Today, almost every bank in the world is a member of the Visa network.

While this seems very normal today, imagine trying to convince the first thousand banks, both inside and outside the United States, that joining a cooperative agreement instead of building their own network was a wise move, and you begin to realize the scale of this achievement.

By 1980, Visa had become the dominant payment network, processing about 60% of credit card transactions in the US. Currently, Visa operates in over 200 countries.

The key was not more advanced technology or more capital, but structure: a model that could align incentives, decentralize ownership, and create compounding network effects.

Today, stablecoins face the same fragmentation problem. And the solution might be exactly what Visa did fifty years ago.

Experiments Before Visa

Other companies that emerged before Visa failed to grow.

American Express (AMEX) tried to expand its credit card business as an independent bank, but its scale expansion was limited to continuously adding new merchants to its bank network. On the other hand, BankAmericard was different; Bank of America owned its credit card network, and other banks merely leveraged its network effects and brand value.

American Express had to approach each merchant and user individually to open its bank accounts; Visa scaled by onboarding banks itself. Every bank that joined the Visa cooperative network automatically gained thousands of new customers and hundreds of new merchants.

On the other hand, BankAmericard had infrastructure problems. They didn't know how to efficiently settle credit card transactions from one consumer's bank account to another merchant's bank account. There was no efficient settlement system between them.

The more banks that joined, the worse this problem became. Thus, Visa was born.

The Four Pillars of Visa's Network Effects

From Visa's story, we learn 2-3 key factors that led to its compounding network effects:

Visa benefited from being an independent third party. To ensure no bank felt threatened by competition, Visa was designed as a cooperative, independent organization. Visa did not compete for the distribution pie; the individual banks competed for it.

This incentivized participating banks to pursue a larger share of the profits. Each bank was entitled to a portion of the total profits, proportional to the total transaction volume it processed.

Banks had a say in network functions. Visa's rules and changes had to be voted on by all relevant banks and required an 80% approval rate to pass.

Visa had exclusivity clauses with each bank (at least initially); anyone joining the cooperative could only use Visa cards and the network, and could not join other networks—therefore, to interact with a Visa bank, you also needed to be part of its network.

When Visa's founder, Dee Hock, lobbied banks across the US to join the Visa network, he had to explain to each bank that joining the Visa network was more beneficial than building their own credit card network.

He had to explain that joining Visa meant more users and more merchants would connect to the same network, facilitating more digital transactions globally and bringing more revenue to all participants. He also had to explain that if they built their own credit card network, their user base would be very limited.

Implications for Stablecoins

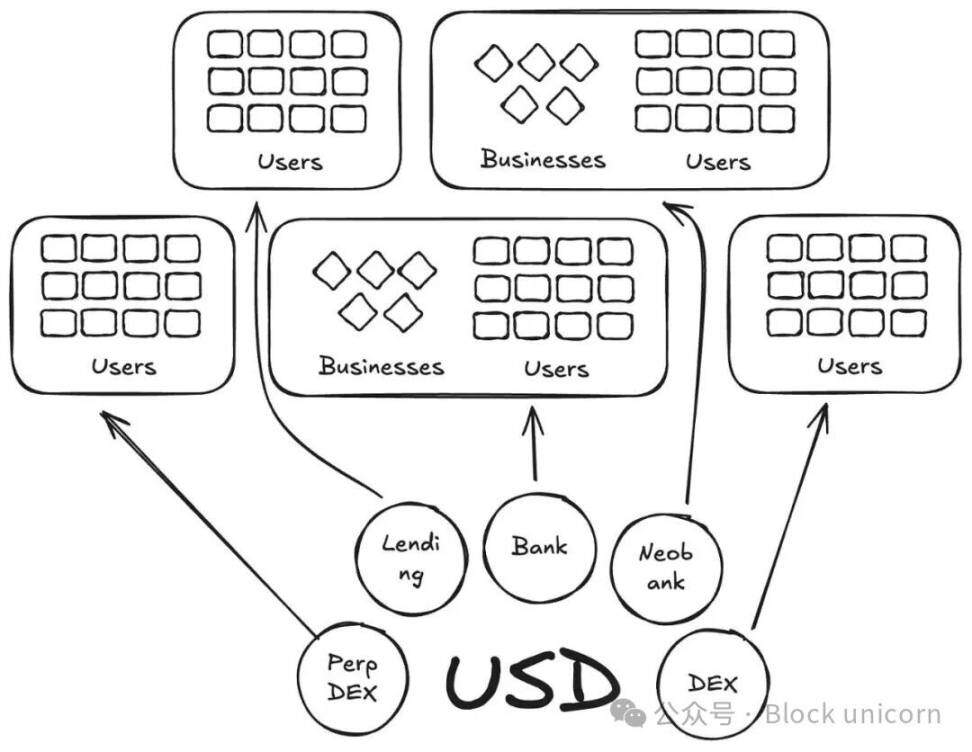

In a sense, Anchorage Digital and other companies offering stablecoin-as-a-service today are replaying the BankAmericard story in the stablecoin space. They provide the underlying infrastructure for new issuers to build stablecoins, while liquidity continues to fragment into new tokens.

Currently, over 300 stablecoins are listed on the DefiLlama platform. Moreover, each newly created stablecoin is limited to its own ecosystem. Therefore, no single stablecoin can generate the network effects needed to go mainstream.

Since the same underlying assets back these new coins, why do we need more coins with new tickers?

In our Visa story, these are like BankAmericards. Ethena, Anchorage Digital, M0, or Bridge—each allows a protocol to issue its own stablecoin, but this only exacerbates industry fragmentation.

Ethena is another similar protocol that allows yield pass-through and white-labeling of its stablecoin. Just like MegaETH issuing USDm—they issued USDm through tools supporting USDtb.

However, this model failed. It only fragments the ecosystem.

In the credit card case, brand differences between banks didn't matter because it didn't create any friction in user-to-merchant payments. The underlying issuance and payment layer was always Visa.

However, for stablecoins, this is not the case. Different token tickers mean an infinite number of liquidity pools.

Merchants (or in this case, applications or protocols) will not add all stablecoins issued by M0 or Bridge to their accepted stablecoin list. They will decide whether to accept them based on the liquidity of these stablecoins in the open market; the coins with the most holders and the strongest liquidity should be accepted, the rest will not.

The Path Forward: The Visa Model for Stablecoins

We need independent third parties to manage stablecoins for different asset classes. Issuers and applications backing these assets should be able to join a cooperative and capture reserve yield. At the same time, they should also have governance rights, able to vote on the direction of the stablecoin they choose.

From a network effects perspective, this would be a superior model. As more issuers and protocols join the same token, it will facilitate the widespread adoption of a token that can retain yield internally rather than letting it flow into others' pockets.