The Future of Stablecoin Payment Systems in 2026: Which Variables Are Most Critical

- Core Viewpoint: Stablecoins are evolving from trading tools into payment and settlement infrastructure.

- Key Elements:

- The maturity of blockchain and other technology stacks enables simultaneous payment and settlement.

- Implementation in scenarios like cross-border B2B settlement addresses efficiency bottlenecks in traditional systems.

- The key to development lies in the stability of the infrastructure and the regulatory environment, not the token itself.

- Market Impact: Complements traditional finance, creating competitive pressure, especially in the cross-border settlement sector.

- Timeliness Note: Medium-term impact

In the early stages of stablecoin development, they were largely viewed as "fundamental tools" within the crypto market. Whether for trade matching, liquidity allocation, or asset management, the role of stablecoins consistently revolved around "trading," serving the functions of USD denomination and settlement.

However, this positioning is evolving over time. Entering 2026, the market has begun to reassess the value of stablecoins. Compared to trading frequency and price volatility, the more significant meaning of stablecoins is increasingly reflected in their ability to "transfer funds" efficiently and continuously. From cross-border settlements to platform distribution, from institutional treasury management to enterprise-grade payments, stablecoins are gradually moving beyond trading scenarios and entering broader financial application layers.

As blockchain networks, custody systems, compliance tools, and fiat gateways gradually integrate into a functional financial infrastructure framework, stablecoins have also begun to operate in parallel with the traditional financial system in the form of payment and settlement rails. This article will trace this evolutionary path, outline the practical logic behind the formation of the stablecoin payment system, and explore which key variables will determine how far it can go in 2026.

TL;DR Quick Summary

- Stablecoins are evolving from trading tools into payment and settlement infrastructure.

- This shift stems from the maturation of the crypto tech stack, including the coordinated development of blockchain networks, issuance mechanisms, custody systems, compliance tools, and fiat gateways.

- The most evident real-world adoption scenarios are concentrated in cross-border B2B settlements, institutional fund flows, and global platform distribution.

- Banking systems still dominate the local payment space but are facing increasing structural pressure in cross-border settlement.

- By 2026, the success of stablecoins will depend more on infrastructure stability, system integration capabilities, and the regulatory environment, rather than on any single token itself.

The Practical Implications of Stablecoins Moving Towards Payment and Settlement Rails

The Difference Between Payment and Settlement

In the perception of most users, payment and settlement are often seen as a single completed action. However, within the financial system, the two are structurally distinct. Payment refers to the user-facing act of fund transfer, while settlement is the process by which financial institutions finalize the transfer of value. In traditional finance, these two stages are deliberately separated.

Taking card networks as an example, payment authorization can typically be completed in real-time, but fund settlement often occurs later through batch clearing. Domestic bank transfers rely on clearing systems like ACH and SEPA, constrained by clearing cycles and time windows. Cross-border transfers rely more on correspondent banking networks coordinated by institutions like SWIFT, whose core function is information transmission rather than the real-time movement of funds.

In cross-border bank payments, funds must pass through multiple correspondent banks, with SWIFT messages facilitating settlement across different banks' balance sheets. This multi-layered process often leads to longer settlement cycles, higher costs, and limited transparency. (Source: Medium)

In cross-border bank payments, funds must pass through multiple correspondent banks, with SWIFT messages facilitating settlement across different banks' balance sheets. This multi-layered process often leads to longer settlement cycles, higher costs, and limited transparency. (Source: Medium)

How Stablecoins Compress the Payment and Settlement Process

Stablecoins merge payment and settlement into a single on-chain transaction. When a stablecoin transfer is completed, settlement occurs simultaneously, with finality directly recorded on the public blockchain ledger. This design significantly reduces settlement latency, removes restrictions imposed by banking hours, and simplifies reconciliation and clearing processes.

Taking fiat-backed stablecoins as an example, after a user deposits USD with the issuer, the issuer mints stablecoins at a 1:1 ratio, backed by reserve assets like cash and short-term treasury bonds. This creates a "digital dollar" fully backed by reserve assets, enabling 24/7, global, near-instant transfers on-chain. (Source: Global X)

Taking fiat-backed stablecoins as an example, after a user deposits USD with the issuer, the issuer mints stablecoins at a 1:1 ratio, backed by reserve assets like cash and short-term treasury bonds. This creates a "digital dollar" fully backed by reserve assets, enabling 24/7, global, near-instant transfers on-chain. (Source: Global X)

Integration, Not Replacement

Stablecoins are not intended to replace banks or card networks but offer a settlement layer option that can integrate with existing payment initiation systems. Traditional payment giants, including Visa, have repeatedly emphasized that payment initiation and settlement are inherently distinct stages, which is precisely why faster settlement solutions hold strategic value.

Key Takeaways

- In traditional finance, user-facing payments and backend settlements operate separately.

- Stablecoins achieve simultaneous payment and settlement through on-chain transactions.

- The value of stablecoins lies in complementing and enhancing existing systems, not replacing established financial institutions.

The Key Infrastructure Behind the Stablecoin Payment System

The reason stablecoins can operate stably in scaled scenarios lies in the reliable coordination of multi-layered infrastructure. No single component alone is sufficient to support the widespread application of stablecoins; the true capability stems from the mature operation of a complete system.

A panoramic view of the stablecoin ecosystem, covering issuers, infrastructure, liquidity, trading platforms, wallets, payments, and data analytics, illustrating how stablecoins are gradually evolving into a full-stack financial rail covering payments, treasury management, and global value transfer. (Source: CB Insights)

A panoramic view of the stablecoin ecosystem, covering issuers, infrastructure, liquidity, trading platforms, wallets, payments, and data analytics, illustrating how stablecoins are gradually evolving into a full-stack financial rail covering payments, treasury management, and global value transfer. (Source: CB Insights)

Core Infrastructure Layers

Why These Layers Need to Operate in Concert

Blockchain networks provide 24/7 settlement capability and verifiable transparency; issuers build trust and ensure liquidity by connecting on-chain tokens to off-chain reserve assets; custodians ensure assets are held and transferred securely under institutional-grade risk controls and permission systems; compliance tools enable stablecoin flows to meet regulatory requirements, qualifying them for entry into mainstream finance; and the interoperability layer is responsible for connecting payment and settlement processes across different platforms and jurisdictions.

Structural Insight

- 24/7 operational blockchain networks provide a continuous, verifiable settlement foundation for stablecoins.

- The credibility of stablecoin issuers depends on reserve transparency and the enforceability of redemption mechanisms.

- The prerequisite for institutional-grade applications is mature custody systems and compliance infrastructure.

Fiat Gateways and Distribution Systems: The Core Hurdle for Stablecoin Adoption

Fiat Gateways Are the Decisive Bottleneck

While the efficiency of on-chain stablecoin transfers is relatively mature, their widespread adoption hinges on the ease with which users can enter and exit the system. Fiat on-ramps and off-ramps directly determine the accessibility, cost of use, and geographic reach of stablecoins. Without support from local banking systems, stablecoins remain difficult to implement in practice, regardless of on-chain performance.

Differences in foreign exchange efficiency and liquidity depth across various payment corridors are also key reasons for the uneven distribution of stablecoin adoption. Some regions have ample liquidity and more competitive pricing, while others face higher spreads and limited availability.

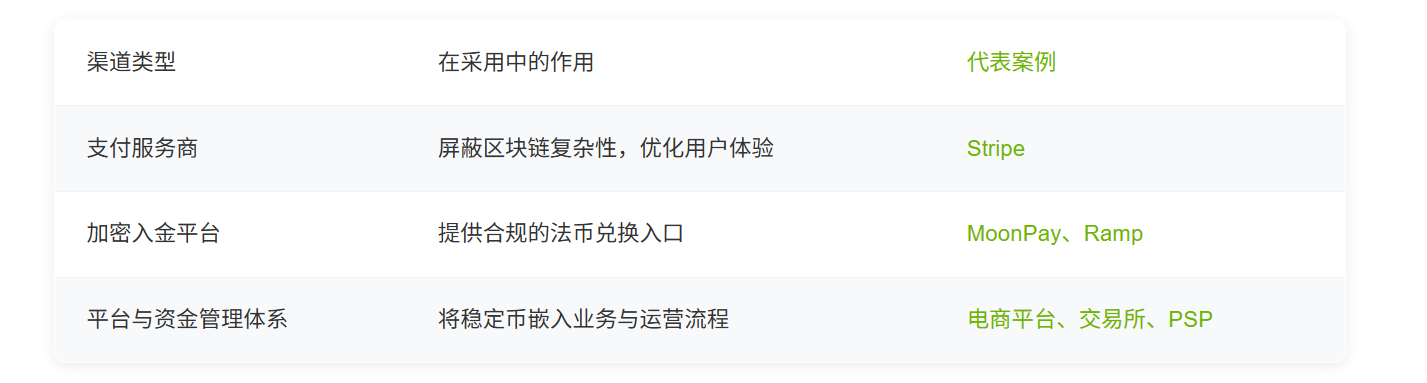

Primary Distribution Channels

These participants play a crucial role in influencing fee structures, settlement speeds, and jurisdictional coverage. Therefore, stablecoin adoption is more a challenge of execution and implementation capability than a purely technical issue.

Operational Reality Check

- The real-world usability of stablecoins depends on stable, reliable fiat on/off-ramps.

- Pricing efficiency is highly dependent on liquidity conditions across different payment corridors.

- The dominant power in stablecoin distribution is shifting from individual wallets to platforms and service providers.

Scenarios Where Stablecoins Will Achieve Scaled Adoption First in 2026

The total market capitalization of stablecoins has reached $308.2 billion, further confirming their trend towards becoming core financial infrastructure. USDT still holds over 60% market dominance, while the continued growth of USDC, DAI, and emerging issuers reflects rising demand for "on-chain dollars" in scenarios like payments, settlements, and treasury management. (Source: DeFiLlama)

The total market capitalization of stablecoins has reached $308.2 billion, further confirming their trend towards becoming core financial infrastructure. USDT still holds over 60% market dominance, while the continued growth of USDC, DAI, and emerging issuers reflects rising demand for "on-chain dollars" in scenarios like payments, settlements, and treasury management. (Source: DeFiLlama)

From a chain-layer distribution perspective, stablecoin liquidity shows a clear concentration trend. Ethereum, leading with a scale of $177.2 billion, remains the primary settlement layer; Tron follows closely with $81.5 billion, driven mainly by the widespread use of USDT. Meanwhile, high-performance networks like Solana and Hyperliquid are growing faster, indicating that stablecoin usage is gradually expanding from traditional mainstream public chains to ecosystems more focused on performance and efficiency. (Source: DeFiLlama)

From a chain-layer distribution perspective, stablecoin liquidity shows a clear concentration trend. Ethereum, leading with a scale of $177.2 billion, remains the primary settlement layer; Tron follows closely with $81.5 billion, driven mainly by the widespread use of USDT. Meanwhile, high-performance networks like Solana and Hyperliquid are growing faster, indicating that stablecoin usage is gradually expanding from traditional mainstream public chains to ecosystems more focused on performance and efficiency. (Source: DeFiLlama)

Core Application Scenarios Ranked by Real-World Adoption Level

- 1. Cross-Border B2B Settlements: Supplier payments and corporate fund transfers benefit from faster settlement speeds and significantly reduced reliance on traditional correspondent banking systems.

- 2. Institutional and Platform-Level Settlements: Payment service providers (PSPs), exchanges, and various platforms use stablecoins for internal and partner settlements, provided they already have custody and compliance conditions in place.

- 3. Platform Distribution and Freelancer Payments: Global platforms use stablecoins to quickly distribute earnings to creators and contractors, converting to local fiat when necessary.

- 4. Selective Consumer Payments: Primarily occurring in regions with underbanked populations or high local currency volatility, application scope is limited by local conditions, showing clear regional differences.

Infrastructure Match for Different Application Scenarios

Key Signals of Adoption Trends

- The expansion of stablecoin usage occurs more in scenarios with the highest economic friction costs, not necessarily the most hyped narratives.

- Cross-border settlements continue to be the dominant application, due to long-standing structural inefficiencies in traditional payment systems.

- Consumer payments show selective adoption, mainly constrained by local financial conditions and regulatory environments.

Changes in the Banking System and Payment Landscape Amid the Rise of Stablecoins

Tokenized Deposits vs. Stablecoins

In the local payment space, the banking system still holds a dominant position, an advantage stemming from regulatory frameworks, user trust foundations, deposit insurance mechanisms, and other factors. Regarding stablecoin development, policy institutions like the Bank for International Settlements (BIS) have begun exploring tokenized deposits as an endogenous alternative within the banking system. Simultaneously, central banks including the European Central Bank are continuously assessing their potential impact on monetary systems and regulatory frameworks.

Banks' Strategic Response Paths

Facing the structural changes brought by stablecoins, banks generally have three response options: first, upgrading and optimizing their existing payment and settlement systems to enhance competitiveness; second, partnering to introduce stablecoin-related infrastructure for complementarity; third, leveraging regulatory advantages and balance sheet strength to consolidate and defend their existing market position. Among these, cross-border settlement remains the most vulnerable area, where stablecoins expose the long-standing efficiency bottlenecks of the traditional system.

Market Impact Assessment

- Banks' dominant position remains solid in local payment scenarios.

- Competitive pressure is most evident in the international settlement arena.

- Stablecoins are gradually playing the role of an external settlement layer, rather than a direct replacement for the traditional system.

Conclusion: Key Observation Points for the Maturation of the Stablecoin Payment System

The future of stablecoins as payment and settlement rails depends not on narrative hype but more on the stability and sustainable operational capacity of the underlying infrastructure. Their adoption process will continue to show corridor-specific characteristics, influenced by the regulatory environment, liquidity conditions, and execution capabilities.

Looking ahead to 2026, key metrics worth focusing on include: the sustained growth of settlement volume, the expansion speed of integrations with payment service providers and enterprises, the gradual unification of regulatory standards, and the degree of diversification among issuers and infrastructure providers.

By 2026, the question is no longer whether stablecoins can exist as payment rails, but in which scenarios and regions they can operate reliably and at scale.

FAQ: Core Interpretation of the Stablecoin Payment and Settlement System

1. Will stablecoins replace banks?

No. Stablecoins still heavily rely on the banking system for critical aspects like custody, compliance, and fiat on/off-ramps. Their positioning is more akin to complementary settlement infrastructure rather than a direct replacement for banks.

2. Are stablecoin payments always cheaper?

Not necessarily. The overall cost depends on multiple factors, including on-chain transaction fees, foreign exchange spreads, fiat on/off-ramp fees, and liquidity conditions across different payment corridors.

3. Which infrastructure is most critical for stablecoin adoption?

In most real-world scenarios, the maturity of custody capabilities, compliance systems, and fiat gateways is often more decisive than blockchain performance or transaction speed.

4. How do regulators view stablecoin payments?

The regulatory focus is primarily on reserve asset adequacy, consumer protection, and financial stability. The overall direction leans towards enhanced regulation and standardization rather than an outright ban.

5. What are the main risks still constraining stablecoin use?

Key risks include fragmented regulatory environments, high issuer concentration, operational and technical risks, and uneven liquidity distribution across regions.

6. Why has cross-border settlement become the primary application for stablecoins?

Because traditional cross-border payment processes still suffer from inefficiency, high costs, and structural complexity. Stablecoins can more tangibly demonstrate their advantages in these weakest links of efficiency.

Further Reading

- XT Christmas Carnival Officially Begins, $2,000,000 Holiday Rewards Fully Released

- X Legends Futures Competition Ranking Strategy: How to Efficiently Accumulate Trading Volume to Compete for the $5 Million Prize Pool

- Top 5 L1 Public Chains to Watch in 2026: The Main Evolution from DeFi to RWA

About XT.COM

Founded in 2018, XT.COM is a globally leading digital asset trading platform with over 12 million registered users, operations covering more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. XT.COM <