The Fed's Independence Crisis: White House Interest Rate Game Behind Powell's Criminal Investigation

- Core Viewpoint: Political threats to the Fed's independence trigger market turbulence.

- Key Elements:

- Powell publicly accuses the Justice Department of using criminal threats to pressure rate cuts.

- The incident led to a decline in US stock futures and a rise in safe-haven assets like gold.

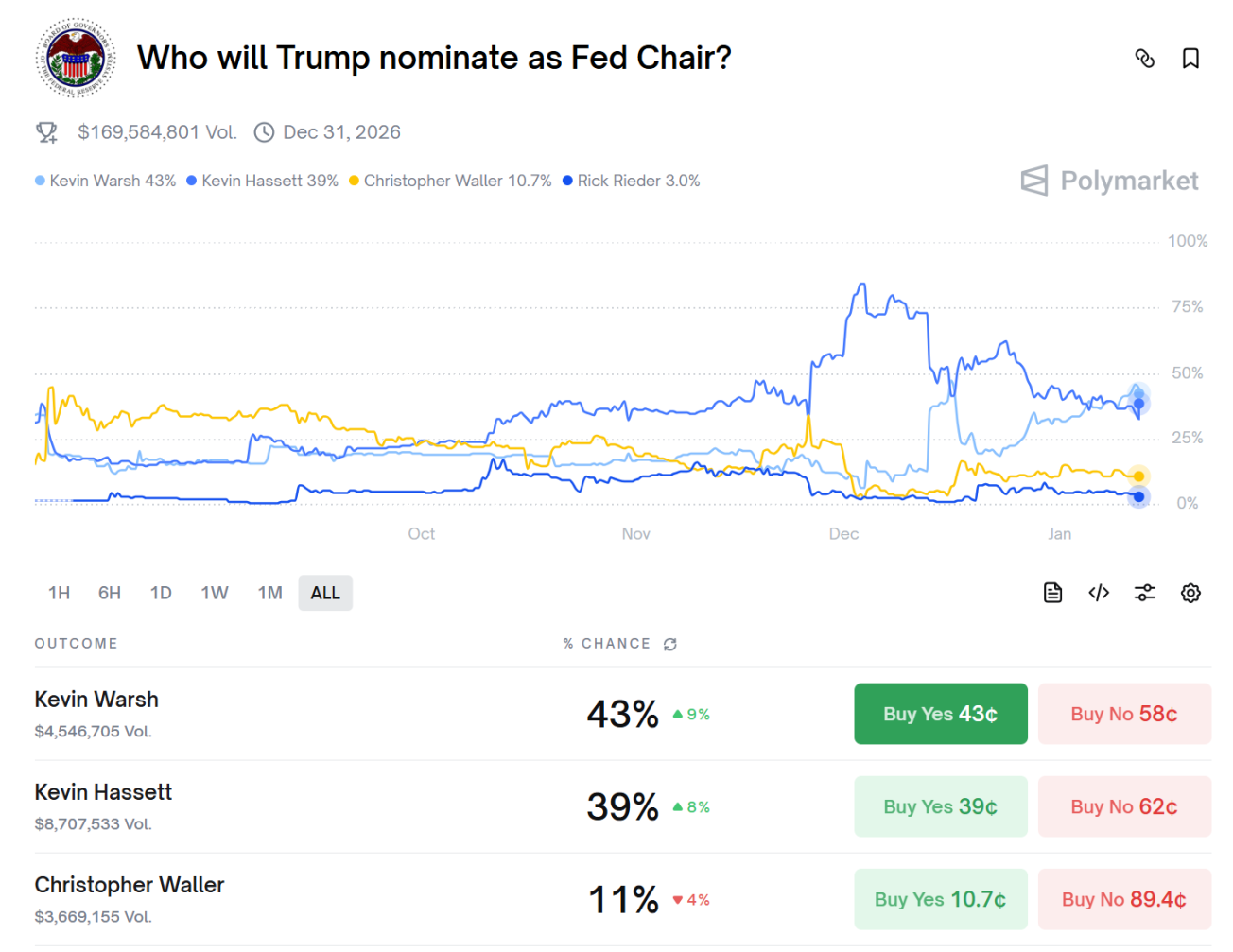

- Market bets on the probability of the next Fed Chair have changed significantly.

- Market Impact: Increases policy uncertainty and heightens market risk aversion.

- Timeliness Note: Short-term impact

Original Author: 1912212.eth, Foresight News

On January 11, Federal Reserve Chairman Jerome Powell released a rare video statement publicly accusing the U.S. Department of Justice (DOJ) of threatening criminal charges in an attempt to force the Fed to comply with former President Trump's interest rate policy demands. This incident quickly became a focal point in global financial markets, sparking widespread concerns about the Fed's independence.

In his statement, Powell emphasized that this threat was a "consequence" of the Fed setting interest rates based on public interest rather than presidential preference, calling it a blatant attack on central bank autonomy. This event is not isolated but the latest manifestation of the intertwining of politics and economics during Trump's second term.

Following the incident, U.S. stock index futures fell rapidly, with S&P 500 futures dropping over 0.5% and Dow futures retreating 150 points during Asian trading hours. Spot gold rose 1.88%, spot silver surged approximately 4%, while in the crypto market, BTC continued to fluctuate around $91,000.

Trump Repeatedly Dissatisfied with Powell's "Slow Rate Cuts"

Powell was appointed Fed Chair by then-President Trump in 2018 and was reappointed in 2022, with his term originally set to end in May 2026. As the head of the Fed, Powell has led the central bank through the challenges of the COVID-19 pandemic, economic recovery, and high inflation. His policies are known for being data-driven and incremental.

However, after Trump won the 2024 election and returned to the White House, he quickly turned his focus to the Fed. Trump has long criticized Powell for being "slow to act," particularly on interest rate policy. He has repeatedly publicly demanded that the Fed cut rates significantly to stimulate economic growth and stock market performance, even promising during the campaign to "take control" of the Fed to achieve his "America First" economic agenda.

The trigger for the event stemmed from a $250 million renovation project at the Fed's Washington headquarters. Initiated several years ago to update aging facilities, the project sparked controversy due to cost overruns and transparency issues.

In July 2025, Republican Congresswoman Anna Paulina Luna accused Powell of providing false testimony about the project during a congressional hearing and called for a criminal investigation. This accusation did not escalate immediately at the time, but after Trump took office, the DOJ quickly intervened. On January 11, 2026, according to multiple media reports, the U.S. Attorney's Office for the District of Washington formally opened a criminal investigation into Powell, focusing on whether he misled Congress and whether the project funds were used improperly. A grand jury has issued subpoenas demanding the Fed provide related records.

On January 12, according to NBC, Trump stated in a phone interview that he knew nothing about the DOJ's investigation and again criticized Powell. "I know nothing about it, but he's obviously not doing a good job at the Fed, and he's not doing a good job building either." When asked how he responded to Powell's claim that the subpoena was government pressure on the Fed to cut rates, Trump said, "No, I wouldn't even consider doing it that way. The real pressure on him should be the reality that interest rates are too high. That's the only pressure he's facing."

In his video statement, Powell bluntly linked this to interest rate policy. He pointed out that the DOJ's actions were "unprecedented," aimed at forcing the Fed to lower interest rates through criminal threats to cater to Trump's demands. In the statement, Powell reiterated the Fed's statutory mission is to maintain price stability and maximize employment, not to bow to political pressure. He described the event as a "blatant violation of the Fed's independence" and hinted it was a continuation of the Trump administration's pressure on the central bank.

As early as Trump's first term, Powell had clashed with the White House over his refusal to cut rates sharply, leading Trump to publicly call him an "enemy." The timing of this investigation is particularly sensitive: the Fed's most recent meeting kept the benchmark rate in the 4.25%-4.5% range, far higher than Trump's desired level.

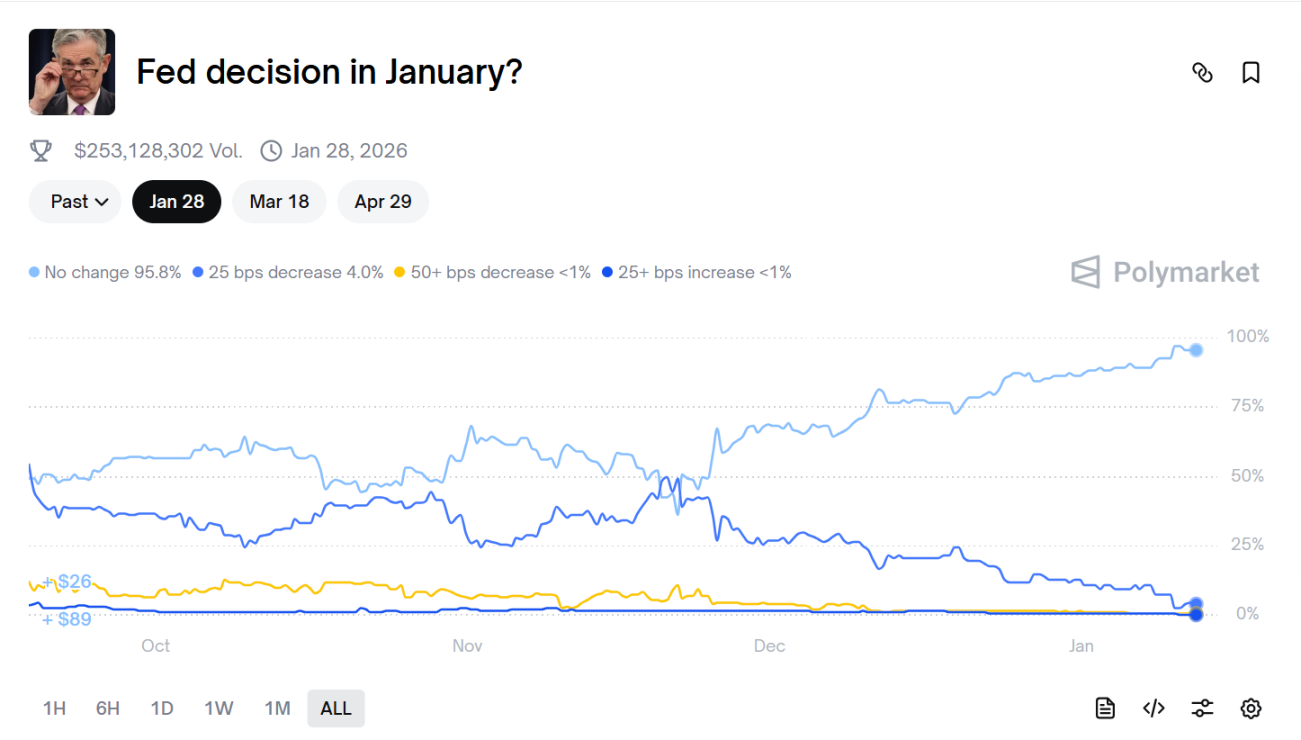

Latest data from Polymarket shows the market's bet on the Fed holding rates steady in January has risen to 96%.

On X, supporters see him as a hero defending independence, while opponents accuse the Fed of "wrecking the economy." Some users said, "Abolishing the Fed is the right path," while others warned this could trigger a constitutional crisis.

The investigation was authorized by the new U.S. Attorney, Jeanine Pirro, a staunch Trump ally, further deepening suspicions of political interference.

Powell responded that he would fully cooperate with the investigation but would not let it influence monetary policy decisions. The root of this event can be traced back to the Fed's institutional design. Established in 1913, the Fed was intended to be independent from politics, but there have been numerous precedents of presidential intervention in history, such as during the Nixon era under the shadow of Watergate. This event marks an extension of Trump's "deregulation" agenda. After taking office, he has promised to restructure federal agencies, including weakening the Fed's power.

As of January 12, the investigation is still in its preliminary stages, with prosecutors repeatedly requesting documents. The White House has not commented. Analysts predict that if the investigation escalates, the Fed may be forced to accelerate rate cuts to alleviate pressure, but this could trigger an inflation rebound, affecting U.S. economic growth.

Powell himself may face personal risks: if charges are substantiated, he could be forced to resign or even face imprisonment, although legal experts consider the evidence weak.

Powell has actively responded through public statements. Subsequent steps, besides hiring lawyers to challenge the subpoena's legality, could include appealing to the courts or seeking assistance from bipartisan lawmakers, especially those concerned about Fed independence.

Hassett and Warsh Become Top Contenders for Fed Successor

The criminal charge incident against Powell has increased market uncertainty. After the news broke, investors worried that damage to the Fed's independence would lead to policy disorder. Powell's statement emphasized that threatening criminal charges would "undermine" the central bank's credibility, potentially pushing up risk premiums.

Secondly, this event is seen as a signal of Trump consolidating power, triggering strong backlash from Democrats and social groups. Democratic lawmakers called it a "constitutional crisis," fearing the DOJ is being weaponized for political retaliation.

Latest speculation on Fed leadership: Although Powell's term lasts until May 2026, the criminal investigation has accelerated discussions about his successor. Trump stated he would announce a nominee by the end of this month.

Latest data from Polymarket shows the market's highest bets are on Kevin Warsh and Kevin Hassett, at 43% and 39% respectively. Warsh was nominated by President Bush as a Fed Governor in 2006, becoming the youngest Fed Governor at the time. He is known for his hawkish stance but is pro-market. In 2017, Trump considered Warsh for Fed Chair but ultimately chose Powell.

Hassett is a well-known American conservative economist, currently serving as Director of the White House National Economic Council and previously Chairman of the White House Council of Economic Advisers. He supports low interest rates and Trump's economic agenda. In November 2025, he was seen by Trump and his advisory allies as the top candidate for the next Chairman of the Federal Reserve Board.