RWA Weekly Report|Non-US Government Debt Rises 18.8%; Yield-Bearing Stablecoins Generate Over $250 Million in Returns in 2025 (12.30-1.6)

- Core View: The on-chain value of RWA continues to grow, with market structure differentiation.

- Key Elements:

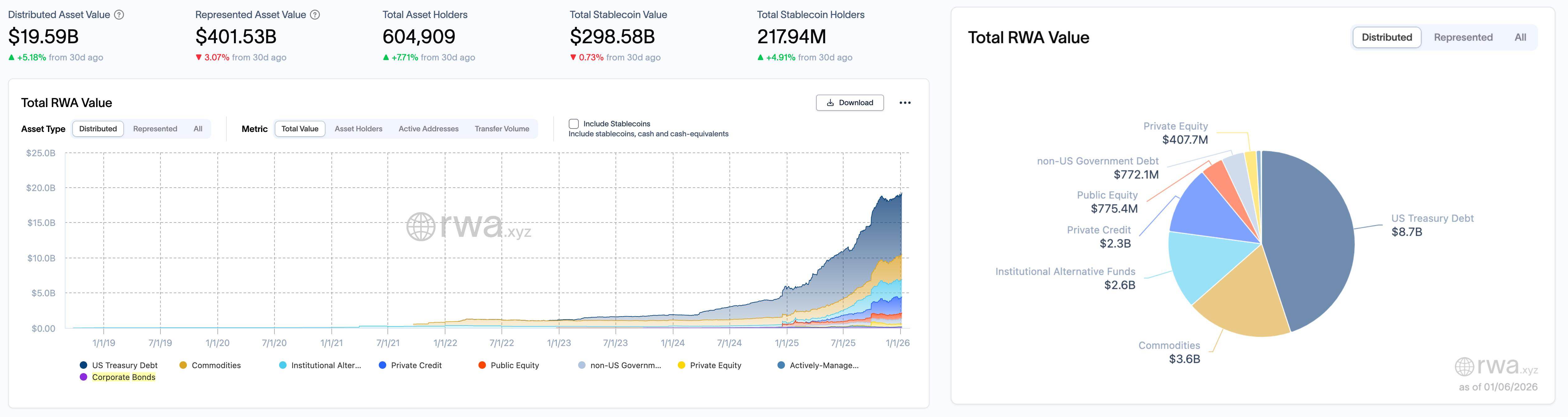

- The total on-chain value of RWA increased by 2.83% over the past two weeks to $19.59 billion.

- Non-US government debt assets saw a significant rise of 18.8%, showing outstanding performance.

- The total number of asset holders increased by 3.82%, indicating rising user activity.

- Market Impact: Indicates the growing attractiveness of the RWA sector and the deepening of institutionalization.

- Timeliness Note: Medium-term impact

Original | Odaily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

RWA Sector Market Performance

According to the rwa.xyz data dashboard, as of January 6, 2026, the total on-chain value (Distributed Asset Value) of RWA continued its upward trend, rising from $190.5 billion on December 23 to $195.9 billion, a net increase of approximately $5.4 billion over the past two weeks, representing a growth of 2.83%. The broader RWA market size slightly contracted, decreasing from $402.57 billion to $401.53 billion, a reduction of about $1.04 billion, or a 0.26% decline. User activity on the asset side continued to rise, with the total number of asset holders increasing from 582,639 to 604,909, adding over 22,200 new holders, a growth rate of 3.82%. Stablecoin users also saw steady expansion, with the number of holders rising from 212.54 million to 217.94 million, an increase of approximately 5.4 million, or 2.54%. However, the total stablecoin market capitalization slightly decreased from $299.17 billion to $298.58 billion, down by $5.9 billion, a decline of 0.2%.

In terms of asset structure, U.S. Treasury bonds remained firmly in first place, maintaining an absolute dominant position of $87 billion, unchanged from the previous period. Commodity assets recorded growth this period, increasing from $3.33 billion to $3.36 billion, a rise of about $30 million. Institutional alternative funds also maintained a mild upward trend, slightly increasing from $2.6 billion to $2.6 billion, remaining stable. Private equity saw a slight decline, dropping from $409.7 million to $407.7 million, a decrease of about $2 million, with the decline controlled within 0.5%. **Non-U.S. government debt rose from $649.9 million to $772.1 million, a significant increase of 18.8%, making it the most outstanding performer in this period's structural changes.** Public equity also recorded growth, rising from $720.8 million to $775.4 million, an increase of $54.6 million, or 7.6%. Private credit experienced a slight pullback, decreasing from $2.5 billion to $2.3 billion, a reduction of $200 million, making it the only sector with a noticeable contraction this week.

Trend Analysis (Compared to Last Week)

Overall, during this cycle, the RWA market continued to expand its on-chain asset scale while user activity strengthened simultaneously, indicating that market attractiveness remains undiminished. Notably, public equity and non-U.S. government debt showed prominent growth this week, possibly reflecting a temporary market preference for medium-risk assets. The slight pullback in private credit and private equity also indicates investors are reassessing high-yield, illiquid assets. The stable growth in commodities and alternative funds reflects continued stable allocation demand for physically anchored and strategic products.

Market Keywords: On-chain growth, structural divergence, user expansion.

Key Event Review

Ethereum Stablecoin Transfer Volume Exceeds $8 Trillion in Q4, Hitting a New Record High

Cointelegraph posted on X platform, stating that Q4 Ethereum stablecoin transfer volume has exceeded $8 trillion, setting a new historical record.

Yield-Bearing Stablecoins Generated Over $250 Million in Returns in 2025

Sentora released data showing that yield-bearing stablecoins generated over $250 million in returns in 2025. sUSDe contributed 24.9% of the returns, BlackRock's BUIDL contributed 9.7%, and sUSDS contributed 14.2%.

According to the official WeChat account of the China Cyberspace Administration's Reporting Center, in 2025, 1,418 imitation and counterfeit website platforms were legally handled, including 61 imitation websites of financial institutions such as China Merchants Securities and China CITIC Bank. These sites induced netizens to download apps for stock trading or purchase so-called "stablecoin" financial products, causing property losses. The Center pointed out that imitation websites typically collect personal information under the guise of "receiving subsidies," "recharging for consumption," "business cooperation," or "investment and wealth management," committing fraud and infringing on people's legitimate rights and property safety, posing significant social harm.

U.S. Senator: Digital ID and CBDC Would Deprive Americans of Financial Freedom and Privacy

U.S. Senator Warren Davidson posted on X platform, stating that the GENIUS Act, centered on stablecoins, could deprive Americans of financial freedom and privacy, backfiring. He warned that the U.S. is trending towards a chartered and heavily monitored financial system, believing recent cryptocurrency legislation undermines the industry's original promise of permissionless and private money. Warren Davidson noted that the design of the GENIUS Act facilitates the realization of a wholesale U.S. dollar Central Bank Digital Currency (CBDC), which could be used for surveillance, coercion, and control. He stated that the rollout of a digital ID system would force Americans to obtain government permission to use their own money, calling for a rejection of the globalist surveillance state and a return to the original promise of Bitcoin as a permissionless peer-to-peer payment system. Another U.S. Senator, Marjorie Taylor Greene, agreed with the above view, stating she voted against the GENIUS Act, believing it hands power to banks while opening a "backdoor" for CBDC. Although both representatives hold a more positive view of the CLARITY Act's potential in protecting self-custody, Warren Davidson believes its improvement effect on personal freedom is limited if the GENIUS Act takes effect.

Tether Invests in Cross-Border QR Code Payment Platform SQRIL

Stablecoin giant Tether disclosed an investment in the real-time cross-border QR code payment platform SQRIL. The specific investment amount was not disclosed. SQRIL currently primarily serves markets in Asia, Africa, and Latin America, and can integrate with APIs of traditional banks (like Barclays or Bank of America) and digital banks like Venmo, Revolut, or Cash App. The new funds will support its exploration of better stablecoin and QR code cross-border scanning payment methods.

Solana Ecosystem U.S. Stock Tokenization Platform BackedFi's Asset Scale Nears $1 Billion

Solana Daily posted on X platform, stating that the RWA on-chain platform BackedFi has tokenized nearly $1 billion worth of stocks on the Solana network.

Standard Chartered Bank and Ant International announced the official commercial launch of a blockchain-based tokenized deposit solution in Hong Kong and Singapore, enabling 7x24 real-time fund transfers. The solution supports instant settlement in HKD, offshore RMB, and USD, aiming to enhance global fund and liquidity management efficiency for cross-regional enterprises.

It is reported that this solution was developed under the framework of the Hong Kong Monetary Authority-led Project Ensemble and the Distributed Ledger Technology regulatory sandbox. By tokenizing Ant International's accounts on its proprietary Whale blockchain fund management platform, it enables near-real-time liquidity transfers between different regional entities of a company.

Standard Chartered stated that the solution breaks through the limitations of traditional banking hours and clearing cycles, meeting corporate demand for "instant liquidity." Ant International said the cooperation deeply integrates its global payment and tokenization technology capabilities with Standard Chartered's banking system, further optimizing cross-border working capital management. This launch is seen as a significant milestone for Project Ensemble in promoting tokenized asset applications and is expected to drive more enterprises to explore the practical application of tokenized deposits within the region.

PwC Ramps Up Crypto Sector Investment, Regulatory Shift Becomes Key Driver

Against the backdrop of a noticeable shift in the U.S. government's stance towards digital assets, PwC, one of the Big Four accounting firms, is increasing its investment in cryptocurrency and related businesses. Paul Griggs, Head of PwC US, stated that this strategic adjustment began last year, primarily benefiting from the appointment of pro-crypto regulatory officials and the U.S. Congress advancing multiple digital asset-related legislative processes. Griggs pointed out that the regulatory framework around stablecoins and the "Genius Act" help boost market confidence in such assets, and asset tokenization will continue to develop, requiring PwC's deep participation in this emerging ecosystem. Reports indicate that such statements reflect that policy environment changes are prompting traditional blue-chip institutions to reassess and gradually enter the digital asset market, where they had long maintained a cautious attitude.

BlackRock stated in its "2026 Global Outlook" that stablecoins will challenge governments' control over fiat currency. As stablecoin adoption surges, there is a risk of shrinking usage scale for fiat currencies in emerging market countries. Shortly before this prediction, UK's Standard Chartered Bank warned in October that stablecoin proliferation could lead to over $1 trillion in deposit outflows from emerging market bank accounts. Similar challenges exist for the U.S. banking sector. The landmark stablecoin bill "GENIUS Act," signed into law in July this year, allows crypto companies to offer yield-like products prohibited for traditional banks, posing a threat to traditional financial institutions. Samara Cohen, Global Head of Market Development at BlackRock, said: "Stablecoins are no longer niche products; they are becoming a bridge between traditional finance and digital liquidity."

DWF Labs Co-founder: Plans to Expand Gold Trading Business and Increase Gold Reserves This Year

Digital asset market maker DWF Labs co-founder Andrei Grachev posted on X platform, stating he received a one-kilogram gold bar with 999.9‰ purity from DWF Labs' gold trading division. The institution's plan for 2026 is to expand its gold trading business and increase gold reserves. It has already started offering gold "retail" delivery services with a minimum scale of one kilogram, and will launch more other Real World Asset (RWA) plans subsequently.

The Washington research team at investment bank TD Cowen pointed out that the U.S. market structure bill aimed at clarifying the regulatory framework for crypto markets, although still has a path forward this year, is more likely to be delayed until 2027 due to Congressional political maneuvering, with formal implementation around 2029. The team's leader, Managing Director Jaret Seiberg, stated that Democrats lack motivation to accelerate legislation before the 2026 midterm elections, especially with expectations of potentially regaining control of the House of Representatives.

Seiberg noted that the main disagreement in the bill centers on conflict-of-interest provisions. Democrats may push for restrictions on senior government officials and their families participating in crypto businesses, which includes Donald Trump. However, if such provisions take effect immediately, they might not gain support from Trump's side unless the effective date is postponed for several years. TD Cowen believes that delaying the implementation of the entire bill along with the conflict provisions could be a compromise path. Reports indicate that this market structure bill is seen as the next key regulatory milestone following the stablecoin "GENIUS Act," but it requires at least 60 votes in the Senate, and Democratic maneuvering on the timeline could further delay the legislative process.

Coinbase: Multiple Forces Will Converge in 2026 to Accelerate Crypto Adoption

David Duong, Head of Investment Research at Coinbase, stated that ETFs, stablecoins, tokenization, and clearer regulation will form a convergence effect in 2026, further accelerating mainstream cryptocurrency adoption.

He pointed out that in 2025, spot ETFs opened a compliant entry point, corporate crypto asset treasuries emerged, and stablecoins and tokenization became more deeply integrated into core financial processes. By 2026, trends such as accelerated ETF approvals, the expanded role of stablecoins in DvP (Delivery versus Payment), and broader acceptance of tokenized collateral will reinforce each other.

On the regulatory front, the U.S. clarified stablecoins and market structure through the GENIUS Act, while Europe advances the MiCA regulatory framework, providing clearer policy boundaries for institutional entry. Duong believes this marks an important stage for crypto moving from a niche market to global financial infrastructure.

Furthermore, he emphasized that crypto demand no longer relies on a single narrative but is driven by macroeconomics, technology, and geopolitics together, and capital structures will become more long-term with reduced pure speculative behavior.

Hana Financial Group Chairman: Stablecoins Could Become a New Growth Engine

Ham Young-joo, Chairman and CEO of Hana Financial Group, stated in a New Year's address that as technology-driven financial structural changes accelerate, funds are flowing from the traditional banking system to emerging areas, and stablecoins are expected to become an important future growth driver for the group. Ham pointed out that the group needs to proactively build a complete digital asset ecosystem covering issuance, distribution, usage, and circulation, rather than merely competing within existing frameworks.

Ham also stated that while the inclusion of digital assets in the regulatory system is still under political discussion, making it difficult to accurately assess the actual impact of stablecoins, the group still needs to engage in fundamental innovation in advance. Through cross-industry and cross-regional cooperation, it should lay the groundwork for distribution networks in anticipation of broader stablecoin application. Additionally, he emphasized the need to reduce high dependence on traditional banking business and accelerate expansion into non-banking businesses to cope with financial structural transformation brought by AI development and changes in capital flow patterns. Ham also warned that relying solely on scale and past success is no longer sufficient to ensure long-term survival. The group needs systematic restructuring in investment banking, risk management, and corporate credit assessment, and must overcome internal inertia to seek new growth opportunities with greater urgency.

Investment bank Cantor Fitzgerald stated in its year-end report that Bitcoin may be entering a prolonged downward phase, potentially facing a "crypto winter" in 2026. Analyst Brett Knoblauch said that it has been about 85 days since Bitcoin's cyclical peak, and prices may remain under pressure in the coming months, potentially even testing the average break-even level of Strategy holdings around $75,000.

However, Cantor believes this adjustment differs from previous bear markets triggered by large-scale liquidations or systemic risks. The dominant market force is shifting from retail to institutions, with a noticeable divergence between token price performance and underlying development, while decentralized finance, asset tokenization, and crypto infrastructure continue to advance.

The report shows that Real World Asset (RWA) tokenization scale has grown to approximately $18.5 billion this year