Trading, DeFi, Payments: How to Choose? A 2026 Guide to Six Major Layer 2 Networks

- Core Viewpoint: Layer 2 has become the main arena for Ethereum scaling and user activity.

- Key Elements:

- Arbitrum leads the DeFi ecosystem with a $21.5 billion TVL.

- Base leverages Coinbase's user base to drive mass adoption.

- Zero-knowledge proof networks like zkSync have achieved practical technological implementation.

- Market Impact: Drives the migration of crypto applications to low-cost, high-efficiency networks.

- Timeliness Note: Medium-term impact

The market is often more honest than narratives. As the cost of using the Ethereum mainnet continues to rise, users and applications have not stopped; instead, they have naturally flowed towards more efficient options. Layer 2 networks have grown rapidly based on this market feedback, becoming an indispensable part of the Ethereum ecosystem.

By moving transaction execution off the mainnet, Layer 2 addresses the practical issues of cost and efficiency while maintaining security. Initially seen as supplementary solutions, these networks have begun to host an increasing amount of real transaction and application activity as their ecosystems have matured.

By 2026, most of the practical use cases in the crypto market have shifted onto Layer 2 networks. From trading and DeFi to payments and the exploration of real-world assets, Layer 2 is becoming the default choice for users. This article will explore these changes, outlining the most worthwhile Layer 2 networks to use today, helping you make clearer decisions based on different needs.

TL;DR Quick Summary

- Ethereum's scaling focus has shifted to Layer 2 networks, where most real crypto activity now occurs.

- By 2026, leading Layer 2s have evolved into complete ecosystems with stable users, application systems, and sufficient liquidity.

- Different Layer 2 networks have distinct focuses, targeting various use cases such as DeFi, onboarding retail users, or payments.

- In practical use, usability and stability have become more important than surface-level performance metrics.

- This article will outline the Layer 2 networks most suitable for daily use and development in 2026, helping readers quickly assess and choose.

Selection Criteria for the Six Top Layer 2 Networks

When choosing a Layer 2 network in 2026, the focus is no longer on single performance metrics or data headlines, but on practical usability. Users care more about: where real activity is concentrated, which networks are stable enough in use, and which ecosystems are more likely to develop sustainably.

Based on this assessment, we evaluate Layer 2 networks from a user perspective, focusing on current real-world usage and their capacity for sustainable future adoption. The core goal is to filter out networks suitable for trading, development, or practical experience, allowing users to make choices with greater confidence.

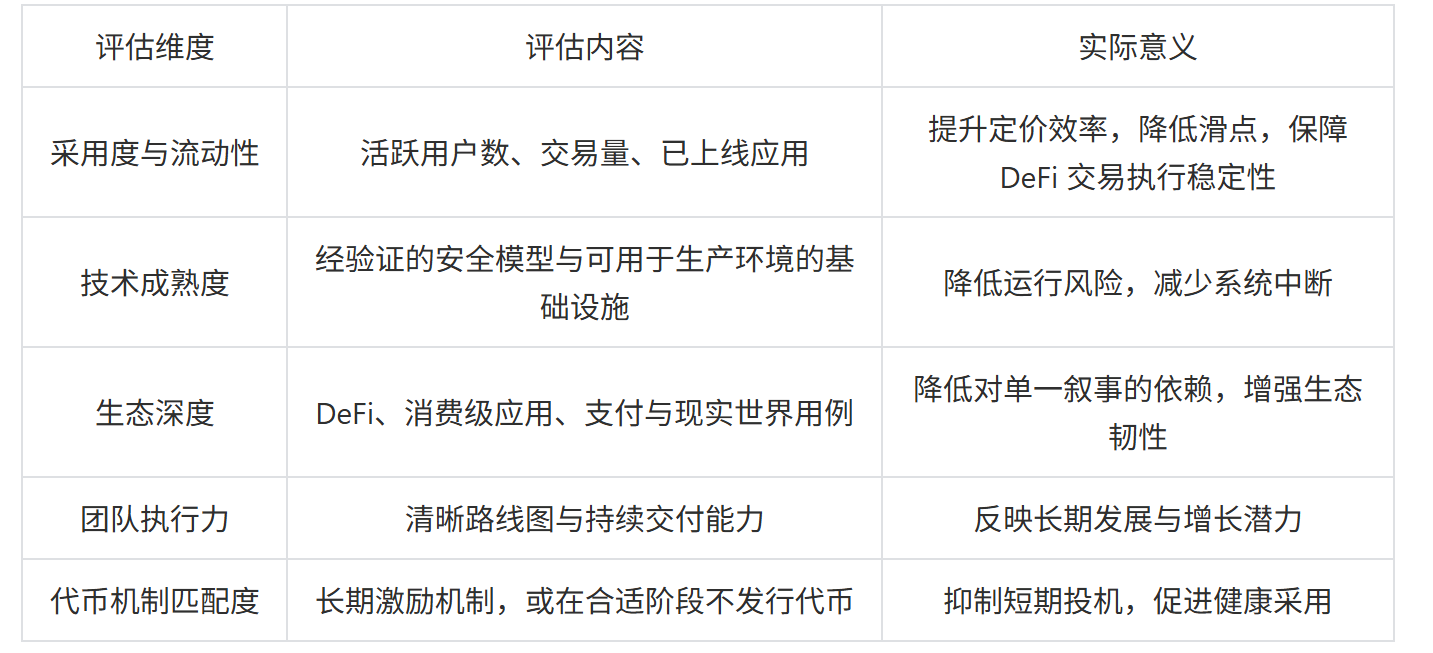

Layer 2 Network Evaluation Methodology

Only networks that perform well across multiple dimensions are included in the final list. This ensures the selection results are not only technically sound but also possess real-world utility.

Under this evaluation framework, the table below illustrates the differences and positioning of the six major Layer 2 networks in practical application. This comparison is not about selecting a "single best solution," but rather helping readers understand the role of different networks in various usage scenarios.

Overview and Comparison of Six Major Layer 2 Networks

The following sections will provide a deeper analysis of each network, focusing on how these differences manifest in real usage scenarios, rather than remaining at the level of abstract technical comparisons.

Why Most Liquidity is Concentrated on Arbitrum

Arbitrum has become the most influential Layer 2 network in the decentralized finance (DeFi) space. For many users, it is also the preferred entry point for their first practical use of Ethereum applications outside the mainnet.

Arbitrum's advantage does not stem from a single factor but from the convergence of multiple conditions. As the Layer 2 network with the deepest liquidity in the Ethereum ecosystem, Arbitrum hosts hundreds of live DeFi protocols and has also seen significant adoption in stablecoin usage and early real-world asset (RWA) exploration. These elements reinforce each other, creating a positive feedback loop: ample liquidity attracts applications, rich applications bring user growth, and user activity further drives liquidity accumulation.

Although the overall scale has slightly declined compared to last year, Arbitrum still recorded a Total Value Secured (TVS) of $21.5 billion in October, demonstrating its foundational liquidity position within the Layer 2 ecosystem. (L2Beat)

In terms of technical architecture, Arbitrum employs a fully Ethereum-compatible Optimistic Rollup solution. Developers can migrate with almost no code changes, and users can continue using familiar wallets in a DeFi environment that is mature rather than experimental.

Token-Level Considerations

ARB tokens primarily serve a governance function; network fees are still paid in ETH, not ARB. This means users do not need to hold ARB to use Arbitrum. The core role of ARB is more evident in governance decisions and ecosystem fund allocation. For new users, this design of "separating usage from governance" helps reduce the learning curve and entry barrier.

https://x.com/arbitrum/status/2005768991843983675

Why Arbitrum Remains Important in 2026: For users who value DeFi experience, liquidity depth, and overall stability, Arbitrum remains the most reliable and mature Layer 2 starting point.

Base: Coinbase's Bet on Mass Adoption Layer 2 Network

Base is a Layer 2 network launched by Coinbase, with its core advantage lying in distribution capability.

Leveraging Coinbase's massive global user base, Base can naturally reach a large number of potential on-chain users. For newcomers, this means a smoother fiat on-ramp, a familiar operational interface, and a lower psychological barrier. Users who already trust Coinbase can transition from centralized exchange activities to on-chain application experiences with fewer steps.

Another key feature of Base is that its transaction activity primarily stems from genuine user behavior rather than short-term incentive-driven actions. The platform encourages daily high-frequency use by maintaining low fees, while its ecosystem focus leans more towards consumer-grade applications rather than solely serving complex financial derivative structures.

Although its TVS scale is approximately $11.88 billion, smaller than Arbitrum's, Base still achieved slight year-on-year growth, particularly showing stronger relative momentum in ETH and BTC assets. (L2Beat)

Technically, Base is built on Optimism's OP Stack and inherits Ethereum's security. Currently, Base's sequencer is still operated centrally by Coinbase, but users always retain the ability to withdraw assets back to the Ethereum mainnet without trusting a third party, effectively mitigating custodial risk.

No Native Token Yet

Base has not yet launched a native token. This choice, in the early stages, actually aids ecosystem development by reducing speculative noise and refocusing user attention on practical use cases. The possibility of a future token launch remains, but at this stage, "having no token" has become an advantage for Base in driving adoption, not a shortcoming.

https://x.com/base/status/2001423689146114142?s=20

Why Base is Worth Watching in 2026: For many new entrants to the crypto market, Base is likely the first Layer 2 network they encounter, especially when entering via centralized exchange pathways.

Optimism and the Superchain's Collaborative Scaling Vision

Unlike most Layer 2 networks, Optimism's understanding of scaling is not limited to building a single "strongest main chain." Instead, Optimism proposes the Superchain concept, aiming to advance the overall expansion of the Ethereum ecosystem through collaboration rather than competition.

The Superchain is a collaborative system composed of multiple Layer 2 networks. These networks share the same tech stack, coordinate on governance mechanisms and incentive designs, and build around unified standards. This approach allows multiple chains to scale simultaneously, rather than competing internally for the same users and developers.

Rollup networks based on Optimism hold a leading position among Ethereum Layer 2s, with the OP Stack ecosystem dominating in both Total Value Secured (TVS) and daily activity. (L2Beat)

In terms of ecosystem building, Optimism invests significantly in funding support. Developer grant programs and retroactive public goods funding are key tools for attracting builders. Meanwhile, the OP Stack has been adopted by multiple networks, gradually shifting Optimism's role from a single Layer 2 to the "coordination hub" for the entire ecosystem.

The Role of the OP Token

OP tokens are primarily used for governance and ecosystem incentives, supporting developer fund allocation and providing an institutional foundation for the long-term collaborative development of the Superchain.

https://x.com/Optimism/status/2005687491626508729

Why Optimism is Worth Watching in 2026: If Ethereum's scaling path ultimately leads to a multi-chain collaborative landscape rather than a winner-takes-all scenario, Optimism is likely to be at the core of this system.

zkSync: Zero-Knowledge Rollups Are Becoming Practical

zkSync Era represents a new generation of Layer 2 networks built on zero-knowledge proof technology. Using zero-knowledge proofs, transactions can be verified quickly while maintaining high security, offering a higher technical ceiling for scaling performance.

zkSync is becoming a key hub for the zero-knowledge ecosystem, with its application landscape rapidly expanding to cover consumer apps, DeFi, blockchain gaming, AI, and more. (zkSync.io)

On the product side, zkSync focuses on "usability." It achieves full EVM compatibility, offers fast transaction confirmation, and natively supports account abstraction, with noticeable optimizations from wallet design to new user onboarding. Additionally, features like Gas sponsorship allow applications to cover transaction fees for users, significantly lowering the participation barrier for newcomers.

Token Mechanism Explanation

ZK tokens are primarily used for governance and will gradually integrate with validator decentralization and staking mechanisms in the future. The overall supply is large, and its practical utility will be released progressively as the network matures.

https://x.com/zksync/status/2002452879765090428

Why zkSync is Worth Watching in 2026: zkSync demonstrates that zero-knowledge technology is not just theoretical but is already capable of supporting real-world applications at scale without sacrificing user experience or developer familiarity.

Starknet: A Performance-Oriented Layer 2 for Advanced On-Chain Applications

Starknet is built on STARK zero-knowledge proof technology. Rather than strictly pursuing EVM compatibility, it emphasizes performance unlocking and support for advanced functionalities, presenting a clear and differentiated positioning.

Although the overall scale remains relatively limited, Starknet's daily on-chain activity continues to rise, indicating steady growth in user participation and practical usage. (DeFiLlama)

In terms of design goals, Starknet targets compute-intensive application scenarios, including complex DeFi protocols, on-chain games, and emerging Bitcoin-related application directions. Its use of the Cairo programming language, while introducing a learning curve, enables deep optimizations and performance scaling difficult to achieve on traditional EVM networks.

The Role of the STRK Token

STRK tokens are used to pay network fees, participate in governance, and for staking mechanisms. Its incentive design tightly binds network security with the ecosystem's long-term development.

https://x.com/Starknet/status/2003747486322532452

Why Starknet is Worth Watching in 2026: For users and developers focused on advanced DeFi, blockchain gaming, or Bitcoin-related innovative applications, Starknet offers performance and functional space that most Layer 2 networks cannot match.

Lightning Network: A Bitcoin Payment Solution Beyond the Mainnet

Lightning Network enables Bitcoin transactions with near-instant confirmation speeds and extremely low fees, while still anchoring security to the Bitcoin mainnet. It does not rely on an independent native token; network incentives primarily come from tiny routing fees denominated in BTC.

Unlike Ethereum Layer 2s, the Lightning Network was not designed to host complex smart contracts but focuses on high-frequency, small-value payment scenarios, addressing Bitcoin's efficiency issues in daily transfers.

The Lightning Network is entering a consolidation phase: the number of nodes remains stable, the number of channels is decreasing, but single-channel capacity is increasing, with overall efficiency continuously improving. (BitcoinVisuals.com)

Of course, Lightning has its boundaries. It is not suitable for complex applications, and wallet management and channel operations still present a technical hurdle for average users.

Why Lightning Remains Important in 2026: If Bitcoin aims to evolve further from a "store of value" to an "everyday usable currency for payments," the Lightning