Market Focus at the Start of 2026: Analysis of the January Macro Calendar and Core Drivers

- Core View: The crypto market has become highly macro-driven, moving in tandem with interest rates and risk appetite.

- Key Elements:

- Prices of Bitcoin, Ethereum, etc., are highly synchronized with macro data.

- Market focus is on inflation data, employment reports, and central bank policies.

- Crypto asset performance is driven by global capital flows, not a single narrative.

- Market Impact: Crypto asset volatility will more closely follow macro events.

- Timeliness Note: Short-term impact.

At the beginning of 2026, the market did not usher in an optimistic start driven by sentiment repair. Instead, it first faced the renewed intensification of geopolitical risks. Political friction, regional instability, and changes in the international relations landscape are continuously transmitting pressure to global markets through energy prices and financial conditions. Against the backdrop of slowing growth and receding inflation, these non-economic factors are becoming important variables influencing market rhythms.

In this environment, the cryptocurrency market has not exhibited an "independent trend" but has clearly integrated into the macro narrative. Since the beginning of the year, Bitcoin has accumulated a gain of approximately 5.2%, Ethereum about 6.4%, and Solana about 8.6%. Price fluctuations are highly consistent with risk appetite, interest rate expectations, and exchange rate changes, indicating that digital assets are operating as macro-sensitive assets.

As key January macro data and policy events unfold one after another, the market will enter a concentrated verification period. Whether crypto assets continue to maintain a high degree of correlation with macro variables will become an important observation point for judging the market structure and capital behavior in early 2026.

TL;DR Quick Summary

- Geopolitical risks and energy market volatility are setting the tone for early 2026.

- Inflation continues to decline, but growth momentum across different sectors shows significant divergence.

- Interest rate levels, real yields, the US dollar's trajectory, and liquidity remain the core variables for cross-asset pricing.

- January's market focus centers on inflation data, employment reports, corporate guidance, and major central bank meetings.

- The crypto market has become highly "macro-ized," with price performance following changes in interest rates and risk appetite more than single crypto narratives.

From Inflation to Policy: The Three Main Themes of January's Macro Environment

Entering 2026, the market's focus is no longer on the emergence of new narratives but on the validation of existing judgments. Although inflation has fallen significantly from previous highs, policymakers remain cautious; economic growth has not stalled, but marginal weakening in manufacturing and labor markets is gradually becoming apparent. Meanwhile, geopolitical risks are injecting new uncertainties into the market through energy prices, trade routes, and exchange rate volatility.

In such an environment, the importance of single data points is diminishing, replaced by the overall trends presented between data sets. Investors are trying to answer three key questions: Is the decline in inflation sufficient to lead to more flexible monetary policy? Can the growth slowdown remain "orderly"? And will external shocks alter the current path? January is precisely the time window when these judgments first face concentrated testing.

The current market is primarily influenced by three concurrent forces:

- Policy Uncertainty: Major central banks are nearing the end of their tightening cycles, but the subsequent path remains highly data-dependent.

- Growth Structure Divergence: Consumption and technology investment remain resilient, while manufacturing activity and hiring intentions continue to cool.

- Geopolitical Pressure: Energy prices and major currencies are highly sensitive to political events, which in turn affect inflation expectations.

Overall, January is a "verification period." The market is confirming whether the decline in inflation is sustainable and whether the economic slowdown remains within a controllable range, rather than evolving into a more severe downturn.

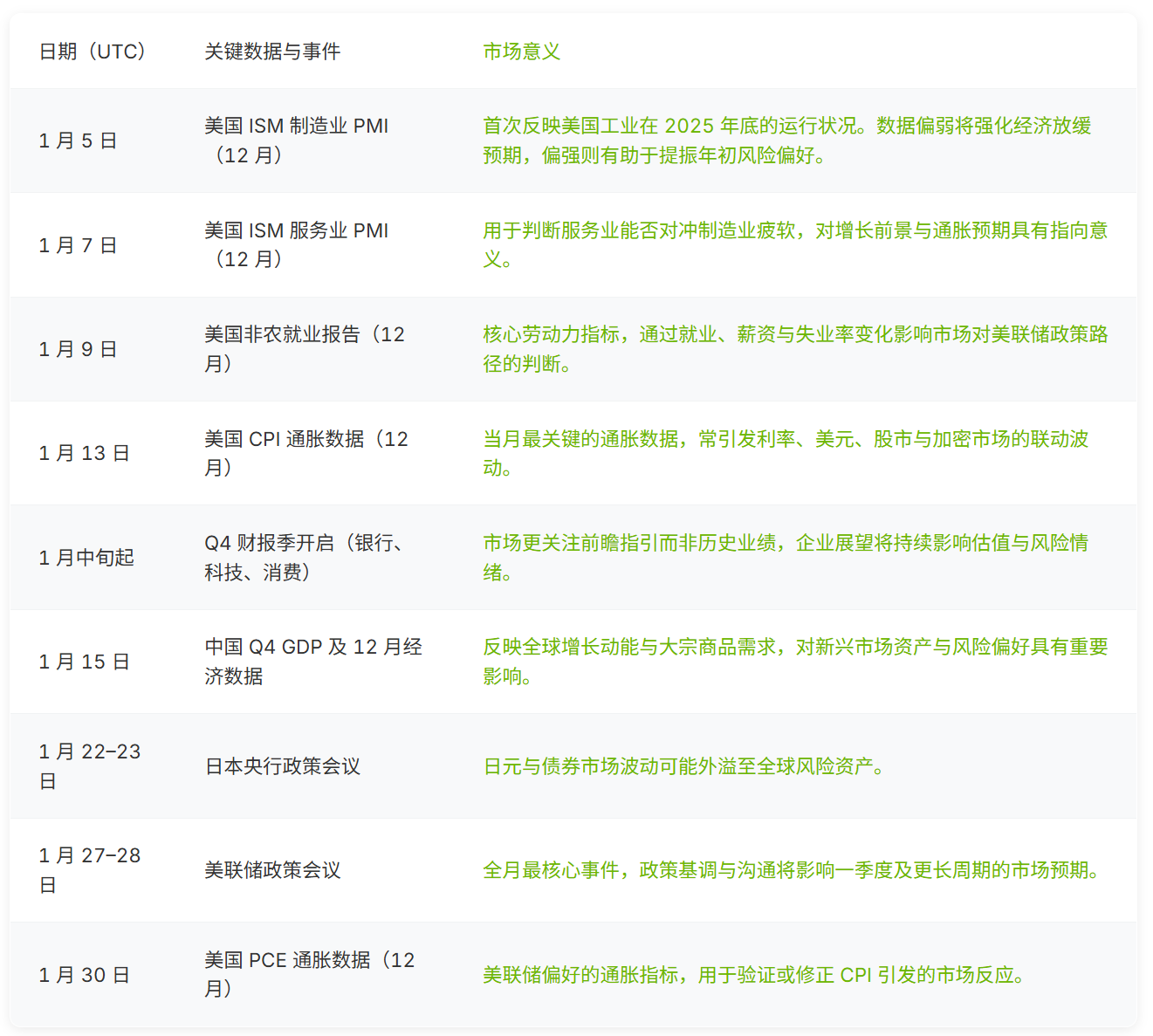

January Macro Event Calendar: Key Dates Impacting Multiple Assets

- Early-Month Growth Signals: Manufacturing and services survey data provide the first clear readings on the global economy's performance at the close of 2025. These data often have an amplified effect on market expectations in the low-liquidity environment of early January and influence pricing direction ahead of central bank meetings.

- Mid-Month Inflation Focus: With the release of consumer price data, inflation becomes the core of market discussion. The data will help investors judge whether the decline in inflation is continuing or showing signs of stalling, often triggering synchronized volatility in interest rates, the US dollar, equities, and digital assets.

- Earnings Season and Forward Guidance: The corporate earnings season kicks off in January. Compared to historical performance, management's guidance on 2026 demand, costs, and investment plans is more influential. Given high valuation levels, statements from the technology and financial sectors are particularly crucial.

- End-of-Month Policy Signals: Approaching month-end, the Federal Reserve meeting becomes the market's focal point. Even if the policy rate remains unchanged, the wording of the statement and the tone of the press conference can reshape monetary policy expectations for the coming quarters.

Overall, January's macro calendar contains several important events that simultaneously impact stocks, bonds, currencies, and crypto assets. Early-month data sets expectations, mid-month inflation readings test those expectations, and central bank communication ultimately determines how the market prices and adjusts positions.

Breaking Down January's Market Rhythm: What to Watch Each Week?

Week 1 (Jan 1–5): Post-Holiday Restart and Sentiment Volatility

After the holidays, markets reopen in a low-liquidity environment, making prices more sensitive to geopolitical dynamics and energy market changes. Year-start position adjustments are often more volatile, prone to emotional reactions.

- Key Events: OPEC+ policy signals, US ISM Manufacturing PMI (Jan 5)

- Core Metrics: PMI level (previous 48.2, fifth consecutive month below 50), new orders, input costs, crude oil price reaction

Focus: Whether manufacturing continues to be in contraction territory (market consensus around 48–49) or shows signs of stabilization. In low-liquidity conditions, even a slight improvement towards 50 could trigger a short-term rebound in risk assets; conversely, weaker data would further reinforce the economic slowdown narrative.

There is no fixed threshold for the ISM Manufacturing PMI that reliably signals a recession. Historically, recessions have occurred both when the PMI was above 50 and when it was below 50. Compared to the absolute value, its trend is more meaningful: during past recessions, the PMI almost always entered a sustained contraction, while during non-recession periods it was mostly in expansion territory. (Advisor Perspectives)

There is no fixed threshold for the ISM Manufacturing PMI that reliably signals a recession. Historically, recessions have occurred both when the PMI was above 50 and when it was below 50. Compared to the absolute value, its trend is more meaningful: during past recessions, the PMI almost always entered a sustained contraction, while during non-recession periods it was mostly in expansion territory. (Advisor Perspectives)

Week 2 (Jan 6–10): How Will Employment Data Affect Rate Expectations?

Market focus shifts to economic momentum and employment-related indicators, which have a direct impact on interest rate expectations.

- Key Events: US ISM Services PMI (Jan 7), US Non-Farm Payrolls Report (Jan 9)

- Core Metrics: Services PMI (previous ~52.4, expected ~51–52), new job additions (previous ~64k), unemployment rate (~4.6%), wage growth

Focus: Whether the services sector continues to cool while maintaining expansion. If new job additions fall within the 50k–75k range, it would confirm a gradual cooling of the labor market, favoring stronger easing expectations; if wage growth remains relatively strong, it could push interest rate pressures higher again and support the US dollar.

When the US Dollar Index (DXY) is at 97.94 and the Financial Stress Index is at -1.29, data shows the dollar maintains strength while systemic financial stress is low, reflecting a stable liquidity environment and overall smooth operation of financial markets. (MacroMicro)

When the US Dollar Index (DXY) is at 97.94 and the Financial Stress Index is at -1.29, data shows the dollar maintains strength while systemic financial stress is low, reflecting a stable liquidity environment and overall smooth operation of financial markets. (MacroMicro)

Week 3 (Jan 13–17): Inflation Verification Period and Corporate Confidence Window

This is the most market-sensitive week of the month, with inflation data and the earnings season appearing simultaneously.

- Key Events: US CPI Inflation Data (Jan 13), Q4 Earnings Season Kick-off (JPMorgan Chase JPM, Bank of America BAC, Citigroup C, Wells Fargo WFC, BlackRock BLK)

- Core Metrics: CPI YoY (previous ~2.6%, expected ~2.4–2.6%), Core CPI (previous ~3.1%, expected ~3.0–3.1%), services inflation, housing costs, corporate forward guidance

Focus: Whether inflation continues its slow decline or shows signs of stalling, particularly in services and housing-related components. Simultaneously, guidance from major banks and asset management institutions will provide early clues about credit conditions, market activity, and corporate confidence at the start of 2026.

The January earnings calendar shows that major US companies will successively release Q4 results, with large banks reporting first, providing early signals on credit conditions and overall market health. Subsequently, earnings from companies like Delta Air Lines, Netflix, and DR Horton will further reflect trends in consumption, travel, and real estate. (Trading Economics)

The January earnings calendar shows that major US companies will successively release Q4 results, with large banks reporting first, providing early signals on credit conditions and overall market health. Subsequently, earnings from companies like Delta Air Lines, Netflix, and DR Horton will further reflect trends in consumption, travel, and real estate. (Trading Economics)

Week 4 (Jan 20–24): Global Policy Signals Come into View

With relatively fewer major US data points, market attention turns to overseas policy and international developments.

- Key Events: Bank of Japan Policy Meeting (Jan 22–23), Global Policy and Geopolitical Dynamics

- Core Metrics: Yen movement, Japanese Government Bond yields, Bank of Japan forward guidance wording

Focus: Whether the Bank of Japan signals any policy normalization. Even subtle changes in wording could strengthen the yen and spill over into global bond markets and risk assets through interest rate and exchange rate channels.

The USD/JPY exchange rate rose to 156.31, reflecting continued yen weakness, while the yen implied volatility is only 9.12, indicating this movement leans more towards an orderly adjustment driven by policy rather than severe volatility triggered by market stress. (MacroMicro)

The USD/JPY exchange rate rose to 156.31, reflecting continued yen weakness, while the yen implied volatility is only 9.12, indicating this movement leans more towards an orderly adjustment driven by policy rather than severe volatility triggered by market stress. (MacroMicro)

Week 5 (Jan 27–31): Fed Sets the Tone and Earnings Season Concludes

The month-end brings the most crucial market catalyst combination for January.

- Key Events: Federal Reserve Policy Meeting (Jan 27–28), Major Tech Company Earnings, US PCE Inflation Data (Jan 30)

- Core Metrics: Fed statement tone, policy guidance (rates still in the mid-4% range), real yields, Core PCE (previous ~2.6%, expected ~2.4–2.6%)

Focus: Whether the Fed continues to emphasize a patient stance or begins to signal the possibility of subsequent easing in 2026. Combined with end-of-month earnings performance, this week often determines the market's directional consensus before entering February.

CME FedWatch data shows the market assigns an 82.8% probability to the Fed maintaining rates in the 350–375 basis point range on January 28, reflecting a high consensus among investors for policy to remain on hold in the near term. (CME FedWatch Tool)

CME FedWatch data shows the market assigns an 82.8% probability to the Fed maintaining rates in the 350–375 basis point range on January 28, reflecting a high consensus among investors for policy to remain on hold in the near term. (CME FedWatch Tool)

The Macro-ization of the Crypto Market: How Are Mainstream Assets Priced?

Entering 2026, the crypto market exhibits a more restrained but structurally healthier operating state. Market pricing is no longer primarily driven by short-term news or single narratives but increasingly reflects changes in the macro environment upon which global capital flows depend.

- Bitcoin (BTC): Bitcoin traded in the range of approximately $87,500–$88,000 at the start of the year and rose above $91,000 in early January, accumulating a gain of about 3–5% since January 1st. This is less a new trend initiation and more a consolidation phase following the significant correction in 2025. Currently, BTC is mainly oscillating within the $88,000–$95,000 range, with the market awaiting inflation data and monetary policy signals to provide clearer guidance for the next directional move.

- Ethereum (ETH): Ethereum's overall trend remains synchronized with Bitcoin but slightly outperforms during periods of improving risk appetite. Since the beginning of the year, the combined net inflow into Bitcoin and Ethereum ETFs has exceeded $640 million, reflecting the return of institutional capital and further strengthening ETH's positioning as an asset combining macro sensitivity and yield attributes. Its price performance is closely related to staking rewards and DeFi activity.

- Solana (SOL): Solana continues to exhibit higher beta characteristics, achieving more significant percentage gains when risk sentiment improves and capital rotates towards higher-volatility assets, amplifying overall market changes in risk appetite.

Beyond price performance, regulatory progress in major jurisdictions and increasing institutional participation are gradually shaping the medium- to long-term structure of the crypto market. However, in the short term, market pricing remains highly anchored to macro variables. Inflation data, central bank communication, and currency movements remain the core drivers for capital allocation and position adjustments in January.

Where is the Market Currently? A Multi-Asset Overview

During periods of significant equity market drawdowns, gold has often remained relatively stable or even recorded gains, while US equities have experienced notable declines. This further reinforces gold's role as a portfolio hedge and a buffer against downside risk. (Man Group)

During periods of significant equity market drawdowns, gold has often remained relatively stable or even recorded gains, while US equities have experienced notable declines. This further reinforces gold's role as a portfolio hedge and a buffer against downside risk. (Man Group)

Risk Scenario Projections for Early 2026

Base Case: Slow Inflation Decline, Range-Bound Markets

Inflation continues to decline at a relatively moderate pace, major central banks maintain a patient stance, and markets overall operate within a range, though with periodic volatility around key data releases.

Upside Scenario: Inflation Cools Faster Than Expected, Dovish Policy Signals

If inflation declines faster than market expectations, or central banks signal a more accommodative policy stance, falling real yields and improving risk appetite could drive a rally in equities and crypto assets.

Downside Scenario: Sticky Inflation or Policy Shock

If inflation remains persistently strong, geopolitical risks escalate, or central bank stances unexpectedly turn hawkish, risk assets will face pressure.